It’s important to understand how taxes are applied in different investment products and how this ultimately impacts your investment returns.

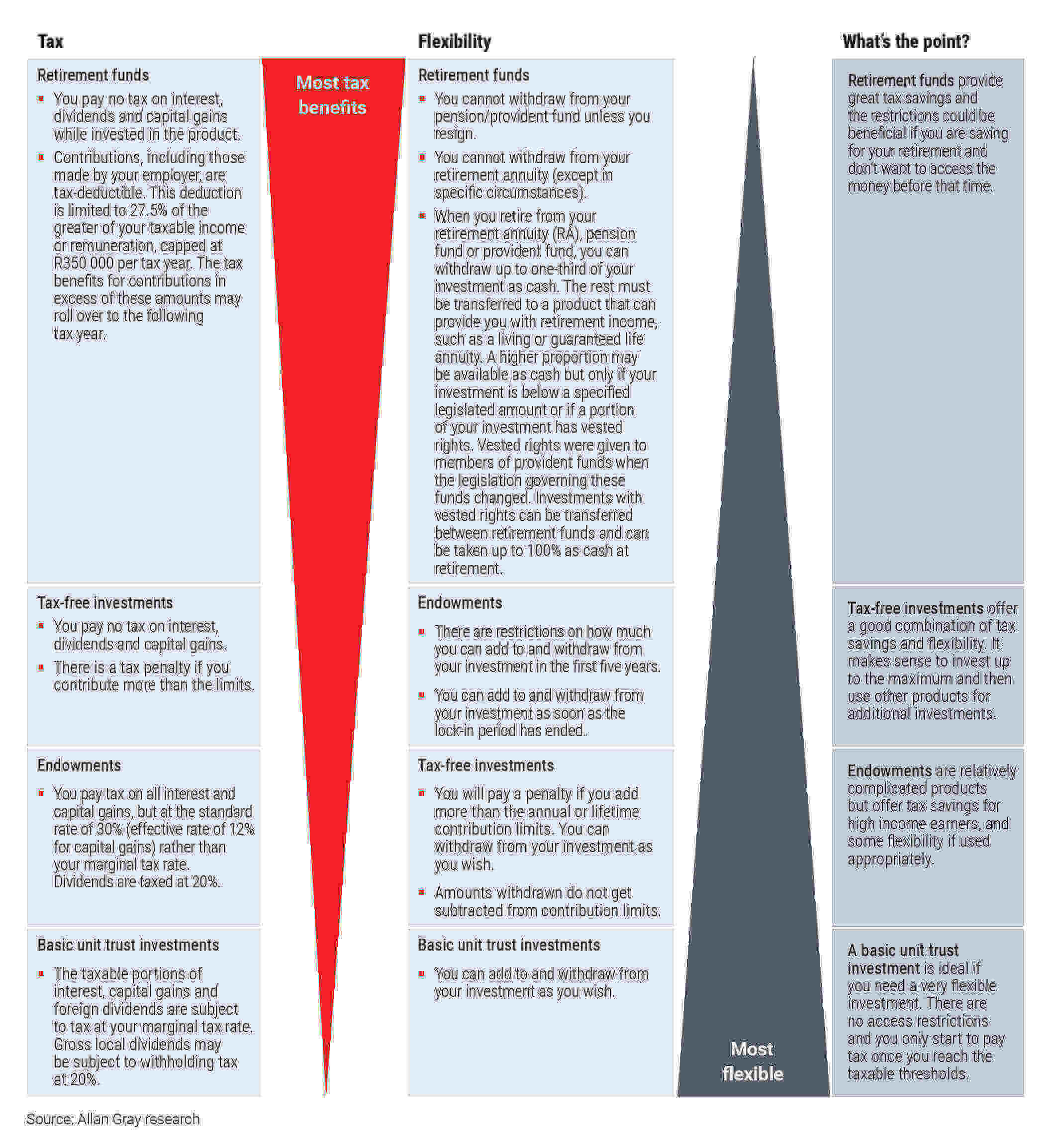

As discussed in Part 1, there are lots of factors to consider when making investment decisions. Tax benefits are one piece of the puzzle. You can never entirely avoid tax, but when you pay it, and how much you pay, can have a significant impact on your long-term outcome. The infographic summarises the impact of tax on your investment return, and if you need more detail, it follows below.

Tax in a unit trust

Unit trust investments are the most flexible of all products as they don’t have any contribution or withdrawal restrictions.

Investing in local unit trusts

You invest in a unit trust with after-tax money and then pay tax on interest, dividends and capital gains. Local and foreign interest is taxed at your marginal rate, and both local and foreign dividends are taxed at an effective rate of 20%. Up to R23 800 of local interest is exempt from tax if you are younger than 65, or up to R34 500 if you are 65 and older.

