Adapted from the Chief Investment Officer’s comments, which will appear in the Allan Gray Unit Trust Annual Report, 2013.

We aim to grow our clients’ wealth over the long term. Achieving this objective requires wisdom from both us and our clients. We need to invest wisely within the parameters of each of our funds. Our clients need to choose wisely between our funds, and guard against switching between them for the wrong reasons.

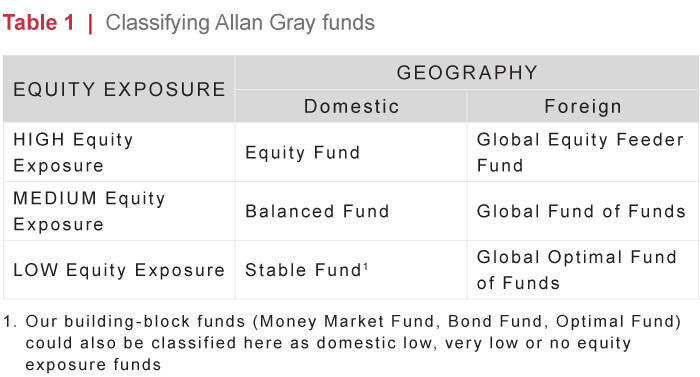

We restrict our product range to simplify choices for clients. Our funds can be classified across two dimensions – geography and equity exposure, as shown in Table 1:

Geography

Clients who upped their foreign exposure after reading our 2010 or 2011 Annual Reports have been rewarded with excellent returns from our foreign funds over the last three years (and especially in 2013). Unfortunately, the success of these foreign funds, along with the weak rand, has resulted in the full absorption of our unit trust management company’s regulated foreign capacity. Effective 1 February 2014, we have been forced to close these funds to investors not utilising their own foreign investment capacity. While the closure of these funds is temporary, we cannot predict when they will reopen – this will depend on overall flows into the management company, performance and the exchange rate.

If you are belatedly reviewing your own foreign exposure, you may wish to consider investing on the Allan Gray offshore platform. Remember that you will need to obtain a tax clearance certificate from the South African Revenue Service (SARS), get approval from the South African Reserve Bank (SARB), and convert rands into foreign currency.

Our February GrayIssue will provide more detail about the fund closures and investing via our offshore platform.

Equity exposure

Investors should take the opportunity presented by the current benign market conditions to review their choice on the second dimension – equity exposure. After a five-year bull market, investors will do well to remind themselves that stock markets are not a one-way bet, and that when they fall, they tend to fall faster than they rise. Investors in the Equity Fund and the Global Equity Feeder Fund should remain cognisant of the fact that these Funds are fully exposed to stock markets. This means that if, for example, the benchmark FTSE/JSE All Share Index (ALSI) falls significantly, the Equity Fund is likely to fall as well. However, our portfolio positioning will hopefully go some way to temper losses, as was the case in 2008, when the Equity Fund lost 14.4% compared to a fall of 23% for the ALSI. Investors who are unable to bear a loss of capital over any two-year period should reconsider whether their risk and return objectives are not more aligned with those of the Stable Fund.

Over the last three years we have sacrificed upside by holding below-average equity exposures in the medium and low equity exposure funds (listed in Table 1) in which we exercise some discretion over the equity weight. We are pleased that despite this conservative positioning, all four funds have beaten their benchmarks over the last one and three years. We believe that this conservative stance is appropriate in light of current market valuations and the attendant risks. Hopefully the funds will be rewarded for this prudence by further outperformance if equity markets weaken.

The Orbis funds materially outperformed their benchmarks in 2013. This is not a result of any extra effort on the part of our colleagues at Orbis in 2013. Rather, it is the result of diligent research and the disciplined implementation of our shared investment philosophy over many years. Unfortunately, we can’t tell when the consistent implementation of our philosophy will be rewarded, but occasionally it results in super years, which contribute meaningfully to our long-term track record. Investors who miss out on these excellent years by mistimed switching will be hard-pushed to match the long-term track record of our funds.

2013 was a frustrating year for our stock-picking efforts in South Africa. The overall outperformance from our portfolio of selected shares was negated by the stellar performance of just two shares which we have been significantly underweight – Richemont and Naspers. By virtue of their strong price appreciation and large weights in the ALSI, these shares have contributed significantly to the return of the benchmark index. The Equity Fund has thus lagged its benchmark by 0.1% over the last year, and by 0.2% p.a. over the last three years. This is disappointing, but probably inevitable at times, for a fund which has the freedom to completely avoid heavily weighted stocks in a concentrated benchmark.

Long-term focus

Our investment team remains focused on estimating companies’ intrinsic values as accurately as possible through diligent research and a peer review process, which encourages independent thought and diversity of views. Our portfolio managers remain focused on the disciplined execution of our valuation-based investment philosophy. We are confident that this approach, which has proven so successful for our patient clients over the last 40 years, will continue to bear fruit over the long term.

Allan Gray Proprietary Limited is an authorised financial services provider. Collective Investment Schemes in Securities (unit trusts) are generally medium- to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Unit trust prices are calculated on a net asset value basis, which is the total market value of all assets in the portfolio including any income accruals and less any permissible deductions from the portfolio divided by the number of units in issue. Allan Gray Unit Trust Management Limited is a member of the Association for Savings & Investment SA (ASISA). The FTSE/JSE Africa Index Series is calculated by FTSE International Limited (“FTSE”) in conjunction with the JSE Limited (“JSE”) in accordance with standard criteria. The FTSE/JSE Africa Index Series is the proprietary information of FTSE and the JSE. All copyright subsisting in the FTSE/JSE Africa Index Series index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved.