Regular readers of our commentaries will know that we follow a valuation-based investment philosophy. At the same time, we are not afraid of investing contrary to our peers and we do not mind looking different to the benchmark. In fact, we believe that, through consistent application of our investment philosophy, it is these differences that allow us to add value to clients’ investments over time.

How different are we?

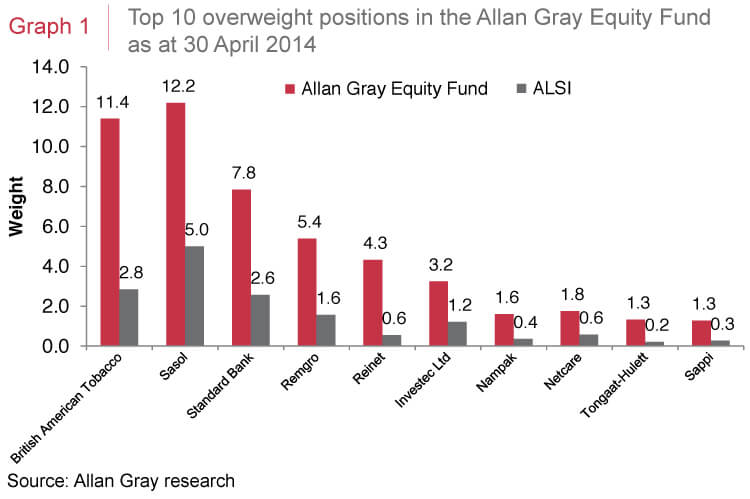

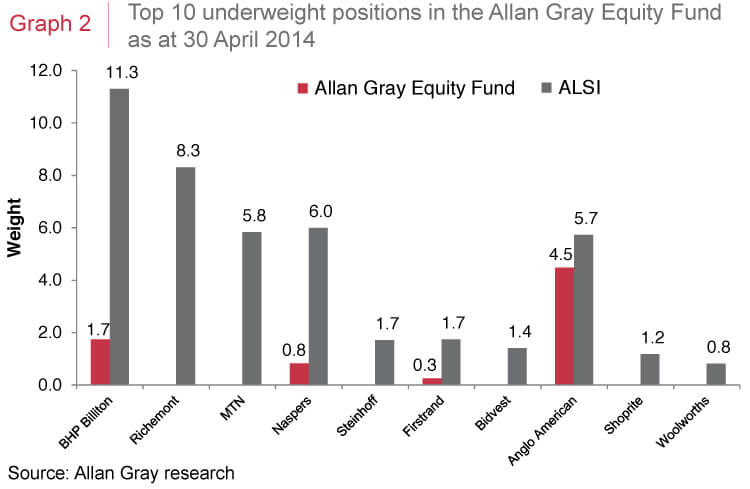

There are various ways to illustrate these differences so our clients can better understand them. A simple way is to look at how the share weights in our funds compare to those of their benchmarks. In other words, we can identify and assess our funds’ over- and underweight positions. Graphs 1 and 2 show the holdings of the Allan Gray Equity Fund compared to its benchmark, the FTSE/JSE All Share Index (ALSI). An overweight share is one in which the Equity Fund holds a greater weight than the ALSI, while an underweight share is one in which the Equity Fund either holds a smaller proportion than the ALSI, or doesn’t hold the share at all.

The individual overweights and underweights give a good sense of the similarities and differences between our portfolios and their benchmarks. But there is also a single number which neatly sums up these differences. This is known as the ‘active share’ of the Fund. This is a fairly intuitive measure which quantifies the extent of these differences by aggregating them. Active share can be used to assess how active one manager is compared to another (although the figures can be quite hard to come by), and it can also be used to assess how a fund has differed from its benchmark over time.

How is active share calculated?

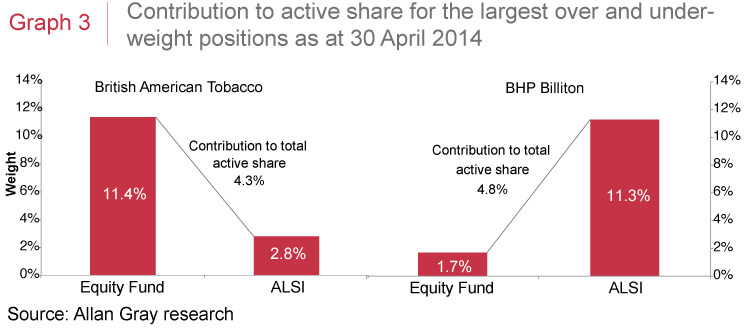

The active share measure takes each individual stock in the fund and/ or benchmark and compares the weight between the two. For each stock, the weight in the benchmark is subtracted from the weight in the fund. If this value is negative, it is converted into a positive number (or its ‘absolute value’). The sum of all these absolute differences is then divided by 2. In Graph 3, for example, the total weight in British American Tobacco (BAT) in the Equity Fund was 11.4% at the end of April, while the stock comprised 2.8% of the ALSI. The contribution to active share from BAT was therefore 4.3% ((11.4% - 2.8%)/2).

The end result is a value for active share which can range between 0% and 100%. Where the fund is on the continuum from 0% to 100% describes how different the fund is to the benchmark. A fund that has an active share of 100% would not contain any benchmark stocks at all. A fund that has an active share of 0% would only contain benchmark stocks in exactly the same proportion as the benchmark and its performance would track the index.

Active share in context

As at 30 April 2014, the total active share for the Equity Fund was 51%, which is lower than the long-term average of about 60%. It is significantly lower than the measure for our offshore investment partner Orbis. The active share for most Orbis funds has typically been over 90%. However, Orbis has a bigger universe of stocks to choose from than we do, and the benchmarks they use are much less concentrated. This means that active share numbers for South African and global equity portfolios are not really comparable. For example, our top three overweight positions (BAT, Sasol and Standard Bank) have a combined benchmark weight of over 10%, which already reduces the Fund’s active share below 90% before even considering the rest of the portfolio. We have written before about the high level of concentration prevalent in the ALSI (see Quarterly Commentary 4, 2013, ‘Analysing your Fund’s performance'). We can’t measure active share for all of the other general equity funds without access to their full portfolio data, but using publicly available information on top holdings, we estimate that our Equity Fund has a higher active share than the median fund in the general equity sector.

Importantly, we do not manage portfolios to target a specific active share number. The active share for any one of our funds is merely a result of the attractive opportunities we are finding in the market at a point in time, and it changes as the opportunities presented by the market evolve. Our focus remains, as always, on generating superior returns for our clients over the long term without taking on undue risk.

Allan Gray Proprietary Limited is an authorised financial services provider and is the manager of the Allan Gray Equity Fund, a Collective Investment Schemes in Securities (unit trust). Unit trusts are generally medium- to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Unit trust prices are calculated on a net asset value basis, which is the total market value of all assets in the portfolio including any income accruals and less any permissible deductions from the portfolio divided by the number of units in issue. Allan Gray Unit Trust Management Limited is a member of the Association for Savings & Investment SA (ASISA). The FTSE/JSE Africa Index Series (ALSI) is calculated by FTSE International RF Limited (“FTSE”) in conjunction with the JSE Limited (“JSE”) in accordance with standard criteria. The FTSE/JSE Africa Index Series is the proprietary information of FTSE and the JSE. All copyright subsisting in the FTSE/JSE Africa Index Series index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved.