While South Africans battle with a cost-of-living crisis, rising unemployment and sluggish economic growth, Finance Minister Enoch Godongwana is faced with the daunting task of balancing the books in a watershed election year, amid a bloated public wage bill, rising debt-servicing costs and struggling state-owned enterprises. His options are limited to achieve stability in the country’s finances: borrow more, raise taxes or cut government expenditure. It looks like the Minister will pull all these levers in one way or another, as proposed in the 2024 Budget.

Carrie Norden highlights some of the tax proposals that may impact investors. These changes come into effect on 1 March 2024, unless otherwise indicated.

What were the highlights?

The key take-outs from this year’s Budget are summarised below:

- No inflationary adjustments have been made to the personal income tax brackets, tax thresholds, tax rebates or medical aid credits. This is expected to raise additional tax revenue of R18.2 billion.

- Above-inflation adjustments have been made to excise duties on alcohol and tobacco products.

- No change has been made to the general fuel levy and the Road Accident Fund levy.

- The “two-pot” retirement system will be implemented on 1 September 2024. An estimated R5 billion is likely to be raised in 2024/2025 due to tax collected as fund members access once‐off withdrawals.

The following applies for the period from 1 March 2024 to 28 February 2025, unless otherwise stated:

Individuals and special trusts

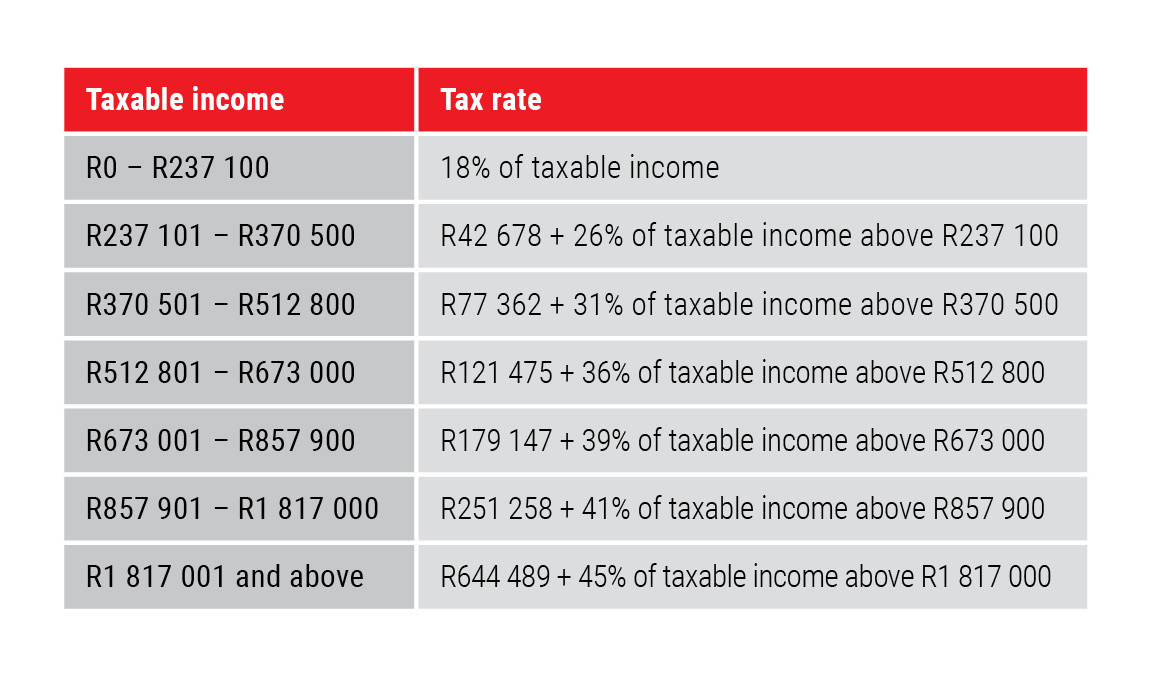

Personal income tax brackets have not been adjusted for inflation for the 2024/2025 tax year and remain unchanged from last year. The highest marginal tax rate for individual taxpayers and special trusts remains at 45%. The personal income tax rates for the 2024/2025 tax year are listed below.

