In his annual President’s letter, Adam R. Karr, from our offshore partner, Orbis, reviews the strong performance of the Orbis portfolios over the past 12 months, reflects on how this raises the bar for the future and discusses why adaptability remains essential for future success.

Last year, I wrote that adaptability feels more essential than ever. It feels even truer today. Change across markets, geopolitics and technology has not slowed; it has accelerated. Against that backdrop, 2025 was an exceptional year for Orbis clients. On a firm asset-weighted basis, client capital appreciated 37.1%. The Orbis funds collectively outperformed their benchmarks by 12.4% net of fees and rank among the best in their respective peer groups. What matters most to me, though, is the human side. Behind every basis point is a person: a retirement, a family, a future.

Performance in a year often reflects decisions made in prior years. We are now seeing the payoff from work we have done since 2022 to strengthen our investment process and improve how we serve you. It took a phenomenal team effort across investments, client service, operations and technology.

Our edge is not that we can predict what happens next. It is that we can adapt and do so without changing our principles. Our philosophy and core values remain constant.

I am proud of what we achieved and mindful of how quickly markets can humble us. A great year never reduces the need for great work. It raises the bar for what we do next.

Looking back: Performance

We are an active, value-oriented manager. Our goal is to own good businesses at meaningful discounts to what we think they are worth, even when that means looking very different from the index. That willingness to be out of step is uncomfortable, but it is a prerequisite for compounding over a full market cycle.

In 2025, we delivered excellent results (all figures are net of fees):

- Global Balanced: 40% return; +22% vs. benchmark

- Emerging Markets: 51% return; +13% vs. benchmark

- International: 50% return; +13% vs. benchmark

- Global Equity: 38% return; +12% vs. benchmark

- Japan: 34% return; +7% vs. benchmark

Clients have asked why results were so strong. Part of the answer is that several long-held positioning choices moved from headwind to tailwind: value stocks outside the US; an overweight in emerging markets; and an underweight the US dollar. More importantly, stock selection added meaningfully. Since early 2022, we have strengthened the team, sharpened our research process and invested in our decision-making tools. That work showed up in returns.

One year is only a chapter. What matters is our ability to compound over time. Over the past three and five years, client capital grew at an annualised rate of 21.6% and 12.5% on a firm asset-weighted basis. Over the same periods, we delivered annualised net relative returns of 3.2% and 3.0%.

The power of ants

To bring our team’s work to life, I will share a story from a talk in South Africa last year at a conference hosted by our sister company, Allan Gray Proprietary Limited. I opened with an analogy that surprised some: ants.

It may sound like an odd comparison. But there is a lot investors can learn from ants, because they have endured for millions of years by adapting.

E.O. Wilson, one of the world’s great evolutionary biologists, called ants “the little things that run the world”. In The Superorganism, Wilson and Bert Hölldobler describe how insect societies can function like a single organism: thousands of individuals coordinating through division of labour and communication so that the colony behaves as one coherent system – a superorganism.

That lens is useful for investors because it raises questions like:

- What does it take for a system to endure?

- How do dispersed efforts become coherent, compounding results?

Ants offer three simple lessons: resilience, adaptability and long-term orientation.

A colony is not built around a single point of failure; it absorbs shocks and keeps functioning. When the environment shifts, ants adjust. They do not waste energy insisting yesterday’s map still applies; they invest in sensing and response. And they think in seasons, not days. Ants are an extreme example of compounding over time. Their “design” assumes change and endures through it.

Orbis as a superorganism

At Orbis, our ambition is to operate as a superorganism: a team and culture that synthesise thousands of individual judgments into one coherent outcome (the results we deliver for clients).

Like an ant colony, our strength is distributed. We have 40+ equity research analysts globally, backed by 10+ colleagues in our quant, risk and decision-analytics teams. There is no single “star” that makes Orbis work; it relies on a rigorous, repeatable framework.

Since reshaping parts of our process in 2022, the average performance of the team’s recommendations has been about 19% per annum.

We push decision-making to where the expertise lives, closest to the information. Analysts originate, test and refine ideas. Portfolio managers then synthesise those insights, ensuring the best ideas shine through.

Communication is the glue. In an ant colony, the glue is pheromones. At Orbis, it is rigorous debate, shared research, proprietary tools and a culture that prizes independent thinking. This is how we translate bottom-up work into a unified set of investments with risk awareness.

