Jithen Pillay outlines the reasons behind the relative underperformance of Anheuser-Busch InBev (ABI), implications for the company’s prospects, and our latest thinking on the risks and opportunities when considering ABI for our clients’ portfolios.

We last wrote about ABI in our Q4 2022 Quarterly Commentary. In the three years since, it has been a disappointing share to own on a relative basis, rising 5% in South African rand (ZAR) and 8% in US dollars (US$) versus the FTSE/JSE All Share Index (ALSI), which rose 59% in ZAR and the US-centric S&P 500 delivering 78% in US$ over the same period. Given this, it is worth revisiting the investment case.

Consumer staples versus other sectors

It is not just ABI that has had a tough time. After peaking in 2015, the MSCI Consumer Staples Index is trading back to where it was in 1999 versus the MSCI World Index. Contributing factors are both market-related and company-specific. At a market sector level, the timing of our last ABI commentary coincided with the launch of ChatGPT, in November 2022. This “ChatGPT moment” catalysed global markets into a new era of artificial-intelligence-induced optimism, rewarding mostly US technology companies seen at the forefront of the build-out. Investors’ active pursuit of higher-risk assets came at the expense of the “boring” consumer staples sector.

After not holding AB InBev for a few years … on valuation concerns, we have used the period of underperformance to build back a meaningful position …

Locally, returns have been dominated by the precious metal miners as the gold price has more than doubled over the last three years. With the precious metal subsector now comprising more than a quarter of the index, looking at the ALSI’s headline performance in isolation hides the long tail of shares that have struggled to match the outsized returns.

At a company level, there is also increasing concern about the growth algorithm employed by some of the consumer staples companies: pushing prices too high to offset weak volume growth and emerging market currency depreciation, and using cheap debt to boost profits by undertaking expensive acquisitions and/or buying back shares.

Concerns about long-term consumption

For any company, but particularly one in the consumer staples sector, sustainable revenue growth is predicated on a balanced trade-off between volume and price. On the former, there is a lot of noise in long-term consumption patterns, particularly for the alcoholic beverage category in the US. We have conducted extensive research into these factors and briefly outline our thoughts on the most important below.

The impact of weight-loss drugs

The last three years coincided with the emergence and increasing penetration of GLP-1 drugs specifically for weight management (Ozempic being the most famous). These drugs work by controlling appetite and suppressing the reward mechanism in the brain, ultimately reducing the dopamine-induced pleasure gained from food and drink consumption. As a result, investors are nervous about the long-term impact they will have on food and beverage producers. While it is still too early to draw definitive conclusions, it is likely that GLP-1s will reduce alcohol consumption for high-volume consumers on these drugs.

The change in youth drinking habits

Driven by survey data out of the US, there are many headlines predicting the death of alcoholic beverages as young people claim to be shunning the category due to health concerns. Our research reveals the reality is not as sensational:

- Survey data alone is unreliable. People generally under-report their vices, even if they do not consume to excess.

- The objective data is less dramatic. Absolute US per capita alcohol consumption is within its long-term range, and the proportion of post-tax income spent on alcohol is flat.

- People are entering adulthood later in life. According to the US Census, the number of 25- to 34-year-olds still living at home has doubled since 1980. In addition, socialising trends have also changed over the last 15 years, with the take-up of social media, which turbo-charged during the COVID-19 pandemic. Alcohol is the original social lubricant; a move to a virtual world is a headwind for consumption.

The cannabis alternative

To the extent that people consume alcohol to “take the edge off”, cannabis is mooted as a credible alternative. Looking at the Netherlands (where cannabis was decriminalised in 1976), Canada (federally legalised in 2018) and the US states that have legalised recreational use thus far (the first occurred in 2014), the data is inconclusive, ranging from increased alcohol consumption to some substitution.

Trading on 16 times our estimate of normal earnings, we believe ABI is an attractive proposition considering both the high quality of its economics and the risks outlined ...

