"There is the old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, 'You don't understand. These are not eating sardines, they are trading sardines.'"

– Seth Klarman, Margin of Safety

Are South African gold and platinum mines 'eating sardines' or 'trading sardines'? Or more directly, as posed by Ian Liddle: would you buy a South African gold or platinum mining company today if you knew that the stock market would be closed for the next 100 years, and that you would depend solely on dividends from the company for the return of and on your capital?

Performance review

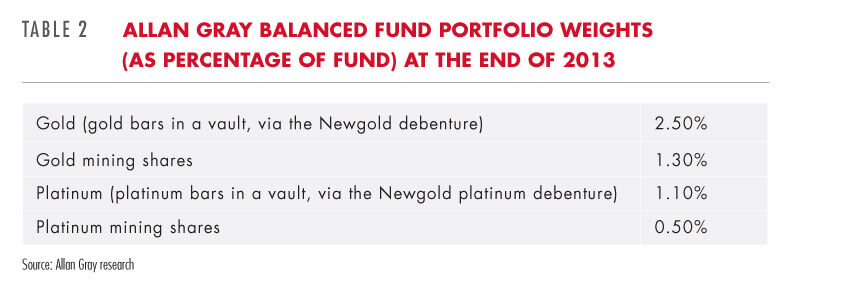

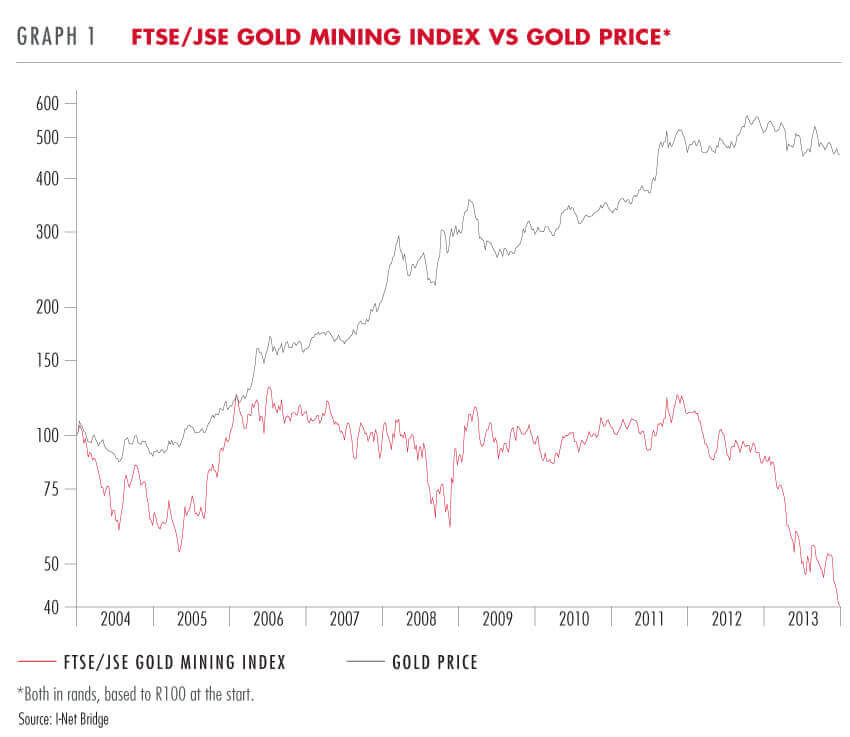

Let us start by reviewing the companies' historic share price performance compared to the relevant metal price over the last decade. See Graphs 1 and 2. The track record of our gold mines is rotten. The platinum miners have performed better from the beginning to the end of the 10-year period, but their performance is divided into a great first half to mid-2008, followed by a woeful second half to 2013. The share price performance of both groups has been especially disappointing in light of rising metal prices (in rands) for most of the decade. Clearly the market has been disappointed by the underlying financial performance of these companies

