Historically, deep economic shocks have prompted significant changes in investment and saving behaviour. During times of uncertainty, investors scramble to manage risk – but should your long-term approach change in response to the short-term environment? Marise Bester investigates.

Imagine you are on a road trip. You enjoy driving and exploring, and always choose the road less travelled; the twists and turns of the journey add to the experience. You take your eyes off the road for a second to change the radio station. You look back up, see a tree, and swerve to avoid a collision. Your heart is pumping. You drive very cautiously for the next few minutes, fearful, when ordinarily, you are perfectly calm and balanced. This is understandable, as your perception of risk skyrocketed in a matter of seconds.

But does your experience change your appetite for action? Will you take the highway in the future, safe in the knowledge that it will be smooth driving, or will you continue to opt for the road less travelled? It is likely that over the long term, your natural sense of adventure will prevail. In other words, although your risk perception changed in the immediate aftermath of the incident, your tolerance for risk remains the same. The same response can be seen in investor decision-making in moments of heightened risk awareness.

What is risk?

Behavioural finance guru, Carl Richards, states: “Risk is what’s left over when you think you’ve thought of everything.” Investors often think of risk as the prospect of an undesirable outcome, such as a financial loss or not meeting an investment objective. At Allan Gray, we view investment risk as the probability of permanently losing money.

Take a moment to consider the following questions: What was your response to the recent 34% drop in the FTSE/JSE All Share Index (ALSI)? Did you sell all or some of your investments? Did you do nothing? Or did you consider investing more?

Your answers to these questions provide important insight into your risk tolerance. In basic terms, your risk tolerance is the amount of risk you are willing to accept in pursuit of your investment goals. This is an innate personality trait and remains fairly constant throughout your life, almost the same as being an introvert or extrovert.

If your risk tolerance remains fairly static, why, then, do investors choose to significantly manage their risk exposure during a time of market uncertainty? The answer: Their perception of risk has changed.

Risk perception is our momentary, emotional sense of how much danger we are facing. It is not an objective assessment of risk, but incorporates the psychological aspects of the investor, and results in decisions being made based on perceived rather than actual risk.

Risk perception is our momentary, emotional sense of how much danger we are facing

Michael Kitces, a renowned American financial planner, said: “Risk perception changes frequently (and sometimes irrationally), depending on whether markets are up or down and what sector is hot at the moment. For example, during the technology bubble of the late 1990s, even risk-averse clients wanted to invest heavily in technology stocks. Why? Because they perceived that these stocks weren’t risky at all.”

Acting on fear

Decisions made in a moment of heightened risk perception can be detrimental to achieving your investment goals. Numerous studies have been conducted to determine the effect of a market crisis on investors’ risk tolerance and risk perception.

FinaMetrica, a global company that offers risk tolerance assessments to the financial services industry, collected risk tolerance data before and after the 2007-2008 global financial crisis. The results showed that investors’ risk tolerance hardly changed; what changed dramatically was investors’ perception of risk. 74% of the investors surveyed viewed the market as more risky after the crisis than before.

The question is, has investors’ perception of risk once again changed as a result of the current pandemic? It seems so. Global research recently conducted by UK-based asset management company Schroders shows that over a quarter of the 26 000 investors surveyed moved significant portions of their portfolios to lower-risk investments during February and March this year.

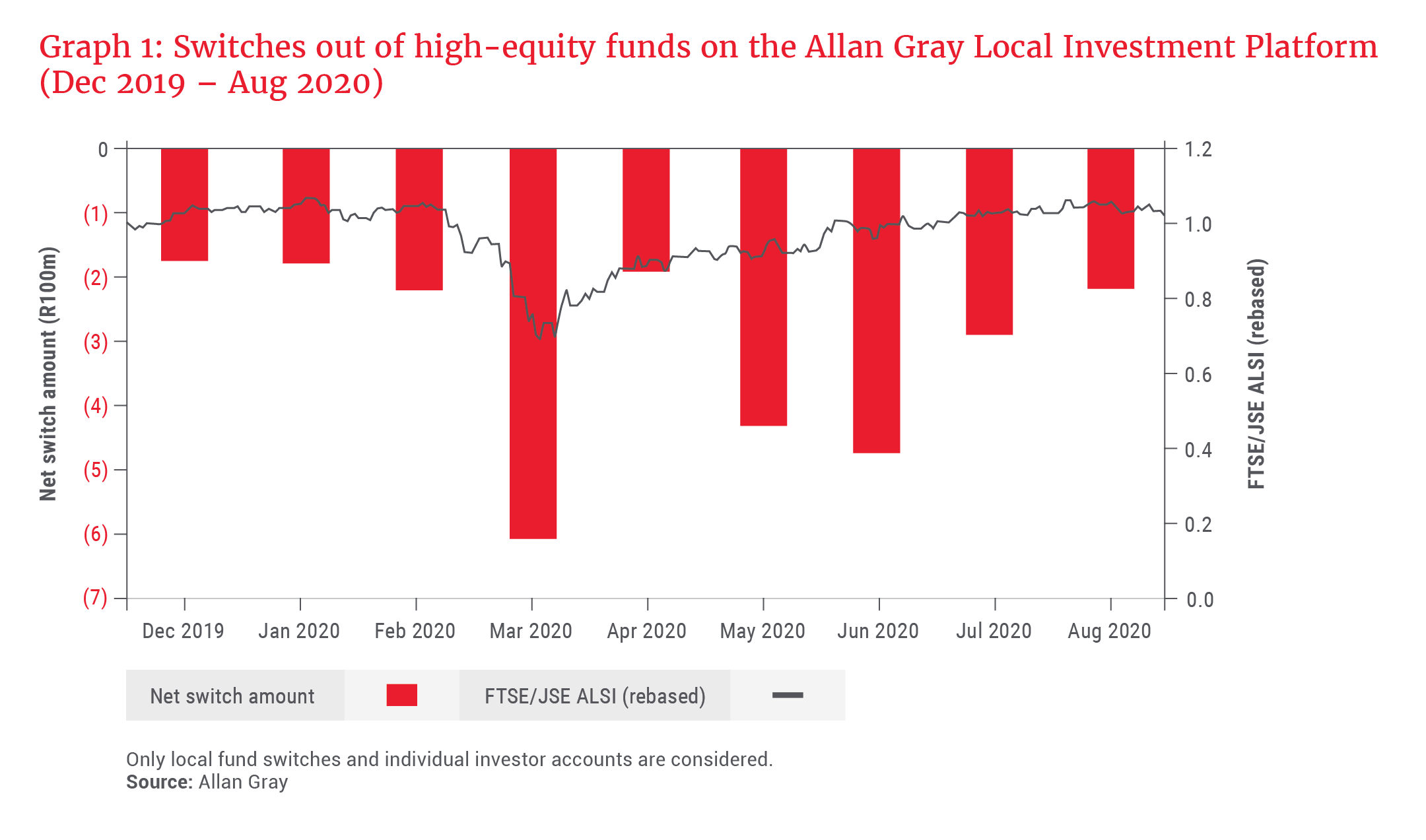

Closer to home, this behaviour holds true for investors on our local platform, as evidenced by the decrease in equity exposure during the recent market drawdown, which is a strikingly similar trend to that during the 2007-2008 global financial crisis. Graph 1 shows the net switch amounts in or out of funds classified as high-equity exposure funds. The black line represents the ALSI, which has been rebased for illustrative purposes to the benchmark price shown at the start of the period (1 December 2019).

As seen in Graph 1, high-equity funds experienced their highest net switch outflows in March 2020, when the ALSI was at its lowest, fear was at its highest, and investors were scrambling to exit this volatile asset class. Remarkably, investors continued this behaviour from April onwards, despite the ALSI showing strong signs of recovery.

In hindsight, this behaviour seems completely irrational, yet at the time, investors acted on the heightened risk they felt they faced, perhaps expecting it to persist indefinitely.

trying to switch in and out of the market seldom pays off

Similarly, statistics from the Association for Savings & Investment South Africa (ASISA) for the second quarter of 2020 show an increased preference among investors for interest-bearing portfolios, such as money market funds, as well as income portfolios. The impact of perceived risk on investor behaviour is therefore strikingly evident in the COVID-19 market drawdown.

How to manage perceived risk

So how can you ensure that risk misperception does not lead to actions that could be detrimental to your investment outcome?

- Be the driver of your investment, not a passenger

Spend time researching your investment and make sure you understand your options when you experience market volatility, which will inevitably come along.

A study on airline pilot decision-making has shown that accidents attributable to pilot behaviour are generally due to a misdiagnosis of the risk (i.e. risk perception), rather than an overly high tolerance for risk. These accidents are prevented by improved pilot education regarding risk identification and management.

The same principle applies to investment behaviour. A financial adviser can play a crucial role in providing expert insight, support and direction.

- Assess the probability of loss realistically

The likelihood of losing money is one of the most important drivers of perceived risk. Overestimating the probability or the extent of investment losses during market turbulence by looking at short-term risk and return measures can lead you astray.

To obtain a realistic view, put current events, and your associated discomfort, into perspective by looking at how your chosen fund(s) have responded to similar events over the long term. Remember, trying to switch in and out of the market seldom pays off, as we discussed in an article earlier this year (“Managing your portfolio through COVID-19”).

