Retirement funds offer valuable annual tax benefits, but these are lost if you do not act each year. Conversely, if you exceed the annual limits, there is no penalty – the benefits roll over to future years. As we approach the end of the tax year on 28 February, Carla Rossouw reminds us of the advantages of these products and how to maximise them over time.

Contributions to pension, provident and retirement annuity (RA) funds are tax-deductible, within certain limits. This serves as an incentive to save for your retirement and be rewarded by means of an annual deduction to be claimed against your taxable income. In addition, you benefit from growth free of any tax (including dividends tax, income tax on interest and capital gains tax) while you are invested – a big win if you invest for the long term.

If you are a member of a company pension or provident scheme, you can supplement your retirement savings by contributing to an RA in your own name. You can make regular or ad hoc contributions, allowing you to bump up your retirement investment when you can.

You may claim a tax deduction of up to 27.5% of the greater of taxable income or remuneration from your employer each tax year, subject to an annual ceiling of R350 000 (across all your retirement products). While monthly expenses can make it difficult to reach, never mind exceed, the contribution limits, there is no penalty for exceeding them. Contributions made above this limit are known as “excess contributions”. These are carried over and can reduce your tax liability in the current and future years, as explained in detail below.

Of course, it is important to be aware of the product restrictions built into retirement funds: Your underlying investments need to comply with the retirement fund investment limits, withdrawals are restricted before retirement, and the bulk of your investment must be used to purchase a pension-providing product at retirement, such as a living annuity (LA) or guaranteed life annuity.

What are the benefits of contributing above the allowable annual limits?

1. Reduces your tax liability in future working years

If you contribute more than the annual limits, these excess contributions roll over indefinitely. They are carried forward and can be used to reduce your tax liability in future years in which you contribute below the annual ceiling – until the full excess amount is depleted. See the detailed example below.

2. Reduces your tax bill on any cash lump sum you take at retirement

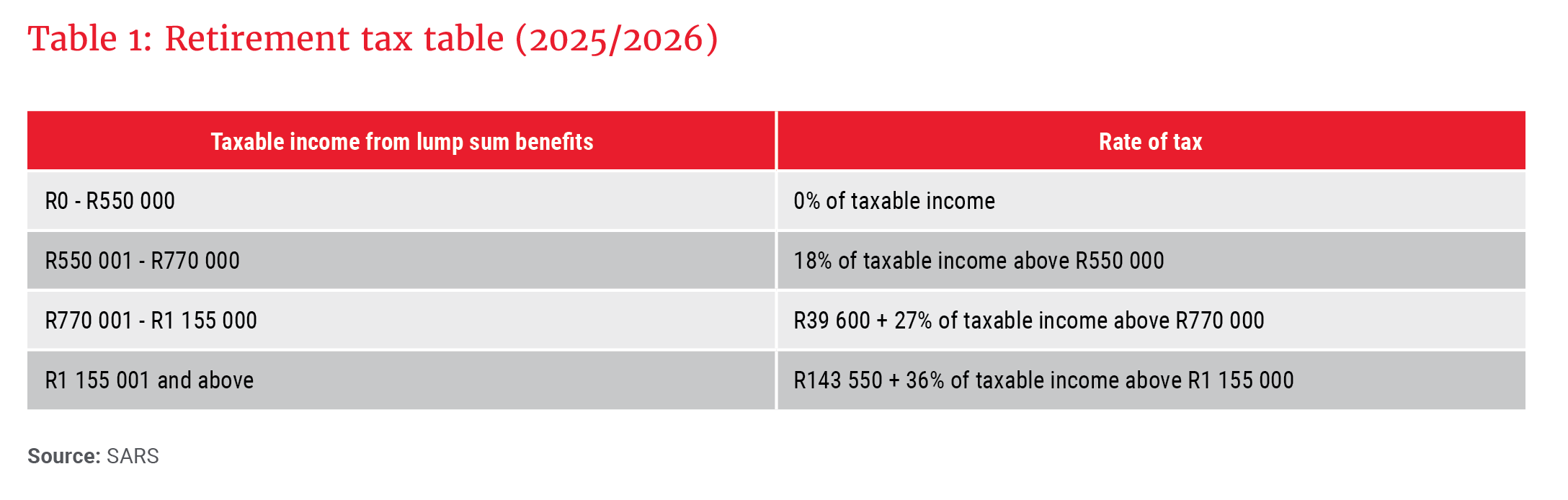

When you retire, you may withdraw up to R550 000 tax-free (less any previous withdrawals).

Your accumulated excess contributions can further reduce the taxable portion of any cash lump sum you choose to take. The excess amount is applied before the retirement tax table is used, effectively creating a larger tax-free portion of your retirement benefit.

