When deciding what to do with disposable income, South Africans spend money far more easily than we save. This is reflected in South Africa’s very low savings rate, which has averaged 16% of GDP between 1991 and 2011, according to the South African Savings Institute. We may find it very difficult to put money away for the future, but it is important to take stock of our spending decisions and realise that investing even a small amount each month can make a big difference to your long-term wealth.

The impact of saving

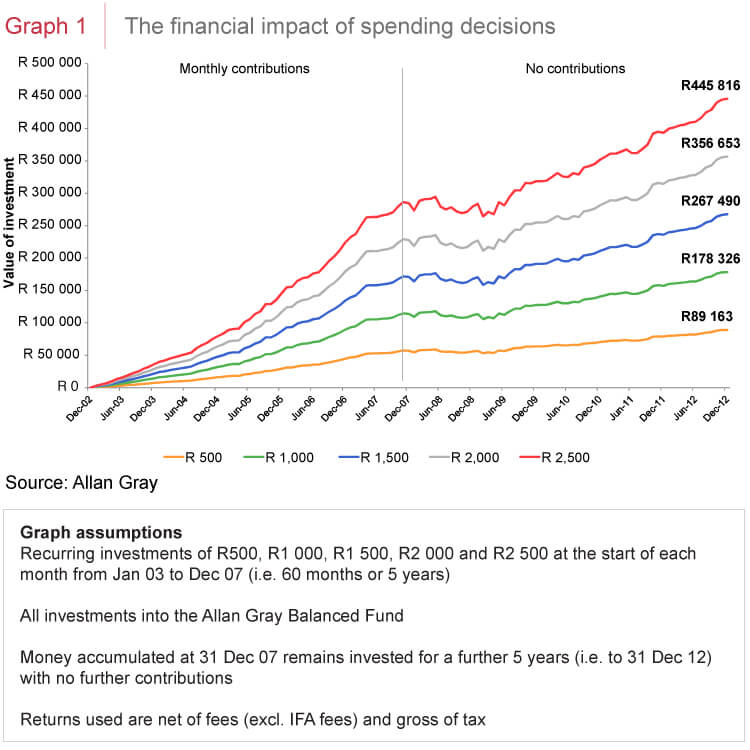

Graph 1 looks at the impact of saving a portion of your disposable income. Each line illustrates a different monthly amount invested in the Allan Gray Balanced Fund for five years and then left to grow for a further five years, making no additional contributions and reinvesting dividends and interest earned. Looking at the orange line, if you had invested R500 a month for five years (R30 000 worth of contributions) your investment would have grown to R89 163 at the end of the 10-year period (the assumptions are listed underneath the graph). While past performance is not always a good indicator of future returns, the example shows the power of compound interest and the benefits of adopting a disciplined, long-term approach.

Changes in behaviour can have a positive impact

Many of us struggle to see how already-stretched budgets can accommodate saving. Consider for a moment not upgrading your vehicle to the latest model. Instead of paying the bank an additional R2 500 per month for your new car, you could invest that amount for five years (total contributions of R150 000) and then take advantage of compounding for the next five years. If you had done this 10 years ago your investment would have grown to R445 816, based on the assumptions used in Graph 1. If you missed out on the opportunity to invest over the last 10 years, of course there is no turning back. However, the good news is if you act now, you probably still have time to make your money work for you.

1. Be disciplined

Put a plan together and stick to it, only changing it if your objectives change. Without a plan you are less likely to achieve your long-term purpose. A plan encourages you to take stock of where you are and to formalise what you are aiming to achieve. Once your plan is in place, you can establish a process to follow that plan.

To achieve your financial goals you need to be disciplined enough to stay the course. More often than not, investors tend to lack the patience to ride out short-term ups and downs. They either dip into the cookie jar when their investment is doing well and withdraw what they have earned, or disinvest as soon as their investment loses value, locking in losses.

Avoid the temptation of taking your money out of an investment earlier than planned, or switching between investments when yours fails to perform as expected in the short term – this behaviour will only delay you in achieving your objectives.

2. Adopt a long-term approach to benefit from compound interest

Often termed ‘the eighth wonder of the world’, compounding can dramatically multiply the value of your investment. Compounding is about making your money work for you. Your investment grows as you earn returns today on the returns you earned yesterday on the returns you earned on the day before, over and above the amounts you contribute. This is especially true if you reinvest any income.

The key ingredients for reaping the rewards of compound interest are time and patience. Unfortunately our emotions tend to get the better of us when investing and sometimes result in us abandoning our initial investment objectives in favour of spending. Refer back to point 1: be disciplined.

3. Understand the value of a good investment manager

It is important to seek a manager who has a long-term track record and whose investment process and philosophy resonate with you. If you understand your manager’s investment philosophy, you should also be able to understand their investment decisions. But investment philosophies are only as good as their application. To judge the merit of an asset manager’s philosophy it is important to assess how they behave relative to their philosophy over a long period of time, through several market cycles.

Make saving a habit. Start saving now and try your best to save as much as you can for as long as you can. Remember, you can’t get back time once you’ve spent it.

If you aren’t comfortable making your own financial decisions, you may wish to speak to an independent financial adviser, who can help you formulate a plan and assist you in sticking to it to achieve your financial goals.

Collective Investment Schemes in Securities (unit trusts) are generally medium- to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Unit trusts are traded at ruling prices and can engage in borrowing and scrip lending. Fluctuations and movements in exchange rates may also cause the value of underlying international investments to go up or down. A schedule of fees, charges and maximum commissions is available on request from the manager. Commission and incentives may be paid and if so, would be included in the overall costs. The Fund may be closed to new investments at any time in order to be managed in accordance with its mandate. Performance figures are from Allan Gray Proprietary Limited and are for lump sum investments with income distributions reinvested. The investment performance above is for illustrative purposes only. It is calculated taking the actual initial fees and all ongoing fees into account for the amount shown. Income is reinvested on the reinvestment date. Allan Gray Unit Trust Management (RF) Proprietary Limited is a member of the Association for Savings & Investment SA (ASISA). Allan Gray Proprietary Limited is an authorised fi nancial services provider.