When it comes to investing, no investor wants to lose money. In fact, as humans, we have a built-in aversion to loss. Unfortunately, by overly focusing on avoiding short-term losses, many investors jeopardise their ability to achieve real returns over long periods of time. Nomi Bodlani discusses the importance of taking on enough risk to ensure you reach your investment goals.

In recent years, global inflation has been spurred on by significant world events, including the COVID-19 pandemic and the ongoing Russia-Ukraine conflict. Many experts believe that the higher levels of inflation we are currently experiencing are likely to persist for some time. In South Africa, we are no strangers to living with high inflation. However, even though most of us factor it into our lives from year to year as we account for our expenses, many investors are guilty of overlooking the impact of inflation over the long term and on their investments.

… the very least you should be asking your money to do is to grow by more than inflation – ideally meaningfully more.

The impact of inflation can feel abstract and hard to visualise over long periods. To gain a clearer understanding of this, consider the following example: The basket of goods that cost you R1 000 in 1999 would set you back R3 650 today. Put another way, in today’s terms, R1 000 would buy less than one-third of what it could at the turn of the century. If you are planning for long-term goals such as retiring in 30 years, you therefore need to plan for that same basket of goods that costs R3 650 today to cost you over R20 000 in 30 years’ time (assuming 6% inflation per year over the next 30 years). As a result, when it comes to long-term wealth creation and preservation, the very least you should be asking your money to do is to grow by inflation – ideally meaningfully more. This is critical to achieving many long-term investment objectives, such as saving for retirement and drawing an income that maintains its purchasing power in retirement.

Because of this, in investing, we often refer to the “real return”, which is the excess return generated by your investment after taking inflation into account. The Allan Gray Balanced Fund has delivered a real return of 9.4% per year since its inception, i.e. the Fund has delivered a 15% annual return, while inflation over that period averaged 5.6% per year. Compounded over 23.75 years, the Fund’s return would have grown an investment of R1 000 in October 1999 to R27 900 today. That is meaningfully more than the minimum of R3 650 to which the investment would have been required to grow to maintain its purchasing power.

Why is our Balanced Fund able to deliver these real returns? The Allan Gray Investment team carefully considers a number of principles to achieve the Fund’s objectives. Following are three principles that can be applied to your own investments if your intention is to benefit from real returns over a long period of time.

Principle 1: Ensure sufficient exposure to carefully selected equities over the long term

If you compare the performance of various asset classes over various periods, equities have significantly outperformed inflation, and more consistently so than bonds and cash. Globally, equities have generated a real return of 5.1% per year since 1900 and 6.6% over the last decade. Locally, equities have fared even better, generating real returns of 9.1% per year since 1900 and 5% over the last 10 calendar years.

Does this imply that simply investing in the FTSE/JSE All Share Index will allow you to reap the long-term rewards of being invested in local equities? Not necessarily.

Firstly, when you invest in equities, you are investing in individual businesses, and not all businesses will succeed or prove to be good investments. Secondly, equity returns do not come in a straight line: Share prices can fluctuate meaningfully in the short term, which we refer to as volatility. The most recent major drawdown is fresh in our minds: The local market declined by more than 30% (top to bottom) in March 2020, but has since recovered to a further 31% above pre-COVID-19 levels.

The above two points demonstrate the importance of active equity selection and taking a long-term view. As an active manager, we focus our efforts on selecting those businesses that we believe will deliver long-term real returns for investors, and we assess the performance of these businesses over long periods to ensure that we take advantage of the opportunities that short-term price volatility can create, rather than be whipsawed by it.

Over the last three issues of our Quarterly Commentary, including the current one, we have provided greater insight into our flagship unit trusts and how you can use them for your various investment objectives. In order to achieve their respective objectives, these unit trusts can invest up to different maximum levels of equities: the Allan Gray Equity Fund: 100%, the Allan Gray Balanced Fund: up to 75%, and the Allan Gray Stable Fund: up to 40%.

However, the right level of equity exposure is determined as a result of a bottom-up, actively managed asset allocation process: The equity exposure in the Allan Gray Balanced Fund and Stable Fund will, at any time, be a function of how attractive our favourite equities are – locally and offshore – relative to other opportunities like selected bonds, listed property and cash. For reference, at 30 June 2023, the equity exposure in our Balanced Fund was 65.9%. We aim to position the portfolios to do well under a range of possible outcomes, while focusing on protecting downside risk and avoiding extreme events.

