If you are knocking at 60's door and fall into the small minority of South Africans who have saved enough to retire comfortably, you may be planning your retirement party. Whether or not you are part of this select group, you need to carefully consider the options available to you, with the help of your independent financial adviser. Richard Carter sheds some light on these options, illustrating how using a combination of products may help to increase the longevity of your retirement savings and your standard of living.

While your personal circumstances dictate the options you have at retirement, it is probably fair to say that most retirees share the same key objective: to receive an income on which they can survive, and which will sustain them for the rest of their lives. But what are your options?

When you retire from a pension fund or retirement annuity fund, you are allowed to take one-third of your retirement capital in cash. With the rest of the money you are legally obligated to buy an annuity. If you are retiring from a provident fund, depending on the rules of your fund, you may be allowed to take a full cash payout. You could then invest the lump sum as you wish, with one option being to buy an annuity. Investors often feel they need to choose between a guaranteed annuity and a living annuity, but your financial adviser can help you understand how you can use both products to combat the key risks faced by retirees: the risk of outliving your money and the risk of inflation eroding the buying power of your monthly income over time.

Guaranteed for life

As the name suggests, a guaranteed life annuity in its simplest form will pay you a pre-determined guaranteed income for as long as you live, effectively insuring you against the risk of living too long. The rate you receive is influenced by your age and the current interest rate. The older you are and the shorter your life expectancy, the higher the income you are likely to receive.

In return for taking on the risk that you will live for a long time, and guaranteeing to pay you an income for life, the insurer takes ownership of your capital and your beneficiaries have no claim to this money when you die. Just as the insurer cannot ask you to pay in more money if you live longer than expected, your family cannot ask for a refund if you die sooner than anticipated. These are the normal principles of insurance. You can protect against this to some extent by adding an initial guarantee period to your annuity. If you die before this period is over, your loved ones will receive the benefit until the end of this period. However, if you select this option, you will receive a lower income to pay for it.

There are different variations of the guaranteed life annuity. You need to shop around for the best income rate and select the type of annuity that will best provide for your needs (see text box). You also need to understand the effects of inflation on your investment before you commit to a product. Inflation erodes the purchasing power of your income. If you lock into payments which increase at too low a rate, or worse, payments which do not increase at all, you run the risk of not being able to maintain your standard of living.

- Level annuity: Your income remains the same for as long as you live. Important to consider is that your income willtherefore not keep pace with inflation, meaning the purchasing power of your annuity weakens as you get older.

- Inflation-linked annuity: Your income increases every year in line with inflation. While you will start on a lower income than you would with a level annuity, at least your income still means something years down the line.

- Escalating annuity: Your income increases by a fixed and pre-determined amount every year. Depending on the percentage increase you agreed on when you bought the annuity, this may or may not keep pace with inflation. Again, your income in the early years will be lower than that of a level annuity.

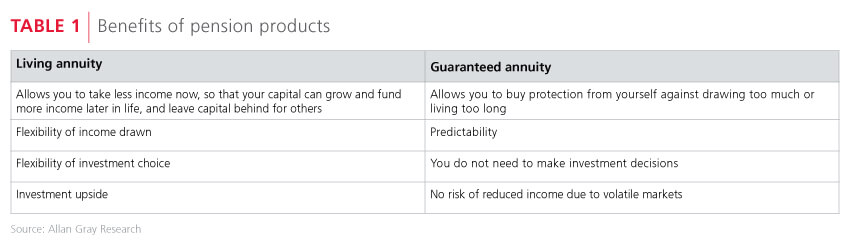

Once you have bought your annuity you do not need to make any further decisions about the product as your terms are set for the rest of your life. If, however, you want flexibility, choice and more investment upside, along with the option of leaving your retirement capital to your loved ones, you should consider the benefits of a living annuity (see Table 1, which compares the benefits of living and life annuities).

Living annuities give you flexibility

Living annuities have been around in South Africa since 1993 and were first offered in response to the limited flexibility of guaranteed annuities. A living annuity is also known as a 'linked annuity' as the income from the annuity is not guaranteed, but is dependent on ('linked' to) the performance of the underlying investments. Living annuities give investors flexibility. However, with flexibility comes risk, in particular market risk and longevity risk. If you go the living annuity route you should consider using an independent financial adviser to assist you with your key decisions to make sure there is no disconnect between your expectations, the way you construct your portfolios and the amount of income you draw down.

As living annuities need to provide an income for life, careful asset allocation is your first big decision - particularly as it will influence how long your investment will last and what standard of living you will be able to afford. Before you begin, you should consider how much growth you need to sustain your investment and how much risk you can afford to take. You need to look for assets that offer long-term growth potential, and allocate capital to these assets based on your risk appetite and ability to handle decreases in income.

Asset classes with the potential for greater returns come at the expense of increased risk of capital loss as well as increased short-term volatility. Therefore, if you want to enjoy the benefit of a greater lifetime income, you must be prepared to tolerate both these risks.

Your next big decision is how much income to draw, within the 2.5%-17.5% range stipulated by legislation. There is some flexibility here as you have the opportunity to change your income level once a year. It is crucial that you withdraw a sustainable level of income - in other words, a level of income which can realistically be supported by your investments and still provide for inflationary increases and last for the rest of your life. Obviously there are lots of unknowns in this, such as what your real investment returns will be, the rate of inflation and how long you will need the income to last. To combat these unknowns you need to make reasonable assumptions, withdraw a reasonable level of income, and adjust your income when things do not go according to plan.

IT MAY MAKE SENSE TO USE BOTH A LIVING ANNUITY AND A GUARANTEED LIFE ANNUITY

The hybrid approach

There is a misconception among retirees that retiring means the end of the investing cycle. Actually, although you are retiring, you may still have a considerable number of years ahead to live, and many of those years need to be used to generate investment returns, even while drawing an income. Bearing this in mind, rather than choosing between products, it may make sense to use both a living annuity and a guaranteed life annuity.

The value that insurers offer gets better as you get older. Although the value might not seem that attractive at retirement, by the time you reach 70 or 75, this situation changes. This is because your risk profile is linked to that of your peers. As the mortality rate of your group increases, the income you would be offered on purchase increases as well. For this reason, retirees could opt for a phased approach, initially taking a living annuity, and transferring to a guaranteed product when it becomes apparent that they will get a better level of income. With this approach, you get flexibility and enhanced return potential in the early years, and then have guaranteed income in your sunset years.

Retirees who prefer the relative security of the guaranteed product from the outset, but do not want to miss out on potential returns, might prefer to divide their retirement savings at retirement, investing partly in a living annuity and partly in the guaranteed product, and potentially transferring the full investment to the guaranteed product later in life. It is important to note that you can transfer from a living annuity to a guaranteed annuity at any point, but the reverse is not allowed.

At the end of the day, with an increasing number of people spending as much time in retirement as they spend in the workforce, it is crucial that retirement is not seen as the endpoint of financial planning; rather it should be the next stage of your financial plan.