We have previously set out the reasons Sanlam has an above-benchmark position in our clients’ portfolios (see Quarterly Commentary 1, 2010). On a ‘look-through’ basis our position is however not limited to Sanlam (although it is currently the only insurer in our Top 10). Total exposure to the insurance and related sectors currently amounts to 11.2% of local equities if both direct holdings such as Sanlam and Old Mutual, as well as indirect exposure via holding companies like Remgro, RMI and Standard Bank, are added together. Despite being out of favour with many investors, the insurance sector has outperformed the total return of the market since 2002. Duncan Artus and Leonard Krüger discuss.

A sector facing adversity

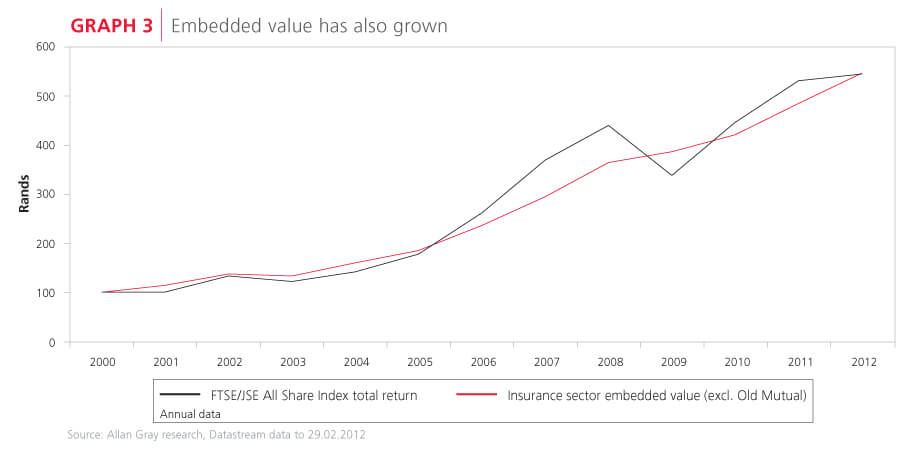

Many investors dislike insurers and dismiss the sector due to its poor growth outlook and the view that it is difficult to understand. High fees, a lack of transparency for customers and the onus of increased regulation further reinforce the negative perceptions. The past decade has witnessed a very public loss of assets relative to third party managers, as illustrated in Graph 1. Whereas insurers managed 80% of South Africa’s savings in 2000, their combined share reduced to 50% in 2011.

