The speed at which the financial market swings from despair to elation is astounding. The past few months have seen no shortage of mood swings as investors priced short-term news into the lifetime value of assets. There is no doubt that there is incredible uncertainty about how the COVID-19 pandemic, and government’s reaction to it, will play out, but the asset price volatility is still surprising. The market prices of many large corporates have moved by up to 50% from one week to the next.

On current assumptions, the developed world will experience its deepest recession since the Great Depression, while the fiscal and monetary responses are breaking new ground. The long-term effects of the various rescue packages are unknown, with some arguing for deflation, while others expect hyperinflation. Our role is to design the best strategy to firstly protect, but also to grow your savings over the long term and make sure your portfolios are positioned for multiple outcomes. Andrew Lapping describes how we are going about this during this unsettling time.

We are very fortunate to be value managers, in that we spend our time trying to work out what a business will earn through the economic cycle, rather than attempting to estimate next year’s earnings. A caveat to this is that the short term matters if there is a chance a business finds itself in distress. When a business becomes distressed, usually due to excessive debt, management must take actions that can severely reduce shareholder value or, in the worst case, liquidate the business.

we have assessed our holdings and are very happy with our valuations and positions

In the case of bankruptcy, the long-term business value is immaterial. Which businesses will survive depends on their health going into the crisis, their ability to weather the storm and how long the economic shutdown lasts. The length of the shutdown will also determine the pace of the recovery. The longer the shutdown, the slower the recovery, as a greater number of businesses will be liquidated or permanently impaired.

The government’s actions are important. Placing too high a price on the potential medical costs may underestimate the economic, social and human welfare consequences of the shutdown. While it is not clear whether the lockdown will actually achieve fewer COVID-19 fatalities over the full cycle, the economic and social costs are far more certain. After the initial containment of the virus, we can only hope the lockdown is relaxed sooner rather than later, to limit the economic and social damage.

While we cannot predict the government’s next steps with any certainty, what we can do is consider scenarios that examine extreme economic contractions and attempt to determine if the businesses we own will endure. This gives us the ability to put valuations and probabilities in context and make informed decisions about each investment’s risk and reward.

We made three major investment decisions over the past two months. We bought government bonds, sold offshore assets and brought the money back to invest in South Africa, and invested in a range of equities.

