There are different types of investment risks, some more obvious than others. One risk that people often forget about is the risk that their invested money won't grow enough to keep up with inflation. When assessing the success of an investment at protecting and growing wealth, it is important to take inflation into account. Thandi Ngwane explains.

Time allows our invested money to grow, and thanks to the power of compounding, it allows it to grow exponentially. But time can also erode the value of our money, meaning we are able to buy less with the same amount of rands, as the prices of goods and services rise. This is called inflation. While it is quite easy to understand inflation's impact in terms of standards of living, what about its relevance in investment decisions and retirement planning?

The not-so-obvious risk

It is important to understand the nature of the risks you face as an investor and to decide how comfortable you are with each, so that you can make the right choices. Investors who cannot stomach fluctuations in returns usually opt for more conservative investments, which promise steady returns. They see investments that are volatile as more risky. However, very conservative investors often forget to account for a less obvious risk: the risk that their returns won't keep up with inflation, meaning that their savings will drop in buying power, even if they don't actually lose rands. Many seemingly 'safe bets' are guaranteed to not grow enough to protect us from inflation, for example keeping cash in the bank.

Consider buying power

The most meaningful way to measure wealth is in terms of buying power, as opposed to number of rands. Therefore, when evaluating your returns, look at the 'real return', which is your return after inflation, not the 'nominal return', which is the growth on your investment before the effects of inflation are considered. The returns on your investment should be at least enough to compensate you for the length of time that you invest so that the value of your money is maintained.

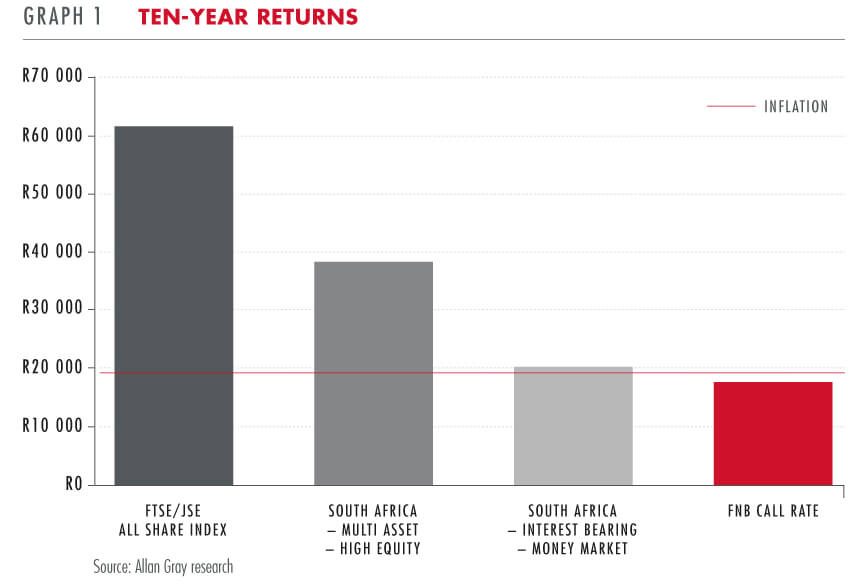

Graph 1 uses the last 10 years of returns to illustrate that a significant portion of investment return compensates for inflation first (everything below the red line) before any real return is earned (everything above the red line). If you had invested a R10 000 lump sum 10 years ago in equities, an average balanced fund, an average money market fund, or the bank, in most cases inflation would have accounted for the biggest piece of the pie.

Where investments are intended to provide an income, for example, in a living annuity, it is particularly important to take inflation into account when figuring out both withdrawal rates and asset allocation. Many retirees believe that they are at the end of their investing cycle. Actually, nowadays, at retirement you are likely to have to live on your pension for more than 15 or 20 years. Despite the fact that you need to draw a steady income, your invested money needs to continue to grow enough to be able to support your lifestyle over time and to help you cope with rising medical needs and costs. This means that you should consider investing a portion of your portfolio in assets that are likely to grow, such as equities.

The trade-off between risk and returns is a very personal decision and getting it right is key to successful investing. If you are not confident making investment choices, you may wish to consider talking to an independent financial adviser.