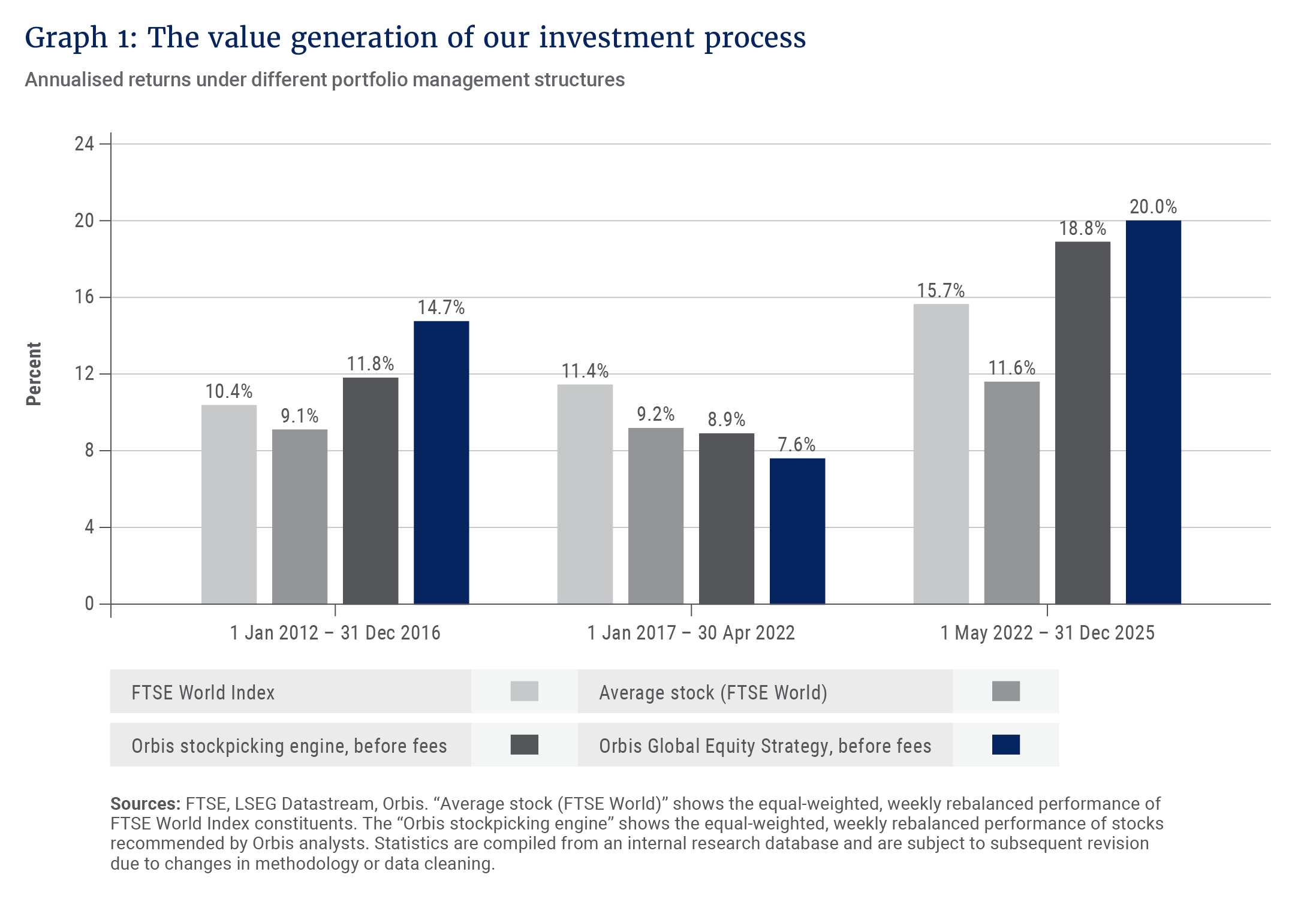

The clearest expression of that system has been the strength of our stockpicking engine: the analysts putting forward their highest-conviction recommendations. Since reshaping parts of our process in 2022, the average performance of the team’s recommendations has been about 19% per annum. That compares to less than 12% for the average stock in the FTSE World Index, and nearly 16% for its capitalisation-weighted return. These are recommendations, not live portfolios, but they reflect the opportunity set our process is generating, as shown in Graph 1.

For those managing client capital at Orbis, this engine has been a genuine differentiator: a pipeline of high-conviction ideas from which to build portfolios. In our Global Equity Strategy, for example, we have been moving capital with velocity to the most compelling opportunities as they emerge – exactly the outcomes we set out to enable a few years ago. Tip of the hat to my co-managers in our Global Equity Strategy, Ben Preston and Graeme Forster; they have been exceptional.

Stepping back, my goal as president is straightforward: select great people, match them to roles that play to their superpowers, and create conditions for them to do their best work. That means high standards, clarity of roles, excellent tools, candid feedback and protected focus. It also means humility. Markets evolve, competitors adapt, and we will keep learning, refining and improving.

Adaptability in the portfolio

Ant colonies manage a simple trade-off: exploit versus explore.

When conditions are stable, colonies exploit; they optimise what is working. When they sense disruption, they explore – sending more foragers outward to map what has changed, find new resources and identify threats. Exploration rises with uncertainty; exploitation dominates in stability.

Today, we are exploring more.

Shifting geopolitics, changing trade regimes, rapid technological adoption and extreme index concentration are reshaping the world. In periods like this, adapting matters.

Our edge is not that we can predict what happens next. It is that we can adapt and do so without changing our principles. Our philosophy and core values remain constant.