Putting reasonable numbers to the above headwinds, we do not believe they are insurmountable challenges for alcohol/beer volumes over the near term. There are also several mitigating factors:

- The aforementioned risks mostly focus on the US, where beer volumes have been declining for more than a decade. Beer volumes in most emerging markets, where ABI has a stronger-than-average presence, continue to grow.

- People may drink less, but drink better. What is lost in volume can be recouped from consumers moving up the pricing ladder (a trend called “premiumisation”, discussed further on).

- Beer is promoted as the drink of moderation; if health concerns escalate, it should win share from spirits. Where alcoholic beer is not healthy enough, the brewers are also scaling their low/no alcohol portfolios. Spain is the leader, with zero-alcohol beer comprising 14% of total beer consumption. By contrast, non-alcoholic beer in the US is still in its infancy. Zero beer is generally higher-margin compared to alcoholic beer: marketed at a premium price but without the excise burden. ABI is growing quickly in the zero-alcohol beer category.

The investment thesis still holds

Many of the reasons we wrote about three years ago, in support of ABI’s investment case, continue to hold true today:

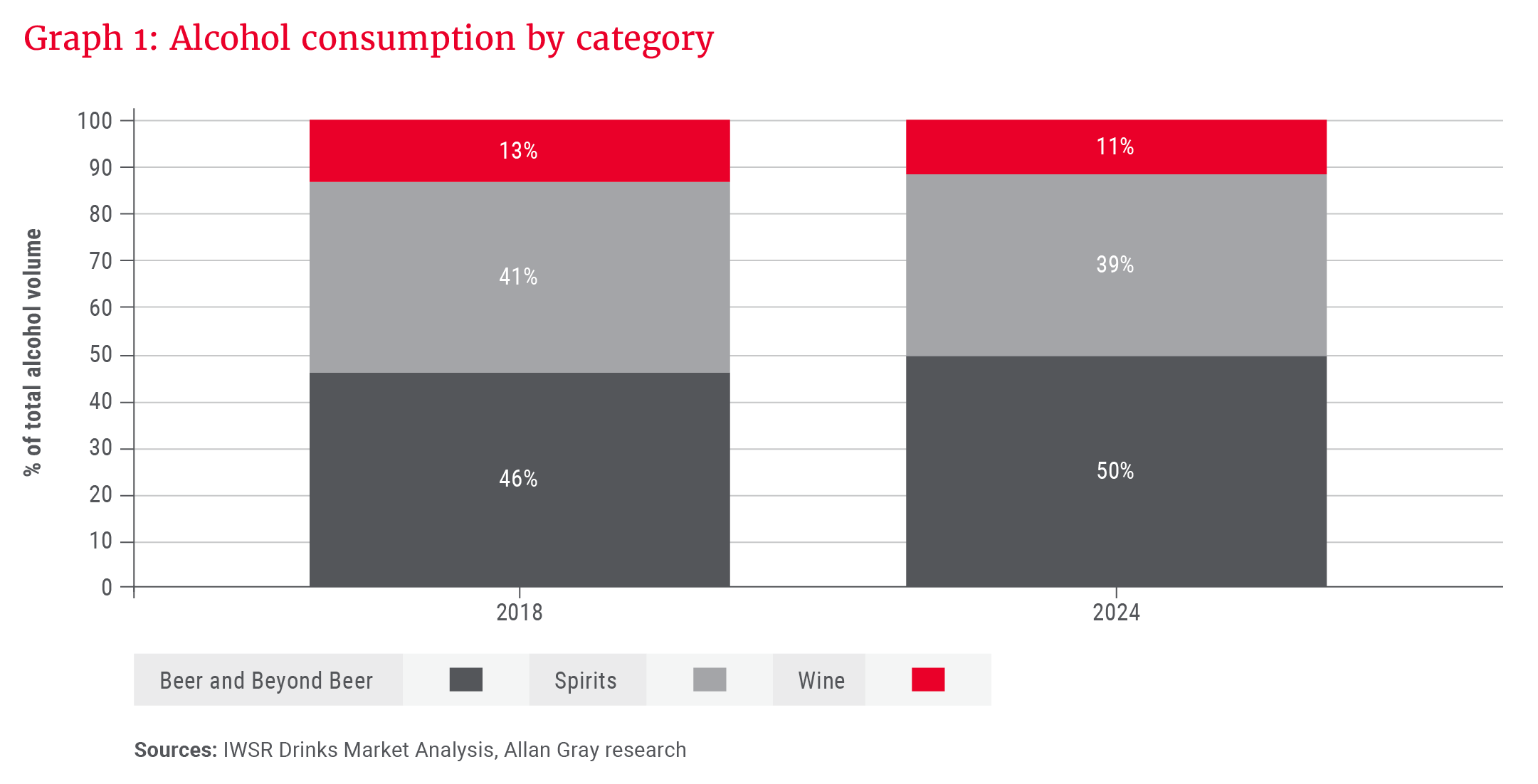

Beer is gaining volume share

Globally, beer (including adjacencies) is winning share of throat away from wine and spirits, comprising 46% share of total alcohol volume in 2018 versus 50% in 2024 (see Graph 1). This includes a sharp headwind from the US (the largest beer profit pool globally), where beer has lost 10% volume share to spirits over the last 15 years. Increasing affordability pressures should support beer relative to other alcoholic beverages going forward, as should the moderation theme, given beer’s lower alcohol content. ABI is the largest and most profitable brewer globally and will naturally benefit if the beer category grows.

ABI is premiumising

Rather than pushing pricing above inflation for core beer brands, ABI is encouraging consumers to trade up to newer aspirational brands. As consumers have become more fickle, this requires a strong innovation pipeline and superior brand-building competence to ensure the product portfolio is in the sweet spot of consumer demand. Fortunately, ABI leads peers on its ability to launch and scale new beverages.

