Raine Adams unpacks progress on South Africa’s reform agenda and infrastructure rehabilitation, noting that momentum could accelerate if reform alignment and macroeconomic tailwinds are sustained, signalling a potential inflection point.

An air of optimism is breaking through the gloom that has shaped South African news flow in recent years. The risk of loadshedding has receded, freight transport woes appear to have turned a corner, and the government of national unity (GNU), while not without strain, has held thus far.

At the same time, powerful rallies in gold and platinum prices have bolstered the fiscus, the rand has strengthened, and a benign inflation outlook creates scope for further interest rate cuts. These factors support consumption and moderate economic growth over the near term.

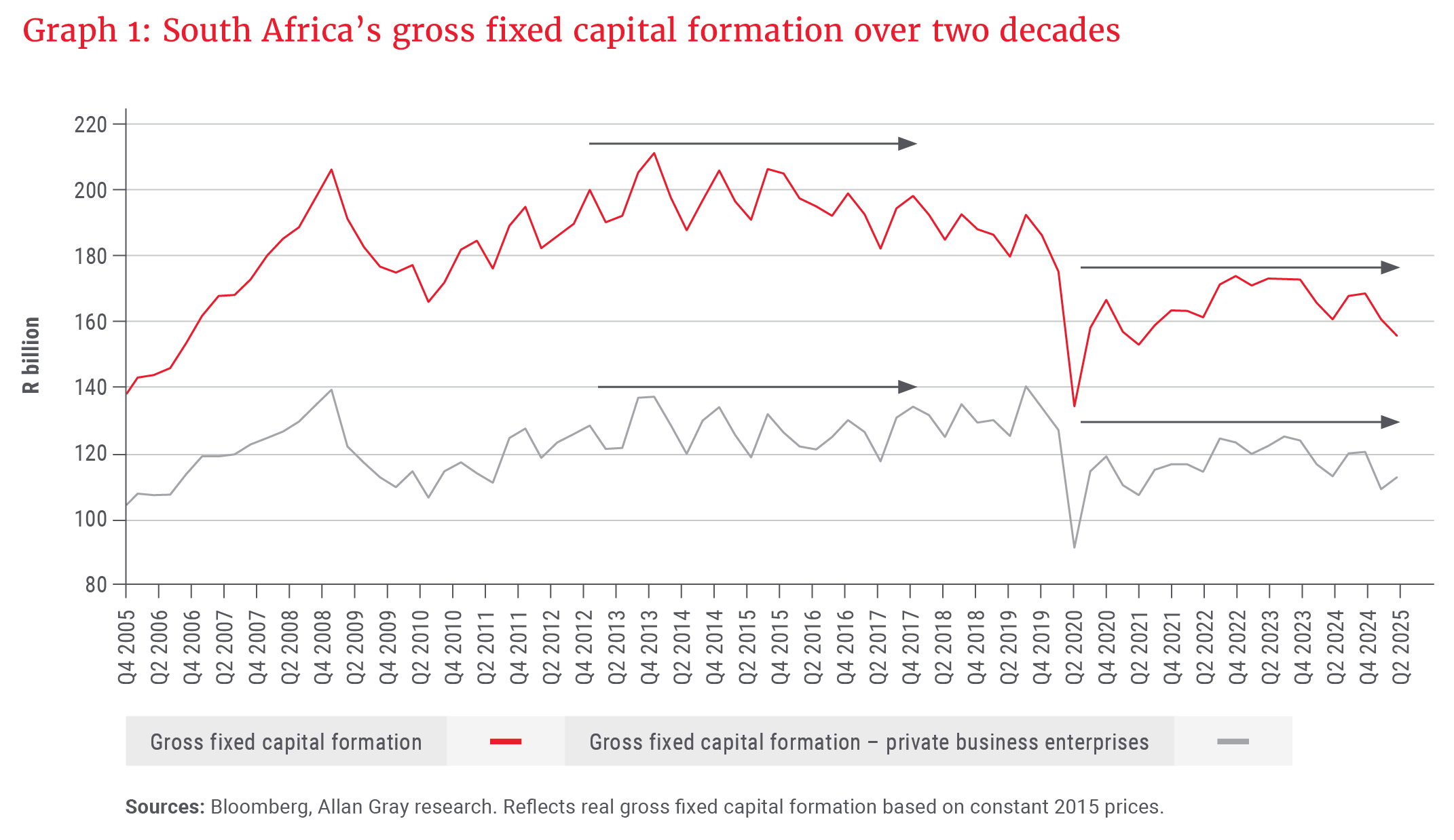

While consumption sustains today, investment secures tomorrow. Despite improved sentiment, South Africa’s gross fixed capital formation – spending on construction, machinery, equipment and other productive assets – remains anaemic, as shown in Graph 1, limiting the economy’s medium-term growth potential.

To achieve the 5% GDP growth that South Africa truly needs after more than a decade of stagnation requires a continued focus on rebuilding and expanding dilapidated infrastructure that weighs on productivity and competitiveness. In acknowledgement of the work required, the government launched Operation Vulindlela in 2020 – a structural reform agenda aimed at addressing entrenched failures in state-owned monopolies and, under Phase II from 2025, widespread dysfunction in local government. Five years on, and with a boost from the GNU, some positive results are emerging.

In addition, as debt-servicing costs ease from a base that currently absorbs 20-22% of national revenue, fiscal space should open for higher public infrastructure investment. This begs the question: Can the alignment of reform momentum and macroeconomic tailwinds deliver an inflection point for South Africa’s economic fortunes?

