Objectives for investing change throughout our lives, from buying a car or house, to longer-term goals, such as saving for our children's education and our retirement. When we reach retirement, our goals change again - but this does not mean investing stops; investments need to be carefully selected to protect the real purchasing power of our income. Investment needs and objectives may change over time and subsequently so do fund and product choices. Jeanette Marais discusses how changes in needs should not mean changes in partnerships. Investing via the Allan Gray Investment Platform means you have an investment partner for life.

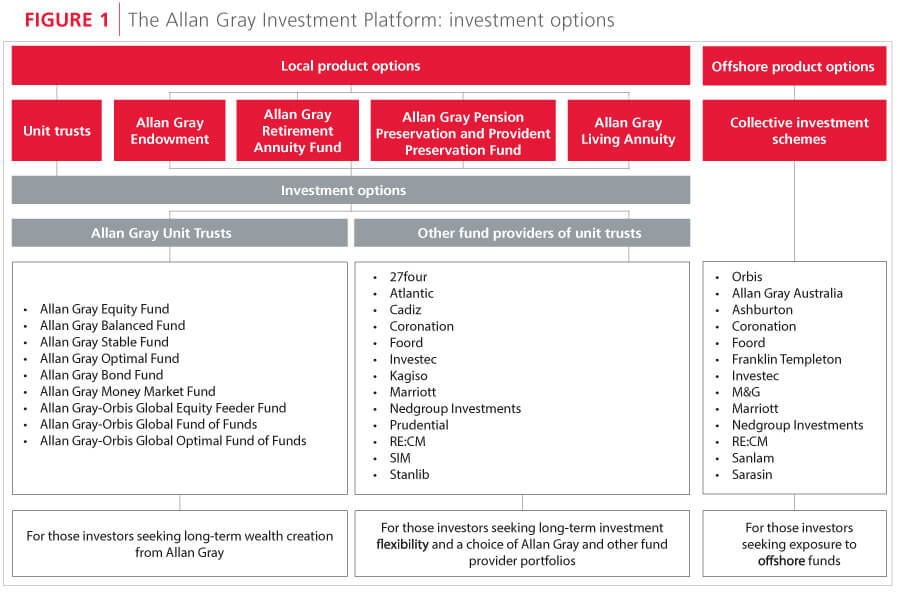

The Allan Gray Investment Platform offers you access to all nine Allan Gray funds in addition to a broad range of third party funds and a simple selection of products to accommodate your evolving requirements see Figure 1. Simplicity, choice, flexibility, safety and cost efficiency are the key benefits of investing via our platform.

Diversify your investment with no extra administrative burden

While many investors choose to invest with more than one manager to benefit from more than one investment philosophy and process, others are put off by the increased administrative headache of dealing with more than one fund provider. Investing via our platform (also known in the industry as a linked investment service provider or LISP) simplifies your process and administration significantly, while allowing you to diversify. This is because our platform offers you a range of Allan Gray and third party (i.e. non-Allan Gray) local and offshore funds, with consolidated administration. This means you can invest with multiple fund managers, but have one point of contact for administration, the Allan Gray Client Service Centre, and you will receive only one statement. Simple and convenient.

You also have the option of registering to use our secure online service, which allows you to review the history and performance of your investments and enables you to transact with us securely at your convenience.

Manageable choice and flexibility

We acknowledge that people are attracted to choice, but that does not mean that having more choice will lead to better decisions, or a better decision-making process. We try to keep the selection on our platform relatively contained - offering 50 funds out of a local universe of around 950. The selection of unit trusts on our platform is driven by independent financial advisers. We regularly survey financial advisers to ascertain demand for both local and offshore funds. We aim to ensure that our range offers adequate choice and remains manageable.

We only offer funds that are registered with the Financial Services Board (FSB) and we require funds to be of a minimum size for liquidity purposes. In addition, we offer more choice where there is more potential for differences in fund performance, i.e. we offer more equity funds than asset allocation/fixed income funds. We therefore ensure that we do not have too much duplication, but rather a spread across the different asset classes.

INVESTING VIA THE ALLAN GRAY INVESTMENT PLATFORM MEANS YOU HAVE AN INVESTMENT PARTNER FOR LIFE

Investing via our platform gives you flexibility: you can put together an investment portfolio that best suits your needs and easily switch between unit trusts as your needs change. Although switching is easy via the platform, regular switching may have a negative impact on your investment's performance. Even if there is no immediate monetary cost of switching, the longer-term erosion of value may be significant.

Legal safeguards

You may think that making all your investments through one company's platform is like putting all your eggs (hard-earned income and savings, in this case) in one basket and may compromise your money's safety if something goes wrong. However, when you invest via our platform, Allan Gray Investment Services Proprietary Limited, the administrator of the platform, cannot hold your assets directly. These assets are held by Allan Gray Nominees Proprietary Limited. Legislation dictates that trust property, i.e. the assets that the nominee company administers and those that are under the control of unit trust trustees, under no circumstances form part of the assets or funds of the financial institution itself. Because you are invested in a protected fund and not in the company, if anything goes wrong with the investment management company, your money is safe from its creditors.

Although our fund range is relatively small, making fund decisions is complicated

An independent financial adviser can help you to make decisions about which products and funds meet your investment objectives and suit your risk profile. He or she can also help you to manage your emotions and stick to your investment objectives and decisions, when you feel like reacting to short-term news.

We believe that the most important way to distinguish our fund platform from competitors is through the quality of our service and administration, not by offering complex products or an unmanageable fund range. We pride ourselves on our client service. In line with our business principles and philosophy, our platform has been designed to offer you investment solutions that are simple, transparent, and committed to the highest standards of ethics and integrity. We look forward to being your investment partner and assisting you throughout your investment journey.

Cost efficiency

When Allan Gray launched the platform back in 2005, we set new standards in terms of fees and have been working hard to make sure our platform pricing is transparent, fair and competitive. We charge an annual administration fee for ongoing administration, and as our business has grown, we have adjusted the fee structure for your benefit.

Up until now, our annual administration fee has been set at a flat rate of 0.5%, less any fee discounts received from fund managers – see below. However, as of 1 August 2012, the fee applicable to your investment account will depend on the size of your account. We will calculate the effective annual administration fee (excl. VAT) as follows:

- A maximum annual administration fee of 0.5% on the first R1.5m

- Plus an annual administration fee of 0.2% on the balance of the account market value

- Less any fund manager fee discount passed onto you from the fund managers of your selected unit trusts

The fund manager fee discount is an amount that the fund management company chooses to pay Allan Gray to account for money it saves by having Allan Gray do its administration. The annual administration fee is reduced by the fund manager fee discount we pass on to you. The fund manager fee discount may be larger than the annual administration fee. In such cases you will pay no annual administration fee and can receive additional units into your account.

If you are invested only in Allan Gray unit trusts you will continue to pay no net administration fee.