Compounding is usually discussed and understood in financial terms, but is the effect of compounding behaviour equally powerful? Thandi Skade looks at three scenarios, using the Allan Gray Balanced Fund, to assess the impact of behaviour. She leaves us with a few ideas to consider as we review our financial resolutions for the year ahead.

Think about the last time you said to yourself: “This time, I’m going to get serious about my finances.” The commitment may have followed a financially difficult period, or a strong market rally, or a moment of inspiration. At the time, the intention probably felt genuine – but did it last? For most of us, it doesn’t, and that’s the trouble with motivation.

Motivation is often described as the spark that ignites change. The problem is that sparks fade and motivation fluctuates with our mood, environment and perceived progress. When progress feels slow or life gets in the way, our motivation often dwindles. This is one of the reasons many well-intentioned financial resolutions fall by the wayside within weeks of a new year.

Psychologists and behavioural scientists draw an important distinction between motivation and momentum: Motivation may trigger action, but momentum sustains it.

Motivation fades while momentum endures

Motivation feels powerful in the moment, but it is inherently unstable. In contrast, momentum is built gradually through repeated behaviours that are easy to replicate and psychologically sustainable.

James Clear, author of Atomic Habits, captures this idea in his book, noting that people do not rise to the level of their goals – they fall to the level of their systems. In other words, our outcomes are shaped less by intention and more by everyday behaviour.

For long-term investors, this distinction is important. Given the unpredictable nature of financial markets, the long time horizons associated with investing, and the absence of instant gratification, investment plans that rely on sustained motivation are vulnerable to distractions and inertia. However, those anchored in momentum tend to be resilient.

Momentum is not necessarily built through grand gestures or perfect decisions; more often, it is built through small actions that are easy to repeat – a concept known in behavioural science as “micro wins”. The idea is rooted in the belief that small, repeatable actions create a sense of progress that encourages and reinforces repetition. Over time, these small reinforcements build momentum, shape habits and support consistent behaviour even when motivation wanes.

Why micro wins work when big intentions fail

Most of us fall short of achieving our financial goals not because we lack good intentions, but because these goals can feel emotionally demanding. This is particularly true for long-term goals. Saving for retirement, investing through market volatility, or committing to a decades-long financial plan requires sustained effort, which comes with an emotional load. This increases the likelihood of disengagement over time.

When goals feel difficult, distant or unforgiving, a natural response is avoidance. This shows up in different ways, such as putting off budgeting until “next month”, waiting for the “right time” to invest, pausing debit order contributions after a setback, and disengaging when progress feels slow or imperfect.

Behavioural research shows that completing a manageable task – such as finalising your monthly budget or making an initial contribution to an investment – triggers the release of dopamine (the feel-good hormone), which encourages repetition. While the financial impact of a single micro win may be modest, the behavioural impact is not. Each small success provides psychological reinforcement, which, in turn, increases the likelihood of repeating the behaviour and gradually turning intention into habit.

... successful outcomes are rarely achieved as a result of a single decisive moment. More often, it is the outcome of ordinary decisions repeated faithfully over time.

Research into perfectionism helps to explain why this matters. In The Perfection Trap, psychologist Thomas Curran discusses how unrealistically high standards can undermine persistence rather than support it. When progress must be flawless to count, falling short feels like failure. Over time, this all-or-nothing mindset can lead to procrastination, disengagement and abandonment.

Micro wins disrupt this pattern. By design, they lower the psychological barrier to action and make it easier to start, continue and resume after interruptions, while progress becomes something that can be maintained imperfectly, rather than something that must be executed flawlessly.

Compounding behaviour and investment outcomes

If micro wins help us sustain habits and behaviours in our day-to-day lives, can the principle be applied to the way we approach long-term investing? And, more specifically, does the way we structure our investment contributions (i.e. the behaviour) influence our outcomes over time? And if so, how?

Long-term investing provides a particularly useful environment to test this idea, because progress is slow and occurs over time, feedback (or gratification) is delayed, and participation needs to be sustained through favourable and volatile market conditions.