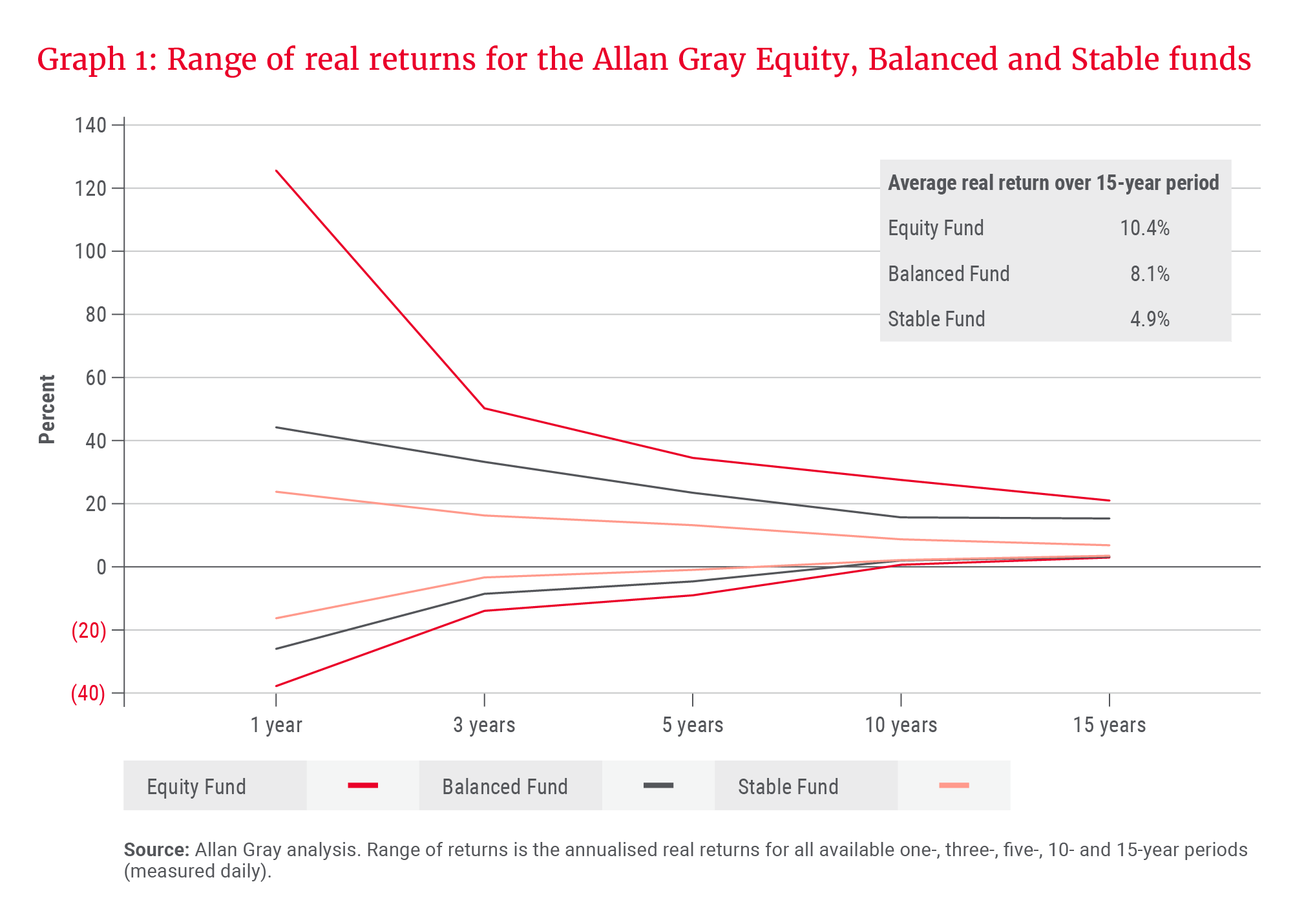

Graph 1 demonstrates the range of real returns for each of these unit trusts over different periods of time. Over any 15-year period (measured daily), the average real return for these unit trusts has been 10.4%, 8.1% and 4.9% respectively. Graph 1 also demonstrates the risk-return trade-off that results from varying levels of equity exposure.

