Planning well for retirement is essential to ensure your long-term financial well-being. One key aspect of retirement planning is choosing the product, or combination of products, that will best enable you to meet your retirement goals. Earl Van Zyl and Tiaan van Wijk discuss the various investment products that investors typically use to save for retirement and shed some light on the trade-offs that investors need to consider.

The process of choosing the most appropriate product, or products, to save for retirement can seem daunting. Among the available options, retirement annuities (RAs) have long been touted as a suitable option for most long-term savers, given the favourable tax treatment of contributions. However, some argue that the investment limits under Regulation 28 of the Pension Funds Act (“Regulation 28”), the limited access investors have to their accumulated savings in these products before retirement, and the requirement to purchase an annuity with your savings in an RA at the point of retirement outweigh the tax benefits.

We will illustrate that, when viewed through a lens of the income in retirement that various products provide, RAs remain a good option for most investors, even after accounting for the restrictions that apply. As always, it is important for every long-term investor, together with their independent financial adviser, if they have one, to understand how our simplified examples would apply to their personal situation so that they can assess how best to use our insights. Our analysis assumes that the product rules do not change in any material way in the future.

Comparing the different products

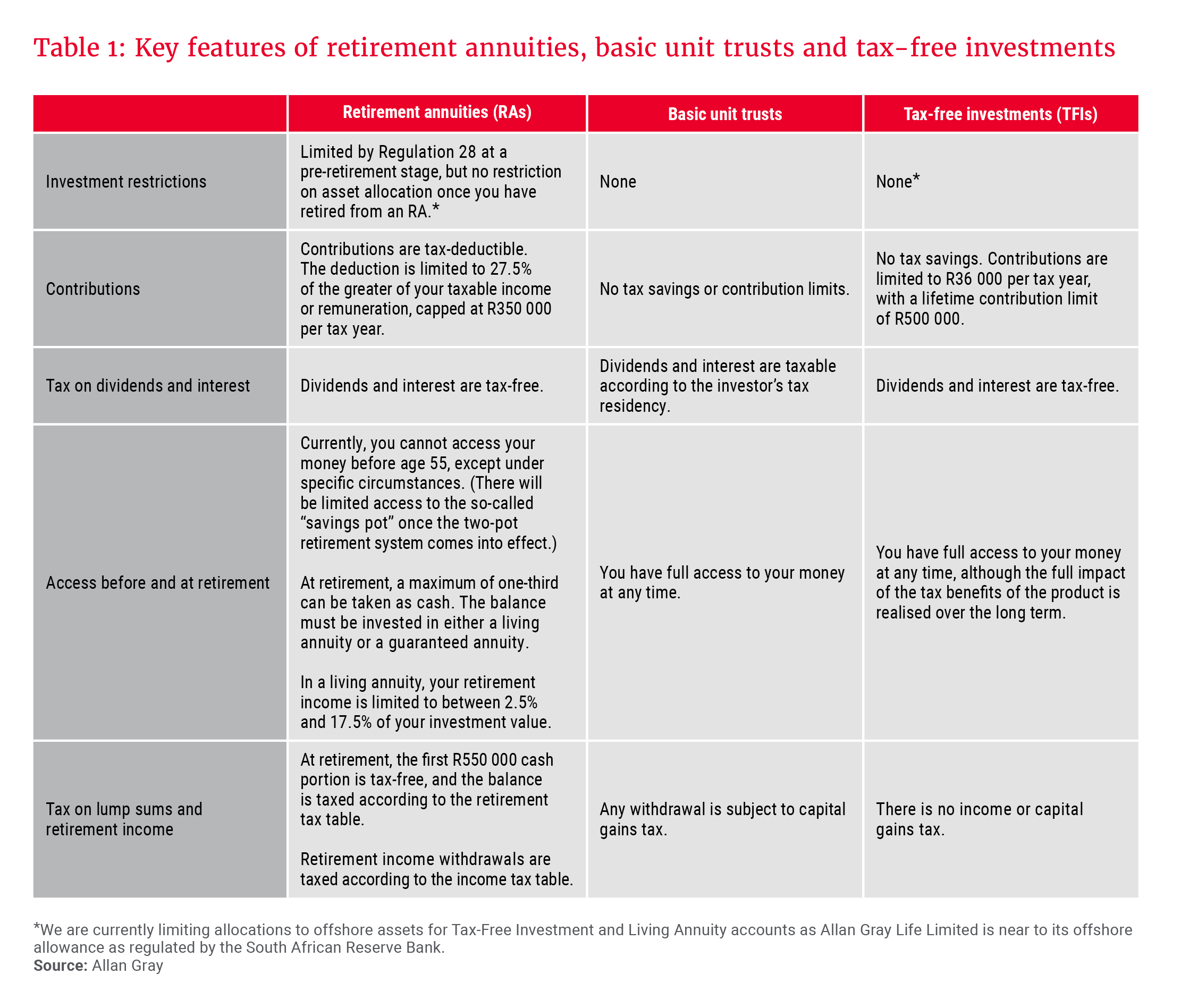

While RAs have traditionally been a popular choice to save for retirement, many investors also use basic unit trusts and tax-free investments (TFIs) for this purpose. Table 1 outlines the key features of these three products. We have assumed that there are no differences in product administration fees across the different options. While this is true for Allan Gray products, it may not be true at all product providers.

To fairly compare the products, it is essential to evaluate the impact of your options across the entire retirement life cycle. While it may seem intuitive to compare the total savings available at retirement of each product or combination of products, we believe a more complete analysis that includes comparing the income available in retirement, goes a step further. This is because the ultimate goal of saving for retirement is not simply to reach retirement with the largest possible retirement pot, but rather to secure the largest possible income that you can sustainably draw during retirement to maintain your lifestyle.

… a retirement annuity provides a higher sustainable income after tax than basic unit trust investments.

A comprehensive comparison therefore includes assessing the pre-retirement tax benefits of each option, the tax implications of lump sum withdrawals at retirement, and the tax implications of income withdrawals during retirement. The highest sustainable net income that can be drawn in retirement offers an objective measure of the benefits of each option, as it is derived by considering all tax implications throughout the retirement life cycle.

