When you think about starting a new investment there are two ways to approach it: either you invest in one go with a lump sum or you do recurring investments with a debit order. Although both are equally valid choices many investors think that they need to save up for a lump sum, when a debit order will do. Bekithemba Mafulela explains why a debit order may be a good solution in situations where you do not have enough to start with a lump sum payment.

Against the backdrop of South Africa’s poor savings rate, it is critical that we create an investing culture, but many would-be investors fall at the first hurdle – the minimum contribution amount. Our lump sum minimum of R20 000 may be out of reach for many South Africans, but in many cases a debit order works equally well – especially when you are trying to build a savings habit.

The return you spurn

Many investors (first-time and experienced alike) fall into the trap of thinking that they need to save in order to invest. Putting aside R500 or more a month to get to the lump sum amount of R20 000 may seem like the way to do it, but evidence suggests otherwise.

Consider two investors who are only able to invest R500 a month.

One investor (A) chooses to save R500 in a bank account for 40 months to get to the lump sum minimum of R20 000. The other (B) invests R500 a month in the Allan Gray Balanced Fund with a debit order. Who would do better?

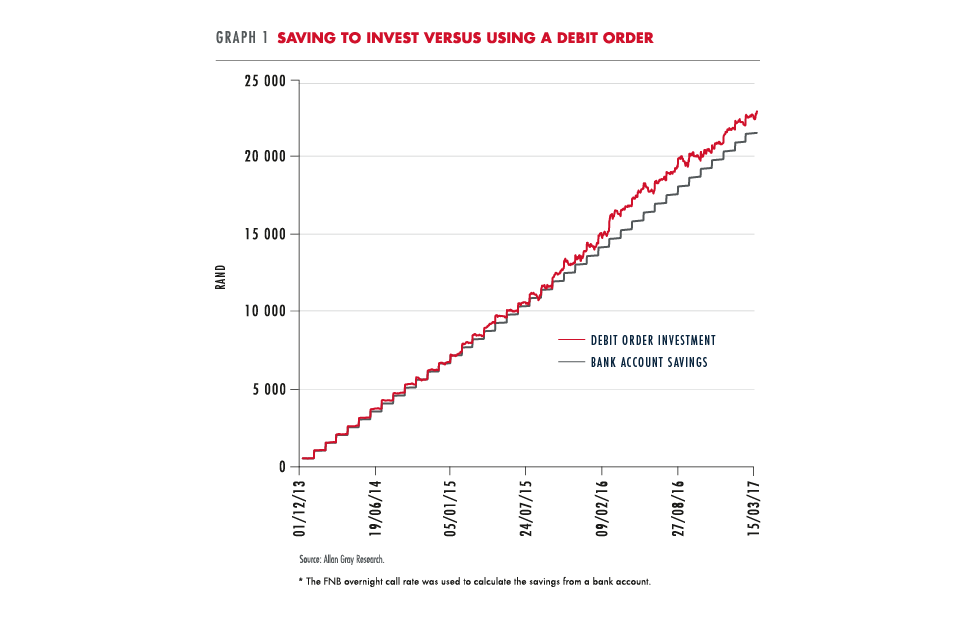

If we assume that these investors both started from 1 December 2013 (40 months ago) and their investment period ended on 31 March 2017, Investor A will have accumulated R22 040.88 and Investor B R24 039.41. Although a bank account offers a smoother, more predictable incline, the returns from the Balanced Fund outstrip it as time progresses (see Graph 1).

There isn’t a guarantee that the Balanced Fund will do better, but in every rolling period since 2008 and 88.3% of the 40-month rolling periods since the Fund’s inception in 1999 you would have been better off investing with a debit order than saving to invest with a lump sum. But that is not the only advantage of debit orders.

The timing risk

A further benefit of using a debit order is that you can reduce timing risk. The biggest predictor of whether an investment will be successful is the price you pay – this applies as much to us as your investment manager as it does to you as an investor. When you buy an investment cheaply there is a higher chance that you will get returns if the investment appreciates.

A lump sum payment gets you only that day’s price. But timing the market perfectly is very difficult to do and waiting for the right moment to invest can mean you miss out on the compounding benefits of being in the market: each month you put off investing waiting for the perfect moment is a lost opportunity (see ‘The cost of waiting to save’).

A debit order solves this problem by allowing you to get the average price of all the months you invest, which is called rand-cost averaging.

Put in another way, when you buy with a lump sum you get the price of the day, which may be high and means you get fewer units. When you use a debit order you sometimes pay a high price when the fund is doing well, and you get fewer units, and sometimes you pay a low price, and you get more units. Over time you pay the average price.

If we reframe our example we see that the price Investor A gets on 1 April 2017, after they accumulated enough for a lump sum investment, is R203.05 per unit compared to Investor B who paid the lower average price of R184.27.

Building a habit and taking emotion out of it

The softer side-benefit of using a debit order is that it takes the emotion out of your decision-making. Every month the money goes off without involving you at all. The motivational legwork of committing to an investment plan happens once at the beginning and then the system handles itself. Of course you need to maintain your debit order – but the habit of investing builds up automatically and over time your budget adjusts. If you need to make changes in your investment, such as when you receive a bonus, you can also make a once-off additional contribution or change your debit order.

The most important thing to remember is that the best time to start your investment is now. Trying to accumulate a lump sum may mean that you miss out on returns in the long term.