Cyclicality and dispersion in valuations can create great opportunities to buy shares at very attractive prices in companies that are out of favour with the majority of investors. Julian Morrison and Werner du Preez from Allan Gray Australia, discuss how our shared contrarian, valuation-based, long-term investment philosophy allows Allan Gray Australia to exploit opportunities presented in the Australian market.

The price you pay counts

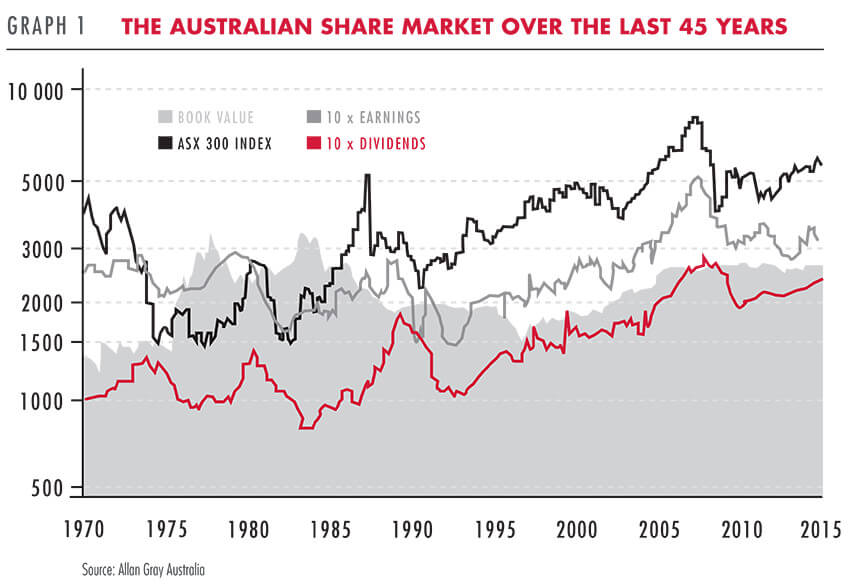

Graph 1 shows the Australian stock market in aggregate. The black line represents the inflation adjusted price level of the ASX 300 Index over the last 45 years. The grey and red lines show company earnings and their dividends respectively (multiplied by 10 to display them on approximately the same scale), with the shaded grey area representing the index book value as a third fundamental measure. The greater the distance between the price and the fundamental measures, the more expensive the market is, and vice versa. The graph includes book value because comparing share prices to earnings or to dividends can be problematic when earnings are at a cyclical high or low. At the 2007 market peak, for example, the price-to-earnings (PE) multiple didn't look excessive on face value, but earnings were well above trend and, looking back, the market was indeed expensive on a normalised basis. (For an explanation on PEs please see Wanita Isaac's piece in Quarterly Commentary 2, 2015.)

In periods such as 2000 or 2007 there was a larger gap between the price line and the valuation of the underlying assets, implying that investors were paying a relatively high price for the index. Where the white space between the measures is a bit more compressed, investors were paying a relatively lower price.

Had you invested in the broad market index 45 years ago, you would have earned very little in price appreciation after inflation. Including dividends, your real return would have been a more reasonable 4.5% per year, although still below the Australian market's long-term average. Investing in the same index only four years later, when share prices were lower, would have yielded an annualised real return of 7.7%. The price you pay matters greatly to your long-term investment outcome. Extreme optimism often presents itself in the form of very high prices, making market peaks a terrible time to buy. In contrast, there were much better buying opportunities during the lows of 1974, 1982, 1991 and 2009, when sentiment was overwhelmingly negative. Poor sentiment often corresponds with better buying opportunities.

Currently, earnings seem to be about in line with the long-term trend. However, the multiple investors are paying for these earnings looks to be full price.

Graph 1 suggests that it is not a particularly appealing time to invest in the Australian market in aggregate right now, but it is important to point out that we don't have to invest in the aggregate. If we can accept that the best times to invest are when sentiment is weak, with bargains more prevalent, we can identify individual companies in selected sectors currently experiencing their own troublesome '1974' or '1991', and are likely to return to more normal conditions over time. This considerably improves our likelihood of paying a low price and earning a better return.