Taking on higher equity exposure increases the return potential, but also the potential volatility in the portfolio. While our Equity Fund has a significantly wide range of returns, and therefore higher volatility over the short term than our Stable Fund, over longer periods, the higher equity exposure should offer higher expected returns: Our Equity Fund achieved an average real return of 10.4% over any 15-year period, compared to our Stable Fund’s 4.9%.

A well-diversified multi-asset unit trust, like the Allan Gray Balanced Fund, can provide meaningful levels of equity exposure while reducing the shorter-term volatility risk. You can see this by the narrower range of real returns experienced in our Balanced Fund compared to our Equity Fund in Graph 1. Additionally, even though our Balanced Fund has lower exposure to equities, it has still achieved an average real return of 8.1% compared to our Equity Fund’s 10.4% over any 15-year period.

To determine the most appropriate level of equity exposure for your portfolio, you should consider your investment objective, your return expectations, your investment horizon and the level of risk you are willing to take on. You can then use these considerations to select a unit trust that matches those needs. Bear in mind that when investing in a retirement product, such as the Allan Gray Retirement Annuity, your portfolio will need to align to the requirements of Regulation 28 of the Pension Funds Act and can invest a maximum of 75% in equities.

Of course, it is not just where you invest your capital – it is also how much, and for how long you invest that makes a meaningful difference over the long term. This leads us to the second principle.