Electricity reform

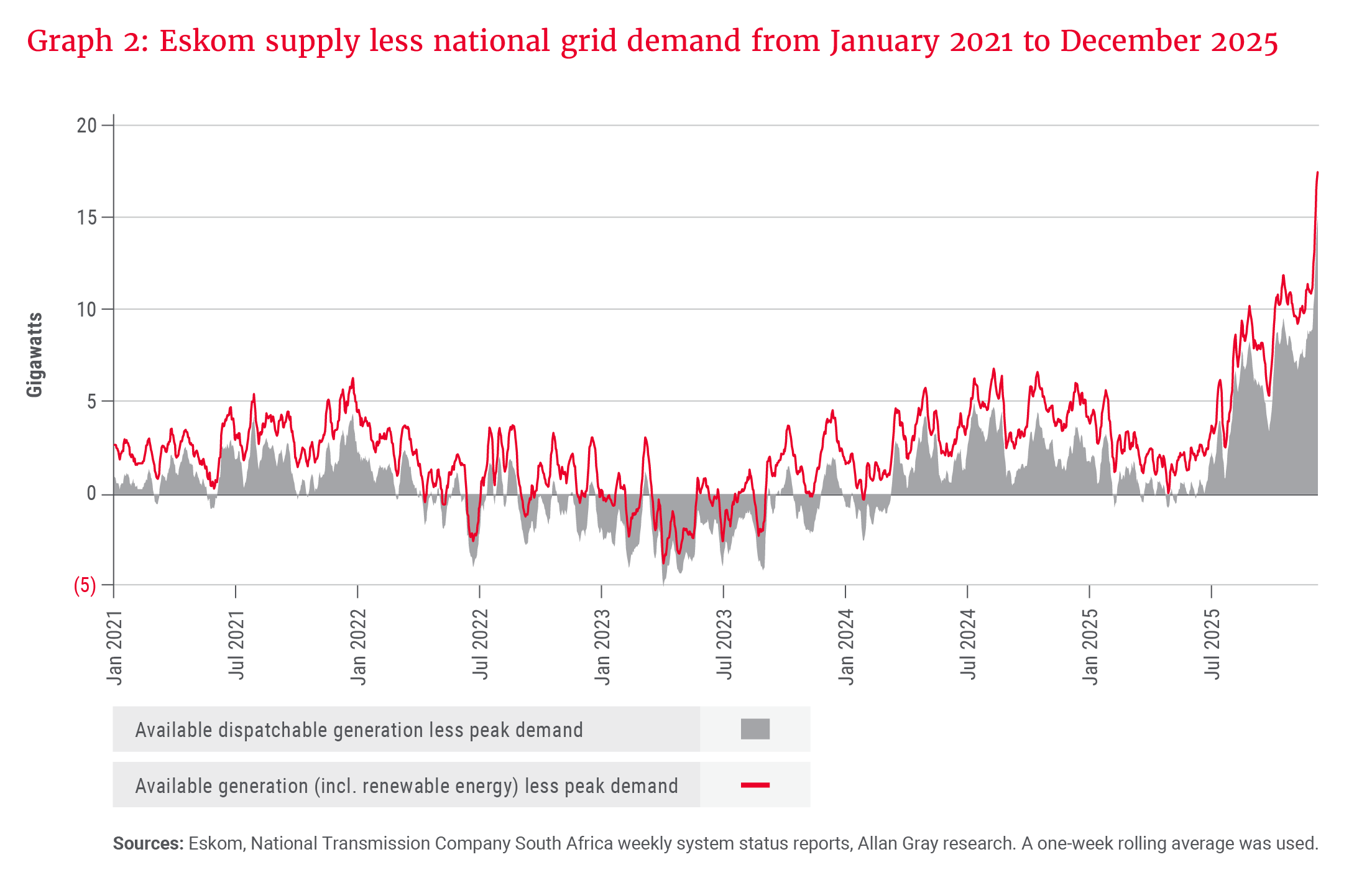

After enduring 335 days of loadshedding in 2023, South Africans are acutely aware of the importance of a reliable power supply for economic growth. The current absence of loadshedding reflects not only improved supply, but also lower demand, easing pressure on the grid. In the second half of 2025, average monthly peak demand ran nearly 3 gigawatts (GW) below the 2021 pre-loadshedding baseline – a material delta given that each stage of loadshedding reflected a roughly 1 GW supply–demand shortfall.

The reform agenda has crossed a threshold, with early signs of progress emerging … Translating these green shoots into sustained economic growth … will now hinge on the pace and consistency of implementation …

A key driver of lower demand has been the government’s 2021 decision, albeit overdue, to lift the licensing cap on embedded generation, unlocking rapid deployment in the commercial and industrial sectors. Together with household deployment, rooftop solar capacity has more than tripled, rising from 2.3 GW in July 2022 to around 7.5 GW today – broadly equivalent to the capacity of all grid-connected utility-scale renewable energy projects. However, weaker demand also reflects the cumulative impact of electricity tariffs roughly doubling over the past five years, weighing on energy-intensive industries.

On the supply side, Eskom’s improved performance has been aided by the return to service of three Kusile units and the commissioning of its final two units – collectively, 3.6 GW of nominal capacity against an average 28 GW of available dispatchable capacity in 2023. Despite some tightness towards mid-2025, the system is now enjoying its largest supply buffer in years. See Graph 2 below.

With operational stability restored, institutional reform is now progressing. Steps towards market liberalisation include the functional separation of the National Transmission Company South Africa (NTCSA), legislation requiring NTCSA to become a fully independent system operator within five years, the planned launch of the South African Wholesale Electricity Market (SAWEM) in April 2026, and the ongoing granting of electricity trading licences to private-sector participants.

From an energy-mix perspective, South Africa remains reliant on an ageing coal fleet, with significant decommissionings scheduled towards 2030. However, gas-fired replacement capacity envisaged under the newly gazetted Integrated Resource Plan remains materially behind schedule. By contrast, renewable generation potential is ample: Around 220 GW of projects are in the pipeline (more than is needed), including 72 GW at advanced stages. The binding constraint has shifted decisively to the transmission network, where connection capacity is largely exhausted in key renewable-resource provinces.