Finding opportunities

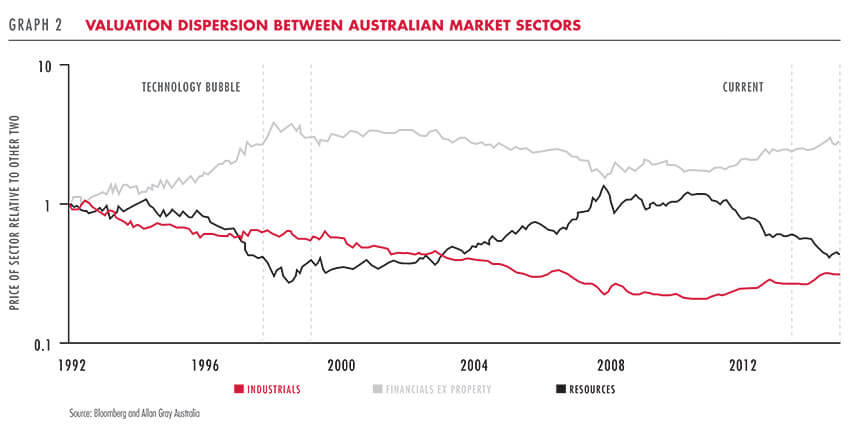

Even though the market on the whole is neither particularly cheap nor expensive, we are finding very good value opportunities in selected segments. When dissecting the broader Australian share market the valuation dispersion between underlying sectors is quite extreme, with a comparable period being the technology bubble of the late 1990s, as indicated in Graph 2. Positioning your investments appropriately may present a significant opportunity for above-average returns for long-term investors. So where is this dispersion greatest and valuations most attractive for contrarian investors like us?

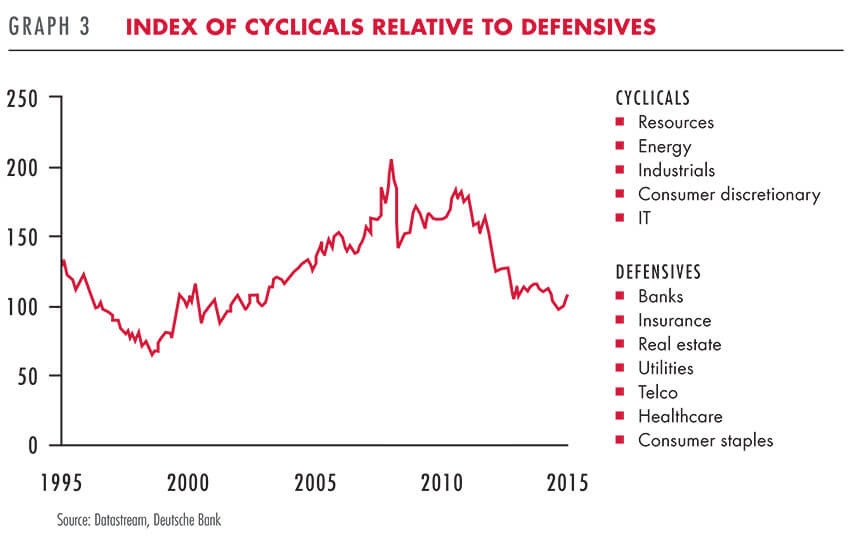

Over the last 10 years healthcare has been Australia's best-performing sector, with returns of 15.7% per year. Investments in the financials, telecommunications, utilities and consumer staples sectors also delivered above-average returns over the past decade. These sectors can be labelled 'defensives' with everything else being the 'cyclicals'. Defensives have benefited from significant tailwinds in recent times, most notably low interest rates driving a ferocious desire for high yields and perceived low risk returns. Graph 3 plots the cyclicals in Australia relative to the defensives and shows the stocks perceived by investors as defensive holdings performing best over the last few years. Companies deemed cyclicals have fallen out of favour substantially – almost halving in price relative to the popular defensives. It should come as no surprise that, as contrarian investors, we are focusing predominantly on the cyclical stocks at the moment.

