Over the years, South African exchange control regulations, which limit the amount that you can transfer or invest abroad, have been relaxed considerably. The Allan Gray Offshore Investment Platform removes many of the barriers to investing offshore, making it easier for you to take advantage of the opportunity to diversify your investment risk and to get exposure to unit trusts and offshore managers not locally available. Julie Campbell explains.

If you are a South African resident individual who is 18 years or older, the South African Reserve Bank (SARB) grants you an allowance of R1 million per calendar year, namely the single discretionary allowance (SDA), to use for any legal purpose offshore. This allowance includes all foreign expenditure, such as monetary gifts, loans, foreign travel expenses, maintenance and offshore credit. You can also use it for investing offshore. Residents are able to use this annual allowance without obtaining prior approval from the South African Revenue Service (SARS) or the SARB. If you have more than R1 million to invest, and are a taxpayer in good standing, you can apply for a tax clearance certificate from SARS to allow you to invest up to an additional R10 million offshore annually. This is called the foreign investment allowance. For amounts higher than R11 million, you will need special clearance from the SARB.

Using our offshore platform allows investors to conveniently invest in a selection of managers and unit trusts according to their investment goals

If you are invested in a local unit trust that invests a portion of its investments offshore, for example a balanced fund, or in a rand-denominated offshore unit trust, this is not counted as part of your offshore allowance. These unit trusts use your investment manager’s foreign allowance rather than your own.

However, locally registered unit trust companies are also limited by exchange control regulation: The SARB currently allows 40% of a fund manager’s retail assets to be invested offshore (plus an additional 10% in Africa outside of South Africa). This is termed a manager’s foreign capacity. Your ability to invest offshore through rand-denominated offshore unit trusts will therefore depend on how much foreign capacity the manager has available.

Given how volatile the rand can be, this route may not always be available. For example, the Allan Gray-Orbis rand-denominated offshore unit trusts are currently closed for discretionary investments as Allan Gray has reached the prescribed limits. We cannot predict when we may have sufficient capacity to reopen, as this depends on offshore compared to local asset performance, movements in the exchange rate, and demand for offshore investments.

What are your options to invest offshore using your own allowance?

There are two routes available to you:

- Invest directly with offshore fund managers of your choice.

- Invest with your preferred offshore fund managers via an investment platform which offers offshore unit trusts, such as that offered by Allan Gray.

Many investors find the large selection of unit trusts available globally intimidating. It is hard enough to know how to pick from around 1 500 unit trusts locally; investing offshore may require you to select from thousands more, depending on which markets you are trying to access. In addition, the process to invest directly with a selection of offshore managers can be administratively intensive as different jurisdictions may have different requirements governing how individual investors access funds regulated in their market. Furthermore, offshore fund managers often have higher minimum investment requirements than offshore investment platforms, as platforms can take advantage of the fact that they aggregate multiple underlying clients’ assets to allow for lower minimums.

If instead of investing directly you would like convenient access to a range of unit trusts with one point of contact for the administration and ongoing management of your investments, using an offshore investment platform may work for you.

Understanding the Allan Gray Offshore Investment Platform

The Allan Gray Offshore Investment Platform offers a smaller, preselected list of approximately 50 foreign currency unit trusts managed by offshore investment managers, including those managed by our offshore partner, Orbis. We believe that a limited selection of unit trusts designed to meet most long-term investment needs makes it easier for investors to do their research and make well-considered decisions. Using our offshore platform allows investors to conveniently invest in a selection of managers and unit trusts according to their investment goals. You can transact online and access consolidated reporting on your investments through our secure website.

We believe that a limited selection of unit trusts designed to meet most long-term investment needs makes it easier for investors to … make well-considered decisions

We only offer unit trusts that are registered with the local regulator, and meet our minimum size requirements (for liquidity reasons). Each unit trust is rated by independent financial services group Fundhouse. Fundhouse is an international company that conducts detailed independent research and due diligences of these offshore managers. The rating provides investors with some measure of the quality of the unit trust, its investment team and the management company.

Our platform is domiciled and regulated in South Africa, giving you a local point of contact. As part of South African regulation, your assets are held in the name of a nominee company (Allan Gray Nominees), meaning your money is separate and protected if Allan Gray ever runs into financial trouble.

Being locally domiciled simplifies estate planning for South African tax residents: If you die while invested, your assets will be part of your South African estate and dealt with by a local executor. However, the downside of the platform being locally domiciled is that it may be impacted by changes in South African exchange control regulation.

Notwithstanding this, your investment is in foreign currency, in a unit trust managed by an offshore manager. If you wish to withdraw money, the proceeds can be transferred to an offshore bank account, provided the account is registered in your name. If you do not have an offshore bank account, proceeds in foreign currency can be transferred to your local bank account, and your bank will do the rand conversion.

If you are a South African resident individual using a portion of your R1 million discretionary allowance, Allan Gray can facilitate the conversion of your rands into the currency of the unit trust(s) that you want to invest in (see “How to invest offshore using rands”). If you wish to invest more than your SDA, we have also negotiated with an independent foreign exchange provider who can assist you with applying for tax clearance certificates, currency conversion and transferring foreign currency into our offshore bank accounts.

