Is investor behaviour improving?

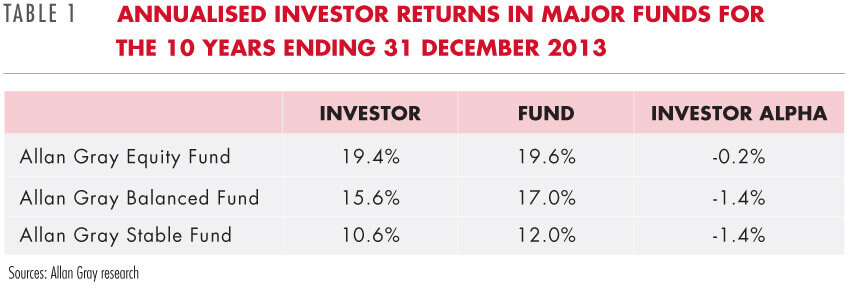

It has been more than a year since I last reported to you on investor returns being distinct from fund returns in our unit trusts. The average investor in a unit trust can do better or worse than the fund's track record depending on when he or she invests and disinvests from the fund. On average, investors switch between funds at the wrong times and tend to destroy value by trying to time their investments. As shown in Table 1, for the 10 years to the end of 2013 the average investor in our Balanced Fund earned 1.4% p.a. less than the Fund's track record, which is based on a single lump sum investment at the beginning of the 10 years. This is not good, but it is a great deal better than the 4.4% gap I reported for the 10 years to August 2010, and the 2.8% gap for the 10 years to June 2012, in the same Fund. This improvement is also evident in our fund churn rates, which have averaged just over 20% p.a., reflecting a weighted average holding period for investors of almost five years.

The Allan Gray-Orbis Global Equity Feeder Fund doesn't yet have a 10-year track record (it will reach this milestone in April 2015), but over the five years to the end of 2013, mostly by patience but also by taking advantage of the strong rand, the average investor in this Fund actually beat the Fund's performance by about 1.7%. This is even more impressive since the Fund's five-year annualised performance of 20.3% didn't come in a straight line – after some leaner years the Global Equity Feeder Fund was the top performing unit trust in South Africa in 2013, delivering over 78%, thanks to strong global markets, careful stock picking and a weakening rand.

Offshore restrictions and opportunities

As you may know, the South African Reserve Bank restricts the amount our unit trusts can invest overseas collectively to 35% of total retail client funds. Because of this limit and our recent strong offshore performance and flows, the Allan Gray unit trust management company is now almost out of offshore capacity, and our rand-priced offshore funds will be forced to close temporarily to inflows from individual investors in discretionary accounts at the end of January.

When this happens you will not be able to invest directly into the Allan Gray-Orbis Global Equity Feeder Fund, Global Fund of Funds and Global Optimal Fund of Funds; however, you will still be able to select these funds in your retirement funds, living annuity or endowment. Remember that you can also access the Orbis Funds, and other offshore managers, via our locally administered offshore platform. For more information please read Johann Grandia's piece in Quarterly Commentary 3, 2013, 'Access global investment opportunities via our offshore platform'.

Available foreign capacity is affected dramatically by offshore assets underor outperforming local assets in rand terms, and the strength of the local currency. When local assets are not doing that well and the rand weakens, the demand for offshore capacity tends to increase, sometimes very rapidly, at exactly the point when less capacity is available. Conversely, when the rand is strong and local assets outperform their offshore equivalents, flows into offshore funds tend to decline at exactly the point that more capacity is opened up. The temporary closure may turn out to be a good thing if it prevents fickle investors from buying into the offshore funds after a year of extraordinary performance expecting more of the same, and then disinvesting if the next 12 months are not as good.

On the point of future offshore returns, in the Orbis contribution this quarter, Adam Karr discusses what the recent Global Equity Fund and market gains mean for Orbis' ability to continue hunting down attractive stocks. He notes that, with US shares near all-time highs, it is prudent to expect lower market returns from current levels. Should that prove to be the case, investors in Global will be well served by owning companies that are resilient and positioned to control their own destiny.

Do gold and platinum mining shares make good assets for owning, or are they only good for trading?

In his in-depth analysis of South African deep level miners, Ian Liddle takes a look at the performance of gold and platinum mining stocks over the past decade. With major economic and operational challenges and demanding and powerful labour and government stakeholders to keep happy, it can be hard to see how these companies will be able to deliver acceptable returns to long-term shareholders. The counter-argument is that significant resources remain unmined and our mines can once again become valuable assets that generate significant free cash flows for shareholders if various prerequisites are met. The challenge we face as fund managers is making the right assessment of the probabilities of these prerequisites being met, and therefore of the potential risks versus rewards of investing.

Are you in the right fund?

Investors themselves face similar challenges when making investment decisions and often make decisions in response to market noise or macroeconomic events over which they have no control. It usually serves you better to make changes to your investment in response to changes in your life stage or personal requirements. Remember, the longer you remain invested, the more you will benefit from the effects of compounding – as discussed by Wanita Isaacs in this quarter's Investing Tutorial – and the more likely you are to benefit from returns similar to those of your chosen fund.

Becoming familiar with the parts of a fund that make up the whole will give you a better understanding of your fund's mechanics. Using the Allan Gray Balanced Fund as an example, Fiona Jeffery explains how it can be useful to drill a bit deeper into the composition of a fund to understand contributors to and detractors from performance. Engaging with this analysis over time reflects how yesterday's losers are often tomorrow's winners, illustrating how critical it is for our analysts to have thorough research to support their long-term investment ideas, and how important it is to invest with conviction.

A life of purpose

Finally, in his update this quarter Anthony Farr discusses how the Allan Gray Orbis Foundation seeks out individuals as Candidate Fellows who are likely to pursue a life of purpose. Potential Fellows should be motivated not simply to make money, but rather to make a difference in the world and in other people's lives through their entrepreneurial efforts.

Allan Gray's purpose is to create wealth for you, our clients. Thank you for your ongoing support and best wishes for the year ahead.