For most of us, retirement planning represents the longest and most important personal finance project we will undertake. This has become more pronounced in recent decades as the primary responsibility for funding retirement has shifted from employers to employees. Although planning for retirement can be daunting, there are established methodologies to guide us through this journey, and even make us look forward to retirement, writes Nshalati Hlungwane.

After decades of work, the goal of most investors is to be able to draw a sustainable income that will see them through a comfortable retirement. However, the sad reality is that the majority of South Africans fail to accumulate enough wealth during their working years to adequately replace their income.

Some of the key reasons people do not build a large enough nest egg are waiting too long to start saving for retirement, not contributing enough to retirement investments consistently, and being overwhelmed by conflicting financial demands and the numerous, often complex decisions that need to be made along the way.

Speaking at Allan Gray’s annual “Through the noise” retirement benefits conference, renowned retirement industry veteran Don Ezra suggested that thinking about retirement in three age-related, purpose-driven phases could simplify the process and help investors confidently navigate many of the potential pitfalls along the way. From around age 20 until our early 40s, he says the main aim is to get started. Then, from this point onwards, when we have typically settled into our careers and relationships, we need to get serious. Finally, as we transition into retirement – which he argues is the happiest stage of life – we need to enjoy the benefits of accounting for this period financially and emotionally.

As with any worthwhile journey, starting late … is better than not starting at all.

While getting to the enjoy phase is the ultimate goal, Ezra emphasises the real danger that inaction poses to retirement outcomes and the importance of overcoming the psychological barriers in each phase: “During every stage, we’re likely to say, ‘I’m too busy now, I’ll look at that tomorrow, or next month, or whenever.’ And then, at the end of that stage, as you realise you’re now actually in the next stage, you regret that you didn’t take the time to make it today’s focal point rather than next month’s.”

Another way to think about a staged approach to retirement is to regard it as a journey. If we fail to get started timeously, we will need to increase our efforts to get there on time, or worse, not reach the destination at all.