... “excess contributions” ... are carried over and can reduce your tax liability in the current and future years ...

There is often confusion around the R550 000 tax-free benefit. Ensure you understand the fine print:

- The R550 000 is a lifetime tax-free cap; it is not available at each instance of withdrawal or retirement. It applies across all your retirement funds and LAs (i.e. those from Allan Gray and other third-party fund providers), even after you have passed away.

- As shown in Table 1, the first R550 000 of the taxable portion of a lump sum benefit is taxed at 0%. If there is no taxable portion remaining after excess contributions have been deducted, the R550 000 tax-free benefit is forgone. (See Point B in the example.)

- The tax bill on the retirement cash lump sum takes all taxable cash lump sum withdrawals you have previously received into account, including severance benefits and cash lump sums withdrawn from an LA (which is allowed if the value of an account falls below the prescribed limits). Any tax-free amount previously received will therefore reduce the R550 000 tax-free portion available at the time of exit.

3. Reduces your tax bill on your LA income in retirement

If you retire with unused excess contributions, these can be used to reduce the taxable portion of your annuity income. However, it is important to consider the following:

- Excess contributions reduce the annuity income value, not the PAYE tax on the annuity income. An excess contribution of R100 does not reduce tax paid by R100 – it reduces the tax that would have been payable on the R100 based on your marginal tax rate, to a maximum of R45 (45% of R100, with 45% being the highest income tax bracket at the time of writing).

- The value of excess contributions erodes over time due to inflation. Assuming an annual inflation rate of 5%, the real value of an excess contribution of R100 made today, but used in 10 years’ time, reduces to R61.

- The exemption is only available on assessment when you complete your tax return. You will still pay PAYE on your LA income throughout the year. When you file your tax return, SARS will apply your excess contributions and you may receive a refund.

- Excess contributions are applied on a “first come, first served” basis. If you take a cash lump sum from a retirement fund before your next tax return is submitted, SARS will first use your excess contributions to reduce the taxable portion of that lump sum. Any remaining excess will be applied to your LA income.

SARS will automatically apply the exemption if it has your contributions on record. This reinforces the importance of declaring your retirement fund contributions when filing a tax return each year. If you believe SARS has applied the wrong amount, you can lodge an objection.

4. Reduces the tax on cash lump sums received by your beneficiaries

When you pass away and your beneficiaries or nominees elect to take a cash lump sum from your retirement fund or LA, SARS taxes this lump sum in your hands according to the retirement tax table.

The calculation takes any previous taxable lump sums you received into account, and the taxable portion of the cash your beneficiaries take can be reduced by any remaining excess contributions.

A few points to note:

- Any excess contributions used when you pass away are included in your estate for estate duty purposes, even if your spouse is a beneficiary.

- Any excess contributions not used against a cash lump sum fall away. These are not classified as deemed property in your estate and cannot be used to reduce the tax bill for heirs drawing LA income.

SARS must have a record of all contributions made to your retirement funds to apply tax calculations correctly. An ITA34 issued by SARS reflects the excess contributions on record for you at the time you filed your most recent tax return.

You may claim a tax deduction of up to 27.5% of the greater of taxable income or remuneration from your employer each tax year, subject to an annual ceiling of R350 000 (across all your retirement products). The other annual tax benefit the government offers is the ability to invest R36 000 per tax year (up to a maximum contribution of R500 000 over your lifetime) of after-tax money in a tax-free investment (TFI). As with your retirement funds, you benefit from growth free of any tax (including dividends tax, income tax on interest and capital gains tax) while you are invested in a TFI.

