The end of February is the end of the tax year – a great time to take a close look at your investments and consider taking maximum advantage of the incentives the government has put in place to encourage us to save.

As discussed in Part 2, there are certain annual tax benefits available to you through your retirement funds and tax-free investment (TFI) account. You forfeit these if you don’t act each year. As we approach the end of the tax year (the end of February), it is worthwhile looking at your finances. If you have cash to spare, consider taking full advantage of the tax incentives.

Every year you are able to make a pre-tax contribution to your retirement funds of up to 27.5% of the higher of your taxable income or remuneration, capped at R350 000 per tax year. If you have not maximised this benefit, you can make an additional contribution to your retirement annuity (RA) in the form of a lump sum. If you are invested in your employer’s retirement fund, you can make an additional voluntary contribution (AVC), or you can start an RA in your own name.

The other annual benefit the government offers is the ability to invest R36 000 per tax year (up to a maximum of R500 000 over your lifetime) of after-tax money in a TFI and benefit from growth free of dividends tax, income tax on interest and capital gains tax.

Retirement funds and TFIs fulfil different objectives and it may not be an either/or decision, but rather a question of using both for different needs.

Let’s consider some additional detail

Contributing to your retirement fund decreases your total tax bill for the year:

Pension or provident fund members

If you are a member of a retirement fund through your employer (such as their pension or provident fund or an umbrella fund), and decide to make an additional voluntary contribution of say 5%, your take-home pay won’t necessarily decrease by 5%. This is because you may get tax back from SARS as a result of increasing your retirement fund contribution amount. This is illustrated by the following example:

Meet Tshepo. Tshepo earns an annual salary of R300 000 and contributes 7.5% (R22 500 per annum) towards his retirement annuity fund. He does not have any other taxable deductions. His taxable income after the deduction of R22 500 is R277 500. Tshepo must pay tax of R39 140 after the primary rebate has been taken into account (as per the 2021/2022 tax table), leaving him with a take-home amount of R238 360 (after tax and retirement contributions).

If Tshepo decides to increase his contribution to 15% (R45 000), his taxable income is R255 000. His annual Pay-As-You-Earn (PAYE) tax liability decreases to R33 290 (after the primary rebate has been taken into account). Although Tshepo doubled the amount of his original contribution, he ends up with R16 650 less in his bank account at the end of the year (from R238 360 to R221 710). This is because the increased contribution has resulted in an annual tax saving of just under R6 000. Tshepo therefore increases his saving towards his retirement and saves on tax too.

New and existing retirement annuity fund members

Anyone can invest in a retirement annuity in their personal capacity. It is a good option to consider if you are self-employed or you can contribute to an RA in addition to other retirement savings you may have. If you are already a retirement annuity fund member, you can increase your monthly contribution to enjoy the maximum tax benefit. You could also do a once-off additional contribution. Doing this will mean that when you are assessed for the tax year you can claim the tax deduction – your savings get a boost, and you get money back from SARS.

Let’s consider Nurhaan as an example. Like Tshepo, Nurhaan earns an annual salary of R300 000. She has contributed 15% of her annual salary to her RA this year. On learning about the benefits of maximising the tax breaks offered to retirement savers, Nurhaan decides to make an additional contribution to her RA. She has been frugal this year and decides to use the money she has saved to maximise the 27.5% tax benefit before the end of February. She contributes an additional R37 500 (which equates to 12.5% of her annual salary) on top of the R45 000 she has already contributed. She contributes the additional R37 500 herself and not via her employer’s payroll. Nurhaan can therefore expect to receive an additional R9 750 from SARS when she files her tax return.