- Accept that risk and volatility are necessary

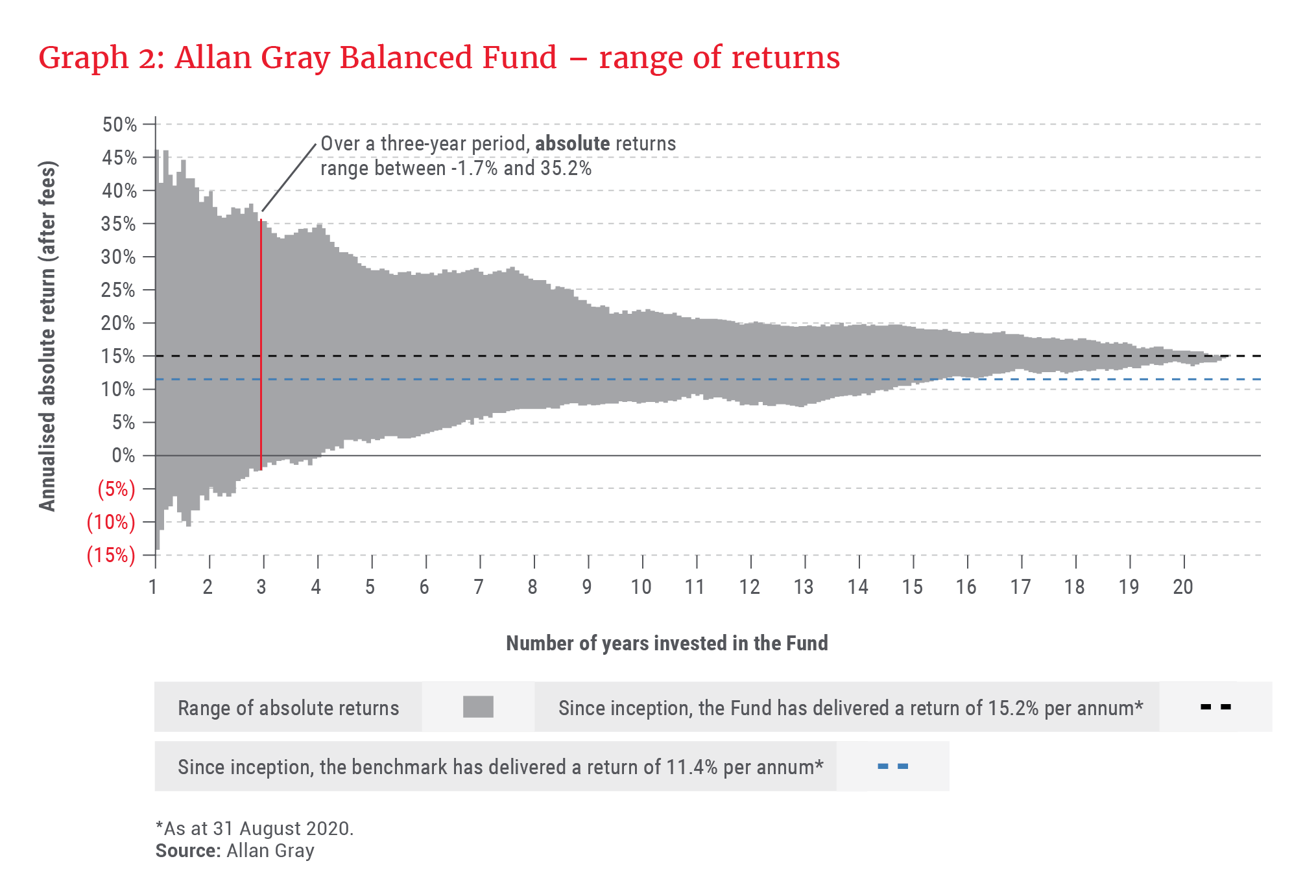

To earn real returns, you need to take on some risk, which introduces volatility. Graph 2 shows the Allan Gray Balanced Fund range of annualised absolute returns (after fees) compared to its benchmark.

Over a one-year period, there is a large variance in return, which has historically been anywhere between 46% and -14%. This can cause discomfort over the short term, like what we have recently experienced. Over a rolling three-year period, the Fund has delivered real returns 87% of the time. When we increase the rolling period to five years, this percentage increases to 98%. Therefore, the longer you remain invested, the better your chances of achieving real returns.

Follow your head, not your heart

It is highly unlikely that our risk tolerance will collapse or change drastically during market volatility. Instead, the more likely Achilles heel we need to manage is our risk perception. We can positively influence our risk perception through deliberate efforts that include educating ourselves about our investment and risk management.

If you find yourself on the verge of making a panicked decision to safeguard your investment, reflect on whether your personal circumstances, investment goals or time horizon has changed. If not, the best course of action might just be to do nothing at all.