In just a matter of weeks our world has changed dramatically. In an attempt to make sense of it all, we look for information that will provide us with a sense of understanding, comfort and reassurance. Instead, we find an overwhelming volume of views about COVID-19 and the humanitarian and financial crisis we face. Marise Bester helps us understand how to filter through the noise and make well-considered decisions that last for the long term.

With additional time on your hands in lockdown, and access to reams of information from different sources across the globe, you may be feeling overwhelmed, or you may sit on the other side of the spectrum, feeling like the expert. This false sense of confidence is referred to as “The state of informed bewilderment” – a term coined by Spanish sociologist, Manuel Castells, to describe a situation when society believes having access to knowledge is the same as having acquired knowledge.

Undue focus on short-term losses can lead to decisions that are not aligned with your long-term goals

It is understandable that in this time of severe market uncertainty, you may feel compelled to check on your investment portfolios more regularly. However, behavioural finance studies show that frequent checking not only raises our anxiety levels but can also negatively impact our long-term outcomes: We tend to make more cautious investment decisions to safeguard our investments – and this is not necessarily aligned with our long-term investment goals. This phenomenon is called “myopic loss aversion”.

Scientific studies show that our brain responds to financial losses in the same way it responds to physical pain. This explains why investors want to sell or switch their investments to avoid future pain when their investment value decreases in the short term. This behavioural trend is very much in evidence today as the COVID-19 crisis impacts the markets, and our investment values. Of course, the natural reaction is to want to do something – anything – to avoid future feelings of pain.