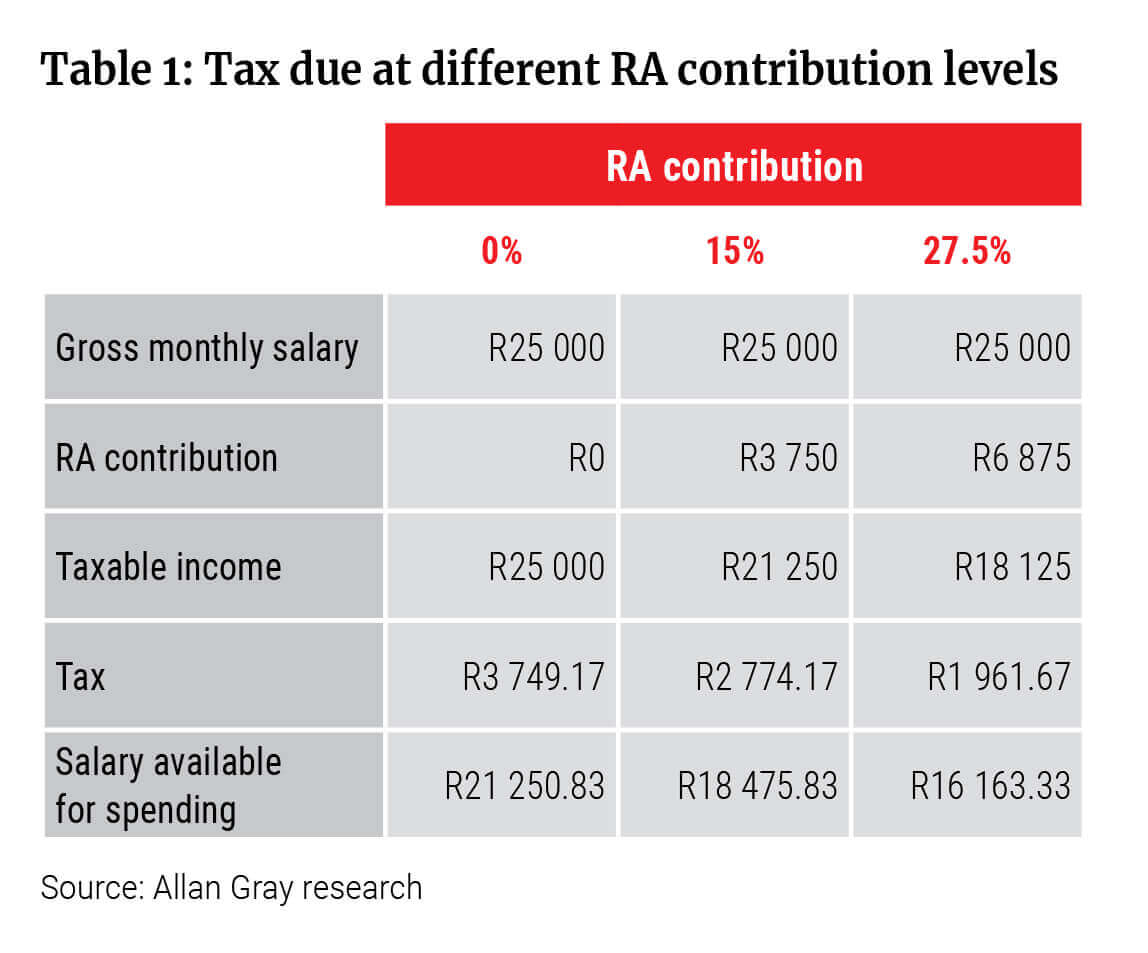

The government encourages us to save for our future now by ensuring our take-home pay doesn’t decrease in line with the amount we save for retirement. This is illustrated in Table 1, which calculates the monthly tax due for an individual earning R300 000 per year (R25 000 per month), at different RA contribution levels. Note that as your contribution levels go up, more money is invested in your RA and less goes to the tax man.

Tax-free investments

As discussed earlier, individuals are allowed to invest R36 000 per tax year up to a lifetime maximum of R500 000 in a tax-free investment account. Like a retirement fund, you benefit from growth free of dividends tax, income tax on interest and capital gains tax – a big win if you invest for the long term.