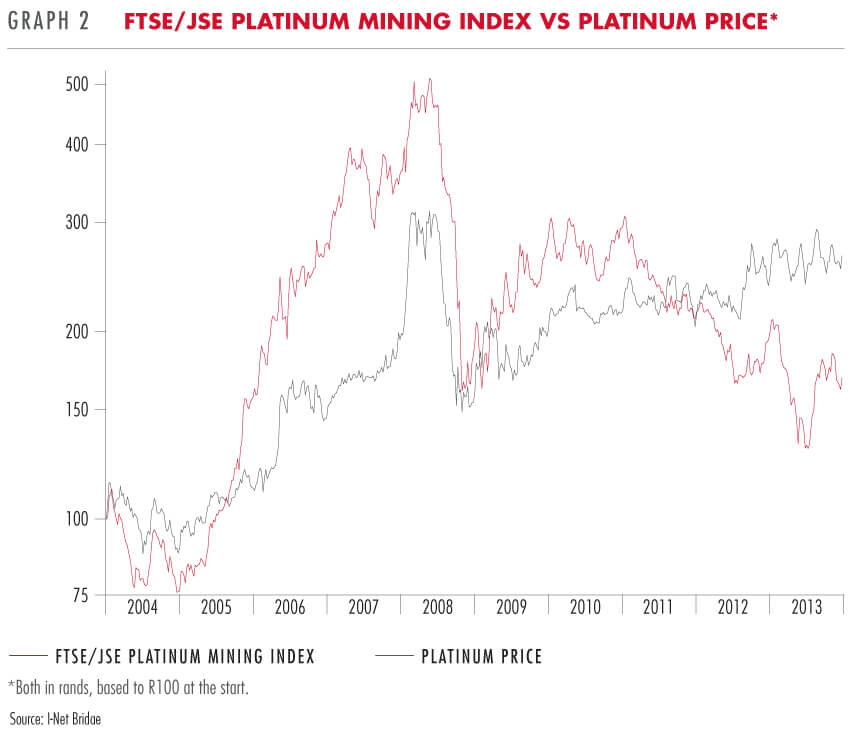

Table 1 displays some key metrics: Column B shows the total dividends per share paid by each of the major miners over the last 10 years. The dividends paid by the gold miners have been pitiful compared with the starting share prices. They are even low compared to today's much lower share prices (see Column D). This could be excused if the companies had re-invested to grow or if they had paid back debt, but the gold miners' annual production per share has more than halved over the last 10 years (a combination of falling production and dilution from issuing new shares) and net debt per share has grown (or remained flat in Harmony's case). So arguably the gold miners could not really afford to pay even these paltry dividends. These are pathetic fundamentals, especially considering that the gold price almost tripled over the decade.

The dividend yield calculated in Column D for the platinum miners is better than that of the gold miners, but still fairly low for a limited life asset. It is also misleadingly favourable. Most of the dividends paid by the platinum miners over the last decade were paid in the boom years leading up to the peak in 2008. Dividends since then have been patchy. Arguably the companies paid dividends that with hindsight they could not afford: Angloplat asked its shareholders for more capital in 2004 and 2010, and Lonmin returned cap in hand to shareholders in 2009 and 2012. Although Impala has not yet asked its shareholders for more capital, the company is now suffering the consequences of having delayed investing in new shafts to replace ageing shafts in the Impala lease area. Platinum production per share has fallen and net debt per share has risen (except at Lonmin which had a big rights offer in 2012 to reduce debt).

Based on this evidence, one would have to conclude that our gold mines are 'trading sardines' and our platinum mines are turning bad too. But it was not always this way – they were 'eating sardines' for large parts of the 1970s and 80s when they offered competitive dividend yields.

How have the fundamentals deteriorated?

Apart from rising rand metal prices, circumstances have been challenging. New legislation resulted in the companies' 'old-order' mineral rights effectively being expropriated. This has placed the companies in a much weaker position when negotiating the terms of their 'licence to operate', and they have to pay an additional royalty on their production. Safety standards have been raised considerably. This has resulted in wider stopes (and thus lower head grades), slower and more expensive mining (e.g. roof-bolting and safety nets) and the sterilisation of some high grade areas. While the improved safety objectives are noble, implementation has at times been overly bureaucratic, resulting in entire mines being shut down for days at a time for minor infringements. Electricity prices and wages have been rising faster than CPI inflation. As mines age and mining activity moves deeper and further from the shafts, travelling time to the face increases and ventilation becomes more expensive. Companies struggle for the labour flexibility they need to operate efficiently. Labour relations are fraught with violence and intimidation as rival unions/union officials battle for control of an 'annuity' stream of membership fees deducted directly from employees' wages. Worker productivity is declining.