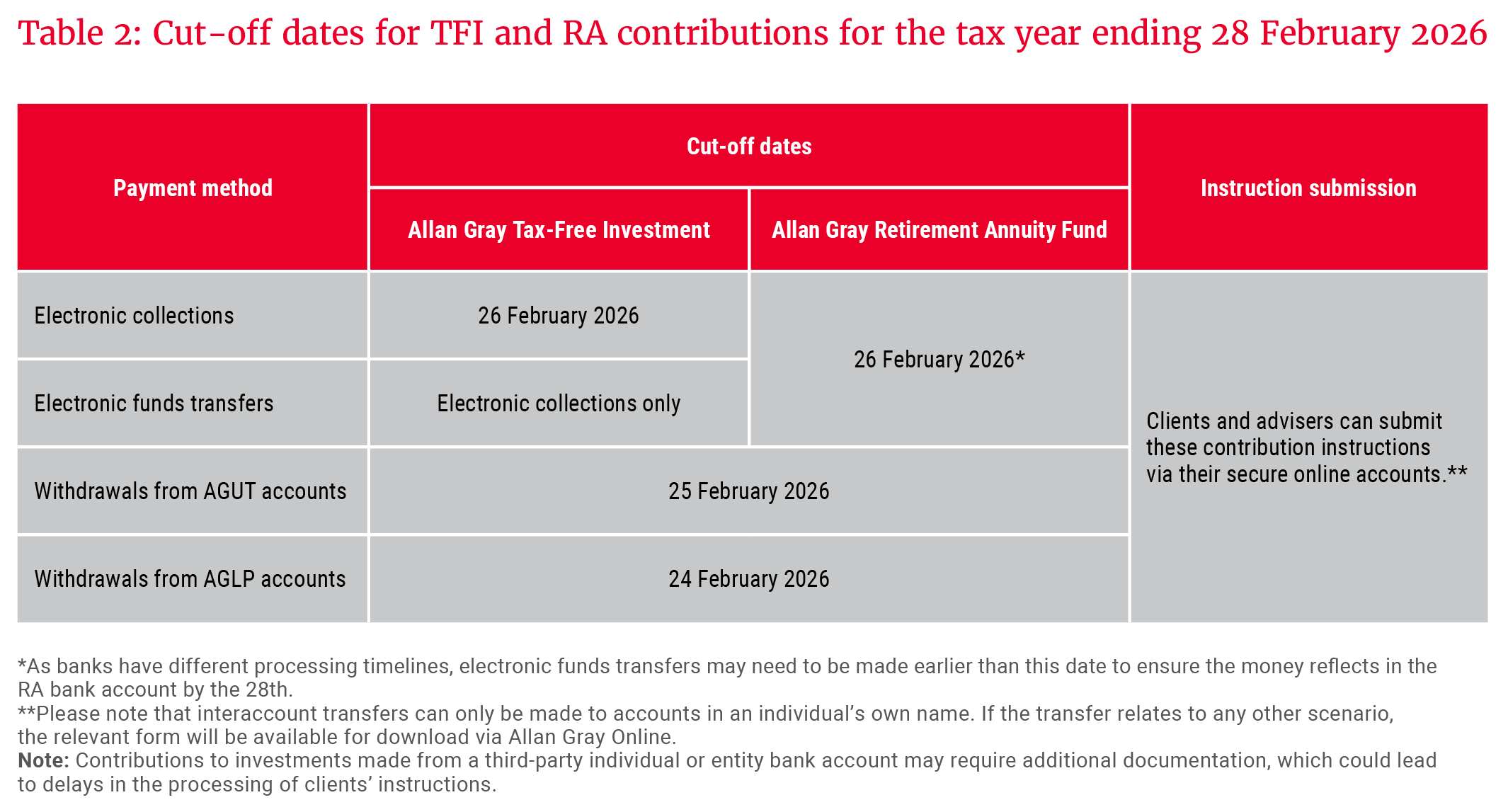

If you are planning to make use of the tax concessions offered through your retirement funds or TFI for the 2025/2026 tax year, please make sure we receive your instruction, supporting documents and payment well in advance of the 28 February 2026 deadlines, shown in Table 2.