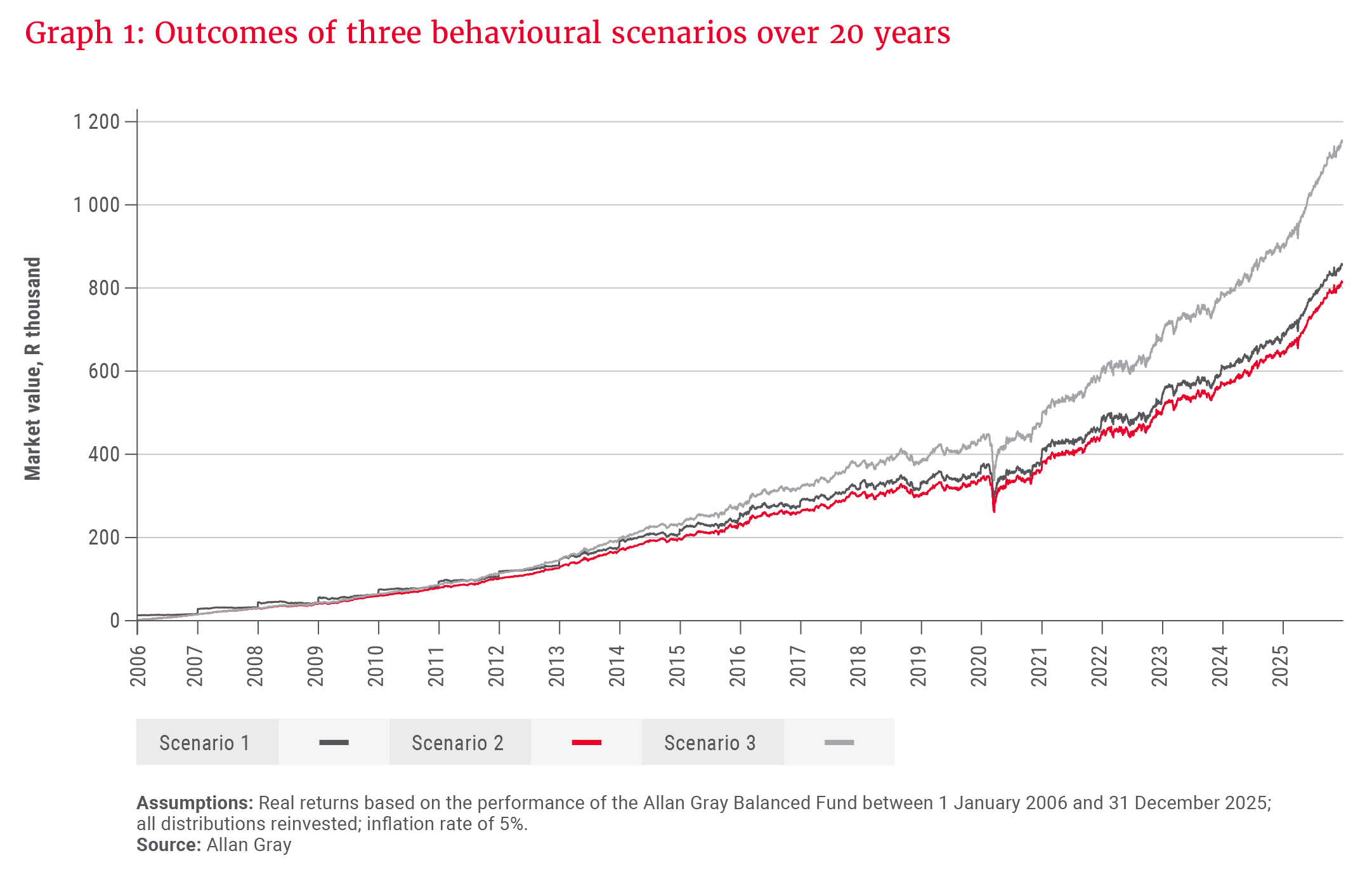

To explore the proposition, we compared three contribution behaviours against real-time market movements and return data of the Allan Gray Balanced Fund over a 20-year period, measured between 1 January 2006 and 31 December 2025. Facing identical market conditions and an assumed inflation rate of 5%, Graph 1 plots and compares the outcomes of the three behavioural scenarios outlined below.