Finding opportunity in South African equities

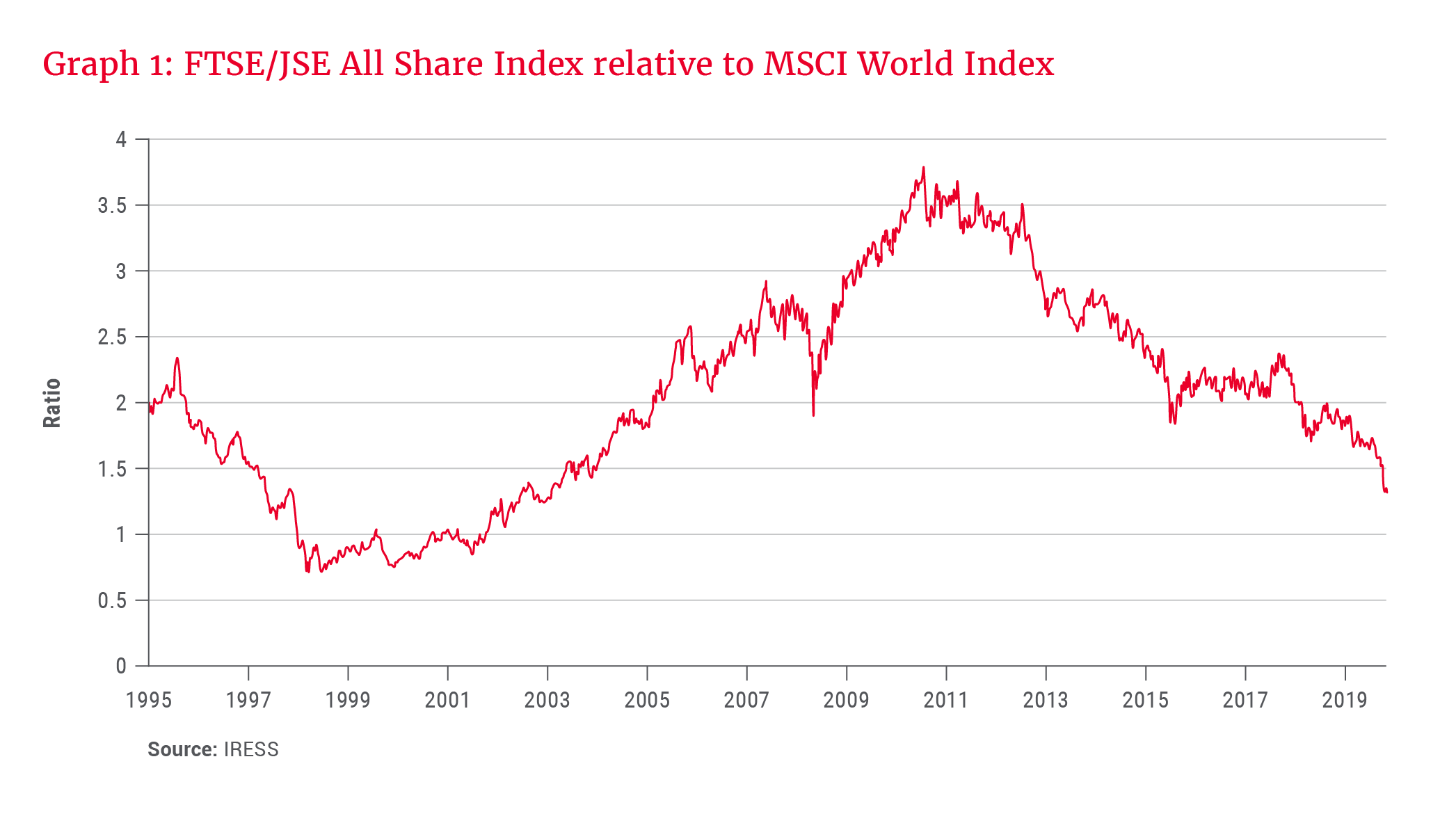

After outperforming the world market from 2000 to 2011, the FTSE/JSE All Share Index (ALSI) steadily underperformed the MSCI World Index (WI), until this year’s sharp 22% underperformance (see Graph 1). Since April 2011, the MSCI WI is up 46%, while the ALSI is down 46% in dollars. This is despite many of the ALSI’s large multinational stocks appreciating over the period.