Loss aversion and investing

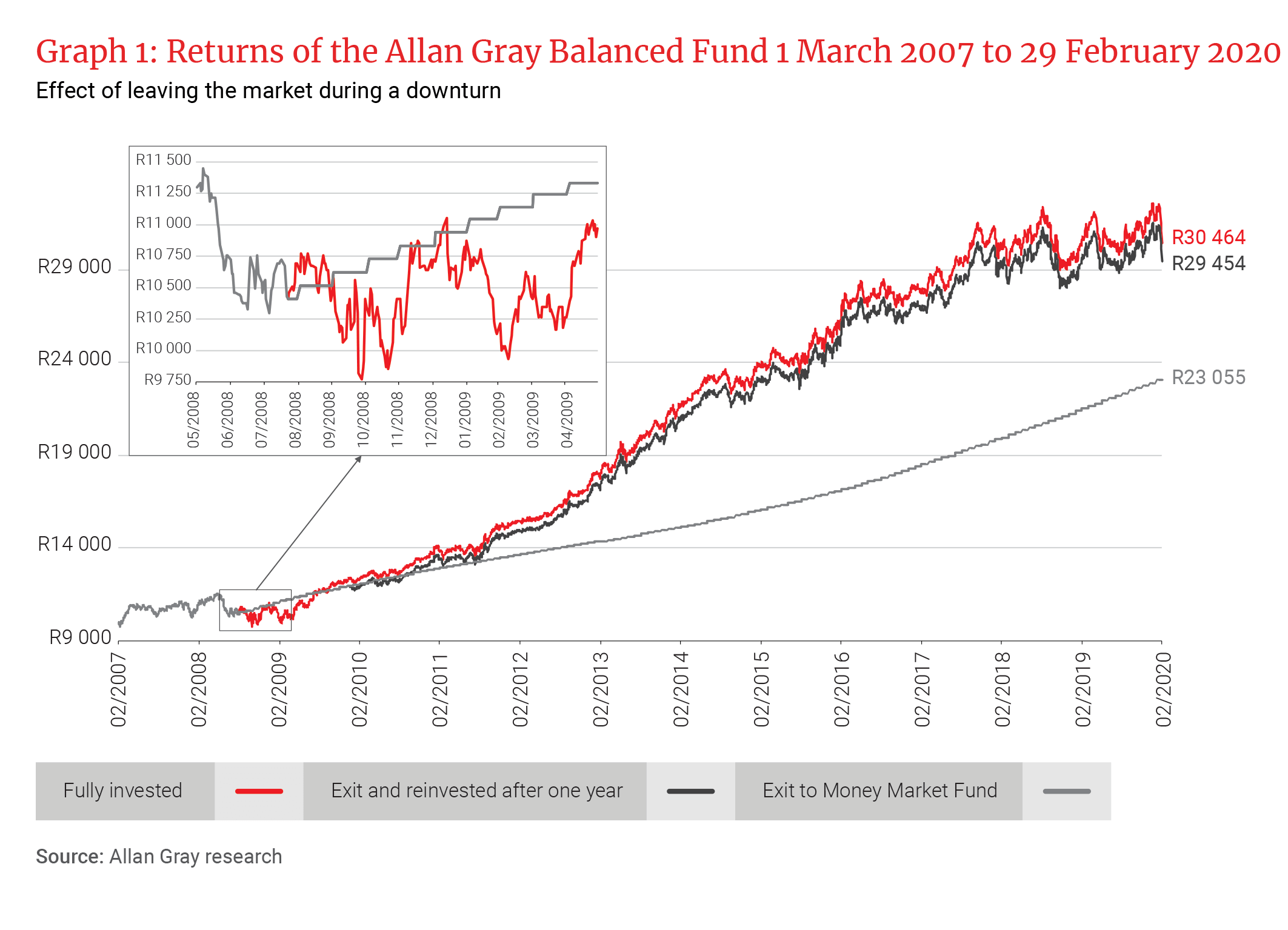

Graph 1 illustrates how loss aversion can negatively impact your long-term investment return. Consider this scenario: Three investors invested R10 000 each in the Allan Gray Balanced Fund before the global financial crisis (GFC) in 2008, during which the Fund experienced a maximum drawdown (the maximum percentage decline over any period) between 20 May 2008 and 27 October 2008. Three months into the crisis, Investor A (grey line) decided to switch their investment into the Allan Gray Money Market Fund for the remainder of their investment period. Investor B (black line) also decided to switch out of the Balanced Fund after enduring three months of the crisis and, like Investor A, switched into the Allan Gray Money Market Fund – but only for one year, which seemed like a reasonable period to allow the dust to settle. Investor B then switched back into the Allan Gray Balanced Fund after one year and remained invested in the Fund. Investor C (red line) remained invested in the Allan Gray Balanced Fund for the full period and endured the market volatility.

When we look at the investment values at the end of February 2020, we can see that Investor C, who made the difficult decision to remain invested in the Allan Gray Balanced Fund and endure more pain in the short term, had the highest end value of R30 464, in contrast to the investors who switched into the Allan Gray Money Market Fund. In addition, by remaining invested, Investor C did not experience any pressure or anxiety in trying to decide when to exit and re-enter the market.

Given the above example, we know that it is impossible to forecast the bottom of the market or Fund performance during a downturn. Like investors A and B, we tend to wait for bad news to pass, and for negative sentiment to turn positive, before we risk re-entering the market – often to our detriment.