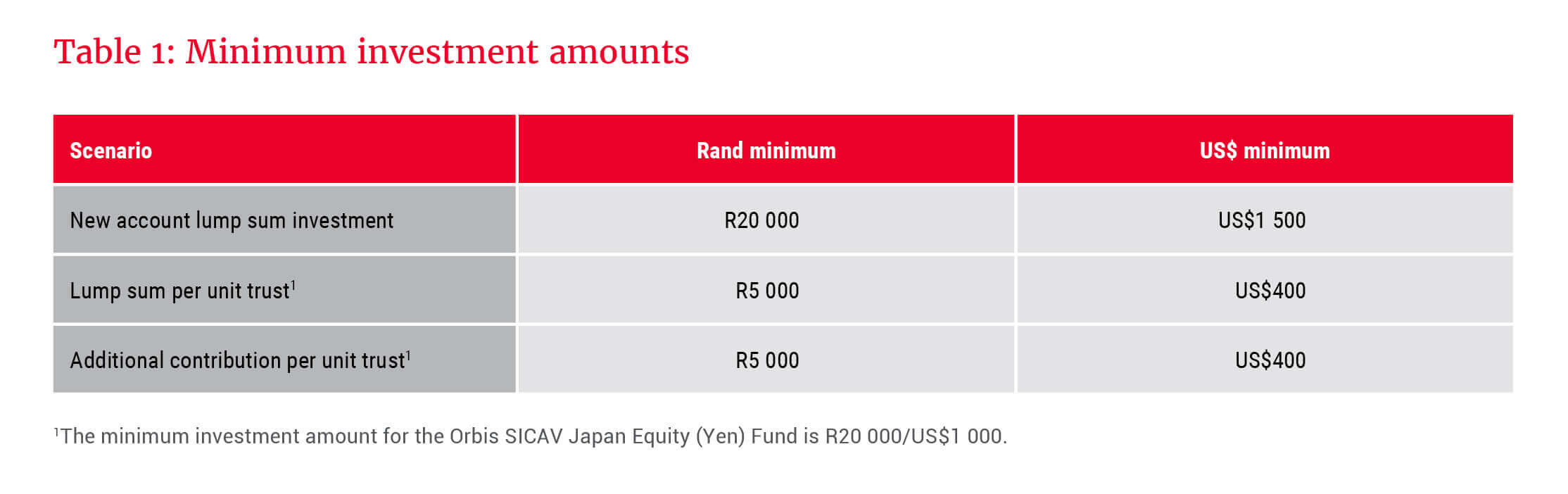

There are investment minimums that apply to our offshore platform. These are shown in Table 1.

Tax considerations

It is important to be aware that direct offshore investments are taxed differently for capital gains tax purposes from local rand-denominated unit trusts. When you withdraw from a rand-denominated unit trust, you pay tax on all gains on your original rand investment, regardless of whether those gains are from capital growth or currency movement.

If you withdraw from a foreign currency unit trust, you don’t pay tax on currency movement while you are invested. When you sell assets bought in a foreign currency, we first calculate the foreign capital gain or loss and then translate it into rands using the exchange rate at the date of sale.

This means that if the rand weakens, it is more tax-efficient to be invested in a foreign currency unit trust, while if the rand strengthens, it is more tax-efficient to be invested in a rand-denominated unit trust.

How to invest offshore using rands

As part of our ongoing effort to make it easier to invest offshore via our offshore platform, we have recently introduced the option for you to use South African rands for lump sum investments in new and existing offshore accounts, and Allan Gray will facilitate the conversion to foreign currency. The following applies:

- You do not need to get a tax clearance certificate.

- You will need to sign a declaration confirming that you are a South African resident, and have not exceeded your allowance for the year.

- We will facilitate currency conversions through an authorised dealer at a preferentially negotiated markup. Since the rands you deposit into our bank account will be converted daily at a predetermined time, you will not be informed of the exchange rate prior to the conversion. The foreign currency amount will reflect on the instruction confirmation we send you once your investment is finalised.

- Conversions for daily traded funds will typically take place the business day after all the requirements have been met to process your transaction. Conversions for weekly traded funds, such as Orbis’s, will take place the business day prior to the fund trade date.

- The exchange rate will include the authorised dealer’s markup, and you will not be charged any additional administration fee for the conversion.

If you would like to use this option, follow these five easy steps:

- Download the application form.

- Complete the form and choose your unit trusts.

- Sign the SDA declaration (Section 6) and investor declaration (Section 10).

- Deposit your money into the bank account reflected on the form.

- Send your signed form, proof of payment and supporting documents to instructions@allangray.co.za.

If you prefer to arrange your own currency conversion, you can still do so by approaching your bank or an independent forex provider, and then submitting a foreign currency instruction to Allan Gray. It should be noted that you cannot invest in foreign currency offshore unit trusts via the Allan Gray Endowment, Living Annuity, Retirement Annuity or Preservation Fund.

Use an independent financial adviser if you need guidance

While we are progressively making investing via our offshore platform as easy for you as investing via our local platform, we don’t offer financial advice. It is a good idea to consult an independent financial adviser who can help you determine the appropriate level of offshore exposure to meet your long-term investment goals, and help you select an offshore unit trust that is appropriate for your needs and circumstances.