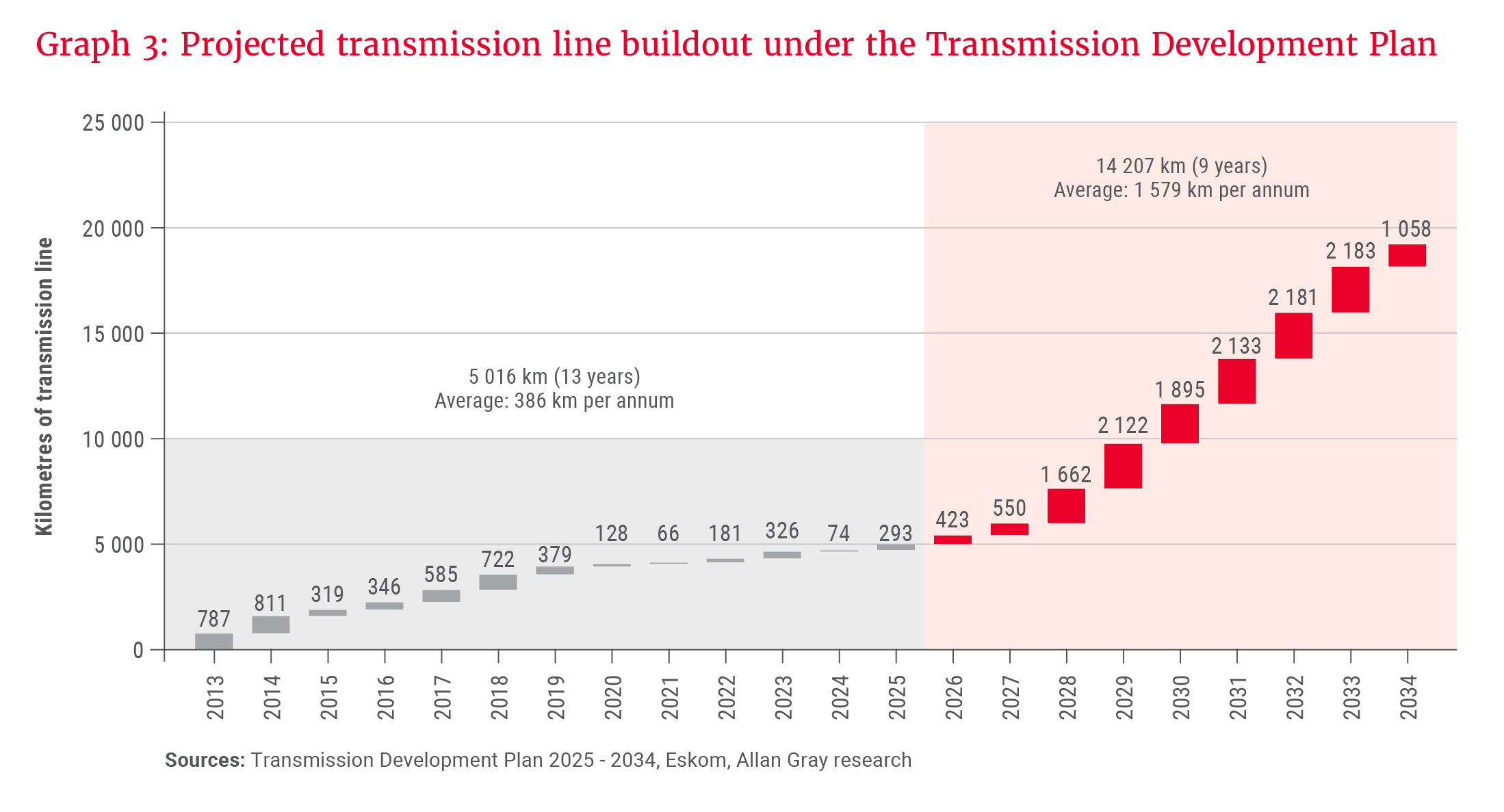

Addressing this will require a major grid expansion. The NTCSA’s Transmission Development Plan envisages approximately R440bn of investment to build more than 14 000 km of new high-voltage transmission lines and add significant transformer capacity – implying a fourfold increase in annual build rates relative to the past decade, as shown in Graph 3. Encouragingly, the private sector is being mobilised for the first time, with the first pre-qualified bidders under the Independent Transmission Programme appointed in December 2025. Execution risks nevertheless remain material, reflecting worldwide transformer shortages and acute skills constraints amid rapid electrification, as well as local land acquisition complexities.