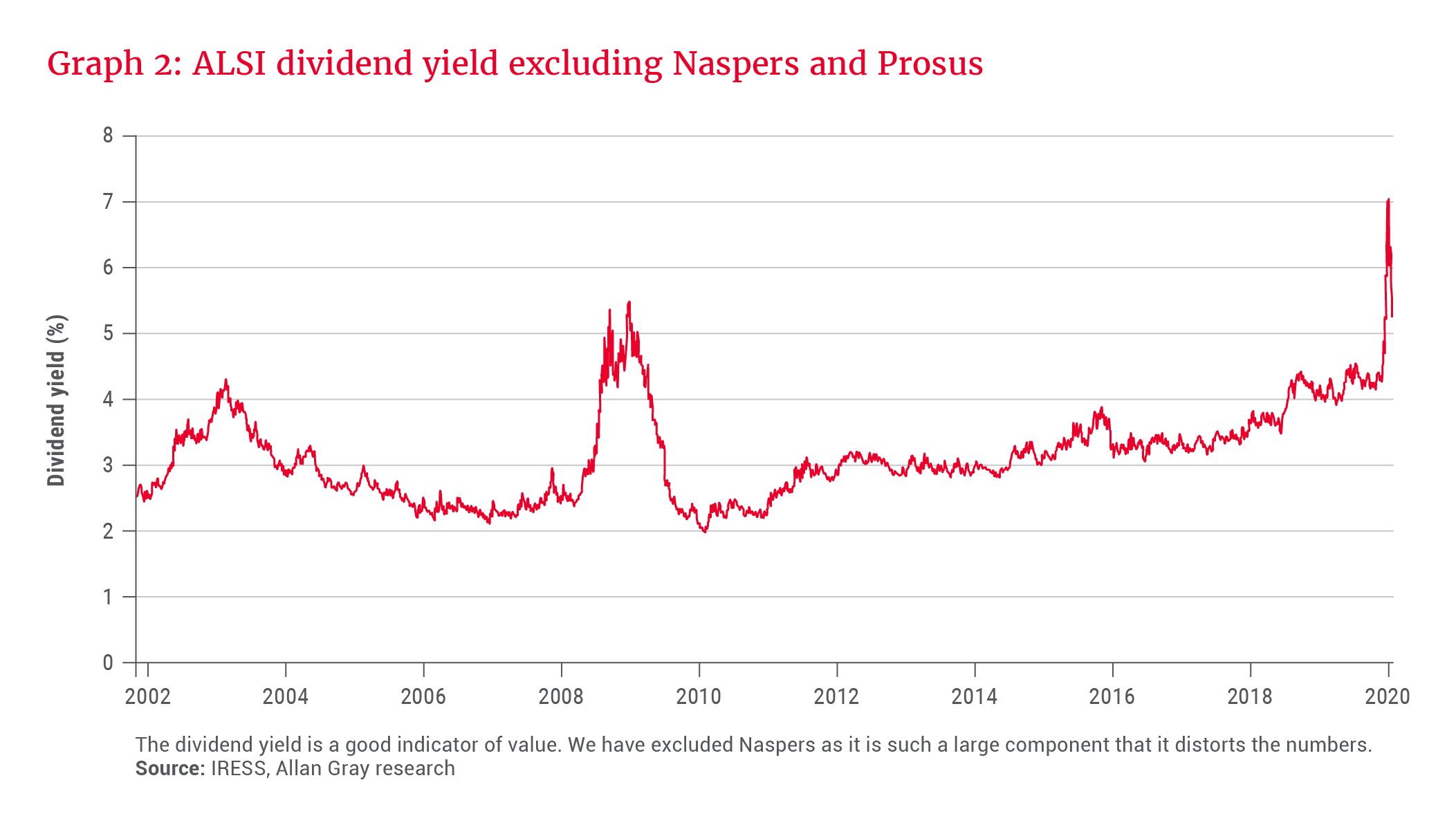

The takeaway is that the average domestic share performed far worse than the headline indices. We were finding good value in South African shares before the COVID-19 collapse (see Graph 2). Despite this value, the ALSI fell 34% from January to mid-March, as the crisis unfolded. In addition, the rand weakened 22%, resulting in the ALSI falling 47% in dollars from January to mid-March.

It is quite incredible to think the value of the shares on the JSE basically halved in 10 weeks. If South African shares were very expensive in January, then a 47% price decline would not be surprising, but the starting point was one of fair to good value. The risks have clearly increased by an order of magnitude, but we are of the view that the market prices of many companies are discounting an extreme scenario.

I discussed Glencore and Nedbank specifically in the March Balanced Fund factsheet commentary, but when we consider our portfolio as a whole, the expected four-year returns from our equity investments exceed 20% per annum. These expected returns compare with those we saw in the early 2000s and briefly in 2009.

We were buyers of a range of different businesses through March, but the share exposure in the asset allocation funds fell over the period, as the performance of equities relative to fixed interest and offshore assets meant their portfolio weight fell faster than we bought.

What happens to the value of money is an important consideration when looking for a place to hide in times like these. Cash is very stable in the short term, but there could come a point where savers realise that money, which can be created without limit by central banks, has very little value. In this case, there could be a rush for real assets, as investors attempt to protect their wealth. This scenario favours a very high equity exposure and, most particularly, companies with lots of debt. But this is just one scenario. We are looking to invest in businesses that will survive in severe and prolonged economic downturns and are undervalued to such an extent that your capital will be protected in a wide range of outcomes.