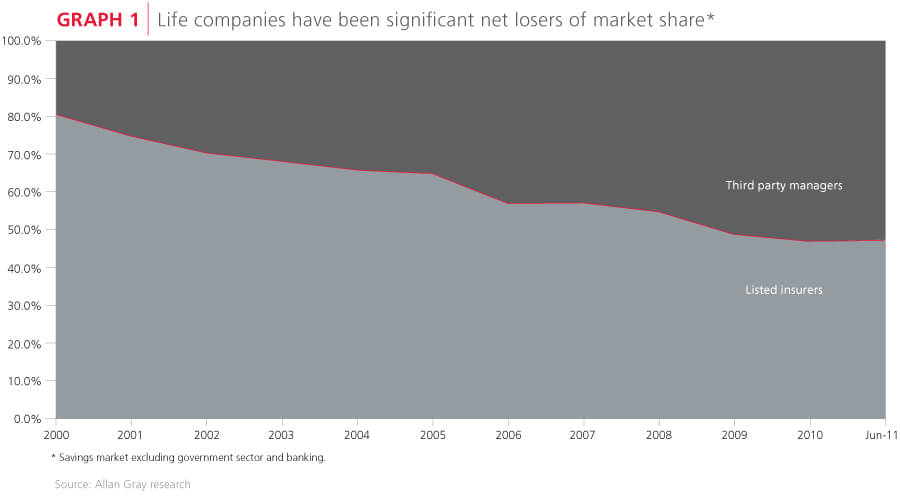

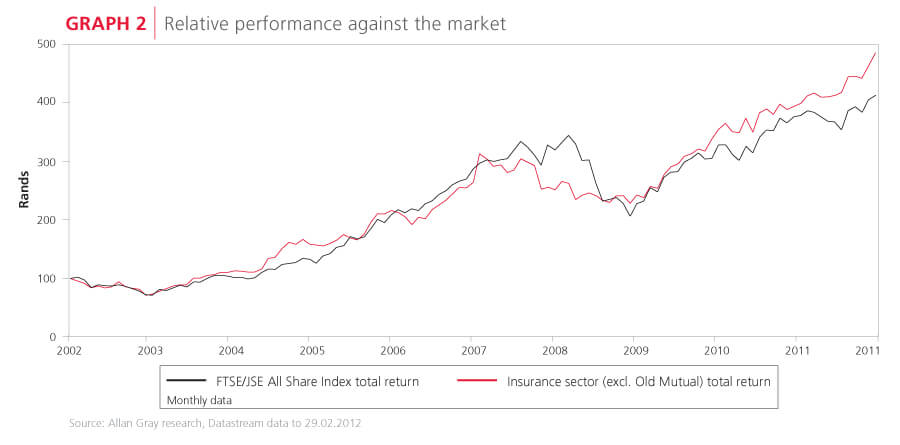

An investor given perfect foresight of such market share losses and the evolving regulatory environment would be surprised to find the excellent returns the sector was able to deliver during this time for shareholders (see Graphs 2 and 3). Measured by the increase in embedded value (an internal measure of value used by insurers), the sector kept up with strong equity market returns. Similarly, the total return (dividends reinvested) from insurance companies has outperformed the total return of the market since 2002.

A closer look at insurance economics

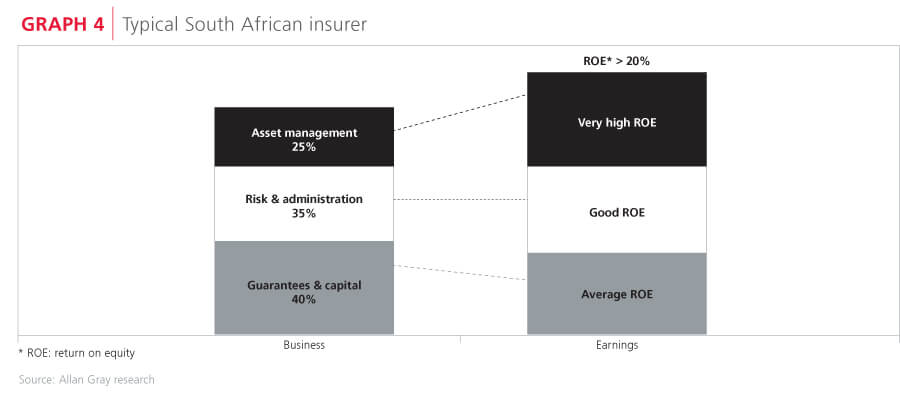

We believe the business of a typical South African insurer can be divided into three broad categories:

1. Guarantees and capital

Many client investments with insurers carry some form of guaranteed return over a specified period. To ensure insurers are able to meet such guaranteed returns when due, capital is held and invested in a conservative manner. Such capital belongs to shareholders if not needed but is valued at a discount due to the tax drag and a lack of control over investment decision making. As insurers have diversified their businesses over time, by our estimates, such guarantees and capital account for 40% of the average total insurance business today and generate an average return on equity through the cycle.

2. Risk and administration

Insurers sell policies covering against the risk of events like death, disability or dread disease and make a profit when premiums received exceed the cost of claims and expenses. They also offer administration and other services to the likes of medical schemes, pension funds, property portfolios etc. By doing so on a large scale, efficiency and pooling of risks allow the industry to earn good returns on equity.

3. Asset management

All the South African insurers own and operate large asset management franchises. Management of different asset classes on behalf of the life parent, as well as non-life client assets such as unit trusts, is a fee-based business that does not require a lot of shareholder capital. This means that returns on equity can be very high.

Combining these individual business segments, insurers on average should achieve returns on equity in excess of 20% per year (see Graph 4). Although returns may fluctuate from year to year, the high average returns on equity allow for higher dividends to be paid if growth rates are low. Purchasing insurers on dividend yields of 1.5 times the market on average over the past 10 years has compensated shareholders for periods of lower return and a lot of the industry negatives that occurred.

Telling tortoise from hare

As is illustrated in Aesop’s ancient tale of the tortoise and the hare, in business, steady progress often gives a better result than aggression and speed. In Graphs 2 and 3 you may have noticed the exclusion of Old Mutual from our analysis. Following its de-mutualisation in 1999, the newly London listed Old Mutual embarked upon an aggressive international expansion at times seemingly characterised by a hare-like attitude of invincibility. New acquisitions focused on size and popular markets, often at peak or very high prices. In doing so, Old Mutual built up substantial company debt and exposure to a varied number of markets, notably in its US Life insurance business. The US Life business primarily offered clients higher than industry guaranteed returns by investing in higher yielding bonds that also had higher risks, including subprime mortgage bonds.

The onset of the financial crisis brought matters to a head and crystallised the risks of this strategy. The hare was caught napping in the fields.

WE BELIEVE THE PERIOD OF PERENNIAL UNDERPERFORMANCE... HAS COME TO AN END AND THAT OLD MUTUAL IN FUTURE SHOULD ENJOY COMPARABLE ECONOMICS TO THAT OF THE SECTOR

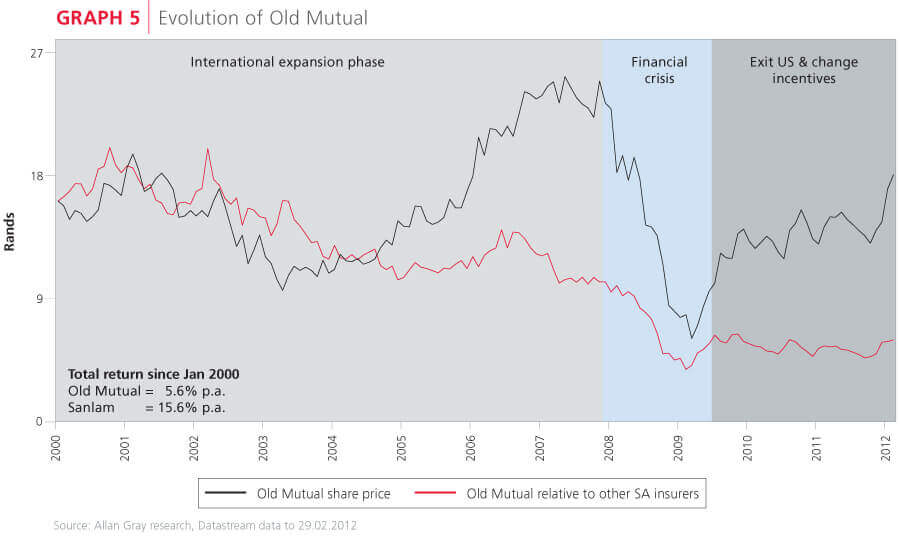

Substantial change has since been achieved at Old Mutual as is often the case in times of distress. Critically, it exited the US Life business and focused management incentives and objectives on shareholder value rather than indiscriminate growth. This has resulted in promising reductions in debt and adjustments in risk exposure. We believe the period of perennial underperformance (the red line on Graph 5) relative to other SA insurers has come to an end and that Old Mutual in future should enjoy comparable economics to that of the sector.

Our investment philosophy typically results in us investing early when building a position in a new share, as prices often continue to fall due to short-term pessimism. With Old Mutual however, this was not the case. We believe Old Mutual offered better value at R13-14 excluding US Life than at R8 including it, given our assessment of the downside risk. Throughout 2011, we continued to acquire Old Mutual shares at around the R13-14 level.

Our investment philosophy typically results in us investing early when building a position in a new share, as prices often continue to fall due to short-term pessimism. With Old Mutual however, this was not the case. We believe Old Mutual offered better value at R13-14 excluding US Life than at R8 including it, given our assessment of the downside risk. Throughout 2011, we continued to acquire Old Mutual shares at around the R13-14 level.

In December, Old Mutual announced the sale of its Nordic operations for a good price. This was a surprise to us and the market and the share price responded favourably to the transaction prior to us acquiring as many shares as we would have liked.

As fundamental analysts we spend our time researching the operating environment, industry trends and company specifics to estimate a firm’s intrinsic value. Determining management quality is usually the hardest part to get right but can be very rewarding. Sanlam has proven the value of a good insurance management team. We believe that fixing the basics and maintaining a patient and disciplined process of capital allocation creates the most value for shareholders.