'Compound interest is the eighth wonder of the world. Those who understand it, earn it... those who don't, pay it.'

– Albert Einstein

Compounding is when the interest on a sum of money, either a deposit or loan, is added to the original amount so that the interest also earns interest. Albert Einstein's popular quote highlights the impact compounding can have over time, and also cautions that it can work either for or against you. Wanita Isaacs explains.

When you invest, time allows your invested money to grow and compounding makes your money work harder for you. Given a long enough period to work, compounding can dramatically multiply the value of your investment so that less of your total investment will be from your contributions and more from growth.

On the other hand, while compounding can be seen as the magic ingredient for successful investing, the same mechanism works against you when you borrow money, for example, through credit cards or a personal loan. The amount you owe earns interest over time and through the effect of compounding, the cost of credit can work out to substantially more than the cash amount you borrowed, depending on the interest you are charged and the length of time you will be paying the loan back.

How does compounding actually work?

The impact compounding will have on either an investment or a loan depends on:

- The amount invested or borrowed

- The time period

- The growth rate (The rate of return on an investment or the interest charged on a loan)

- The compounding frequency (The more frequently interest is added to the original amount, the greater the impact of compounding. For example, daily compounding means that you earn returns today on the amount you invested, as well as the returns you earned yesterday on the returns you earned the day before. This has a greater impact than compounding monthly, which has a greater impact than compounding annually.)

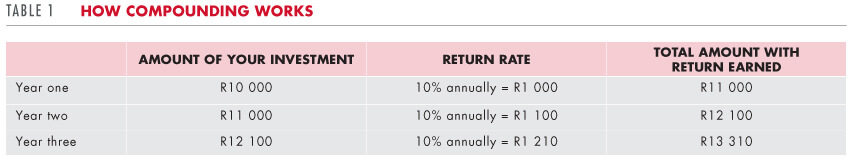

Table 1 uses an investment of R10 000 and annual compounding to illustrate how compounding works. After 20 years, your R10 000 investment would have grown to R67 275 – a gain of R57 275. If your returns had not been added to the original amount and left to grow; if you had spent them instead, the total gain from your investment would be only R20 000. And since you would have spent this R20 000, you would only have the original R10 000 still invested.

How do you ensure compounding works for you?

To benefit from compounding, you first have to start saving and the sooner you start the better. You also have to be disciplined and not spend the money your investment makes before you reach your savings goal.

The cliché that good things come to those who wait is especially true when it comes to compounding. Both the decision to invest and the decision whether or not to use credit are essentially choices between instant and delayed gratification. If you choose to use credit you will have to pay for the benefit of instant gratification whereas, if you choose to save, you will be rewarded for delaying gratification.