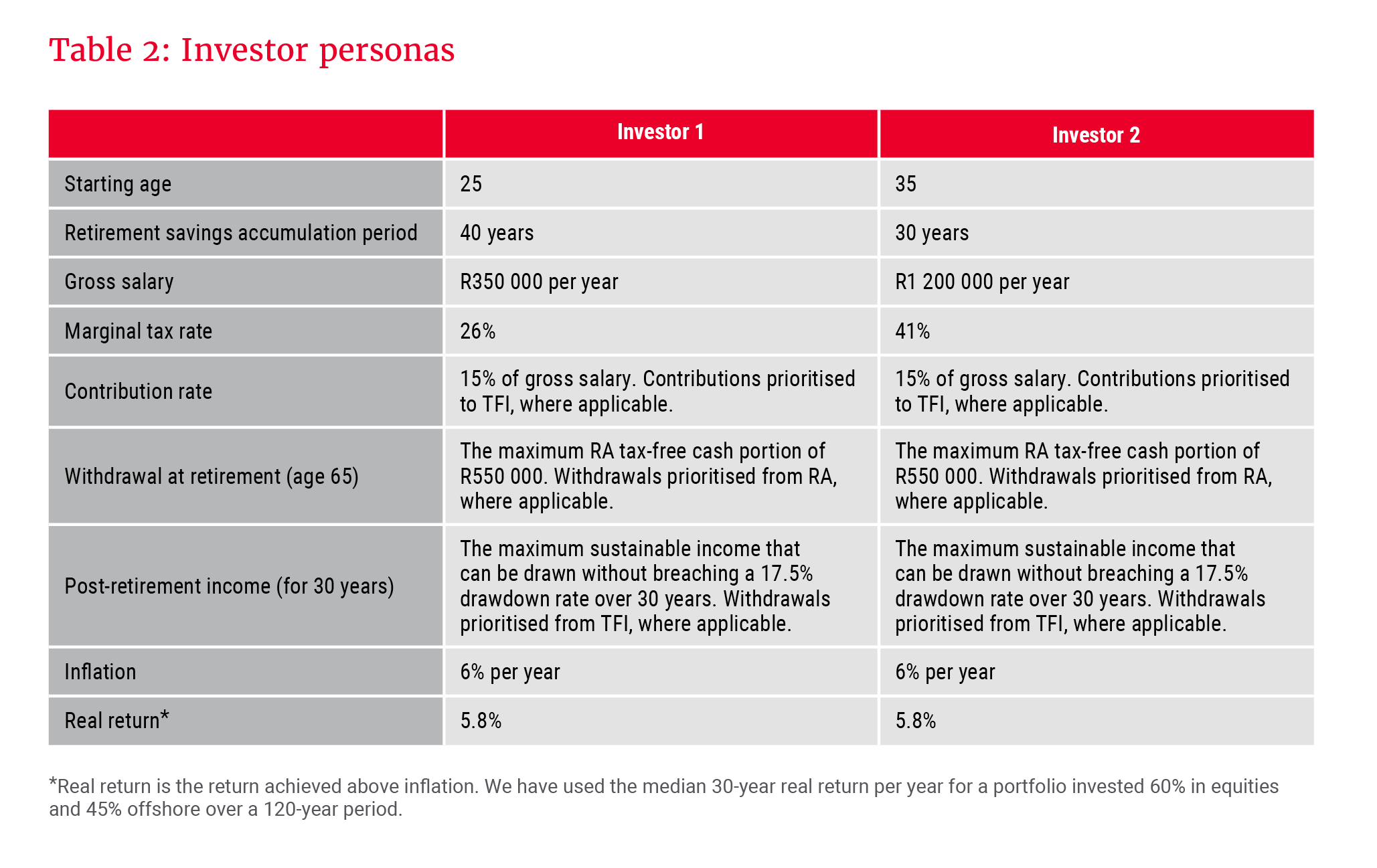

To assess the attractiveness of an RA relative to a basic unit trust investment and a TFI, we constructed four product options that investors might use to save for retirement:

Option 1: An RA only. To ensure that we compare products with the same take-home income, we assume that tax savings on contributions, or, in the case of an individual RA, tax refunds are invested in the RA.

Option 2: A combination of an RA and a TFI, assuming that the tax savings on RA contributions, or, in the case of an individual RA, tax refunds are invested in the RA.

Option 3: A basic unit trust investment only.

Option 4: A combination of a basic unit trust investment and a TFI. Contributions and withdrawals are assigned to the TFI first.

We then applied these product options to two investor personas with the same contributions and after-tax cash needs relative to their income, which are set out in Table 2.

The results of our analysis

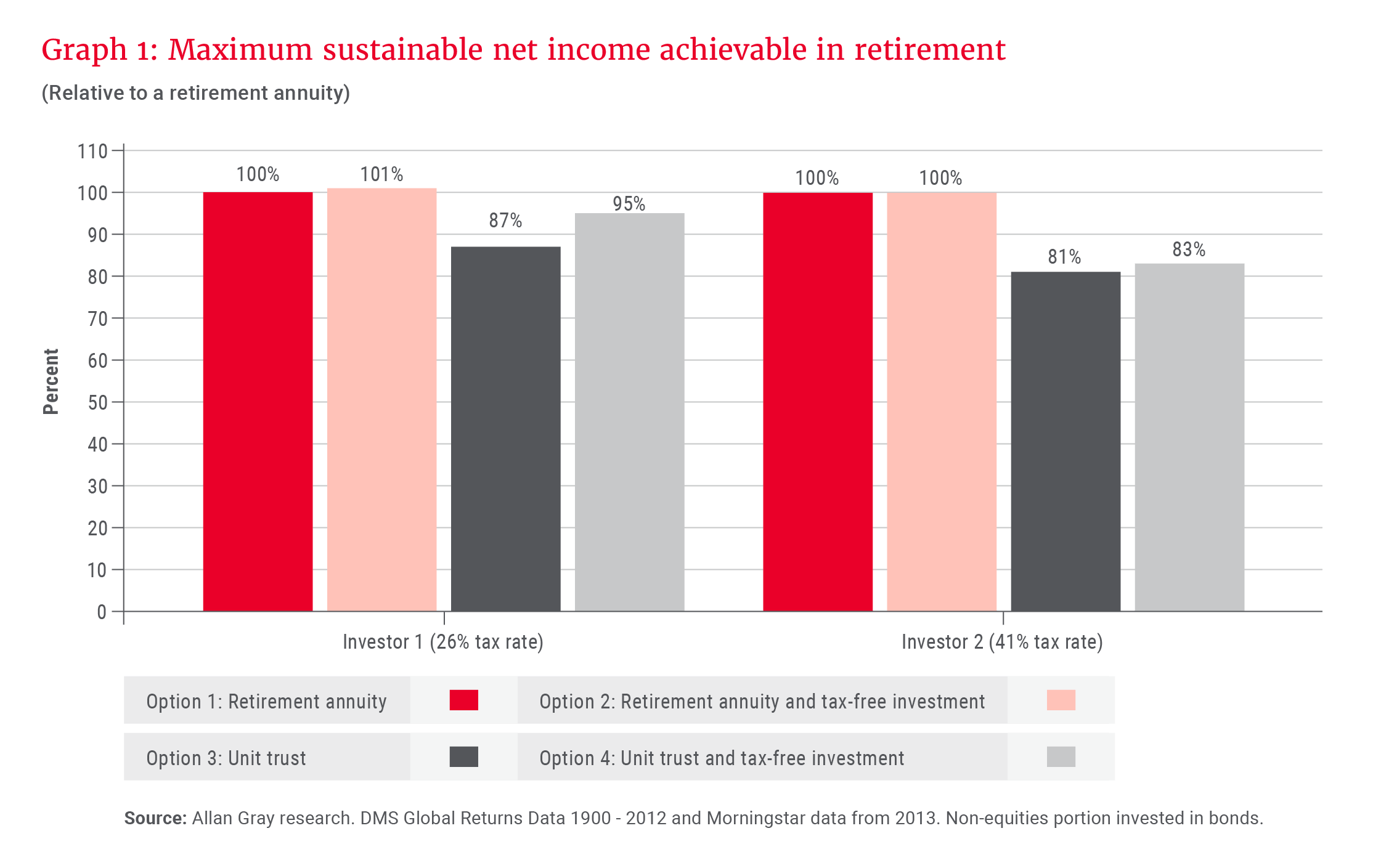

To make the comparison easier, we illustrate the maximum sustainable net income in retirement for each of the three alternative options relative to the total income delivered in Option 1 for both investor personas – see Graph 1. Assuming the same investment strategy across all options, the graph illustrates that an RA provides a higher sustainable income after tax than basic unit trust investments.

This analysis highlights some key truths regarding retirement savings product options, assuming that the investment strategy across the options is the same:

- Higher marginal tax rates result in greater tax savings on RA contributions before retirement. Consequently, the difference in sustainable net income earned between an RA and a basic unit trust investment is higher for individuals with a higher marginal tax rate than for individuals with a lower marginal tax rate.

- Pairing a basic unit trust investment with a TFI offers a superior outcome to investing in a unit trust alone, as it capitalises on the tax benefits of a TFI while being able to maintain the same investment strategy. In this combination, it is essential to prioritise contributions to the TFI to maximise the long-term benefits.

- The impact of combining an RA with a TFI is influenced by several factors, including your level of contribution, marginal tax rate and cash portion taken at retirement. Each investor needs to trade off their liquidity needs before retirement and their intended use of their TFI, bearing in mind that TFIs have annual and lifetime contribution limits that do not “reset” if withdrawals are made.

For investors with a risk appetite that does not require exceeding Regulation 28 limits, an RA therefore remains an effective retirement savings product, particularly when tax savings are invested. However, investors should be aware that if tax savings on RA contributions are not invested in the RA, the attractiveness of an RA compared to a unit trust diminishes due to potentially higher taxes at and after retirement compared to those applicable to a basic unit trust investment.

Assessing the impact of Regulation 28 investment restrictions

A significant advantage of basic unit trusts and TFIs compared to RAs is the absence of Regulation 28 investment restrictions. Regulation 28 is relevant when an investor's risk appetite exceeds an equity allocation of 75% or an offshore allocation of 45% – the two investment restrictions on which most critics of Regulation 28 focus their attention.

… historically, there has been minimal benefit to having more than 45% of your retirement portfolio invested offshore.

However, the restrictions set by Regulation 28 have the often-overlooked advantage of protecting investors from themselves: These limits serve as a safeguard against asset allocations that may create very volatile portfolio performance, which may lead to suboptimal decisions from investors, such as switching in and out of funds when performance disappoints.

