Many investors lack the time, knowledge and experience to invest successfully, often encountering difficulties that could have been avoided had they taken advice from an independent financial adviser (IFA) at the outset and continued to listen to their counsel over time. Jeanette Marais discusses some of the merits of getting financial advice and offers a few practical points to consider when choosing an IFA.

I recently overheard a financial adviser tell a client: 'I am not here to make you a lot of money. If you want someone to do that, and trade shares back and forth, then I'm not the person; but if you're looking for someone who makes investments consistent with your risk tolerance and goals, then I can help you.' This got me thinking about how many people have misconceptions about the role IFAs play. While not every investor may need, want or be able to afford an adviser, it is worthwhile understanding that IFAs are more than just product pickers; they play an important role in helping you make decisions that are right for your circumstances and, importantly, help you to avoid the pitfalls of investing on your own (see text box).

An adviser can help you avoid some typical mistakes investors make, such as:

1. Investing without a plan

If you do not know where you are going, how will you know when you get there? If you have some money to invest take the time to consider your goals and needs. Do you need to save for your child’s education? Do you need retirement savings? A financial adviser can help you think things through and develop a workable plan.

2. Investing in the wrong product or fund

The choice of products and funds available is mind-boggling. Different products have different tax structures, while different funds have different objectives. An adviser can assist you in making choices suitable for your circumstances.

3. Not thinking about inflation

Time can erode the value of your money, leaving you able to buy less with the same amount of rands. This is called inflation. The returns on your investment should be at least enough to compensate you for the length of time that you invest so that the value of your money is maintained. An adviser can help you to achieve this.

4. ‘Blowing’ your retirement savings when you change jobs

If you have been retrenched or are changing jobs, make sure you preserve the retirement savings you have built up. If you do not, you probably will not be able to retire with enough money to live on. An adviser can encourage you to preserve your savings.

5. Focusing only on one market and one asset class

One of the keys to successful investing is diversification. In other words, do not have all your eggs in one basket. For example, in addition to South African investments, including offshore investments in your portfolio can help your savings grow, while lowering your risk. An adviser can help you to make sure your investments are adequately diversified.

6. Acting on your emotions

Investors are particularly bad at picking the right times to buy or sell investments. In addition, they tend to switch between investments too often, destroying the value of their savings. An adviser will help you avoid this pitfall.

The role of a financial adviser

The critical starting point for achieving financial freedom is a well-crafted financial plan. This should document your financial goals and serve as the point of departure for making informed decisions that suit your unique circumstances. While you can naturally put a plan in place yourself, an adviser will help you to figure out the complexities of your financial situation, identify potential gaps in your thinking, and help formalise your plan based on your attitude towards risk, your time frame for results and your personal priorities.

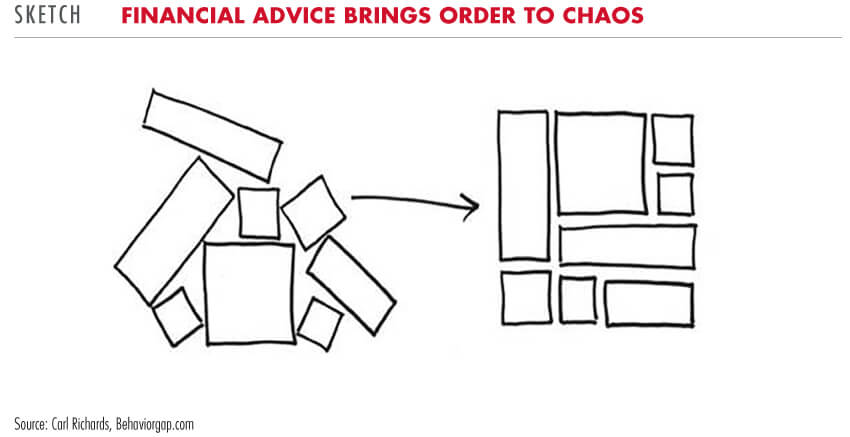

Once your plan is in place, an IFA will help you to navigate the investment options available and ensure that you make the right choices based on your goals and circumstances. Financial adviser and New York Times blogger Carl Richards sums it up well in his sketch below: financial advice brings order to chaos.

You can also rely on your adviser to stay abreast of investment trends and changes in regulations, tax and product offerings. Your adviser will review your situation regularly, report back to you and revise your plan as necessary so that you can stay on track to meet your goals.