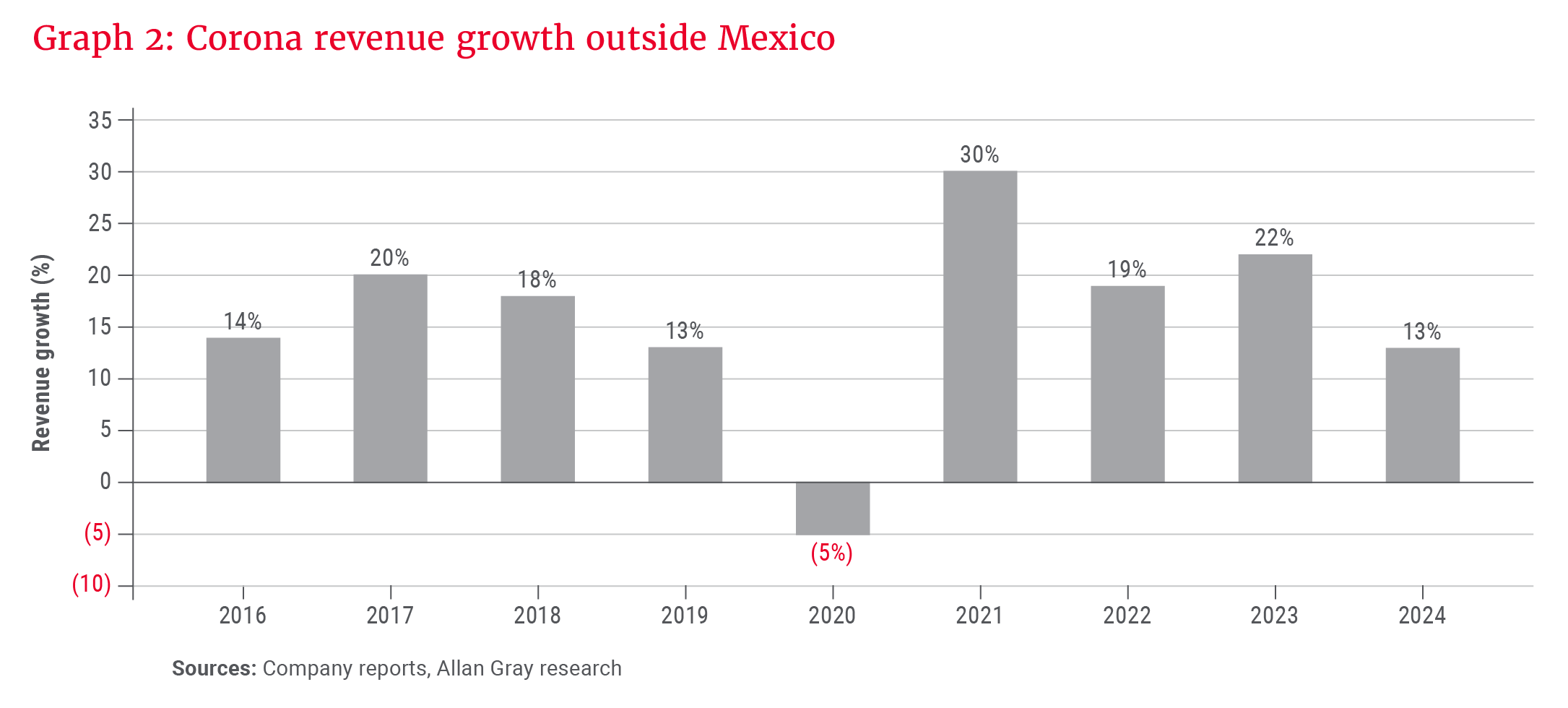

Corona is a good example: a beer known as “superpremium” outside Mexico, given its 20% higher price relative to other premium beers. Corona is growing revenue quickly in foreign markets, as shown in Graph 2. Regardless of brand, beer is a simple beverage made using a handful of ingredients. Given similar production costs, the incremental revenue from a consumer buying a Corona instead of a Castle Lite falls more directly to the bottom line.

