The end of the year is a good time to review your financial well-being and put some new year’s resolutions in place that aim for better saving and spending habits. At the end of the year you may be lucky enough to get a bonus, so a decision now to take stock and consider investing in your future can have a big impact. Equally, if you don’t stop to consider, the end of the year’s expensive combination of indulgences and duties can overwhelm your finances. With our country’s savings rate sitting at a meagre 1.7% of GDP, according to the Reserve Bank, set yourself apart from the majority of South Africans by committing to saving.

If the thought of managing your finances intimidates you, or if you would like some help in making investment decisions, you may wish to consult with an independent financial adviser. Whatever you do, don’t procrastinate – there is no time like the present to address your financial health.

Look at your spending versus your saving

It can be quite a reality check to look at your spending habits, and a great place to start is to keep a running total of where your money is going in any given month. You may find you are spending too much on items you don’t really need.

With education inflation 4% higher than the average annual inflation rate, and medical inflation currently 3% higher, investing for the future will ease the pressure of these increases on your future monthly budget. Small financial sacrifices today can have a very big impact on your peace of mind and of course on your future wealth, and good habits are easier to stick to than you may think.

Statistics to get you thinking

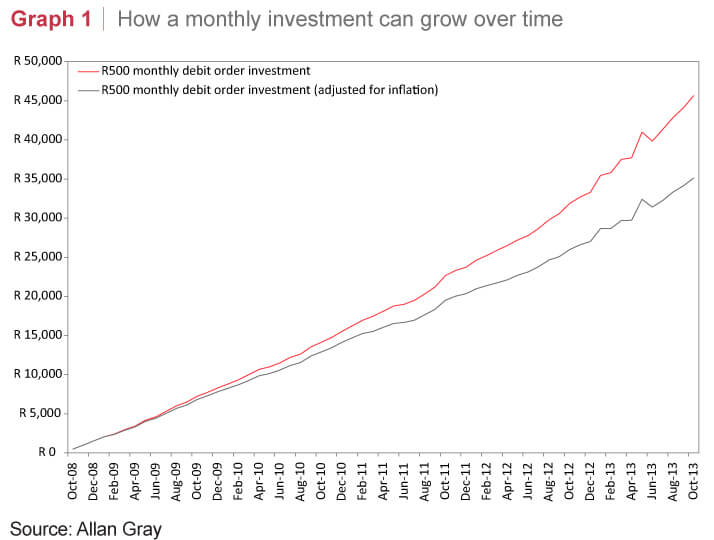

Did you know that it costs more to have a monthly DSTV subscription than most minimum monthly contributions towards a retirement annuity or a unit trust investment? Many financial services companies offer investment minimums of R500 per month, and the sooner you begin putting money aside, the more time will help your money grow through the power of compounding.

Graph 1 shows, for example, how an investment of R500 per month in the Allan Gray Balanced Fund would have grown to more than R45 000 if you started investing five years ago.

If you get a bonus, what should you do?

In the current economy, a bonus, or 13th cheque, is no longer a certainty. If you do receive a bonus, the best tip is to stop and think ahead before you spend it. Bonuses are a savings windfall – they give you a chance to take a big step ahead in your financial plan.

1. Invest for future opportunities and/or unexpected events

It is never clear what will happen next in life. You may stumble across the opportunity of a lifetime and need excess funds to buy into it. You may have health difficulties and need additional cash for hospital bills. Even expected costs like educating your child can be crippling. Building up an investment is important as it gives you options and buffers you against unforeseen elements. If you spend your bonus you forgo this opportunity.

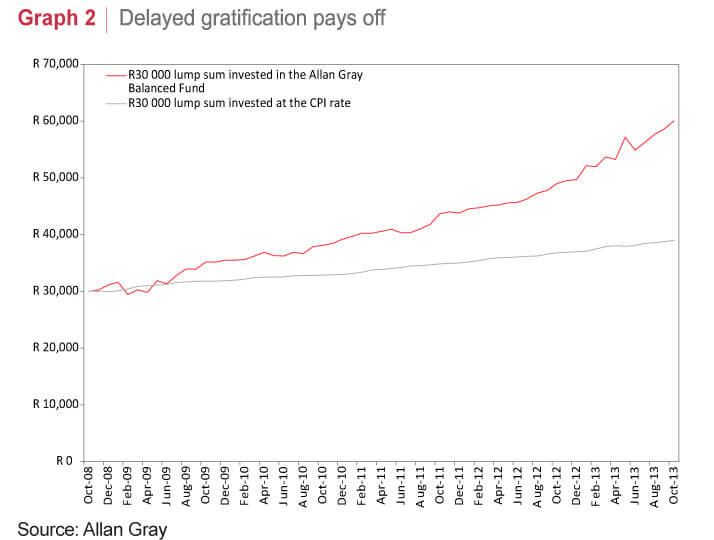

Graph 2 illustrates this point. If you had invested a bonus equivalent to R30 000 in today’s money since 2008 in the Allan Gray Balanced Fund, the investment would currently be worth approximately R60 000. By delaying your spending, you will have more to spend in the future, thanks to investment returns and the benefits of compound interest.

2. Add to your retirement savings

Another wise way to spend a portion of your bonus is by opening a retirement fund investment. To retire comfortably requires planning, discipline and time for your plan to be effective. The government encourages saving for retirement by offering tax incentives if you invest in a registered retirement fund, such as a retirement annuity. Starting early, and making additional contributions when you can afford to, not only increases the amount that can be contributed, it also increases the effect that growth can have on these contributions.

You probably wouldn’t skip your annual health and dental check-ups; your financial check-up is just as critical. Review your financial situation and establish good habits for the years ahead.

Collective Investment Schemes in Securities (unit trusts) are generally medium- to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Unit trusts are traded at ruling prices and can engage in borrowing and scrip lending. Fluctuations and movements in exchange rates may also cause the value of underlying international investments to go up or down. A schedule of fees, charges and maximum commissions is available on request from the manager. Commission and incentives may be paid and if so, would be included in the overall costs. The Fund may be closed to new investments at any time in order to be managed in accordance with its mandate. Performance figures are from Allan Gray Proprietary Limited and are for lump sum investments with income distributions reinvested. The investment performance above is for illustrative purposes only. It is calculated taking the actual initial fees and all ongoing fees into account for the amount shown. Income is reinvested on the reinvestment date. Allan Gray Unit Trust Management (RF) Proprietary Limited is a member of the Association for Savings & Investment SA (ASISA). Allan Gray Proprietary Limited is an authorised financial services provider.