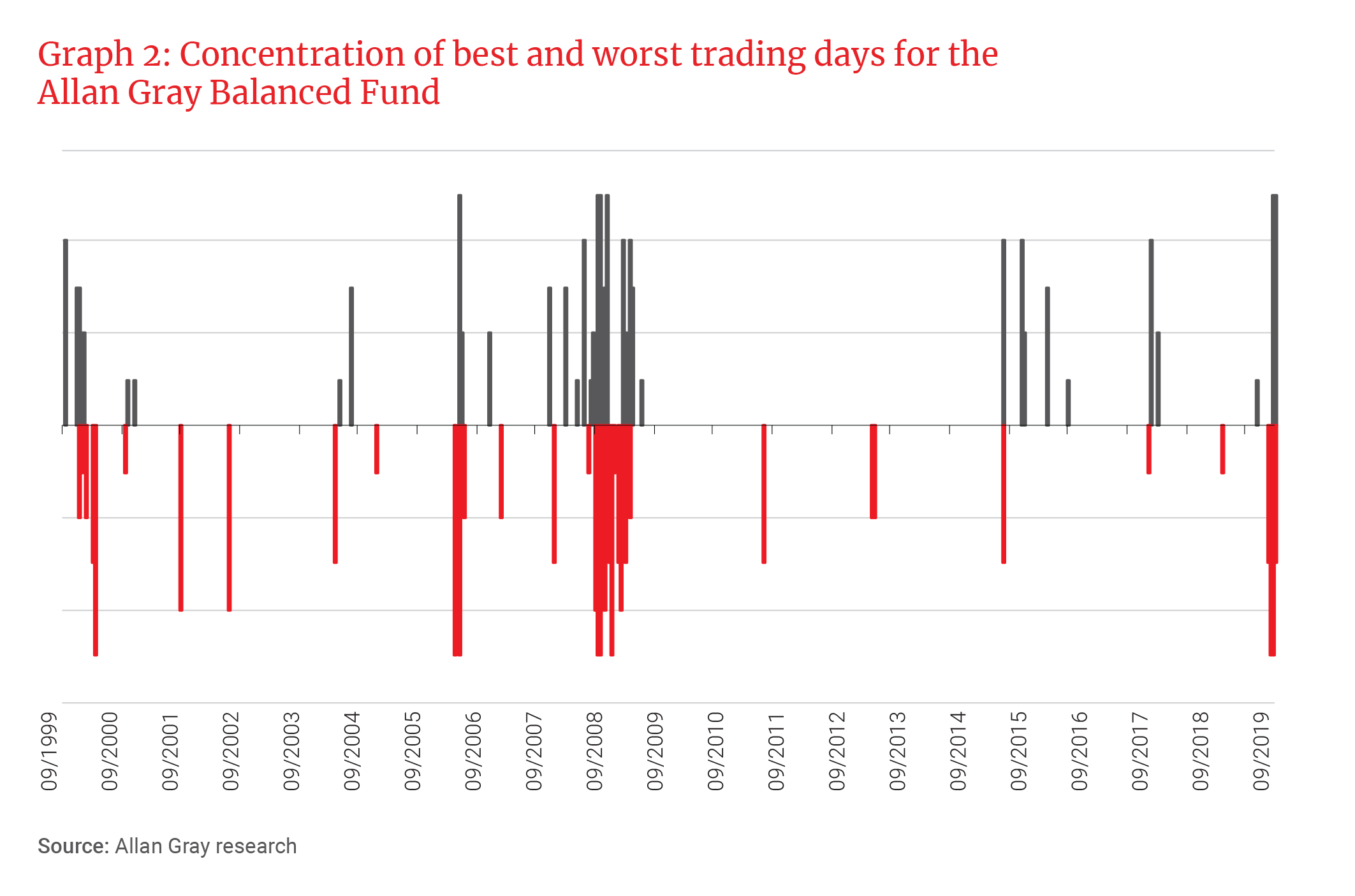

Research conducted by JP Morgan in the United States suggests that, on average, six out of the 10 best trading days happen shortly after the 10 worst trading days, and the chances are good that you might miss out on those 10 best trading days when you switch out at or near the bottom of a Fund’s performance. Our Allan Gray Balanced Fund data affirms the above research. Graph 2 shows the top and bottom 50 trading days bucketed into groups of 10. The length of the line indicates the magnitude of the daily performance movement. As you can see, high and low returns tend to concentrate around each other, suggesting that you run the risk of missing a recovery if you disinvest at the wrong time.