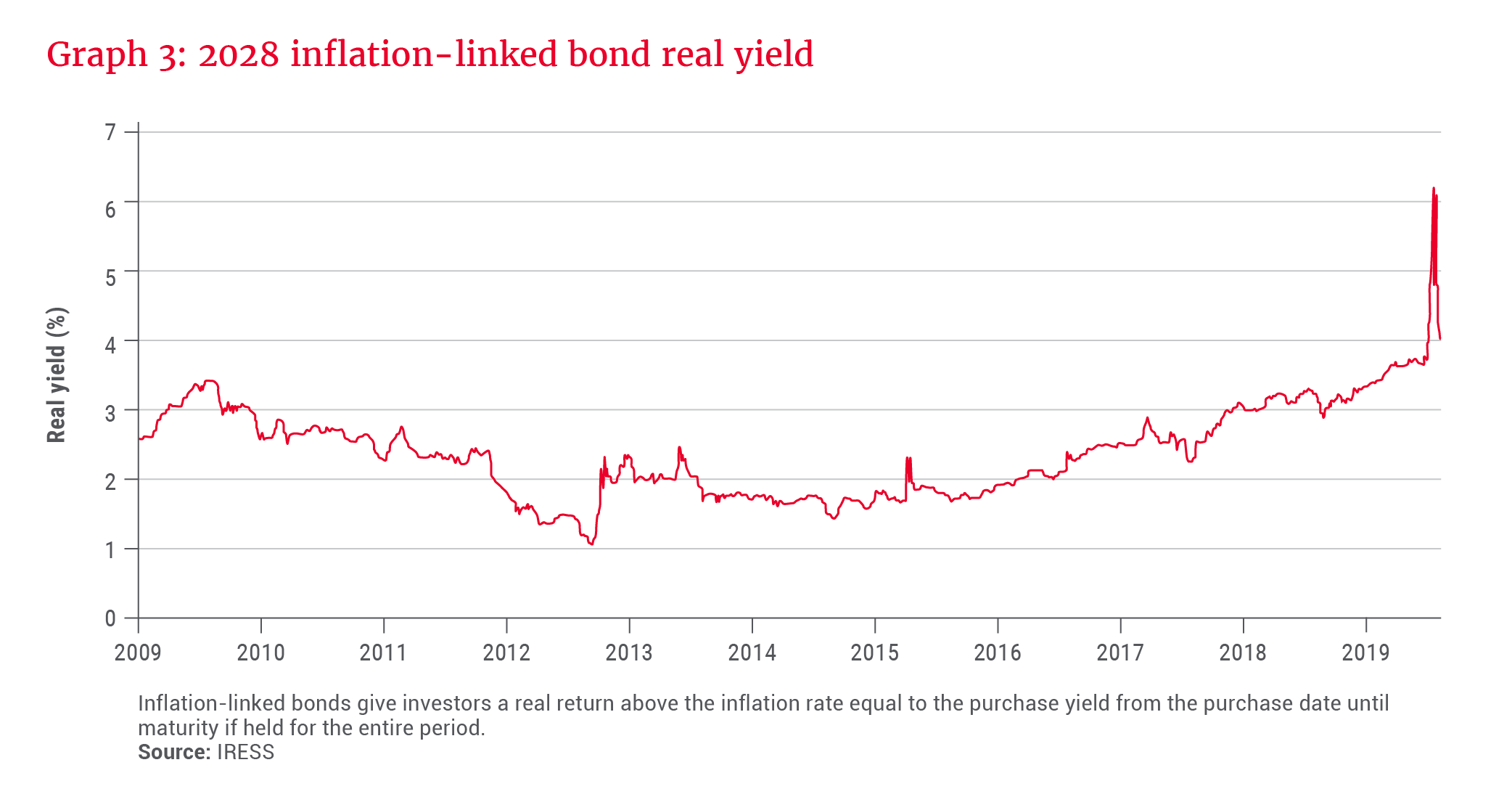

Government bonds: Low-risk assets offering excellent value

In the case where money begins to lose value, inflation-linked bonds are a very valuable asset. We began buying South African inflation linkers in the latter half of 2019 as the real yields sold off past 3.5%. Locking in government-guaranteed real yields of 3.5% for 10 years is an excellent risk/return outcome. We think inflation-linked bonds are one of the lowest risk assets available. During the March market dislocation, inflation linkers sold off to 6.5% real. Real yields of this magnitude are a rare opportunity and we were keen buyers. Yields subsequently rallied to 4.3%: still a fantastic deal. See Graph 3.

Nominal bonds are a far higher risk asset than inflation linkers, as there is no protection from high rates of inflation. We worry about inflation rising as the government struggles to fund its deficit, particularly in a rapidly shrinking GDP environment.

Prior to the COVID-19 crisis, the 15-year bond yielded 9.8%, compared to inflation of 4.6%, for a real return of 5.2%. The high real rate means investors think the inflation rate will, on average, exceed 4.7% over the next 15 years. Even before the crisis the South African government was expecting a fiscal deficit of 6.8% of GDP for 2021, a very large number for an economy with no growth. Deficits of this magnitude can lead to an unsustainable debt burden and a currency collapse. The current crisis has accelerated this process. This increased risk was quickly reflected in bond prices, with 15-year yields selling off to 13%, a rate that reflects the market’s very low expectations that inflation can be kept in check.

Discussing bonds as an investment may seem strange given the grim picture I have painted, but it is not all bad news. The South African Reserve Bank is independent and targets inflation aggressively, and the forthcoming fiscal crisis may also force the ANC to make real changes to the way it manages the economy. This is particularly true if the government takes an International Monetary Fund (IMF) bailout. Finally, South African yields are exceptionally high by global standards. This, together with a weak rand, may entice foreigners, who led the March sell-off, back into our market.

Despite the risks, there is a price at which nominal bonds become attractive. We think South African bonds are pricing in enough bad news and see value in the asset class.

