This magazine includes the performance of all of our funds in its last few pages, based on a single lump sum invested at each starting point, as is required by global reporting standards. Fund performance is an important contributor to returns, but equally important is investor behaviour. A track record without clients is meaningless. A great year of performance without clients also earns no performance fees. As a firm, we are both morally and economically dependent on our clients’ investment success.

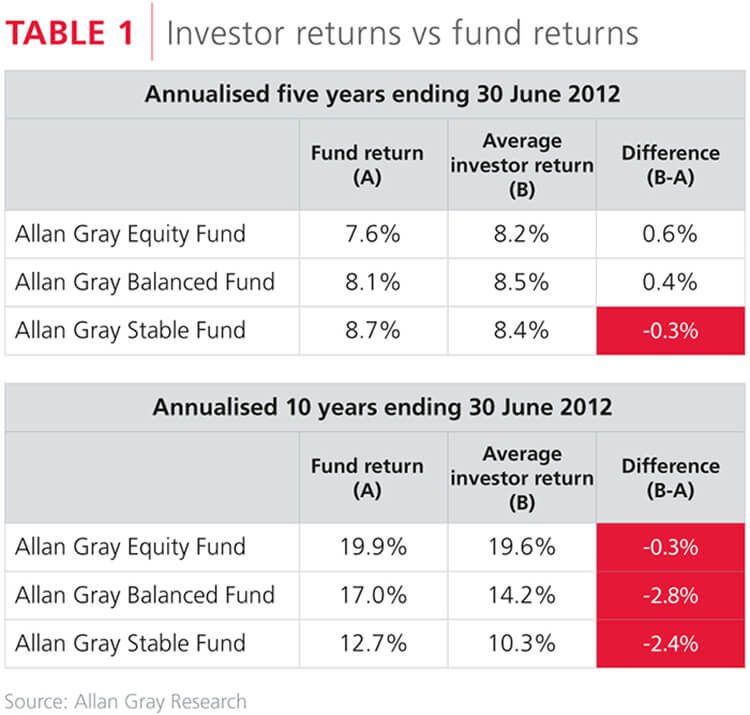

Investors switching between our funds can destroy value by switching out of a fund that is in a performance dip and into one that is at a peak. They can also add value by doing the opposite, although this is less common because it is hard for most people to switch out of a fund that is doing well and into one that is not. Table 1 shows that over the five years to end June 2012 the average investor in our largest unit trusts has achieved returns broadly in line with those of the funds themselves. But with the Balanced and Stable funds beating their benchmarks by approximately 4% over 10 years, the table also shows that approximately two-thirds of the outperformance of these funds has been lost over 10 years through investors not being invested when the funds did their best work. This is an alarming outcome.

The numbers in the column on the right depend on your – and other investors' – behaviour. We try to make it easier for you to make better investment decisions by offering a small and simple range of funds, providing educational material to you (such as this publication), discouraging switching, and by offering client service that builds confidence in us regardless of short-term fund performance.

Of course, if all of our performance came in a straight line it would not make a difference when investors switched into or out of a fund. We cannot deliver performance in a straight line, but we can and do try to reduce the risk of loss in our funds. Buying diverse assets, being careful not to overpay for these and selling investments once they reach our estimate of fair value, all serve to reduce the risk of permanent loss of capital in our funds. This means that our funds generally take less risk to deliver returns similar to their benchmarks.

On top of this, some of our funds are mandated by clients to invest not only in shares, but also in other types of assets. In fact, the majority of our retail and institutional clients ask us to implement our views on asset classes through a multi-asset mandate of some kind, like the Allan Gray Balanced or Stable funds. In these two funds, share investments are assessed against alternative asset classes like cash, bonds and offshore investments. This allows us to look for opportunities to grow your investment when we think shares are generally expensive. These funds are designed to allow you not to have to switch. We encourage you to think carefully about your investment objectives and choose your funds accordingly, and to adopt a long-term approach. This will give you a better chance of achieving returns in line with your fund.

An unpredictable economic environment

Regular readers know that we focus our efforts on researching and evaluating companies, rather than trying to make predictions about the macroeconomic environment. In his article this quarter, Ian Liddle encourages readers to ask themselves if their current investment strategy implicitly relies on the belief that the South African economy is healthy. He uses a selection of graphs from a recent presentation to show some of the factors currently supporting the local economy and questions their sustainability. Some food for thought for investors deciding whether or not to invest offshore.

No shortcuts in investment research

We choose a bottom-up approach because we prefer to work with facts and, while we may be attracted to a particular sector, we assess each company in its own right. Although most industries have a single factor that helps investors to understand them better, it does not always help to figure out what these factors are, as their future state is often unpredictable. There really are no shortcuts in investment research and we assess the merits of each investment opportunity in itself, and relative to the other opportunities the market is offering. Ruan Stander takes a look at some of the factors that define various industries, focusing on British American Tobacco and why we still find it attractive.

Choice and flexibility

With so much uncertainty and complexity in investment research and the investing process, many people prefer to leave it to the professionals. Some investors like to diversify their portfolios and benefit from more than one investment philosophy by investing with more than one investment manager. The Allan Gray Investment Platform makes it easy for you to invest with multiple managers, with consolidated administration. Our platform offers you access to all nine Allan Gray funds in addition to a broad range of third party funds and a simple selection of products. This is not meant to encourage switching. Jeanette Marais discusses some of the key benefits of investing through a fund platform.

Foundation update

In the Allan Gray Orbis Foundation update, Anthony Farr discusses a new move to codify entrepreneurship through development of an 'entrepreneurship method', similar to the development of the scientific method in the 16th century. He notes how, even in its current early stages, the entrepreneurship method provides a powerful lens with which to evaluate and refine the activities undertaken within the Allan Gray Fellowship and Scholarship.

Thank you for your continued support.