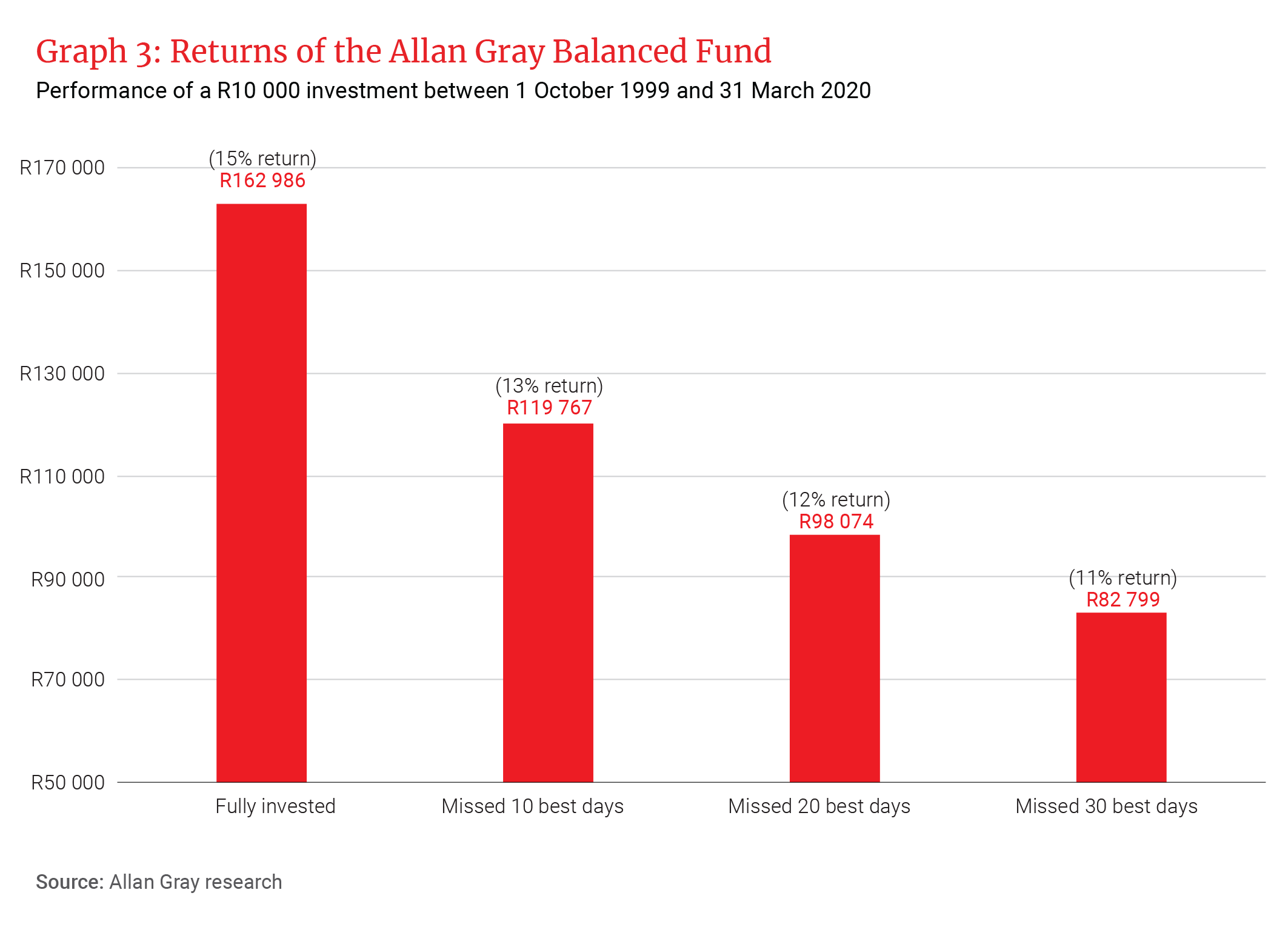

Graph 3 illustrates that if an investor missed the 10 best trading days since the inception of the Allan Gray Balanced Fund (a period of approximately 20 years, which equates to 7 305 days), the end investment value in March 2020 would be at least 25% less than if the investor had remained invested.

Where to from here?

The global outlook is truly uncertain. It is impossible to calculate when the South African stock market will recover. We don’t know for how long this situation will persist and we should all expect continued volatility over the coming weeks and months. Fear and negative sentiment are at record levels. So, what can we do?

1. Focus on “investment truths”

The price you pay relative to the true worth of each asset is the most important determinant of future returns. Asset prices have fallen sharply; global equity markets experienced a 30% drop – the fastest fall since the Great Depression of 1929.

The true worth of a business does not, however, fluctuate wildly on a daily, weekly or a monthly basis, even if the share price can. When you look at your equity investments, you should see yourself as a partial business owner. You still own the same businesses you owned three months ago; the prices of those businesses are just 33% lower. Remember, when we buy businesses on your behalf, we buy them for earnings and dividends that they will deliver over the next 10 years and not the next 12 months. As a result, we are taking the opportunity to cautiously allocate capital to companies where we believe the gap between the long-term value and the current price at which we can invest has opened up. When we do this, we are thinking carefully about which businesses are well positioned to survive the crisis and therefore offer rewarding future returns.

2. Give your investment time

Try not to act impulsively. Historically, the best course of action in times like these has been to stay invested, even though it is extremely uncomfortable while you are experiencing short-term losses. Try and separate yourself from the market noise and focus on the above investment truths.

3. Focus on your long-term goals

Well-considered investment decisions are based on your risk tolerance, investment horizon and investment goals; these factors should not change due to market movements. Of course, if your personal financial circumstances or investment goals change, it is important to check that your investment choices are still appropriate. In the absence of a change in your circumstances or goals, in most cases no action is needed when there is market volatility. More often than not, trying to time the market leads to disappointment.

4. Reach out to someone you trust or speak to your independent financial adviser

In our temporarily isolated world, this market uncertainty and the overload of negative information can make us feel overwhelmed and confused. Without normal social contact it is much harder for us to regulate our emotions. When in doubt, reach out to someone you trust, like your financial adviser via technology and discuss any actions you plan to take regarding your investments.

History reveals that this too shall pass

In the 1930s an Ohio lawyer named Benjamin Roth kept a detailed diary about his observations during the Great Depression. His lessons from 90 years ago serve as a reminder that the current market conditions we face are temporary. In his summarised learnings he wrote: “Business will always come back. It will remain neither depressed nor exalted. The stock market forecasts business in only a limited way. The beginning of a stock market movement usually is caused by the trend of business but in the end the movement is carried too high or too low – by the extreme optimism or despair of human nature.”