To make matters worse, pain has been self-inflicted by poor overhead cost control, misguided capital allocation and misdirected incentives for executives. In an effort to correct apartheid-era abuses, company directors have concentrated on meeting the demands of all stakeholders, including various arms of government, employees, former employees, unions, empowerment shareholders and local communities. The shift to a more equitable sharing of the value created by our mining enterprises is necessary and understandable, but based on recent evidence it appears that the pendulum has swung too far and that shareholders are now right at the back of the queue.

Prerequisites for redemption

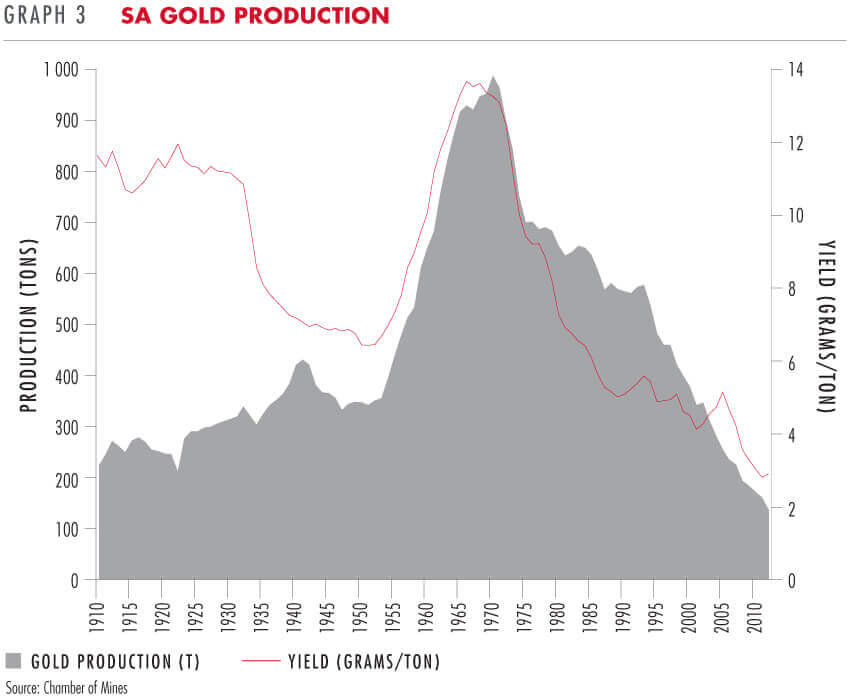

Clearly, 'trading sardines' cannot revert back to being 'eating sardines'. Some would argue that the analogy is fitting for our limited life mining companies – very few deep mines recover once they start to struggle. Resource depletion is a powerful undertow on production, as illustrated by the rapid decline in South African gold production since the 1980s (see Graph 3). The platinum mines are challenged by the depletion of the richer Merensky reef. The counter-argument is that significant resources remain unmined and our mines can once again become valuable assets that generate significant free cash flows for shareholders. In our view, there are three prerequisites for such a cure (but they need to happen soon):

1. Self-help

The directors of these companies are beginning to internalise shareholders' discontent. They seem more open to constructive criticism of their executive incentive schemes. Many of the companies are now under new leadership. These new CEOs appear more focused on shareholder value and more likely to grasp the nettle of stakeholder demands. There is some opportunity for improving efficiencies with new technology.

2. Higher rand metal prices

Self-help will not be enough to fully offset continuing electricity and labour cost pressures. Our mines will need higher rand metal prices. Dollar prices are high. The world is reliant on platinum supply from South Africa, but on the other hand higher dollar platinum prices incentivise thrifting/substitution of platinum in vehicle emission control systems and recycling supply. Commodity prices are hard to predict, but one can probably have more confidence in one's forecast of rand precious metal prices (as opposed to dollar prices) given the continuing importance of commodity exports to South Africa's trade balance. Please refer to 'How healthy is the South African economy?' in Quarterly Commentary 2, 2012 for a fuller explanation of the asymmetric risk to the rand exchange rate.