Tax thresholds

The tax-free thresholds for personal income taxes have not been adjusted for the 2024/2025 financial year and remain as follows:

- R95 750 for taxpayers younger than 65

- R148 217 for taxpayers age 65 to 74

- R165 689 for taxpayers age 75 and over

Rebates

The primary, secondary and tertiary rebates (deductible from tax payable) have not been adjusted and remain as follows:

- R17 235 per tax year for all individuals

- R9 444 for taxpayers age 65 and over

- R3 145 for taxpayers age 75 and over

Medical tax credits

Monthly tax credits for medical scheme contributions remain unchanged for the 2024/2025 tax year:

- R364 per month per beneficiary for the first two beneficiaries

- R246 per month for each additional beneficiary

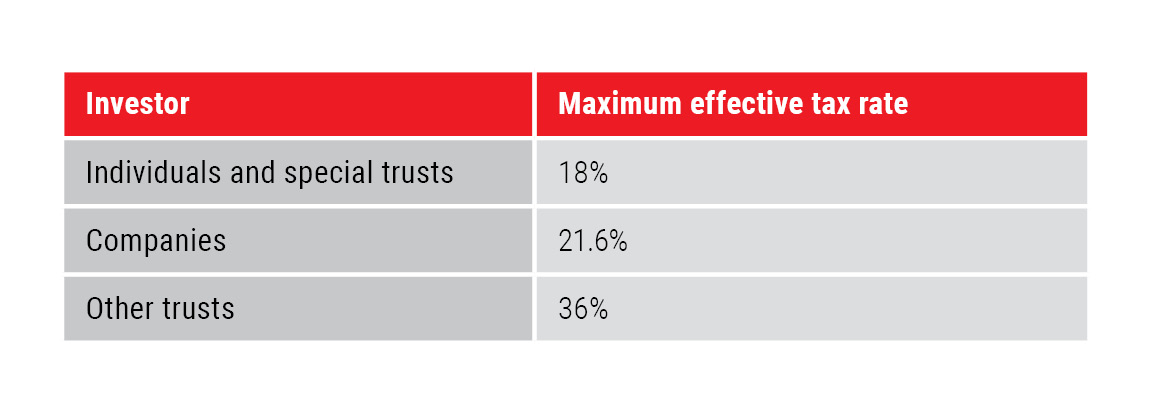

Capital gains tax (CGT)

The CGT inclusion rate for individuals and special trusts remains at 40%, and for other taxpayers at 80%.

The annual exclusion for a capital gain or loss granted to individuals and special trusts remains at R40 000. The exclusion granted to individuals remains R300 000 in the year of death.

Trusts

The income tax rate for trusts (other than special trusts) remains unchanged at 45%.

Interest exemptions

The local interest exemptions remain unchanged:

- The exemption on interest earned for individuals younger than 65 years remains R23 800 per annum.

- The exemption for individuals 65 years and older remains R34 500 per annum.

Foreign interest remains fully taxable.

Dividends tax

Dividends tax remains at 20% on dividends paid by resident and non-resident companies for shares listed on the JSE.

Foreign dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company) are taxable at a maximum effective rate of 20%.

Interest withholding tax for non-residents

Interest withholding tax remains at 15% on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Tax-free savings account

The annual cap on contributions to tax-free savings accounts remains at R36 000 from 1 March 2024, with the lifetime limit also remaining at R500 000.

Retirement lump sum taxation

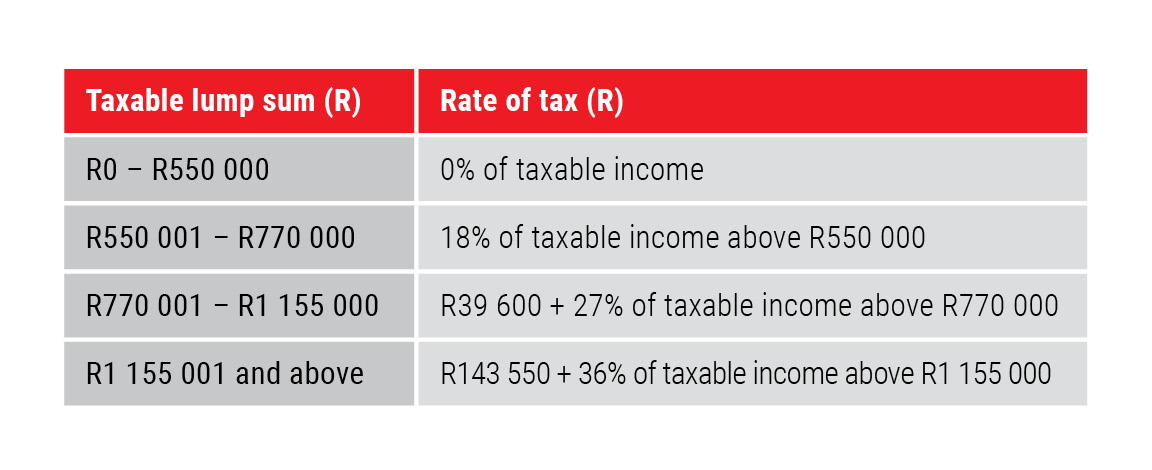

At retirement

The first R550 000 of a retirement lump sum remains tax-free. The table below illustrates how retirement lump sums will be taxed from 1 March 2024:

