We have written on many occasions about the role investors play in their investment success. Key to this is understanding your fund's risk profile and objectives and how your fund manager goes about picking investments for your fund. This will help you to remain focused and not lose heart during periods of underperformance. Claudia Del Fante and Lise-Mari Crafford take a look at the Allan Gray Stable Fund's objectives and explain why investors should expect some short-term volatility.

The Stable Fund aims to meet the needs of the more conservative investor with a low tolerance for capital loss over any two-year period. The Fund's positioning may be suitable for the risk averse investor who requires capital stability, while simultaneously seeking to capture long-term returns in excess of bank deposits.

Fund composition

The Stable Fund is an asset allocation fund. Also known as 'solution funds', asset allocation funds invest in a range of asset classes, such as shares, bonds, cash, property or offshore assets. Exposure to these asset classes varies, depending on the opportunities presented at a point in time, and in keeping with retirement fund regulations (Regulation 28 of the Pension Funds Act limits exposure to certain asset classes).

One of the key benefits of investing in an asset allocation fund, is that the fund manager (not the investor), bears the responsibility of managing the underlying asset class exposure within the fund. The fund manager has the flexibility to alter the exposure to various asset classes, based on available opportunities. The returns investors ultimately experience come from all the different components that make up the fund (see 'Analysing your fund's performance' for a more detailed description of performance attribution).

The Stable Fund's large cash holding acts as the foundation to its stability, with the alternate asset class exposure used to generate superior returns to cash over the long term. The fund managers use a bottom-up equity selection process, meaning they look for shares which they believe are priced below fair value, with emphasis placed on picking shares with limited risk of capital loss, high current or prospective dividend yields and shares that tend to perform differently from the overall market.

Expect some short-term volatility

Although conservatively managed, the Fund's equity and offshore exposure introduces a level of volatility to the returns of the Fund over short periods of time.

The offshore exposure is a case in point. In previous years, the Fund's offshore investments lagged its local holdings. As the Fund was at its maximum offshore exposure (25%, the maximum allowed under the retirement fund regulations), this detracted from relative performance. In 2013, however, our offshore partner Orbis experienced a sharp turnaround in relative and absolute performance at the same time as the rand weakened, and the offshore component became the largest contributor to the success of the Stable Fund over the year.

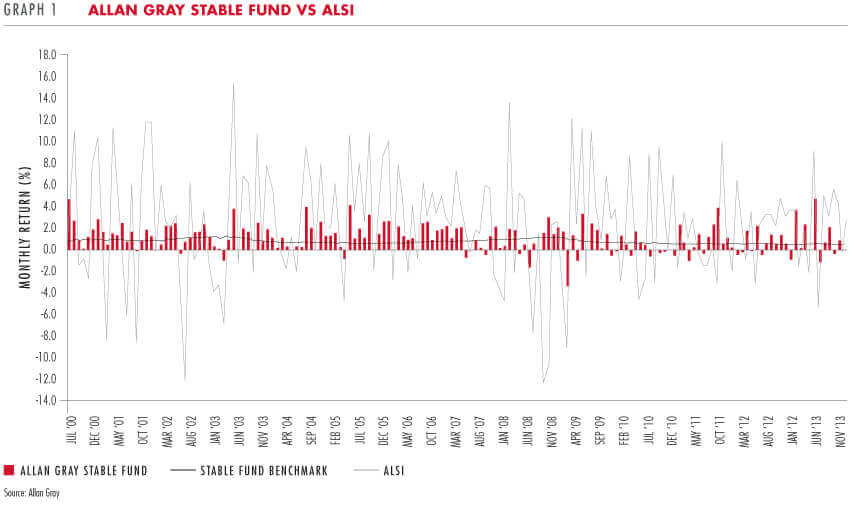

Reflecting the Fund's monthly returns since inception, Graph 1 shows that it is not uncommon for the Fund to generate a negative return over a one-month period. While it would be nice for our funds to consistently top the short-term performance charts, this is not our aim. We believe an unhealthy focus on short-term performance can be detrimental to us creating long-term wealth for our clients.