3. Shareholders are rewarded with their fair share of any additional margin

Even if both of the first two prerequisites come to pass, it will not do shareholders any good unless company executives maintain stringent cost control, do not kowtow to every demand from other stakeholders, and allow the additional margin to flow through to shareholders (as dividends) and to the state (as income taxes).

If you believe any one of these prerequisites to have a zero probability, then clearly the companies will remain 'trading sardines' and should not be bought at any price (unless you are in the business of speculating, of course). However, if you believe the probability of each of these prerequisites is non-zero, then the companies may still be redeemed as 'eating sardines', and the key question becomes whether the current share prices properly reflect the probability and possible extent to which these prerequisites come to pass.

While there are many common themes, the investment merits of each company still need to be assessed separately. For example: the dominant market share of our platinum producers is a plus versus the gold miners; Gold Fields has only one remaining mine in South Africa, South Deep, and it is more mechanised than typical South African gold mines; Harmony has discovered a significant undeveloped resource in Papua New Guinea; the new shafts being sunk in its lease area are probably make-or-break for Impala; some boards/executives appear bolder and more shareholder-focused than others.

How does this impact your investments?

In managing our clients' portfolios over the last decade, we erred in over-estimating the probabilities of prerequisites 1 and 3, by not recognising the full extent of the many challenges facing the mining companies sooner, and by not reducing our exposure to South African miners more aggressively at opportune times. Our investment in the Newgold debenture in our clients' balanced and stable portfolios has been a much better way to profit from our past bullish view on the rand gold price.

One of the reasons we previously over-estimated the probability of prerequisite 3 is explained by our view that it would be irrational for public policy to be stacked against mining companies to such an extent that they were unable to provide reasonable returns on shareholders' capital. Unfortunately, public policy can remain irrational for a long time. At least some policymakers are realising that capital can also go on strike. The dive in the share prices of our mining companies is investment managers' rendition of a toyi-toyi. If public policy towards mining companies remains hostile, and their share prices continue to fall, our mining companies will find it increasingly difficult to raise capital. If the current trends persist, there may come a time when shareholders decline to bail out a mining company again, and South Africa will prematurely lose mines that could have continued to operate for the benefit of all stakeholders.

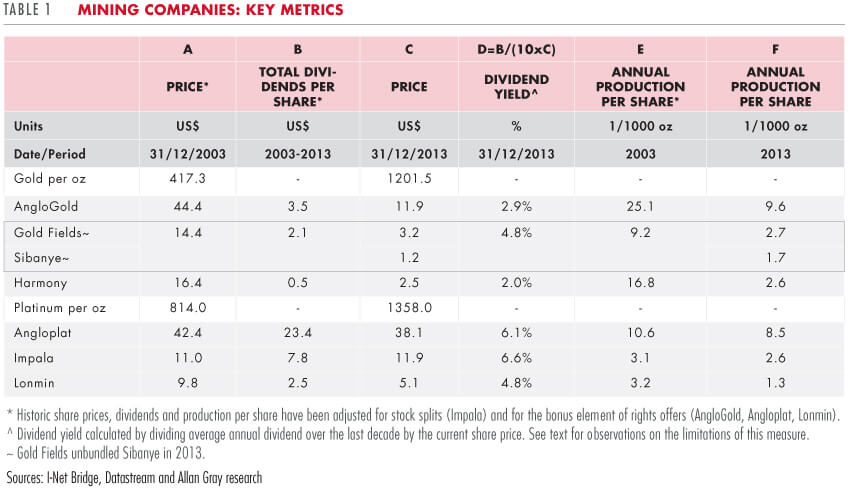

The three prerequisites listed above are critical, but their probabilities are clearly difficult to ascertain. This means that fund managers subscribing to similar valuation-based investment philosophies may put widely differing values on our mining companies depending on their subjective assessment of the probabilities. This is even the case internally. Our portfolio managers differ over the intrinsic value of our mining companies, and each has the freedom to structure his own 'manager' portfolio accordingly, within the discretion allowed by our internal rules and parameters. We believe that the individual discretion and accountability afforded our portfolio managers are critical ingredients of our successful long-term track record. The outcome for clients is hopefully a portfolio weight which appropriately reflects the probabilities and possible extent of the potential risks and rewards (see Table 2 for the Balanced Fund's exposures to the gold and platinum miners and precious metals as at the end of 2013).