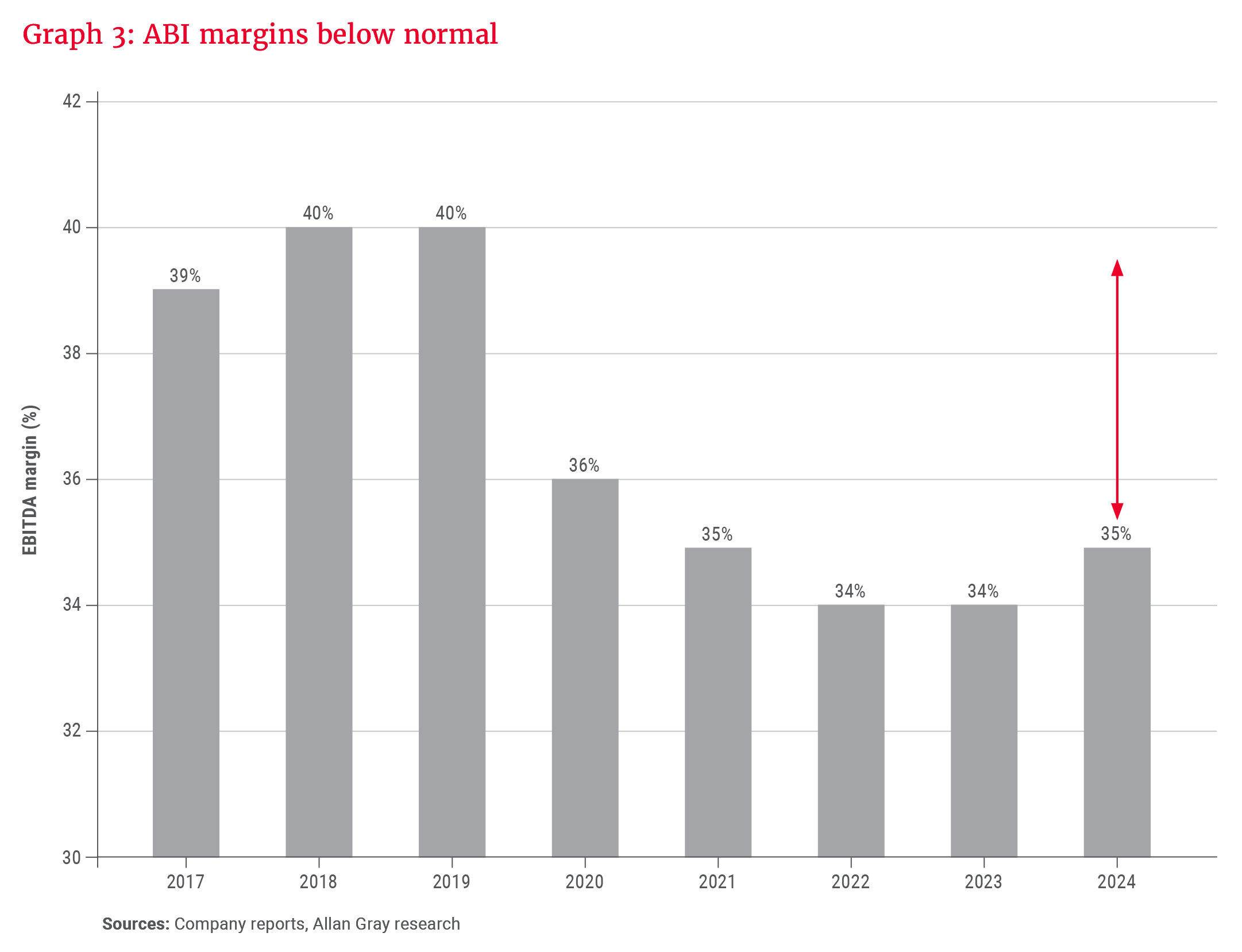

Opportunity for margin recovery

We believe current margins are below normal. ABI earns more than 50% of its revenue from emerging markets. Beer is sold in local currency, and ABI’s policy is to price in line with local inflation. In contrast, up to 50% of production costs are denominated in US$, and since 2019, ABI has experienced high US$ increases in key commodity input costs (e.g. barley and aluminium). This dynamic is evident in Graph 3. We believe there is scope for ABI’s margins to increase from the 2024 base, on more supportive input prices and a weaker US dollar. This is in addition to the premiumisation benefit described earlier.

Increasing returns to shareholders

Following ABI’s US$103bn debt-funded purchase of South African Breweries (SAB) in 2016, very strong cash generation since then has allowed ABI to repay more than US$50bn of this. With its net debt now at more manageable levels, this increases scope for ABI to translate its superior cash conversion ability into higher returns to shareholders via dividends and share buybacks.

The future is inherently uncertain, but an investor can swing the odds in their favour by the price they pay for an asset.

