Back in September 1998, there were 186 unit trusts available in South Africa. Fast-forward 16 years, and there are now 1 477 registered unit trusts in a variety of different investment strategies and styles to choose from. This makes the job of selecting the correct unit trust for an investment a tough task. Daniel van Andel discusses why you should not be too distracted by size, and offers a basic guide to picking a fund manager.

Something which advisers and investors are often unsure of, is how much consideration they should give to size when purchasing a fund. At R83 billion, the largest rand-denominated fund in the industry (the Allan Gray Balanced Fund) is around 80 000 times larger than the smallest start-up fund. To put this into perspective, visualise the difference in size between a fully grown adult elephant and a mouse! It is hardly surprising that many investors are left wondering what an impact this disparity in size has on the returns managers are able to generate. Is it important to consider size when selecting a unit trust or is it a distraction which should not be part of the decision-making process?

In theory the size of the asset manager you choose can be a good and a bad thing

Let us continue with the analogy of the mouse and the elephant. The small, more agile mouse is able to change direction far more quickly than the larger, somewhat cumbersome, elephant. In the same way, smaller asset managers are able to quickly change the look of their portfolios, while larger asset managers are forced to adopt a longer-term approach when purchasing and selling positions. The mouse can also go where it chooses, easily allocating significant portions of a portfolio to the shares of any company. The elephant, on the other hand, is constrained by where it can go and inevitably leaves a trail behind it when forging a path. In the same way large asset managers are constrained to investing significant proportions of their portfolios in the shares of large companies and sometimes struggle to do so without impacting the price of these shares in the market.

"WE WERE UNABLE TO UNCOVER ANY EVIDENCE OF A CORRELATION, EITHER POSITIVE OR NEGATIVE, BETWEEN THE SIZE OF A FUND AND THE PERFORMANCE IT WAS ABLE TO GENERATE"

Theory has it that large fund managers have more assets to invest and are thus forced to hold positions in shares which they would not necessarily have held, had the level of their assets under management been lower. What is important to remember, is that both the market capitalisation and the number of shares available for purchase on the stock exchange grow over time. Therefore, the level of assets managed and the number of shares a manager invests in, should be considered relative to what is available on the stock exchange and not in absolute terms.

Scale has its benefits. For example, scale should help asset managers remain in business and stick to their investment philosophies during prolonged periods of adverse market conditions that they have no control over – something that the small asset managers may not have the luxury of doing. Also, large asset managers have access to superior research which, if used correctly, could translate into stronger performance over the long term. To complicate matters further, large managers are not all large by virtue of good marketing or luck: some are large because they are skilled and have therefore delivered attractive returns and flows. Small managers are not all small deliberately because they enjoy the freedom of being nimble: this group includes some that have not shown evidence of skill and therefore failed to attract assets.

Size is relative

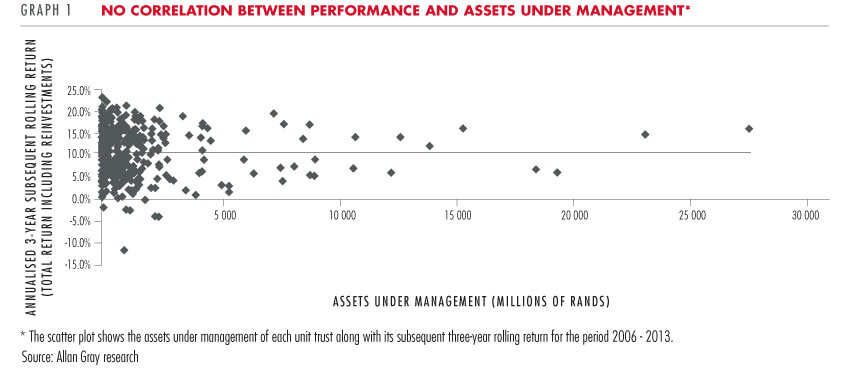

Considered next to a mouse, an elephant seems large. But an elephant has plenty of room to manoeuvre in the Kruger National Park. Even the largest funds in our unit trust universe are able to take quite different positions in their universe of potential investment. The JSE has a market capitalisation of R9 trillion, about 100 times bigger than the largest fund, which invests its assets in shares but also in bonds, cash and internationally. This is evident in the very differing performances of even the largest funds in our sample in Graph 1, and the fact that fund positions deviate from the index regardless of fund size.

Theory is one thing, but what of evidence?

We have not come across any compelling evidence of a correlation between performance and the level of assets under management in the South African market. This may seem surprising, but to test our theory we categorised all active unit trusts in South Africa's general equity sector by size and took a look at the one-, three and five-year rolling returns which they were able to generate for the years 2006 to 2013. We were unable to uncover any evidence of a correlation, either positive or negative, between the size of a fund and the performance it was able to generate. Further, we were unable to uncover anything suggesting that the returns generated by large funds deviate less (and therefore conform more) compared with an appropriate benchmark relative to the returns generated by small funds.

These findings are in line with other research done on this topic both in the South African market and elsewhere in the world, which concludes that the relationship between size and performance, in general, is neither positive nor negative, with certain years favouring large funds.

If size is not a concern, what should you focus on?

Here is a basic guide to picking a unit trust manager:

1. Identify management companies with a proven track record of long-term success. On average, fund managers underperform index benchmarks after management fees have been deducted: this must mathematically be so (assuming that the performance of the average fund manager is equal to the benchmark, it stands to reason that the average fund manager will underperform the benchmark once fees are taken into account). A surprisingly small number of managers outperform the ALSI, and over long periods this performance is more persistent than short periods.

2. Look for a management company that is able to attract and retain the best talent and that has a proven and consistently applied process and philosophy. These considerations are more likely to have a far greater impact on the performance of your investment than the size of the unit trust you decide to invest in.

3. Make use of quality independent information available, such as evaluations which rating agencies perform on unit trusts available for investment in South Africa. Fundhouse, an independent qualitative fund ratings agency, has rated all the unit trusts available on Allan Gray's investment platform. To view these ratings, or for more information on the evaluation process and the three tiers which Fundhouse uses to categorise unit trusts, please refer to our local and offshore fund lists available on our website www.allangray.co.za

4. Do not switch around. Short-term switching tends to destroy value because it usually happens just after one fund has done badly and the other has done well (please see Thandi Ngwane's piece to learn more about switching). Although past performance is not a predictor of future performance, identifying and investing with a manager that has a proven track record of long-term success should give you the confidence you need to stick with your choice when it lags competitors, and not switch.

5. Consider getting advice. Choosing the right manager is a complex task. If you do not feel comfortable making your own investment decisions you may wish to consult an independent financial adviser. (Please see Jeanette Marais' piece, which discusses the merits of good, independent advice).