Leg 1: Start the journey

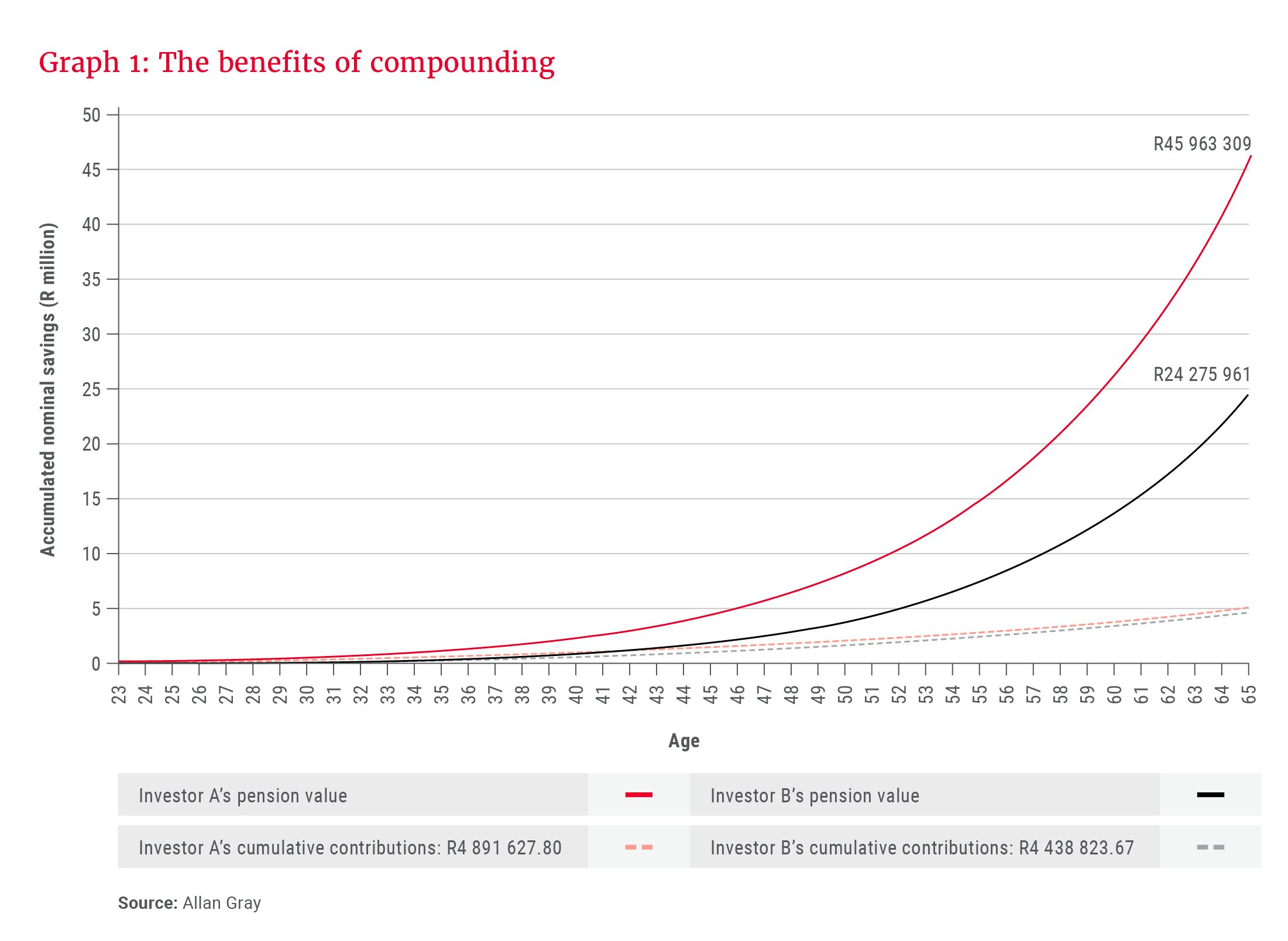

Entering full-time employment in our 20s typically kick-starts retirement planning. Time plays a critical role when it comes to investing for retirement; the more time we have to invest, the better our outcomes. At the beginning of our careers, we are likely to feel that we have all the time in the world. Overcoming this psychological hurdle early on is highly beneficial, as it allows us more time to take advantage of the benefits of compound interest, as seen in Graph 1, which shows two individuals' contributions and their subsequent growth, and reflects the cost of delaying getting started.

Investor A, represented by the red line, began saving 15% of their R20 000 monthly salary from their first paycheque at age 23, and increased their contributions annually in line with inflation (assumed to be 5%). Investor B, shown by the grey line, earned the same salary but only began saving after 10 years of working. Assuming a nominal annualised investment return of 11%, after 42 years, Investor A ended up with 1.9 times (or 89%) more than Investor B at retirement; put differently, Investor B had a pension half the size of Investor A. Most of this difference came from compound growth – earning returns today on returns earned yesterday – illustrating the magic of this phenomenon.

For most retirement savers, Leg 1 is initiated by compulsory contribution to their employer’s retirement fund. If you are not offered a solution by your employer, or wish to supplement your retirement investments, you can invest in a retirement annuity, which is held in your name. You can also consider ordinary (discretionary) investments, such as a unit trust or tax-free investment, although these do not come with the retirement funding tax incentive.

Preparing for retirement holistically ensures that it truly will be the enjoy phase of your life.

As we get started, we must be mindful of the growth we will need to achieve our investment goals, and the amount of risk we will need to take on in pursuit of these goals. A higher allocation to more volatile asset classes – such as equities – at the start of the journey makes sense, as they are likely to deliver better returns over time, however, it is important to be willing to stomach the bumpy ride that comes along with investing in these asset classes. Market fluctuations do tend to smooth out over the course of the retirement investment journey; losses are only on paper – unless we get fearful and disinvest at the wrong time.

The Allan Gray Balanced Fund complies with the legal investment limits for retirement funds, and given its 25-year track record and objective – to create steady, long-term wealth for investors by balancing income generation, capital growth and risk of loss using a mixed selection of assets – it is a great choice for retirement fund investors.

Leg 1 is also an opportune time to start accumulating an emergency fund. This fund should eventually be large enough to cover three to six months of your monthly expenses, and be invested in a low-risk unit trust, such as the Allan Gray Interest or Money Market Fund. Having an emergency fund helps prevent dipping into your retirement investments when life happens and you need money unexpectedly.

Leg 2: Activate cruise control

As you settle into contributing regularly to your retirement nest egg, automating aspects of the retirement planning process can make it easier to stay on track and minimise the number of decisions that need to be made further down the line. Consider making additional contributions to your retirement investments when you receive an unexpected windfall, such as a year-end bonus, and ask your investment manager to automatically increase your contributions each year by a defined percentage so that you don't need to remember to do so (or grapple with the decision annually).