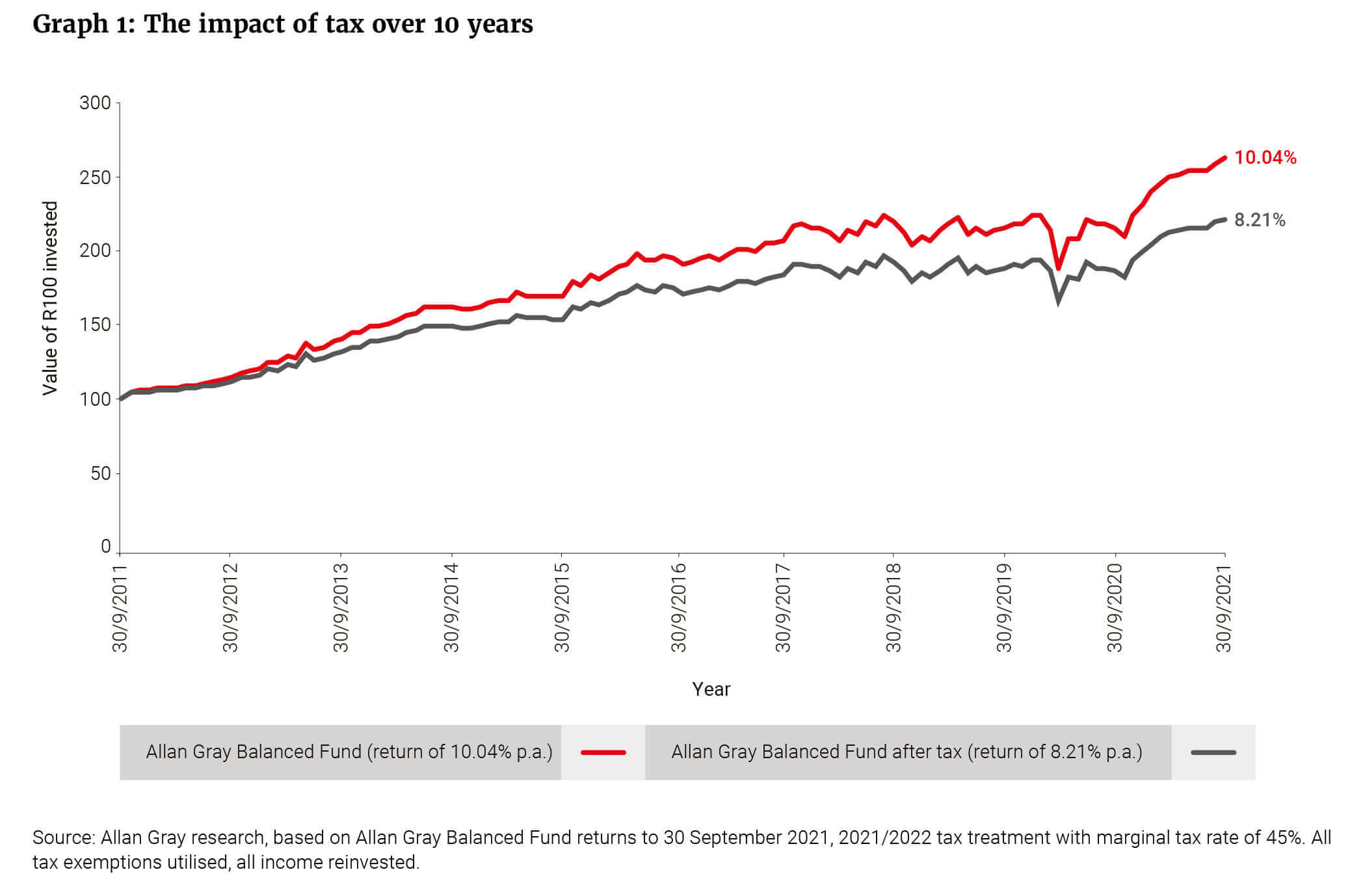

In terms of flexibility, TFIs are similar to unit trust investments, but your return potential is higher than in a basic unit trust, as you can see in Graph 1, which shows the impact of tax over 10 years. The red line illustrates the 10-year return of the Balanced Fund, while the black line reflects the return an investor would receive after tax – although of course this differs for everyone as it is based on your personal tax rate and circumstances. The catch is that if you exceed the maximum investment amount in a TFI, the tax penalties are high.

If extra resources are limited, should you up your contribution to your retirement fund or use a TFI?

The main differences between retirement funds and tax-free investments are:

- Retirement funds offer tax savings now, i.e. you pay less tax now because you make contributions with earnings on which you have not paid tax, but you will pay tax later, i.e. you defer paying tax. In return, there are rigid legal restrictions on withdrawing your money.

-

Tax-free investment accounts offer less tax savings and are capped at a lower amount, but are less restrictive – they allow you to take your money out at any time.

Apart from deferring tax in a retirement fund, an additional tax saving comes from paying a lower average tax rate on the benefits withdrawn from your retirement fund at and after retirement, versus the tax saved on contributions. The first R500 000 lump sum you take at retirement is currently tax-free (importantly, this amount includes all previous taxable lump sums received from any other retirement fund or an employer as a severance benefit).

As noted in Part 2, when you retire, you must transfer the rest of your benefit to an income-providing product. When you pay income tax on this benefit, you are likely to be taxed at a lower rate than when you were making contributions, which is where the additional tax saving comes in.

From a retirement savings perspective, in most cases retirement funds offer the best tax deal. However, you need to be able to live with the restrictions. For long-term discretionary investments, it probably makes sense to put your first R36 000 into a TFI. Remember, however, that you will need to be disciplined and resist the temptation of withdrawing from your TFI account in order to enjoy the long-term compounding benefits.

It is important to look at your portfolio holistically, either on your own or with the help of a good, independent financial adviser, to ensure your decisions fit in with your long-term plan.

If you haven’t contributed 27.5% of your taxable income/remuneration to your retirement fund in this tax year, you have until the end of the tax year (the end of February) to open an account or to top up your investment.

You also have until the end of February to open a tax-free investment, or contribute up to R36 000 if you haven’t done so already.

If you are planning to make use of these tax concessions, you will need to do so well in advance of the end of February deadline to allow time for your investment manager to process your investment.

This article forms part of a series on maximising your tax benefits.