While humans take comfort in mimicking the behaviour of one another – we would rather be wrong in the company of many – when it comes to our finances, moving with the herd does not always produce the best results.

Buying the market and following trends is comfortable, but the best investment ideas are often found where others fear to tread. Therefore, unless you are happy to invest in an index, it is a good idea to seek out an asset manager who guards against ‘herding’, and an independent financial adviser who can help you stick to your objectives when you are being tempted by the crowd.

So if it isn’t a great strategy, why do investors herd?

Money is emotional and markets can be intimidating. You may be tempted to act because you think everyone knows something you don‘t and everyone can’t be wrong. But this can be counterproductive.

Emotions get the better of all of us – on the upside and downside. When things are going well we tend to be overly optimistic, assuming that the future will continue on an upward trajectory. This often leads to investors paying too much for assets, assuming prices will continue to climb. The converse is also true: when assets fall in price, investors tend to race for the exit. This is counter-intuitive. When asset prices are punished for no good reason is often the best time to pick up bargains.

But sometimes the herd may be right – how do you know when to follow?

Valuations count. Price is what you pay, value is what you get. Look at the information out there – read as widely as you can, get different opinions. Remember that people talk about their successes; they are quieter about their losses. Make sure you have a good understanding of the picture and try to make a rational, informed decision.

South African politics makes it hard to be rational

In the wake of the news of our credit rating downgrades, business confidence was severely shaken, unsettling investors. Poor sentiment is a problem, but an even worse problem is the lack of growth. China and India are examples of economies that have grown exponentially over time. South Africa, meanwhile, has stagnated. Businesses have stagnated, fuel sales are down, economic activity is depressed and our debt to GDP ratio is worrying. The government needs to rein in spending. Our current account deficit is sitting at 52% of GDP. This is not an alarming figure in itself, but the problem is that revenue is not growing. Of every one rand of revenue, 13c goes towards servicing debt. It is the rate of the increase in debt and debt servicing costs that concerns the ratings agencies, and this is what could lead to a downgrade of even our local currency debt ratings.

A downgrade of our local currency government debt rating could mean that foreigners who are only mandated to invest in investment grade debt have to leave the country. As some foreigners exit, it is likely that others will follow blindly – even those who currently have a seemingly insatiable appetite for South African assets. This kind of herding has the potential to derail our fragile economy.

What does this mean for your investments?

Risks are elevated in the current environment. This means you should think about how much risk you are prepared to take on. Think about your risk capacity, i.e. how much risk you can afford to take and your risk appetite, i.e. how much risk you are willing to accept in pursuit of superior returns. Your answers should inform your investment decisions.

At Allan Gray our portfolio managers determine the risk appetite within our unit trusts and manage the asset allocation accordingly. A good, independent financial adviser can help you to choose a unit trust with a risk profile that most closely matches your own. If you invest for the right reasons at the outset, and choose your investments carefully, it should be easier to resist the herd.

How are we managing our unit trusts in the current environment?

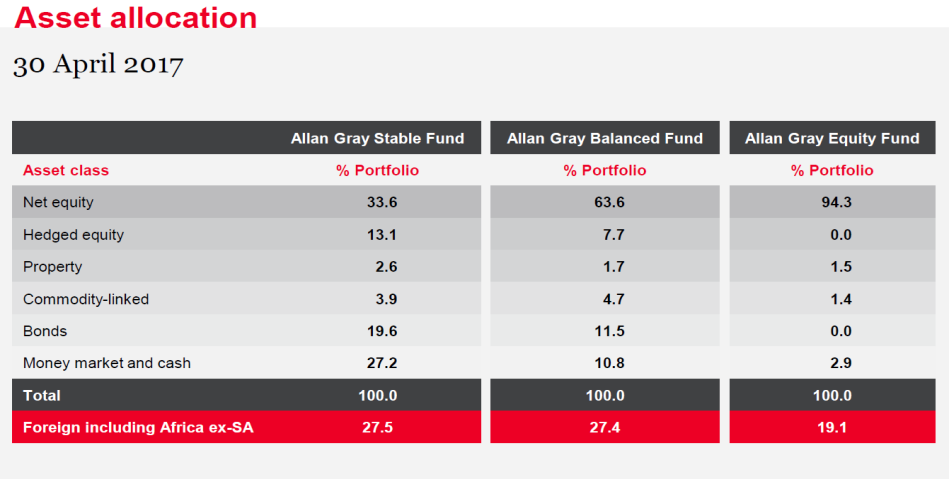

The net equity exposure of our flagship unit trusts matches our risk appetite in those unit trusts and the asset allocation is managed accordingly.

As the rand appreciated over the last year we used the opportunity to buy additional offshore investments funded through the sale of SA equities. We reduced our banking, mining and forestry share exposure, and upped our position in healthcare and media.

It is also important to note that we like highly diversified companies with earnings outside of SA, who will not be hamstrung by the lack of growth at home.

Top tips to protect against following the herd

In summary, here are three tips to help you resist the lure of the herd:

1) Do your research

Read as widely as you can and get different opinions. Make sure you have a good understanding of the picture and try to make a rational, informed decision.

2) Think about your long-term objectives

Emotions often get the better of us when investing. Formulating a long-term plan will help you remain rational and avoid herding.

3) Seek help

Consider investing via a professional asset manager who guards against ‘herding’ and consult with a good, independent financial adviser for advice on the investments that are best suited to your needs.