Despite reform momentum, the escalation in municipal debt owed to Eskom’s Distribution business remains a serious overhang, surging from R2.4bn in 2014 to R74bn in 2024, to over R100bn today. This complicates Eskom’s unbundling and, if unresolved, threatens gains stemming from National Treasury’s R230bn debt relief package. Eskom has begun implementing Distribution Agency Agreements with financially distressed municipalities to restore sustainability, though resistance from organised local government persists. Finally, Eskom’s recent operational improvements have not been cost-free, with staff expenses rising 34% over the past two years – a trend that warrants monitoring.

Transport

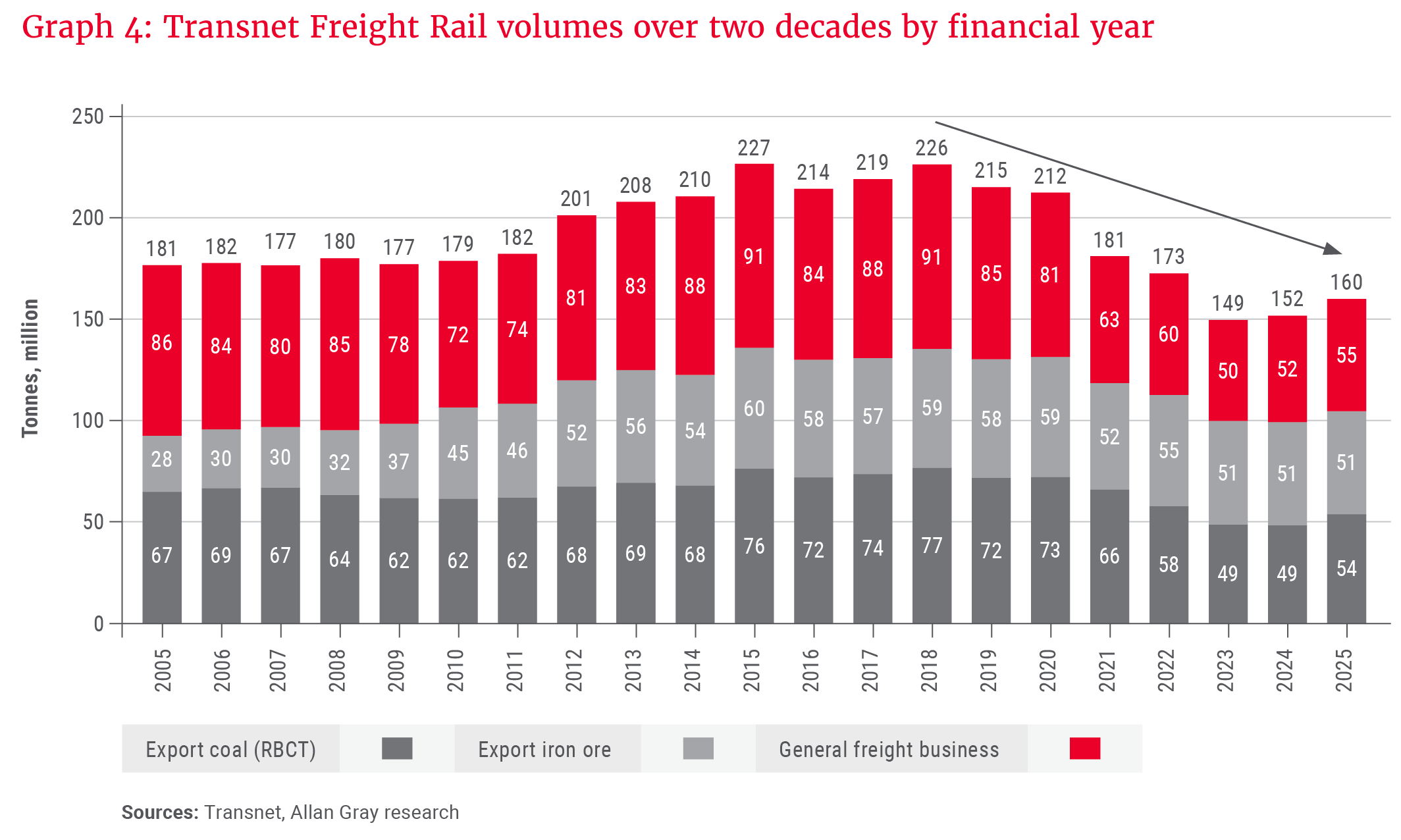

Today, for every tonne of freight moved by rail in South Africa, roughly six tonnes are transported by road. This is not only significantly more expensive for long-distance, bulk freight, but also imposes heavy burdens on road infrastructure, while increasing road accident rates. Transnet’s freight rail volumes fell sharply from 226 million tonnes (Mt) in 2018 to 149 Mt in 2023, as shown in Graph 4. While the current management team has begun to reverse this trend – lifting volumes to 160 Mt in 2025 and sustaining an upward trajectory – the rail network remains constrained by chronic underinvestment and requires substantial rehabilitation. Transnet’s financial outlook has been stabilised following the provision of a further R146bn of government guarantees from National Treasury in 2025, enabling a renewed focus on capital expenditure.

The sector’s outlook has also improved under an ambitiously target-driven minister of transport. In 2025, 11 private train-operating companies were conditionally awarded freight rail slots. While we doubt the feasibility of delivering the announced 20 Mt of additional freight by the 2026/27 financial year, the direction of travel is positive, signalling greater openness to private sector participation. Traxtion’s subsequent announcement of a R3.4bn rolling stock investment – the largest private freight rail investment in our history – represents a meaningful vote of confidence. Lastly, while delayed, plans have been announced for private sector capital to be mobilised directly into the rail network, most likely through concessions. Further work is required to tackle security risks and cable theft.

At the ports, much of the post-COVID-19 underperformance reflects underinvestment in equipment over the prior decade. The new management team is advancing a solid procurement pipeline. Transnet’s recent court victory also cleared the way for a 25-year concession at Durban Port’s Pier 2, to be operated by global player ICTSI. This is very positive given that Pier 2 handles 72% of the Durban Port’s throughput and nearly half of South Africa’s container volumes.

Water

In 2024, we highlighted the escalating crisis in South Africa’s water and wastewater infrastructure in an article on our “Latest insights” page. Alongside rapidly deteriorating water quality and widespread untreated wastewater discharges, non-revenue water has reached 47% nationally, driven largely by physical leaks.