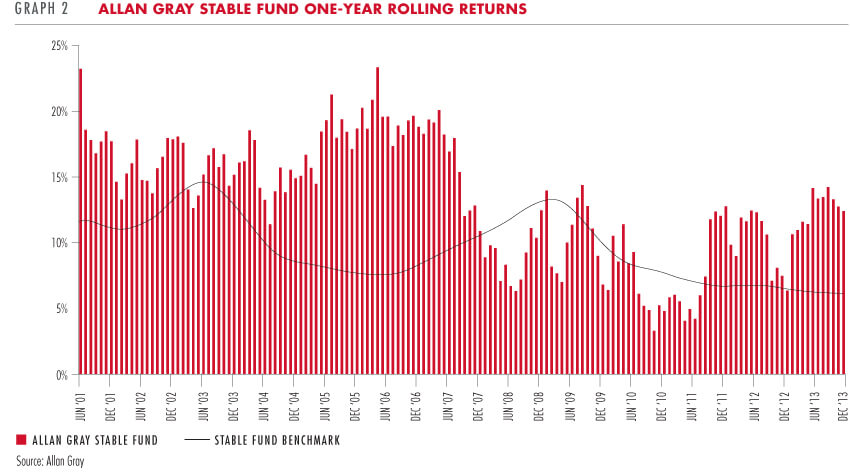

Minimising the risk of permanent capital loss over a two-year period is an explicit objective of the Fund. Graph 2 shows that despite the short-term volatility described on the previous page, over a one-year rolling period, the Fund has managed to achieve its primary goal of protecting clients' capital consistently for 13 years. In addition to this, it is pleasing to see the level to which the Fund reduces the volatility of the asset classes inherent in the Fund. This is shown in Graph 1, which compares the volatility of the returns of the FTSE/JSE All Share Index (ALSI) to that of the Fund. Equity exposure offers a great opportunity for significant reward, however only if purchased at the right price. The Fund is comfortable foregoing short-term upside to avoid taking on unnecessary levels of risk.

Returns in different market conditions

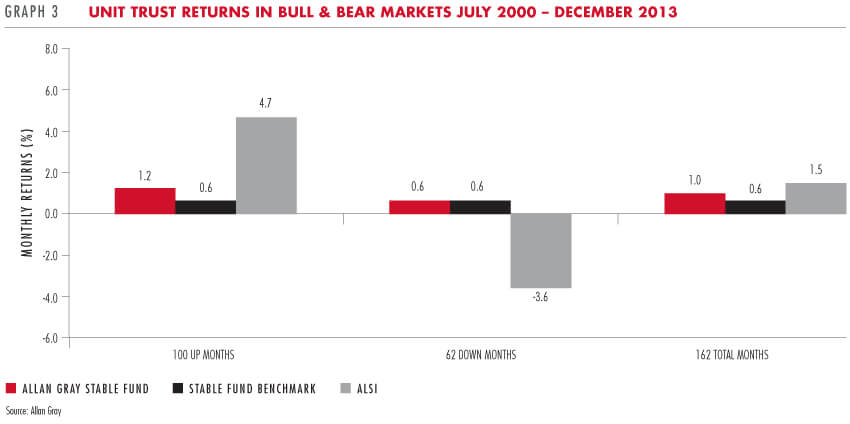

Even amongst its peers, the Stable Fund is a relatively low risk fund and therefore maintains a low net equity exposure. By virtue of its conservative equity positioning, the Fund tends to lag its peers when the market is rising but provides protection for its investors when the tide turns. Graph 3 shows the average monthly returns of the Fund since inception (versus its benchmark) during months when the ALSI delivered a positive return (100 months) and during months when the ALSI delivered a negative return (62 months).

In the 100 months of a positive return, the ALSI had an average monthly return of 4.7%. The average monthly return for the Fund was 1.2%, outperforming its benchmark by 0.6% per month on average and capturing about a quarter of the average monthly return of the ALSI. It is in the 62 months when the market declined that the true nature of this Fund is evident. The Fund protected its capital by returning 0.6% per month on average, whereas the ALSI had an average monthly return of -3.6%. Combining both up and down months for the full 162-month period, the ALSI delivered an average monthly return of 1.5%. The Fund was able to deliver an average monthly return of 1.0% – with significantly lower annualised volatility in monthly returns.

Try not to be swayed by emotion

Investors are often swayed by sentiment and make rash investment decisions on the back of short-term noise in the markets. A major risk to unit trust investors is that they personally do not enjoy the same returns as their Fund. As we have discussed previously (see Rob Dower's column in this Quarterly Commentary and his column in Quarterly Commentary 2, 2012), investment returns are the result of both a client's behaviour and a fund's performance. Unit trust investors who adopt a long-term approach are usually more successful than those who attempt to time the market.

The nature of our investment philosophy often finds us in short-term positions of discomfort. It is up to investors to remain true to the objective they signed up for when investing in the Fund, and give the manager the time required to generate superior returns over the long term.

As South Africans we have become very used to the exceptional level of absolute returns from almost all asset classes since the turn of the century. Given the current level of local and global capital markets, it is highly unlikely that this pattern will continue in the next 13 years. Asset allocation and stock selection become even more critical in an environment where returns may be scarce. It is important to pick a fund manager that you trust to protect your capital, first and foremost, and a fund whose objectives match your own. Then allow your fund manager the time required to provide a good return for you over the long term.