You trigger a capital gain or loss on unit trust investments only once you sell the units (e.g. when you switch between unit trusts or withdraw). Forty percent of the capital gain is taxed at your marginal tax rate, but your first R40 000 per tax year is exempt. You do not pay capital gains tax when your investment manager buys and sells underlying assets within the portfolio.

If you invest in a rand-denominated offshore unit trust, you pay tax on all gains on your original rand investment, regardless of whether those gains are from capital growth or currency movement. You also pay tax on foreign interest and dividends. Foreign dividends are included in your taxable income and are taxed at an effective rate of 20%. The full value of foreign interest is included in your taxable income and is taxed at your marginal rate.

Offshore investing

You can take up to R1m offshore every calendar year without having to apply for a tax clearance certificate, but if you want to invest more you will have to apply for tax clearance from SARS.

If you invest directly in foreign currency with a foreign manager or through an offshore platform, you don’t pay tax on currency movement while you are invested. When you sell assets bought in a foreign currency, the foreign capital gain or loss is first calculated and then translated into rands using either the average exchange rate (available on the SARS website) or the exchange rate on the date of sale.

Tax-free investment accounts provide a decent alternative (but note the restrictions)

If these figures leave you wondering how you can earn a similar return but not suffer the tax sacrifice, a tax-free investment (TFI) account may be the answer. As with a unit trust investment, you invest in a TFI account with after-tax money – the key difference is that all interest and dividends are tax-free and you pay no CGT when you withdraw. This is the same as in your retirement funds (as described below) – but TFIs allow you access to your investment whenever you need it. While this flexibility is appealing, it is not necessarily a good thing when you are trying to be disciplined. And the true benefit of this product will be experienced in the long term.

There is a catch. The maximum amount you can currently invest is R36 000 per tax year with a lifetime maximum of R500 000. If you exceed these limits, you will incur a 40% penalty on the excess amount.

If you can handle the restrictive rules, endowments are another option

If you are a high income earner, you can benefit from a favourable tax rate if you invest in an endowment. An endowment is a policy issued by a life insurance company. When you invest in an endowment, you effectively swap your tax position for that of the policy. The big deal here is that for higher taxpayers, instead of paying tax at 45%, you pay tax at the rate that the life company must apply, which is 30%. The downside is that the life company can’t give you your exemptions – so you pay tax, albeit at a lower rate, on all of the interest income and capital gains. Dividends are subject to 20% dividend withholding tax. Endowments have restrictive rules regarding contributions and withdrawals, and should only be considered if you are willing to lock your money in for five years.

Retirement funds win on the tax front

Retirement funds – including retirement annuities (RAs) and occupational pension and provident funds (either directly from your employer or in an umbrella fund) – offer the greatest tax benefits and the government provides various incentives to encourage us to use these retirement savings products:

- Contributions, including those made by your employer, are tax-deductible. This deduction is limited to 27.5% of the greater of your taxable income or remuneration, capped at R350 000 per tax year. This doesn’t mean you cannot invest more than you can deduct for tax purposes in a tax year. The tax benefits for contributions in excess of these amounts may roll over to the following tax year. Alternatively, you can increase the tax-free amount of a cash lump sum on withdrawal/retirement or you can offset the amount against the taxable portion of your annuity income.

- You do not pay CGT, dividend withholding tax or income tax on the investment growth earned in a retirement fund. Because you are compounding all growth tax-free, your investment value at the end of 30 years could end up far higher than in a basic unit trust investment.

- You pay tax on benefits at a favourable rate. Lump sum benefits are taxed on a sliding scale with a portion of the benefit tax-free. Income benefits, such as annuities and pensions, are taxed at your marginal tax rate.

It’s important to be aware of investment and withdrawal restrictions on retirement funds. To make sure that your investment is not exposed to excessive risk, retirement fund regulations limit your exposure to higher risk assets, such as equities. In addition, retirement funds come with restrictions on withdrawal. Although you are able to withdraw from a pension or provident fund if you resign from your employer, in a retirement annuity you are only able to withdraw before retirement if you become permanently disabled; emigrate from South Africa, as recognised by the South African Reserve Bank for the purposes of exchange control (if the emigration application was submitted on or before 28 February 2021 and is approved on or before 28 February 2022); cease to be a South African tax resident (for an uninterrupted period of at least three years on or after 1 March 2021); leave South Africa at the expiry of a work or visit visa; or if the total value of all your retirement annuity accounts is below the amount prescribed by legislation, which is currently R15 000.

When you retire from a retirement fund, you can withdraw up to one-third of your investment as cash and must use the remainder to buy a product that can pay you an income (such as a living annuity or guaranteed life annuity). A higher proportion may be available as cash if your investment is below a specified legislated amount or if a portion of your investment has vested rights, as mentioned.

This article forms part of a series on maximising your tax benefits.