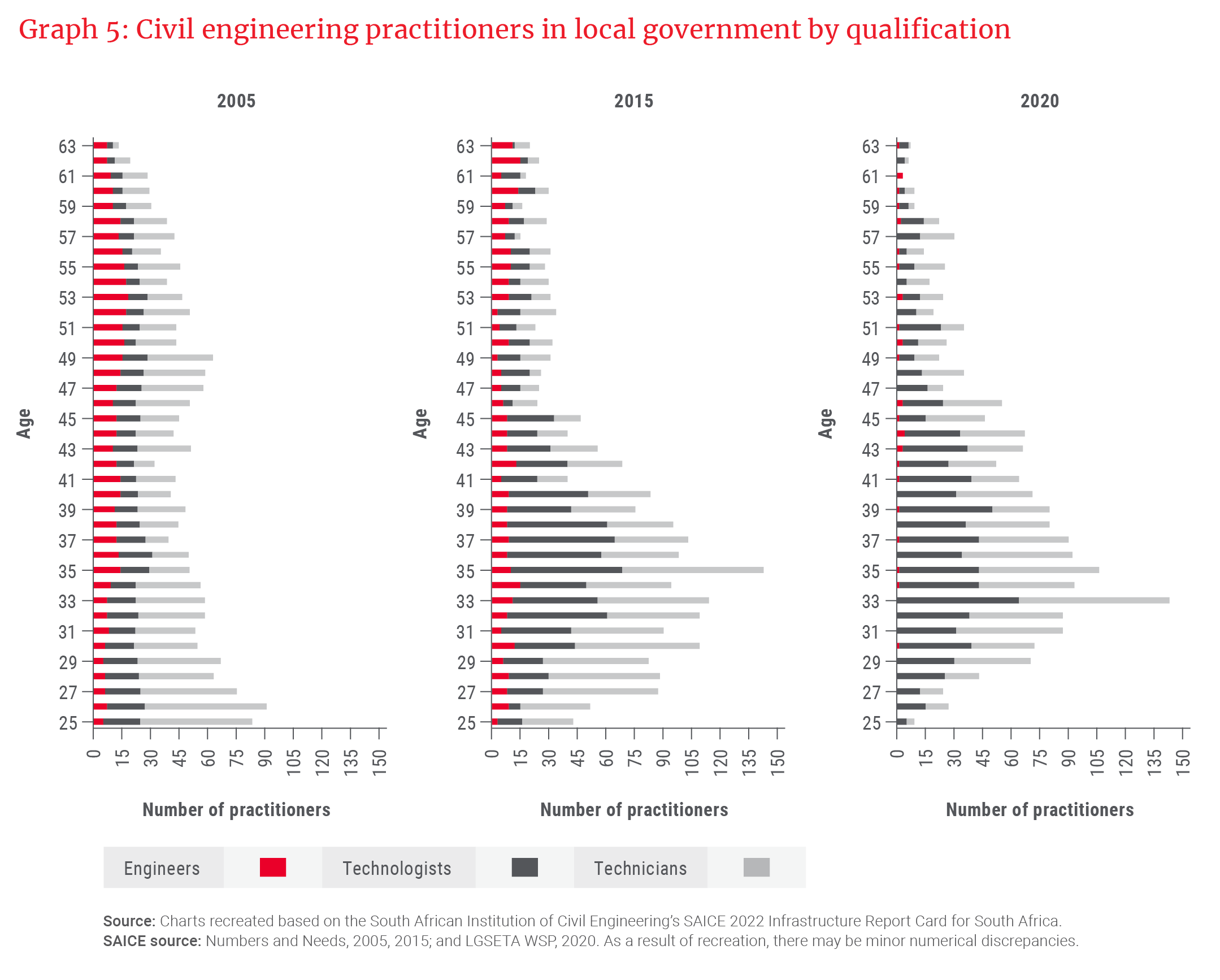

Addressing these failures requires urgent intervention, particularly given the heavy reliance on often-dysfunctional municipalities as water service authorities. As Graph 5 illustrates, local government has suffered a significant loss of civil engineering capacity – which is concerning given its responsibility for extensive reticulation networks, reservoirs and associated infrastructure.

Encouragingly, several interventions are underway, with a highly capable director general at the Department of Water and Sanitation building confidence. Since late 2024, National Treasury has started withholding the Local Government Equitable Share – the mechanism through which municipal governments receive unconditional funding from national revenues – of defaulting municipalities until current obligations, especially water bills, are paid. While this does not yet resolve arrears, early signs suggest improved payment discipline on current accounts.

Secondly, Treasury has launched the R54bn, six-year Metro Trading Services Reform Programme. To access funding, metros must develop and implement Performance Improvement Action Plans. Annual grant allocations will be based on independent assessments across 30 performance indicators, such as non-revenue water reduction, ring-fencing of water revenues and creating single-point accountability. Albeit overdue, the slow shift towards “pay for performance” is an encouraging move in the right direction.