Rand looking relatively weak

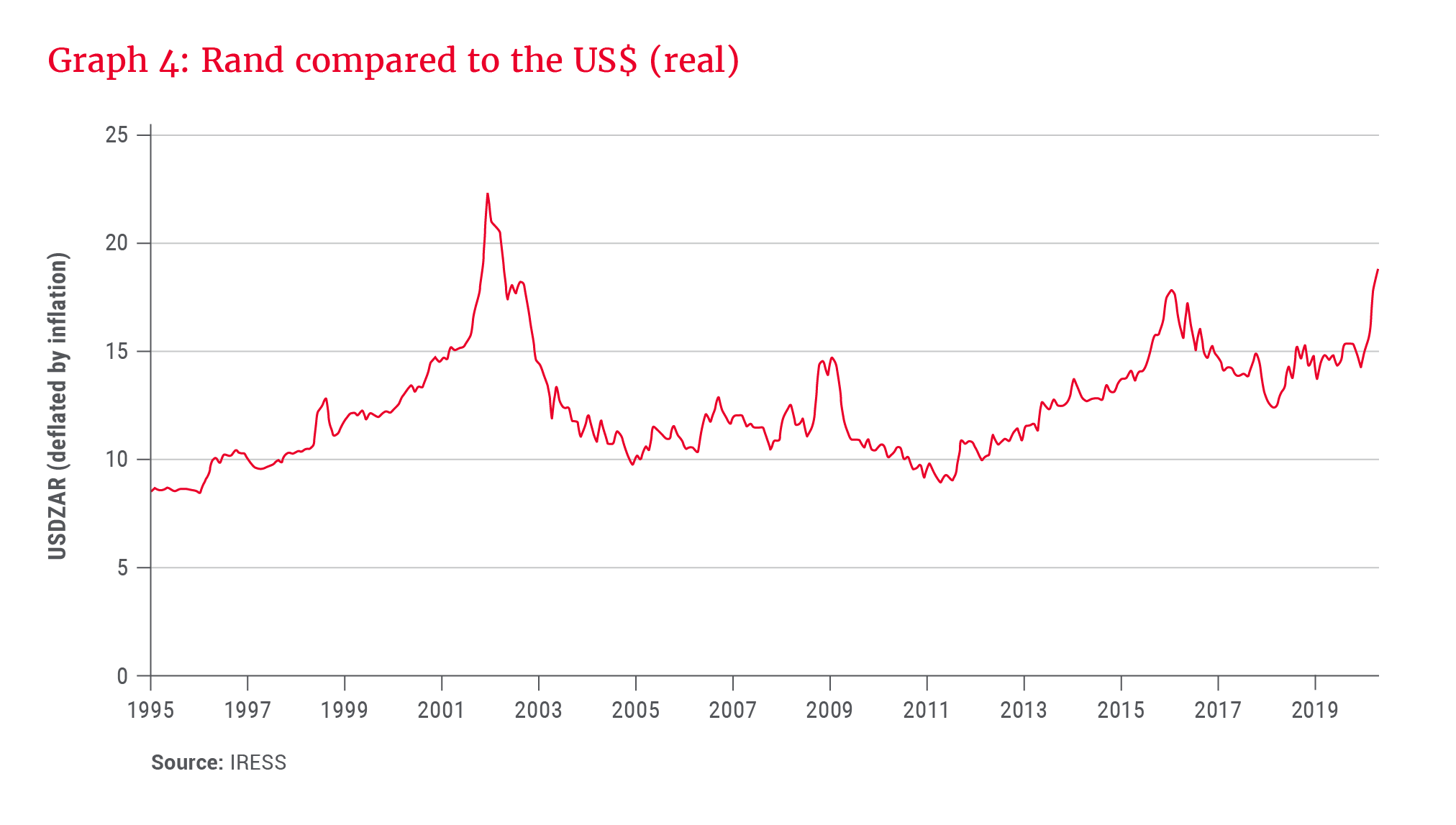

Through February and March, we steadily sold offshore assets and repatriated the funds to invest locally. This seems counter-intuitive during a South African fiscal crisis, but as noted earlier, South African assets grossly underperformed global assets and the situation is not that much worse in South Africa. Global asset prices have, in many cases, held up incredibly well during this crisis. The S&P 500 is only down around 15% from the peak and back to where it was in March 2019, when the world was perfect.

On a purchasing power parity basis, the rand looks weak against developed market currencies, as shown in Graph 4. It is important to remember that currencies are measured relative to one another. The SA situation is dire, but the Reserve Bank and Treasury have not resorted to extreme monetary measures, or wholesale money printing, as is the case in Europe and the US. In time, these actions may cause the dollar and euro to lose substantial value; whether against other currencies or real assets is unclear.

