Time is of the essence when it comes to investing. Start now and benefit from the magic of compounding.

Sometimes referred to as the eighth wonder of the world, compounding makes your money work for you by earning returns today on the returns you earned yesterday.

If you start early and save consistently over long periods, less of your total amount saved will be from your contributions and more from growth. Your early contributions are more important than your later ones, as your money has that much longer to grow.

But time is also an enemy

However, time also erodes the value of your money and you’re able to buy less with the same amount of rands. This is called inflation. To counter inflation you need to earn investment returns. Often a significant portion of any investment return you earn compensates for inflation first, therefore the returns on your investment should be at least enough to compensate you for the length of time that you invest so that the buying power of your money is maintained.

For example, if the rate of inflation is 6% per year, your investments have to grow by more than 6% each year before you achieve any real return. If the growth in an investment exceeds inflation then it creates more buying power.

Therefore, when evaluating your returns, it’s important to look at the real return, not the nominal return, which is the growth on your investment before the effects of inflation are considered.

Over the very long term (around 100 years), South African equities have delivered, on average, real returns of 7.3%. Based on this, if you allowed 40 years for retirement saving, two-thirds of your total amount would have come from returns and compound growth and one third from the money you actually saved.

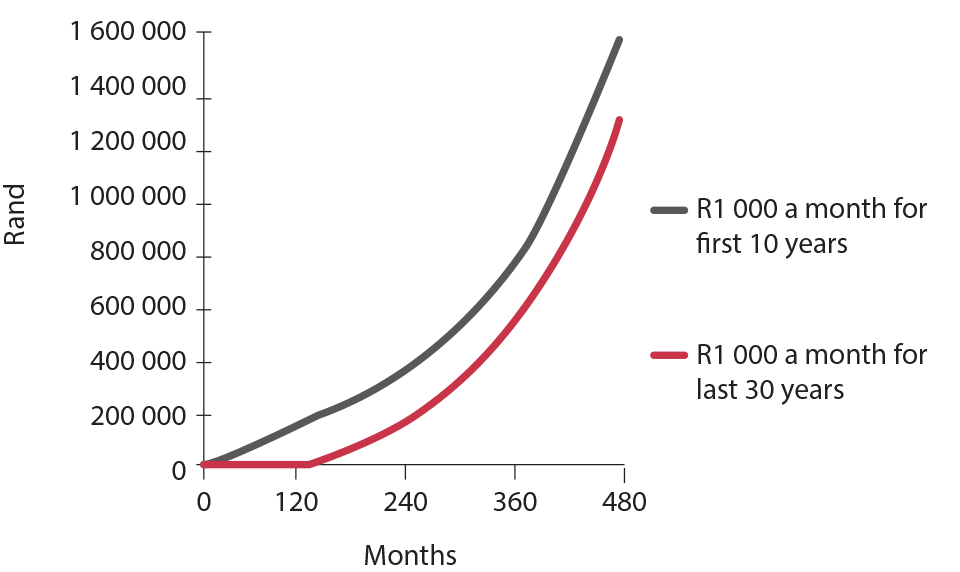

By way of example, assuming a return in line with very long-term equity returns and taking historic inflation into account, an investor who contributes a consistent amount of R1 000 per month for 10 years (R120 000) and then stops contributing but remains invested for another 30 years will accumulate more than one who delays starting for 10 years and then contributes R1 000 a month for 30 years (R360 000).

As the time allowed for compounding increases, so does growth, relative to your contributions, increase exponentially.

This shows that starting as soon as you can, with even a relatively small amount, pays off over the long term.

Time in the market versus timing the market

Now you may be thinking that it is all good and well to invest as soon as you can – but what if market conditions aren’t exactly right?

It is true that you receive better value for money if you invest after the market has fallen, rather than at its peak. However, this does not mean that you should put off saving if you are unsure what the market is going to do next. In all but the most extreme situations, the cost of putting off saving exceeds the benefit of starting at the bottom. This is because even money that has decreased in value is a better contribution to a long-term objective than money that has been spent on short-term gratification.

You can also set up a monthly savings debit order, which gets you into a consistent savings habit and removes the pressure of finding the ideal time.

So when should you start?

You can substantially improve your financial situation if you start saving sooner rather than later and you will be a step closer to being financially independent. A little really can go a long way.

This article forms part of a series that you can access here.

Find this article useful? Please let us know.