Finally, the Water Services Amendment Bill, approved by cabinet in September 2025, strengthens the regulatory framework by clearly separating the roles of Water Service Authority (WSA) and Water Service Provider (WSP). Under the Bill, WSPs must hold an operating licence from the Department of Water and Sanitation, and the minister is empowered to compel a WSA to appoint an alternative licensed WSP where performance failures persist.

Major challenges remain

While the above developments are positive, they must be tempered by persistent news flow underscoring deeply entrenched corruption and powerful organised crime networks. Much of the evidence provided in the 2018 Zondo Commission and more recently the Madlanga Commission has been extremely damning, yet high-profile arrests, dismissals and accountability remain absent. The outlook will be shaped by several milestones, including the recent appointment of a new National Director of Public Prosecutions, at a time when the National Prosecuting Authority urgently needs to strengthen its credibility and effectiveness. This will be followed by upcoming local government elections, which could yield improvements in key metros such as Johannesburg, but where coalition dynamics and systemic corruption within the public service may prove difficult to manage. Beyond this, attention will turn to the ANC’s leadership transition at its 2027 National Conference.

While many reforms have been legislated and therefore offer some continuity, President Cyril Ramaphosa’s successor will have important implications for South Africa’s political and institutional trajectory. Although a lower probability, downside political scenarios cannot yet be fully discounted. Foreign relations add a further layer of risk, as ties with the United States have soured amid South Africa’s deepening engagement with more contentious international partners.

Weak capacity and governance, particularly at local government level, also remain a significant constraint, as much of the above is easier said than done, and the acute skills shortage at municipal level cannot be easily reversed. This has the potential to slow the implementation of certain reforms. At the same time, the domestic construction sector – once highly capable of delivering large-scale infrastructure projects – has been hollowed out by years of policy uncertainty and economic stagnation and may take time to rebuild.

We continue to monitor indicators for evidence of a more durable inflection, particularly a sustained breakout in gross fixed capital formation.

Closing thoughts

We have long believed that South Africa’s reform process would unfold over a longer horizon than consensus expectations – a view that has thus far been borne out. That said, momentum can shift rapidly when macroeconomic and structural tailwinds align. We continue to monitor indicators for evidence of a more durable inflection, particularly a sustained breakout in gross fixed capital formation.

The reform agenda has nonetheless crossed a threshold, with early signs of progress emerging: greater stability in and performance from state-owned enterprise leadership, the gradual opening of historically monopolised sectors to private-sector expertise and competition, and a stronger legislative emphasis on accountability. Translating these green shoots into sustained economic growth – even at a 3%-plus pace – will now hinge on the pace and consistency of implementation, alongside a far tougher stance on crime and corruption. On both fronts, we believe South Africa’s track record warrants some caution.

Accordingly, our portfolio positioning does not “bet the farm” on South Africa’s economic recovery. Local equity exposure remains anchored in defensive rand hedges such as British American Tobacco and Anheuser-Busch InBev (see Jithen Pillay’s piece). In this context, it is worth noting that in 2025 – a year of lacklustre domestic economic growth – South African government bonds performed remarkably well, and the FTSE/JSE All Share Index returned over 40%. However, it was not SA Inc. stocks that drove this performance; rather, it was the gold and platinum group metal miners rallying well over 100% on the back of higher metal prices. Many SA Inc. counters, including quality retailers like Shoprite, Clicks and Mr Price, declined in value. As such, among SA Inc. stocks we are seeing greater opportunities, but valuation remains paramount. Our domestic positioning favours businesses where we believe the economic risks are already more than reflected in prices, and businesses capable of delivering growth even if the recovery unfolds more slowly than hoped, providing downside protection while still allowing clients to participate in a moderate growth outcome.

Explore more insights from our Q4 2025 Quarterly Commentary

- 2025 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- AB InBev: Catching up over a beer by Jithen Pillay

- Orbis: President’s letter 2025 by Adam R. Karr

- The long-term benefits of maximising your retirement fund contributions by Carla Rossouw

- The compounding power of micro wins by Thandi Skade

To view our latest Quarterly Commentary or browse previous editions, click here.