Example

A. How your excess contributions affect your tax liability while you are working

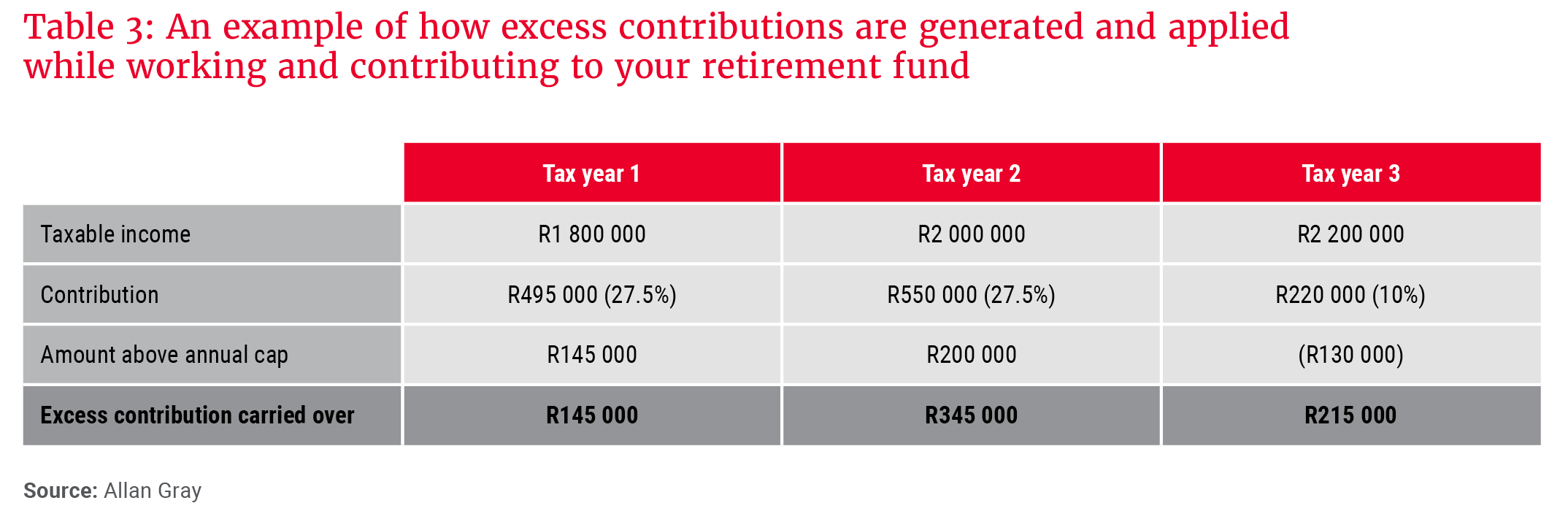

Table 3 reflects the assumptions for our example and shows taxable income, retirement fund contributions and the amounts contributed in excess of the limits. Remember, tax deductions are capped at R350 000 per tax year.

- In Year 1, your contribution to your retirement fund of R495 000 exceeds the R350 000 limit, so you can claim a tax deduction of R350 000; R145 000 is carried over to the next tax year.

- In Year 2, you again contribute above the limit, this time by R200 000. After applying the R145 000 from Year 1, you end the year with R345 000 in accumulated excess contributions.

- In Year 3, your contribution drops to R220 000, which is R130 000 below what you could have contributed in that tax year. You are therefore able to use R130 000 of your carried over excess contributions to reach the R350 000 annual limit, reducing your tax liability for that year.

B. Determining your tax liability on your cash lump sum and LA income at retirement

Now, assume you continue contributing to your RA for another eight years:

- RA value at retirement: R4 500 000

- Total excess contributions: R2 000 000

- No previous cash lump sum taken

At retirement, you may take one-third of your RA as a cash lump sum:

- One-third of R4 500 000 = R1 500 000

i) What is the tax on your cash lump sum?

For tax purposes, your excess contributions (R2 000 000) are deducted before applying the retirement tax table:

R1 500 000 (lump sum) – R2 000 000 (excess contributions) = R0 taxable

This means:

- Your entire R1 500 000 cash lump sum is tax-free.

- You forfeit the R550 000 lifetime tax-free benefit (discussed earlier in Point 2), because there is no taxable portion for SARS to apply it to.

ii) What happens with the remaining excess contributions in retirement?

You still have R500 000 of excess contributions left:

- R2 000 000 – R1 500 000 = R500 000

This can reduce the taxable portion of your LA income after retirement.

Assume your first year’s annuity income is R150 000:

- R150 000 is deducted from the R500 000 excess contributions.

- You pay no tax on your annuity income.

Remaining excess contributions after Year 1:

- R500 000 – R150 000 = R350 000

This means:

- Your LA income will remain tax-free until the R350 000 is used up in future years.

It is important to note that in this scenario, you effectively forfeit the annual tax rebate offered by SARS, as excess contributions available are applied from the first rand of income earned.

C. What happens when you pass away before using all your excess contributions

If you pass away in Year 2 of retirement, and your beneficiaries elect to receive R100 000 of the death benefit in cash (with the remainder used to purchase LAs), then:

- Your remaining R350 000 excess contributions are first used to reduce the taxable portion of that cash lump sum.

- Because the excess contributions exceed the R100 000 cash amount, the full R100 000 is tax-free.

- The R100 000 used to reduce the taxable lump sum is then treated as part of your estate and may be subject to estate duty.

The R250 000 balance of your excess contributions (R350 000 – R100 000) is not carried over to the new annuitants. However, beneficiaries can reduce the tax they pay on the annuity income using their own excess contributions on record with SARS from contributions they have made to retirement funds in their own names.

Explore more insights from our Q4 2025 Quarterly Commentary

- 2025 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Tipping point or false dawn? South Africa’s defining question by Raine Adams

- AB InBev: Catching up over a beer by Jithen Pillay

- Orbis: President’s letter 2025 by Adam R. Karr

- The compounding power of micro wins by Thandi Skade

To view our latest Quarterly Commentary or browse previous editions, click here.