Offshore opportunities abound

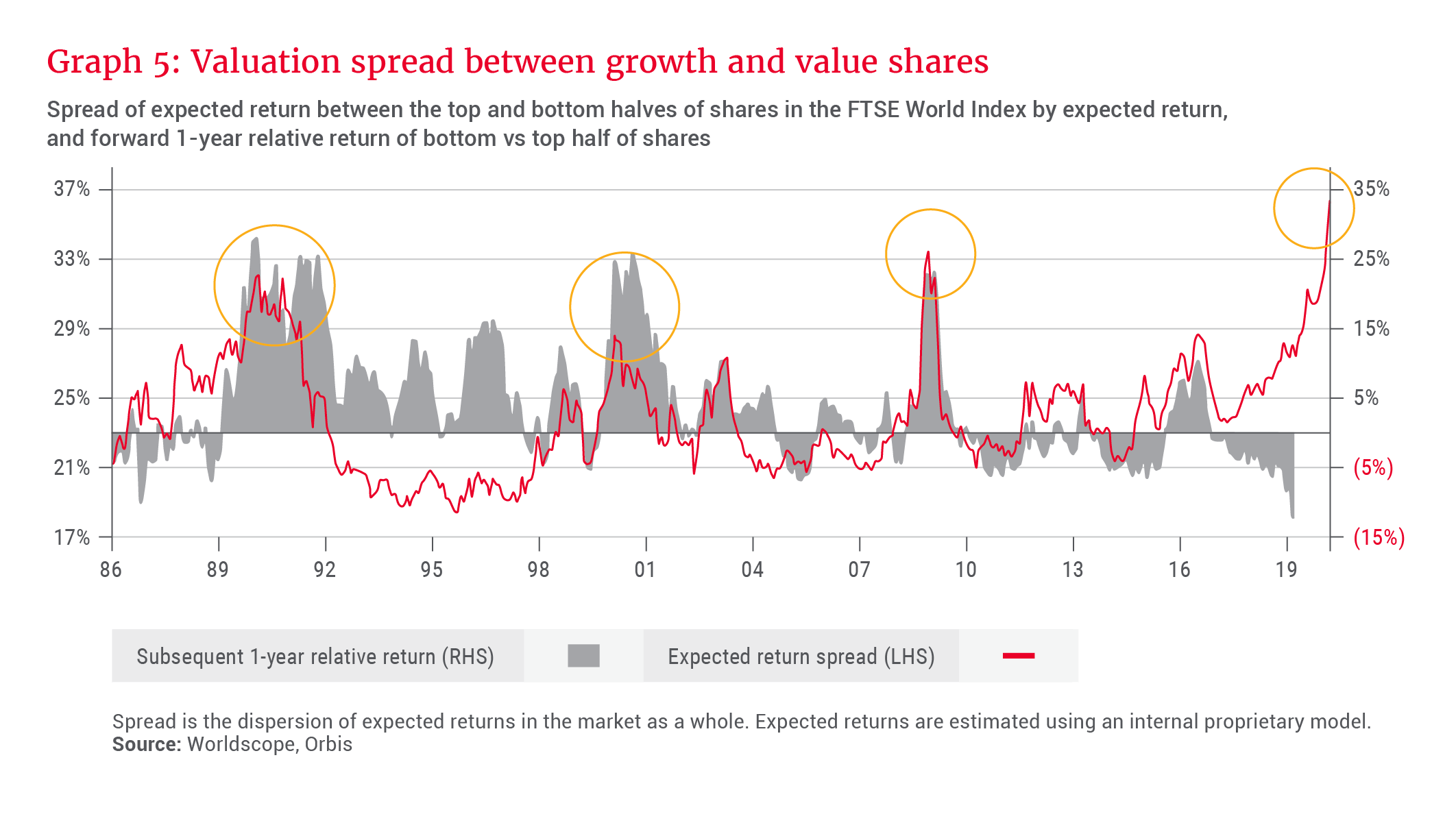

Orbis, our offshore partner, is extremely excited about the assets they own. They are invested in a range of undervalued businesses and, similar to us, have scrutinised company balance sheets to ensure they have the staying power to survive. A limited number of highly rated US growth stocks drove equity market returns over the past five years. The recent sell-off exacerbated this trend as investors rushed to the perceived safety of these large, highly rated shares and dumped the already undervalued cyclical shares.

The valuation spread between growth and value shares has reached record levels, as shown in Graph 5. This valuation discrepancy bodes well for Orbis returns. Furthermore, today’s market conditions, where some investors panic and throw the baby out with the bathwater, suit Orbis’ detailed, research-driven approach and allow them to pick up bargains.

Sticking to our strategy

Historically, owning undervalued assets has protected the downside and resulted in superior real returns over time. Unfortunately, our portfolios did not protect the downside as we hoped during the recent sell-off, but we have assessed our holdings and are very happy with our valuations and positions.

The past few years have been very tough for South African investors, and there is no doubt that the coming months will bring extreme volatility and uncertainty. But it is at times like this that sticking to your strategy is most important. We believe we own a portfolio of undervalued assets which should protect the wealth of our clients and generate excellent returns through a range of outcomes.