Leg 3: Accelerate your efforts

From our early 40s until about five years before we reach retirement is the time to hit the gas. As we mature in our careers, and our salaries rise, we typically enter the peak of our accumulation phase. This presents an opportunity to make up for lost time by rectifying any mistakes we made, or accounting for any disruptions to our contributions in the first phase of our retirement planning.

To make the most of this phase, we need to ensure that we are maximising our retirement contributions through our employer’s scheme and/or in our personal capacity. Remember to account for any lifestyle creep, which occurs as we earn more and enhance our personal definition of a comfortable lifestyle. Our definition of a “comfortable lifestyle” is likely to change during the journey and therefore to increase our retirement income needs.

During this phase, we should develop an “income mindset” by looking at our accumulated investments and calculating how much we would be able to draw as a sustainable monthly income in retirement. This exercise gives us an understanding of whether the amount we have accumulated is sufficient to live on in retirement. It can also help us to correct our course if we have not saved enough. An independent financial adviser or an online retirement calculator can help with these projections.

Leg 4: Take the scenic route

Successful retirement will require you to manage two things carefully: your finances and your time. The five years leading up to retirement is the time to change gears and start thinking about dreams and goals for retirement. We should envision what we would like to do with our new-found free time and evaluate whether we are, in fact, ready to retire.

Irrespective of where you are in your retirement planning journey, it is important to be deliberate in your decisions and actions.

For many, the outcome of this process may mean considering deferring retirement, or looking at alternative ways to earn an income. For others, it may be an opportunity to shift their focus and pursue passion projects, give back to the community, or try something completely new.

These decisions are personal – and require us to balance our financial circumstances and our vision for meaningful retirement years. Failing to take the time to think about these aspects of retirement can make the transition difficult when the time comes.

Leg 5: Ease into the enjoy phase

Retiring is one of the most significant transitions we make in our adult lives; it is therefore critical to engage with the psychological requirements of retirement planning through each phase, and especially as we prepare to leave full-time work. Your sound financial health could be wasted if you neglect your physical and mental well-being.

Counselling psychologist Dr. Hannetjie van Zyl-Edeling emphasises the importance of not only developing your financial portfolio for retirement, but also focusing on your psychological, health and social portfolios. In other words, it is crucial to think about your needs holistically as you plan for the years to come.

Remember that retirement is not the end of your investment journey, but the beginning of the next stage. The risks to manage closely at this time are the risk of capital loss, the risk of an investment not keeping up with inflation, and the risk of outliving your income.

Investors who are nearing retirement tend to start switching to lower-risk investments to protect their portfolios against market volatility. This process of derisking should happen gradually. Some exposure to growth assets like equities is key to make sure your portfolio keeps up with inflation and can continue to grow over time. The Allan Gray Stable Fund, which can invest up to 40% in equities (versus the Balanced Fund’s mandated 75%), is a popular choice for those at this stage looking to derisk, but maintain some market exposure.

Perhaps most feared is the risk of outliving your accumulated savings. Estimating longevity is complex and best tackled with professional assistance. An independent financial adviser can help with managing risk and implementing an appropriate post-retirement investment drawdown strategy.

Intentional retirement planning increases your likelihood of success

Irrespective of where you are in your retirement planning journey, it is important to be deliberate in your decisions and actions. This is not limited to getting good advice, but also means overcoming the various psychological shifts in each stage.

As with any worthwhile journey, starting late – even though it means needing to accelerate harder – is better than not starting at all. Preparing for retirement holistically ensures that it truly will be the enjoy phase of your life.

Explore more insights from our Q1 2025 Quarterly Commentary:

- 2025 Q1 Comments from the Chief Operating Officer by Mahesh Cooper

- Tariffs: The stealth tax by Sandy McGregor

- A gear shift in electric vehicles? by Raine Adams

- How to invest in a volatile market by Stephan Bernard

- Orbis Global Balanced: Defensively positioned to deliver long-term returns by Alec Cutler and Rob Perrone

- Allan Gray Orbis Foundation: 20 years of purpose-driven impact by Nontobeko Mabizela

To view our latest Quarterly Commentary or browse previous editions, click here.