Principle 2: Pay attention to the level at which you contribute and draw down

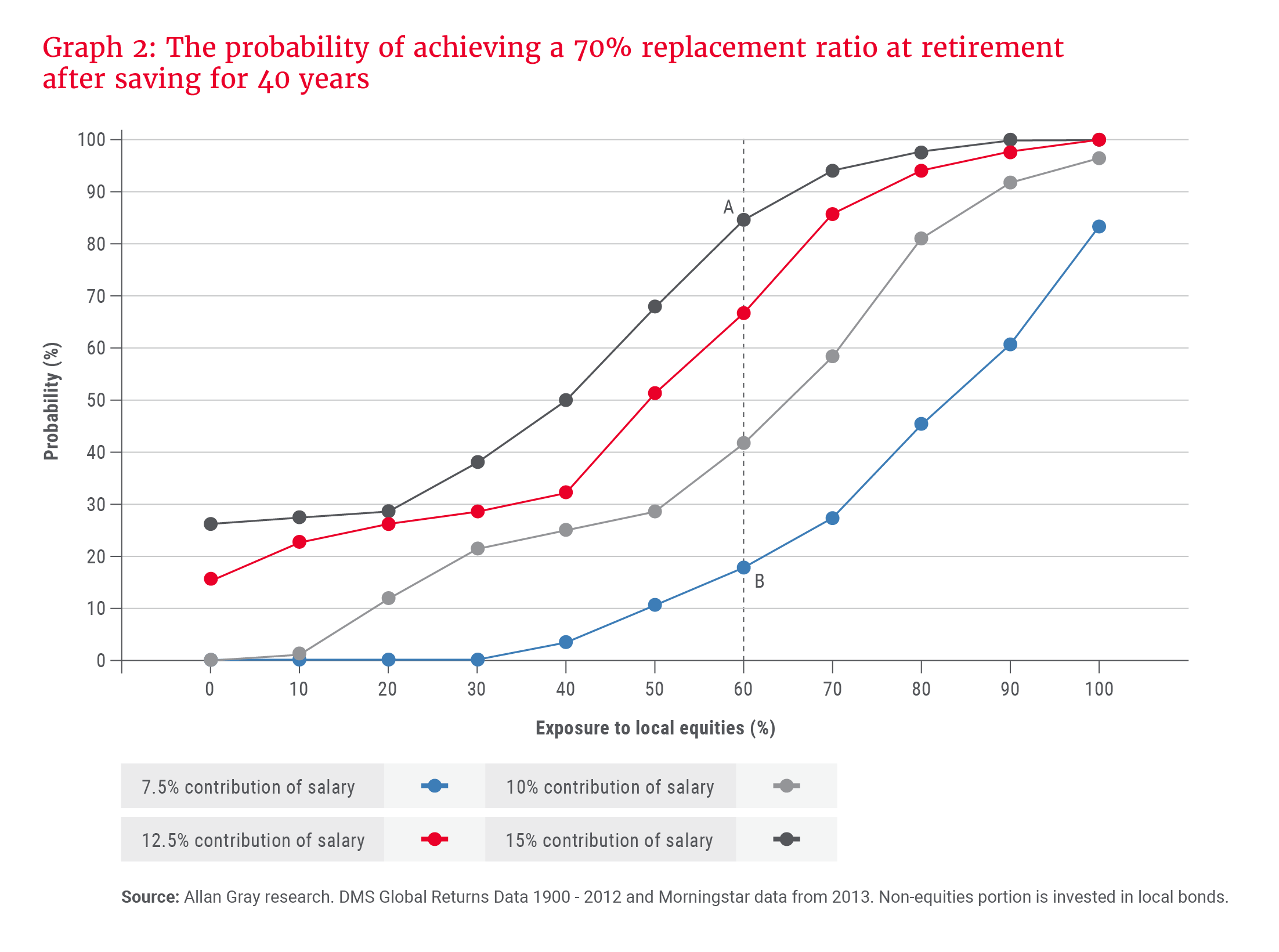

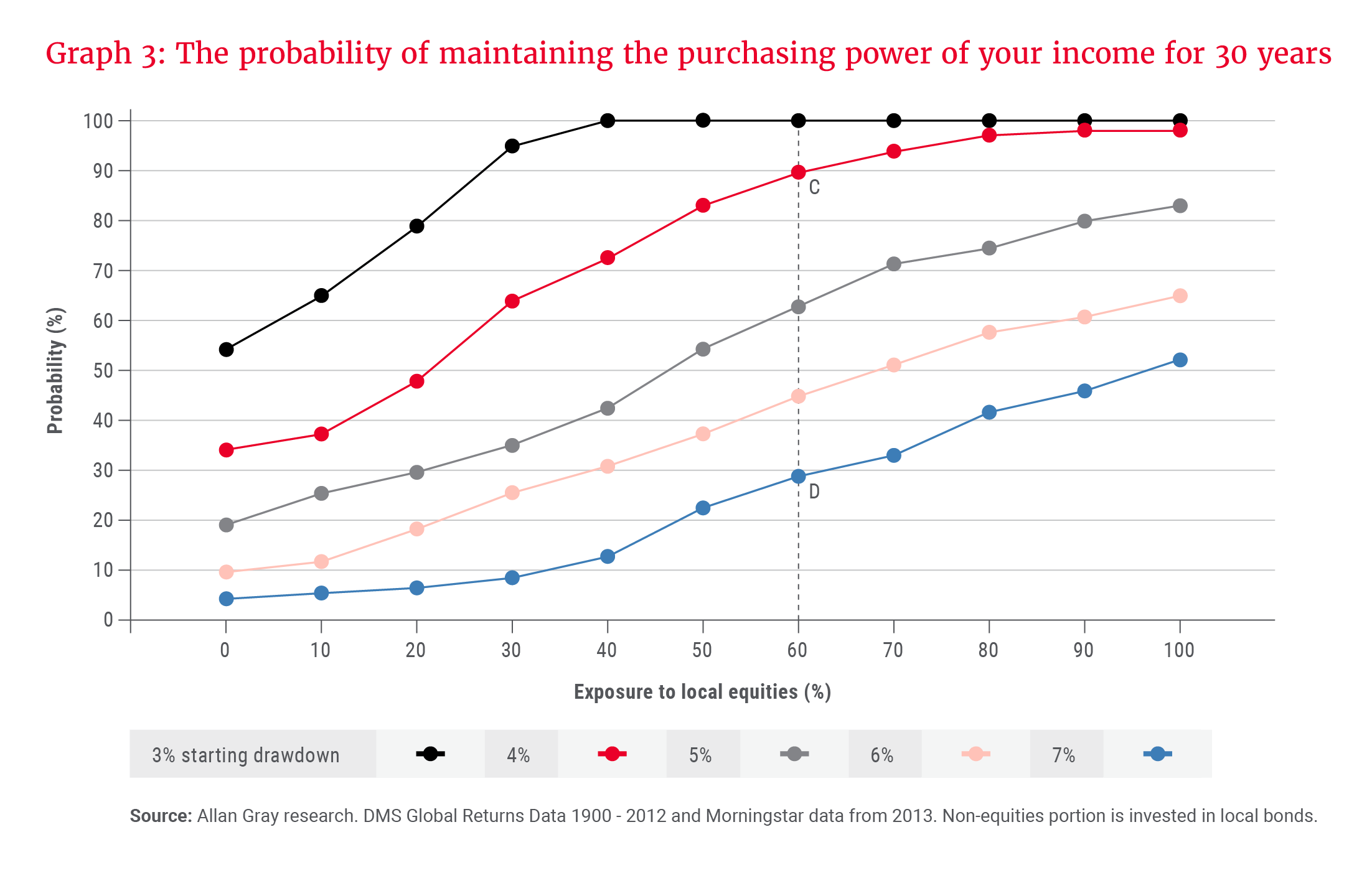

Even if you maximised equity exposure, no amount of equities is going to make up for not starting early enough or investing sufficiently for your investment objective or drawing down too fast. Graphs 2 and 3 illustrate the impact of varying levels of contribution and drawdowns on the chances of achieving two investment objectives: 1) being able to save enough to replace 70% of your final income at retirement (i.e. achieve a 70% replacement ratio), and 2) being able to increase your income in retirement by inflation each year (i.e. maintain the purchasing power of your income).

… for optimal long-term outcomes, investors should make sure they take on enough risk … as this improves their chances of … achieving their investment objectives.

If you start working at 25, you will have roughly 40 working years to save for retirement. In Graph 2, point A demonstrates that historically, when contributing 15% of your salary towards retirement over 40 years, an equity exposure of above 60% corresponds to a more than 80% probability of saving enough for retirement (i.e. a 70% replacement ratio). As the contribution level declines, it becomes increasingly challenging to achieve this objective. Point B illustrates that, at the same equity exposure of 60% and a contribution level of 7.5%, the probability of saving enough for retirement declines to less than 20%.

Graph 2 demonstrates historical outcomes for investors saving over a 40-year period: While a 15% salary contribution over 40 years can help you achieve your objective, the required contribution level will increase significantly beyond 15% as you give yourself less and less time to save for retirement.

If you retire at age 65, you should plan for your income to last you 30 years. During that time, you want to draw an income at a rate that still allows you to increase your income by inflation each year, maintaining its purchasing power. Point C in Graph 3 illustrates that, at 60% equity exposure and an income drawdown of 4%, you can have a 90% chance of achieving your objective. If you increase your drawdown to 7% (point D), at the same equity exposure of 60%, it drastically reduces the chances of maintaining your income’s purchasing power to less than 30%.