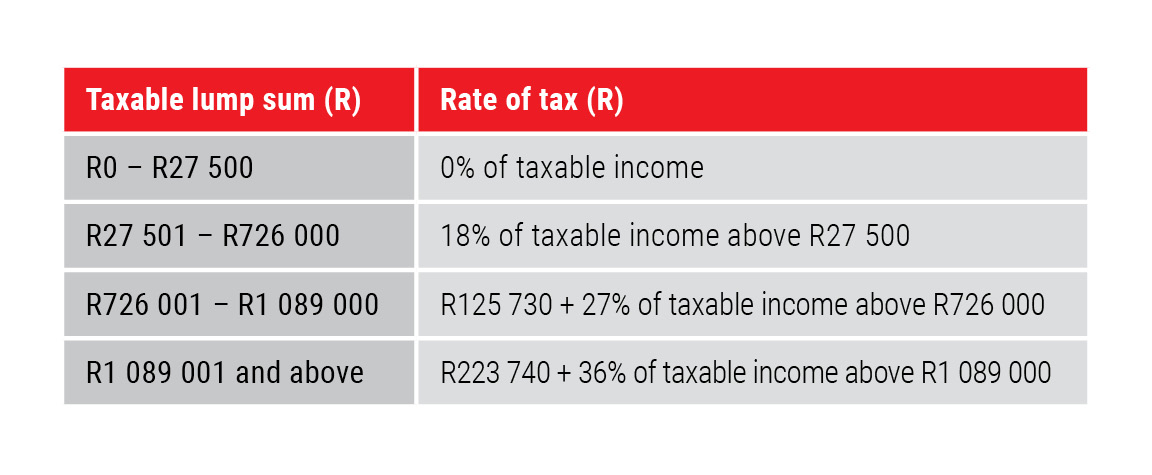

Pre-retirement

The first R27 500 of a pre-retirement lump sum withdrawal remains tax-free. The table below illustrates how withdrawal lump sums will be taxed from 1 March 2024:

Value-added tax

Value-added tax is charged on the supply of goods and services provided by registered vendors. It remains at 15%.

Estate duty

Estate duty is levied on property of residents and South African property of non-residents, less allowable deductions. The duty is levied on the dutiable value of an estate at a rate of 20% on the first R30 million and at a rate of 25% above R30 million.

A basic deduction of R3.5 million is allowed in the determination of an estate’s liability for estate duty. The tax rates and deductions remain unchanged from last year.

Donations tax

Donations tax is payable on the value of property disposed of by donation. It is levied at a rate of 20% on the cumulative value of property donated since 1 March 2018 not exceeding R30 million, and at a rate of 25% on the cumulative value of property donated since 1 March 2018 exceeding R30 million.

The first R100 000 of property donated each year by an individual is, however, exempt from donations tax. The tax rates remain unchanged from last year.

Additional tax proposals for the upcoming legislative cycle

Transfers between retirement funds by members who are 55 years or older

From 1 March 2024, members of pension or provident funds who have reached the normal retirement age, as contained in the rules of the fund, but have not yet elected to retire, will be able to transfer their retirement interest tax‐free to other pension or provident funds, provided the transfer is an involuntary one, and the transfer is made to a less restrictive fund.

Government proposes that the law be amended to also allow for tax-free transfers of this nature between retirement annuity funds.

International corporate tax reform

South Africa will implement a global minimum corporate tax of 15% from 1 January 2024. Its introduction is in line with the Organisation for Economic Co-operation and Development’s base erosion and profit-shifting framework and is expected to increase corporate tax collection by R8 billion in the 2026/2027 tax year.

This tax will apply to South African multinationals with annual revenue exceeding EUR750 million, who will be subject to an effective tax rate of at least 15% in South Africa, regardless of where profits are earned.

The Explanatory Memorandum and Draft Global Minimum Tax Bill will contain more details on these proposals and will also request public input.