There are a number of less obvious benefits to having an IFA. An adviser serves as a 'voice of reason', minimising doubt in volatile times, helping you to be rational rather than emotional about your investments, and encouraging you to avoid switching between investments for the wrong reasons. An adviser will ensure that a disciplined savings and investment process is implemented and maintained, thus eliminating any tendency to procrastinate and allowing you to gain valuable time in the market.

Important considerations when selecting an adviser

Your IFA will advise you on some of the most important decisions in your life, so your choice should not be taken lightly. Some points to consider:

1. Trust

A good relationship with an adviser is founded on trust. You need to know that s/he is honest, values your business and has your best interests at heart.

2. Credentials and qualifications

By law, all financial advisers must be licensed by the Financial Services Board (FSB). To get a license, they need to pass regulatory exams and fulfil the FSB's Fit and Proper requirements (including honesty, integrity and competency). All advisers must prove to the FSB on an ongoing basis that they are developing and maintaining their professional competence. To add an additional layer of reassurance, at Allan Gray we also perform regular credit reference checks on IFAs who have contracts with us.

Apart from these basics, you should question prospective advisers about their academic or other credentials.

3. Your rights

Financial advice and those who provide it are strictly regulated. If you believe that you been misled, have not received appropriate advice, or have been unfairly charged, you should raise your concerns with your adviser. If you have a complaint which cannot be resolved, you can turn to the Office of the Ombud for Financial Services Providers, referred to as the FAIS Ombud, for help.

"AN ADVISER SERVES AS A ‘VOICE OF REASON’, MINIMISING DOUBT IN VOLATILE TIMES, HELPING YOU TO BE RATIONAL RATHER THAN EMOTIONAL ABOUT YOUR INVESTMENTS"

4. The importance of independence

The best advice is independent advice. A proper Independent Financial Adviser is not incentivised to advise on some products over others or employed by product providers to sell their products. S/he is not restricted to selling the products of any one company. In addition, there are laws in place that aim to prevent conflicts of interest between independent advisers and product providers, which means a higher likelihood that an independent adviser will remain objective and choose the products that are best suited to you.

5. Fees

Disclosure and transparency are crucial – make sure that your adviser explains to you upfront what fees you will pay and how they work.

Fees are usually charged as a percentage of the value of your investment. The product provider will deduct the amount from your investment and pay it over to the adviser on your behalf, i.e. it will be deducted from your investment total. These fees cannot be charged or paid unless you have agreed to them. Fees of this nature include initial and annual (ongoing) fees. An initial fee is based on the value of your investment and will be deducted from the initial sum invested, and paid to the adviser. An annual fee is based on the value of your investment, but it is calculated daily to allow for any fluctuation in your investment's value over the year.

Allan Gray has set parameters of 0% to 1% on annual fees, but will only allow an adviser to charge a maximum annual fee of 0.5% if he has charged an initial fee that exceeds 1.5%. Where the annual fee exceeds 0.5%, the initial fee will be limited to 1.5%. The fee parameter for initial fees is between 0% and 3%. Allan Gray has initiated these parameters as we feel that they are fair and reasonable caps on rates that clients should pay for advice.

Some financial advisers use a different fee model entirely, charging for the advice provided directly, as a rand amount, usually an hourly rate.

At Allan Gray we do not pay commission as we believe that products with built-in commission have the potential to skew an adviser's preference and therefore prevent him from being able to offer proper independent advice.

Finding an adviser

Bearing in mind that a key consideration in selecting an adviser is trust, a good starting point in looking for an adviser is to ask for a recommendation from someone whose judgment you value. You could also turn to the Financial Planning Institute of Southern Africa (FPI) for help.

Some companies provide the contact details of trusted IFAs on their websites, such as Allan Gray's 'Find an adviser'. All advisers listed have been recommended by their clients.

Do you need financial advice?

Allan Gray does not offer advice but we do believe in the merits of independent investment advice for those who lack the knowledge and skill to make investment decisions unaided. If you are not comfortable making your own investment decisions, or do not have the time, we suggest you engage the services of an independent financial adviser.

If you cannot afford good advice, or if you feel equipped to make your own financial decisions, it remains your prerogative to choose how to invest with Allan Gray.