A few years ago the resources boom was in full swing and the initial public offering (IPO) market was dominated by new listings in mining and energy. The industry was enjoying record profits and incentives were strong to bring on new supply.

It was a good time for those companies, but the high share prices made it a risky time to invest. Today, with sentiment having turned the other way, we may be seeing the build-up of a latent return opportunity in some of the cyclical sectors, with low prices providing a less risky opportunity to buy the shares than in, for example, 2011. Investor behaviour has continued to drive the trend of rising prices with the majority of investors chasing the most popular expensive stocks, bidding them up even further, while unpopular cheap stocks have become more depressed as they are neglected by the crowd. Once defensive stocks become expensive, they are no longer really defensive for investors, because the high price increases the risk of overpaying and therefore of permanent capital loss. Investors who believe that this level of 'trending' (see Graeme Forster's piece in Quarterly Commentary 1, 2015) cannot persist indefinitely, would be prudent to consider seriously the risks of continuing to hold popular shares alongside the crowd at elevated price levels. One may also consider the opportunity for outsized returns by investing in depressed shares.

An active stance against herd mentality

A true active approach is required for investors who want to be positioned away from the crowd in pursuit of outperformance by taking advantage of current valuation divergences. The top 10 share holdings in both the Allan Gray Australia Equity Fund and the ASX 300 Index account for roughly 50% of assets, but it is a vastly different top 10 with hardly any overlap between the two.

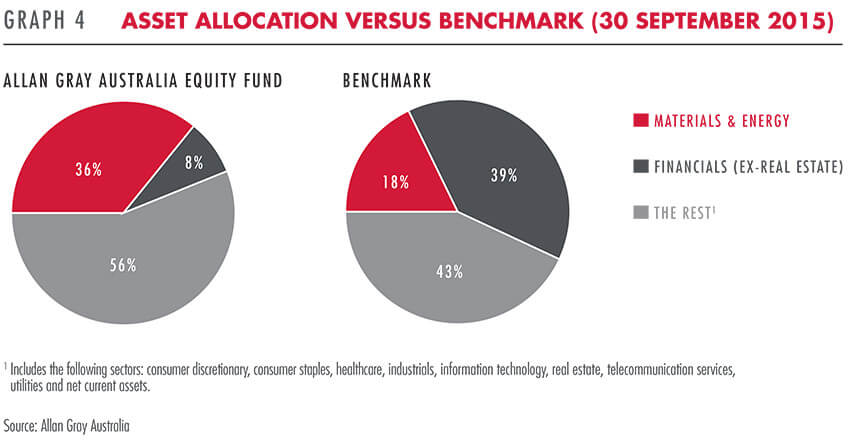

Graph 4 illustrates the differences in sectoral exposure between the Fund and its benchmark. Financials make up a disproportionately large share of the benchmark index with more than 30% concentrated in just the big four banks.

This is an unprecedentedly high level for the banking sector in Australia and in markets globally. These financial stocks look ominously stretched and we are largely avoiding them. Our portfolio is focused in the depressed cyclical stocks, smaller cap companies and the out-of-favour energy sector in an attempt to exploit the valuation dispersions.

We are significantly underweight the financials with overweight positions in selected shares in materials & energy and the rest of the market.

Successful, truly active managers will not outperform consistently every month, quarter or year and periods of pain are a normal part of the investment cycle.

Warren Buffett famously commented that the share market is a mechanism that transfers wealth from the impatient to the patient. Even if you select a better-than-average manager you should expect to experience periods of meaningful underperformance. Investors need patience to sit through such periods and shun the crowd to benefit fully from the outperformance they may deliver over the long term. For those that have the fortitude, active management can add significant long-term value. History has shown this to be particularly important when specific sectors or segments of the market become over-represented within the benchmark index. We believe this is very much the case today.

The Allan Gray Australia Equity Fund and the Allan Gray Opportunity Fund are available via the Allan Gray Offshore Investment Platform and have been approved by the FSB for marketing to South African investors.