ABI in our clients’ portfolios

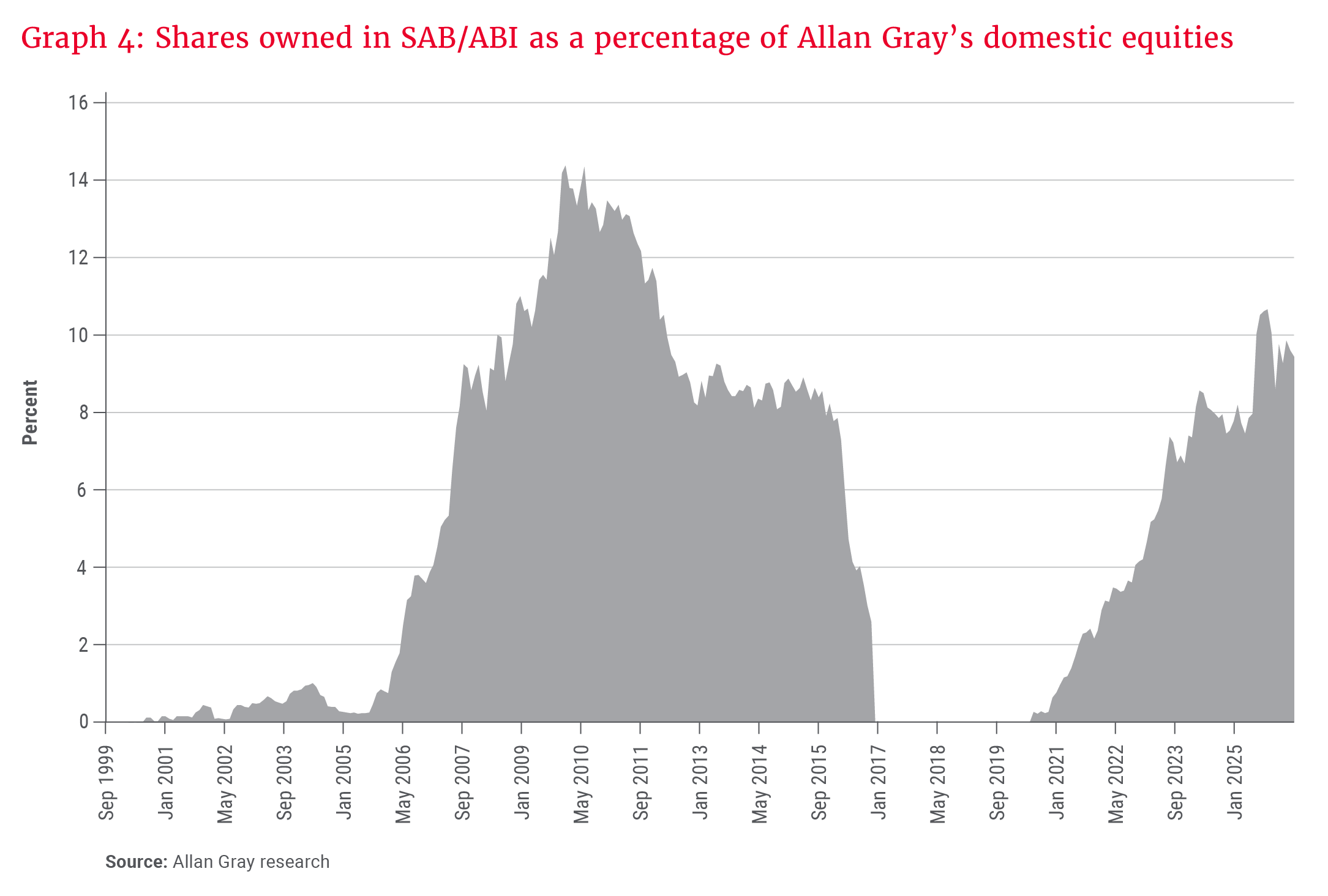

SAB was a big winner for our clients up to being acquired. After not holding ABI for a few years thereafter on valuation concerns, we have used the period of underperformance to build back a meaningful position, as can be seen in Graph 4.

Famous investor Seth Klarman once opined: “Being very early and being wrong look exactly the same 99% of the time.” The future is inherently uncertain, but an investor can swing the odds in their favour by the price they pay for an asset. Trading on 16 times our estimate of normal earnings, we believe ABI is an attractive proposition considering both the high quality of its economics and the risks outlined earlier. At a portfolio level, ABI tends to behave differently in times of market chaos, it is a natural hedge against South Africa/China risks (both are small in its business mix), and its core product is unlikely to be disrupted by artificial intelligence. ABI is now our clients’ largest domestic equity position.

Explore more insights from our Q4 2025 Quarterly Commentary

- 2025 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Tipping point or false dawn? South Africa’s defining question by Raine Adams

- Orbis: President’s letter 2025 by Adam R. Karr

- The long-term benefits of maximising your retirement fund contributions by Carla Rossouw

- The compounding power of micro wins by Thandi Skade

To view our latest Quarterly Commentary or browse previous editions, click here.