There are many reasons to invest. Start now: small sacrifices today can make a big difference over the long term.

Casinos the world over employ a simple mind trick to get you to spend more money: they use chips instead of cash to throw off your sense of value. Throwing a R10 000 chip takes no more effort than throwing a R100 chip, whereas a sheaf of notes immediately sets the stakes higher. But when you think about it, even money is a layer of abstraction away from the things we truly value.

What do you truly value?

Answering the question ‘why should I invest’ requires that you look deeper and answer the root question: what do I truly value?

For most of us investing seems like work because we can’t connect the dots between what we value and the effort of investing – just like the gambler who only sees chips.

We may have some unique things that we value, but we also tend to all value some of the same things:

- Taking care of family

- Being secure

- Having a home

- Having a comfortable retirement

- Having enough money to pursue future options

If you don’t value the things on this list, you may have other priorities that require more money than you may have in the future, or more money than you earn monthly. There are not many people who can buy a home or educate their kids with just their salary, and the alternative, debt, can leave you in a precarious financial position. This is where investing comes in.

In a way, investments and debt are two sides of a coin

When you use debt to, for example, buy a car, you take from your future to pay for your present need. And for this privilege you pay interest on top of the amount you loan.

Investments do the opposite: you withhold money from yourself in the present by investing wisely, aiming to get a greater sum back in the future.

To further illustrate this point, let’s put numbers to it:

Your present self wants to buy a car worth R200 000.

If we suspend disbelief and imagine that you could fly back into the past, which would you choose: would you choose to go back six years and start saving for your car, or would you be happier to take a loan and worry about paying it off over the next six years?

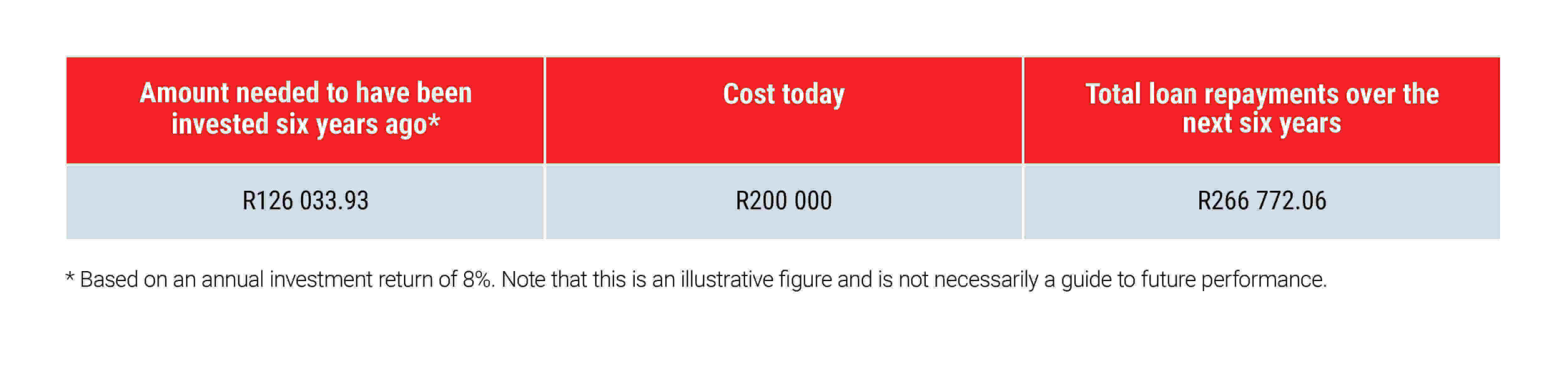

To compare these two options, the table below shows you how much you would have needed to have saved six years ago compared to the cost of repaying the loan over the next six years. This assumes that you pay zero deposit, there is no balloon payment, and you took out the car loan at an interest rate of 10%. We are also ignoring any additional administration fees that the vehicle finance institution may charge you. The assumed rate of return on the savings you would have invested six years ago is 8% per year.

The unfortunate takeaway from this is that we only ever own the present. You have to invest ahead of time to reap the rewards, which means thinking about what you value and setting goals should happen way before the moment when you will need the money. If you value having a comfortable retirement now is the time to start investing for that future, likewise for any other goal.

How much will you need?

A useful next step after identifying the things that you value is to try and place a monetary value to them. Even if it’s a rough estimate it can give you a target to aim for. If you want to save for your children’s education you can inflate current school fees by the rate of education inflation (historically, CPI + 4%) with a simple calculation:

Current High Schools Fees X (1 + Education Inflation)number of years = Future Costs

Once you have numbers for the things that you value, you can work backwards to figure out how much you need to be investing to get there.

Three things to do before you get started on your investing journey

- Ask yourself what you truly value. Answering this question will help you buy into the idea of investing for your future; it will make the activity of investing seem purposeful.

- Take the debt option off the table. Debt is the go-to option for most people who can’t afford to pay for something from their salary. Debt is very expensive. In the third part of our series you will see why investing is the best way to meet your goals in most situations.

- Put a figure to the things you value. Once you have a figure your goals become real. If you find calculations scary, the fifth part of our series will demystify how much you should be investing to meet your goals.

This article forms part of a series that you can access here.

Find this article useful? Please let us know.