Once you have selected a unit trust with the right level of equity exposure for your return expectations, investment objective and risk appetite, and are contributing (or drawing down) at a level that gives you the best chance of achieving your objective, the final critical step is to stay invested.

Principle 3: Stay invested

To truly benefit from long-term equity exposure, investors need to stay invested. This can be particularly hard when times are uncertain and market volatility seems constant. It is often during the toughest times, when short-term performance is materially down, that investors are tempted to abandon their choice of unit trust. When performance is negative, investors disinvest, and when performance is positive, investors return. The effect of this over time is that investors miss the periods of recovery that typically follow a downturn. Compounded over time, this behaviour erodes investment outcomes.

… staying invested over the course of your investment horizon will help you maximise your investment outcomes.

If you invested R100 000 in the Allan Gray Balanced Fund 20 years ago and missed just the top five months of performance recovery, you would have achieved an outcome of R784 735. If you stayed invested throughout the period, you would have accumulated R1 185 830, equivalent to an annualised return of 13.2%, versus 10.9%. Poor investor behaviour would therefore have cost you a third of your potential return in rands.

Given the global economic uncertainty and accompanying market volatility in recent years, there has been renewed and growing interest in low-equity investment solutions. However, for optimal long-term outcomes, investors should make sure they take on enough risk and not shy away from ensuring their portfolios have appropriate levels of equity exposure, as this improves their chances of earning real returns and achieving their investment objectives.

Our core unit trusts offer varying levels of equity exposure to suit various investment objectives, time horizons and risk appetites. Once you have selected the unit trust that aligns with your goals, and are contributing or drawing down appropriately, staying invested over the course of your investment horizon will help you maximise your investment outcomes.