Scenario 1: Decisions as a system

An investor makes a lump sum investment of R12 000 (the equivalent value of R1 000 monthly debit order contributions collected over one year) at the start of the investment. They repeat this contribution behaviour at the beginning of each year over the period, with no escalations. The investment’s final market value is R857 248.

Scenario 2: Automation as a system

An investor starts an investment with R1 000 monthly debit order instruction that gets collected on the first day of every month, with no escalations. The final market value of their investment is R815 275.

Scenario 3: Automation with escalation as a system

An investor starts an investment with R1 000 monthly debit order instruction that gets collected on the first day of every month. They opt to escalate their monthly contribution by 5% annually to match the assumed inflation rate and protect the purchasing power of their investment. The final market value of their investment is R1 153 962.

In all three scenarios, all distributions are reinvested, and the total is net of fees.

Three paths, varying outcomes

The first two scenarios assume identical total contributions to focus the comparison on behaviour, while the third scenario introduces a small, systematic increase to examine whether gradual progression changes the outcome over time. Viewed together, the scenarios highlight three important insights.

Firstly, small actions are behaviourally powerful even when their immediate financial impact appears modest. Scenario 1 benefits from earlier exposure to the market, with each annual contribution invested in full at the start of the year. While this boosted returns during this period, it also relied on a single, high-effort decision made at a specific point in time. Scenario 2 exchanges some of that potential upside for a system that is easier to sustain.

Secondly, our data shows that adding a layer of progression, in the form of inflation-adjusted annual escalations on top of a repeatable system, materially improves investment outcomes over time – as illustrated by Scenario 3. No single decision drives the result; instead, a series of small decisions accumulates into a meaningful difference: the capital compounds alongside the behaviour.