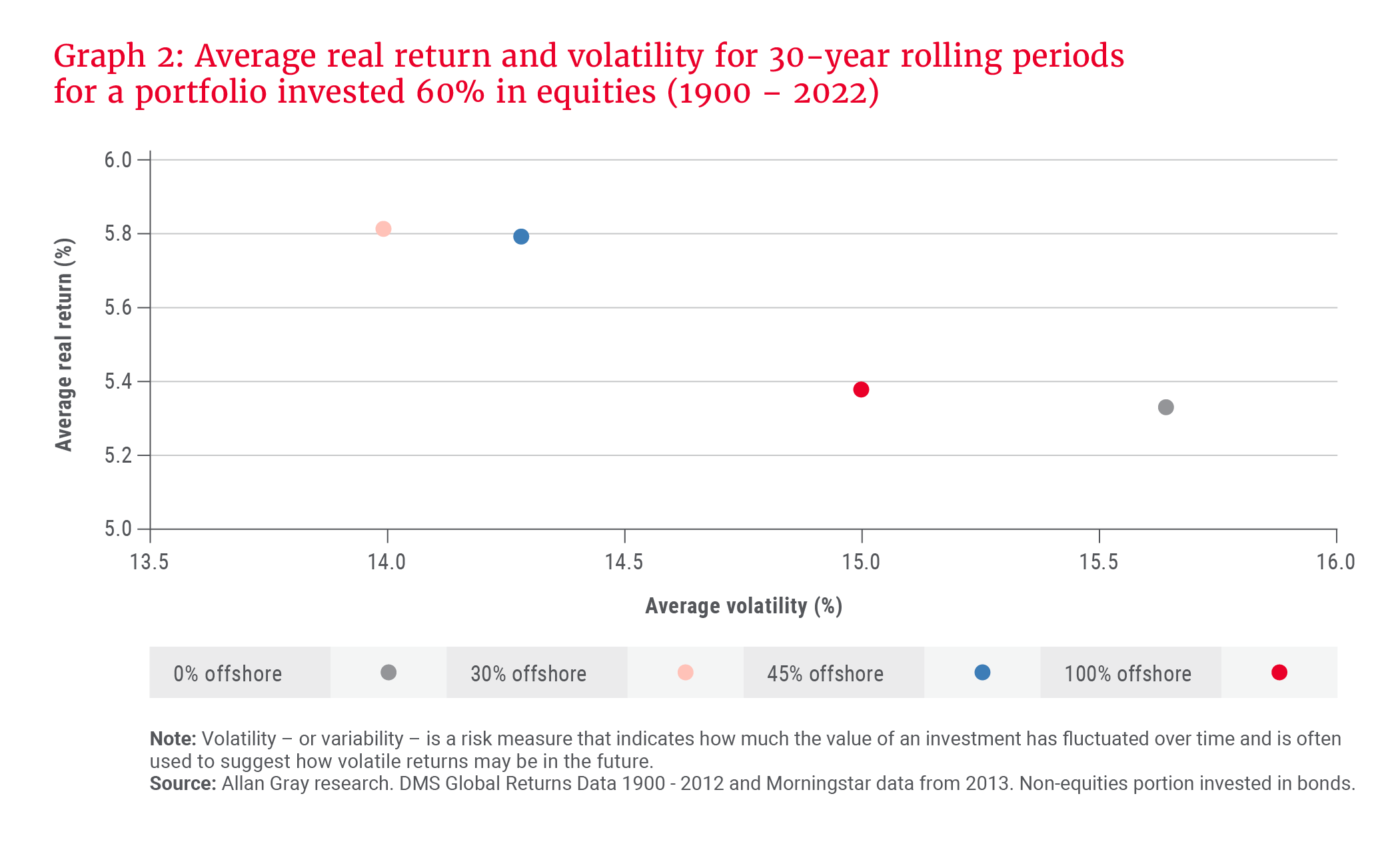

While we acknowledge that a risk appetite beyond the limits of Regulation 28 is not typical for most South African retirement savers, it is important to assess the potential impact of being able to invest without the restrictions imposed by Regulation 28. Our research shows that, historically, there has been minimal benefit to having more than 45% of your retirement portfolio invested offshore. Graph 2 demonstrates that, over 30-year rolling periods since 1900, increasing offshore exposure beyond 45% did not lead to higher risk-adjusted returns. We therefore believe that the current Regulation 28 offshore limit of 45% provides sufficient opportunity for retirement investors to diversify their portfolio offshore.

While there is potential for generating additional returns by increasing your equity allocation beyond 75% of your portfolio, it is important to be aware of the additional volatility that would be expected from this decision. To illustrate the point, we can again consider 30-year rolling returns since 1900 of a portfolio with 45% in offshore assets. Increasing portfolio equity allocation from 60% to 100% would have achieved an additional 1.9% real return per year, but at the cost of an additional 4.3% in average annual volatility. For many investors, such increases in risk can make it more challenging to maintain discipline by sticking to their investment plan and avoiding switching in and out of funds during volatile markets. Investors often experience lower returns than those delivered by the funds in which they are invested due to their behaviour, as we discussed in our Q1 2023 Quarterly Commentary. It is therefore not clear that a limit on equity allocation of 75% within RAs is a negative constraint for the average retirement saver if the reduction in risk compared to investing 100% in equities helps you to stick to your investment plan.

RAs are still a great option – but there are trade-offs

Our analysis demonstrates that for a typical investor, an RA is a highly effective vehicle to save for retirement. In most scenarios, an RA will also play an important role in enabling investors to build a retirement pot from which to earn an income in retirement – the ultimate goal of saving for retirement. However, it is crucial for each investor to engage in a thoughtful decision-making process to understand the trade-offs on RAs and other products that are most relevant to their long-term goals and personal circumstances.