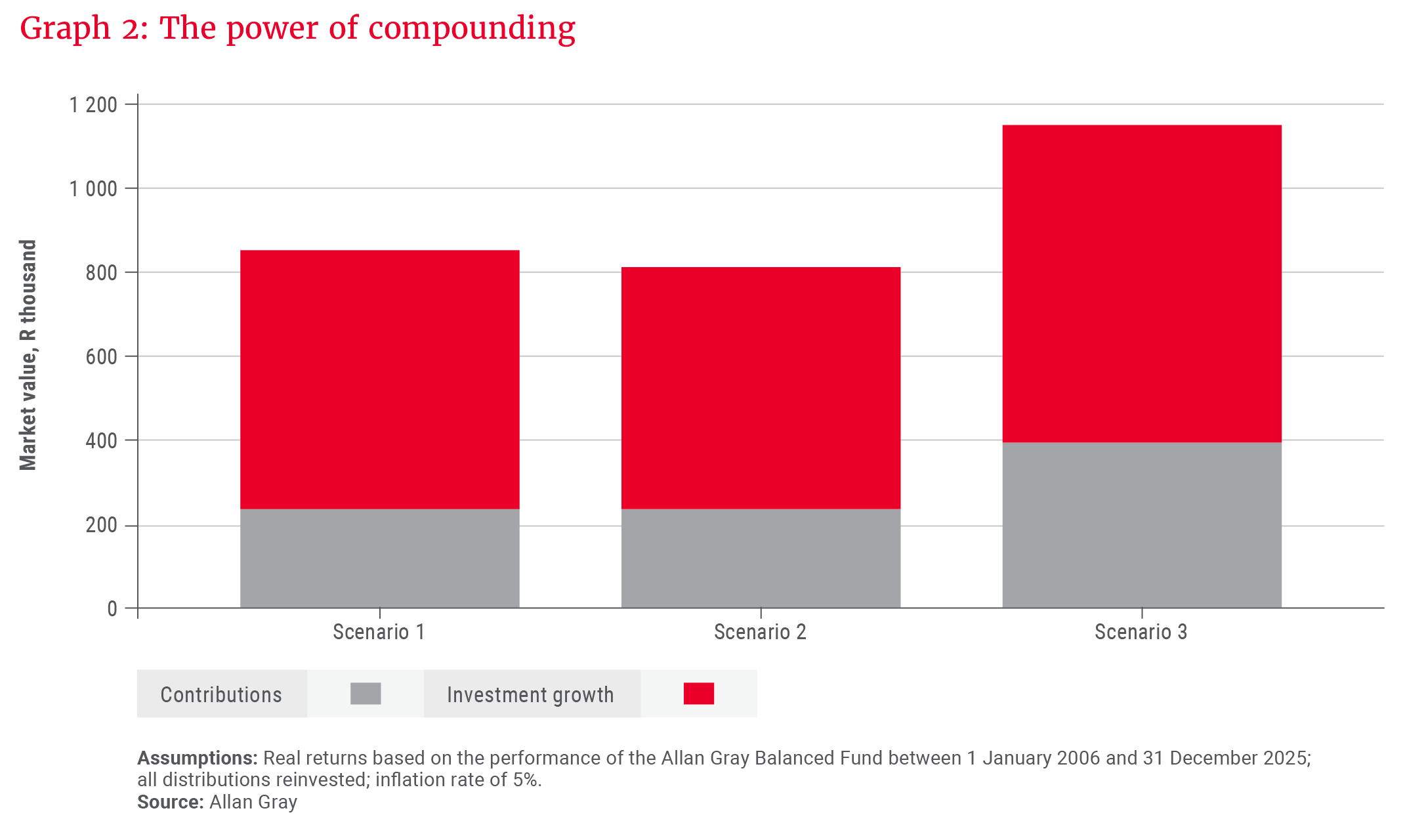

Finally, systems create consistency. Despite the results across the scenarios varying, the consistent behaviour – either actioned monthly or annually – resulted in compounding returns over time. As shown in Graph 2, more than two-thirds of the final market values across the scenarios came from investment growth.

Progress over perfection in practice

Translating the principle of micro wins into action doesn’t require dramatic changes or flawless execution. In fact, the most effective behavioural shifts are often the least conspicuous. The aim is not to optimise every decision, but to design defaults that make steady progress easier. Here are a few ideas to consider:

- Make consistency the default: Regular debit orders are one of the simplest ways to turn intention into action. This matters because decision fatigue is a real phenomenon, and even well-intentioned investors are more likely to delay or disengage when repeated effort is required.

- Let progress happen gradually: Small, incremental and scheduled annual escalations, whether linked to time, salary increases or inflation, allow progress to compound without demanding noticeable lifestyle changes.

- Rebound from lapses: If life happens and you find yourself needing to pause contributions, it is important to treat the interruption as temporary, not a failure, and to resume your contributions as circumstances allow.

The quiet power of consistency

In long-term investing, successful outcomes are rarely achieved as a result of a single decisive moment. More often, it is the outcome of ordinary decisions repeated faithfully over time.

Motivation may spark action, but momentum carries these actions forward. Focusing your investment approach on small, repeatable actions makes it easier to stay invested when motivation fades.

As we settle into the new year and focus on our financial resolutions, let the quiet power of consistency compound, and allow time to do the heavy lifting.

Explore more insights from our Q4 2025 Quarterly Commentary

- 2025 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Tipping point or false dawn? South Africa’s defining question by Raine Adams

- AB InBev: Catching up over a beer by Jithen Pillay

- Orbis: President’s letter 2025 by Adam R. Karr

- The long-term benefits of maximising your retirement fund contributions by Carla Rossouw

To view our latest Quarterly Commentary or browse previous editions, click here.