In practice, that means we are doing what you hired us to do. We are looking for businesses that have been overlooked, misunderstood, or left behind by crowded narratives. We are backing management teams and cultures that adapt as technology and incentives shift.

And we are insisting on resilience: a margin of safety that does not depend on a single perfect scenario.

Many clients have asked us if there is still upside left, both absolute and relative. The honest answer is that we do not know. Markets rarely move in a straight line. When things are uncertain, the best response is the same one that ants take: explore.

Our research pipeline is strong, and I’m energised by what the team is finding. They search where enthusiasm is low and misunderstanding is high, and they have been returning to the colony full of ideas. I am equally confident in the repeatable process and tools we’ve built to synthesise those ideas into our portfolios.

An example: Healthcare

Healthcare is an illustration of what exploration looks like in practice.

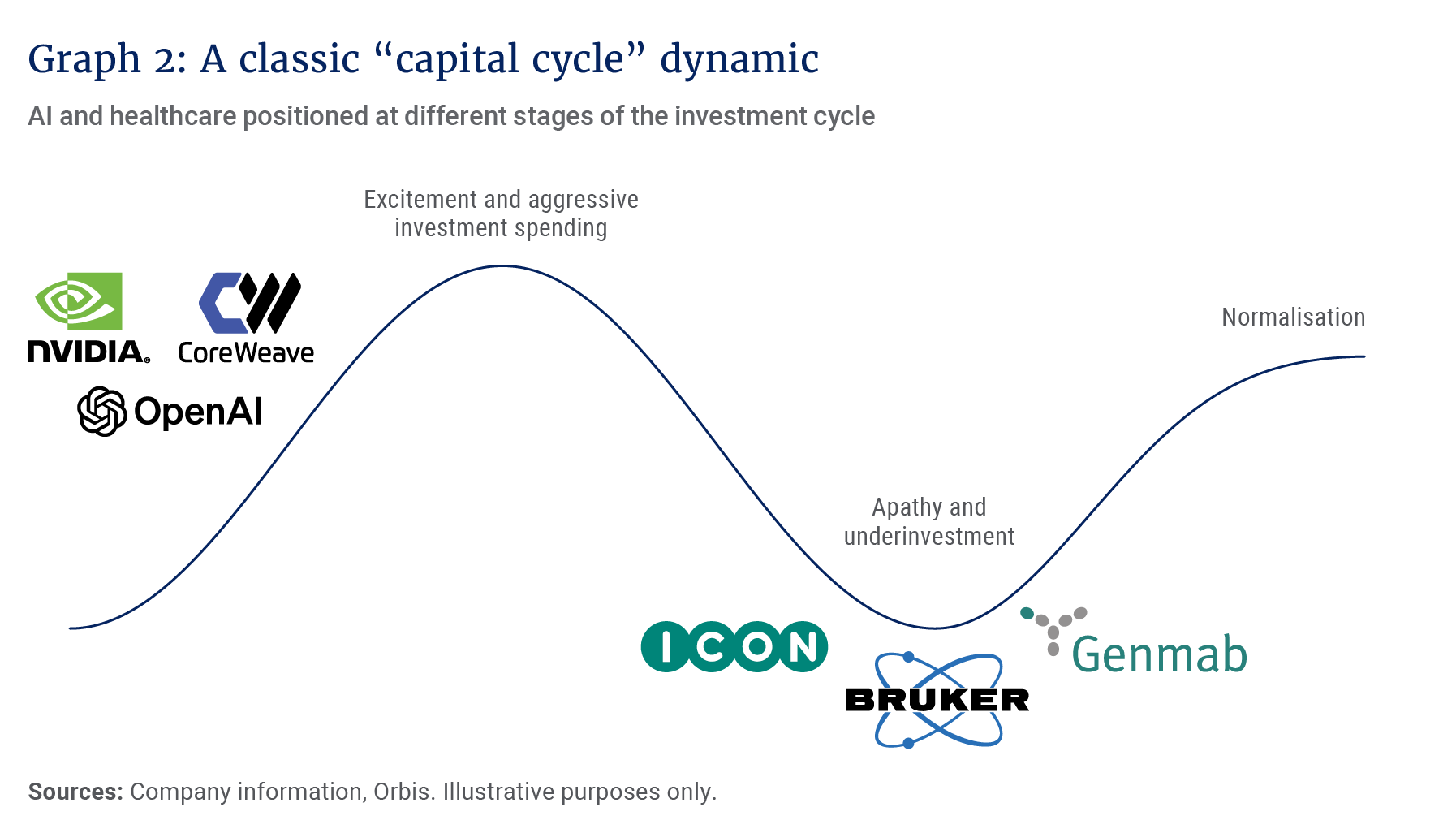

Over the past few years, investor enthusiasm and capital have flowed disproportionately toward anything AI-related, as illustrated in Graph 2. As with prior cycles (PCs, the internet, mobile, the cloud), it has driven extraordinary innovation and, at times, extreme pockets of speculation.

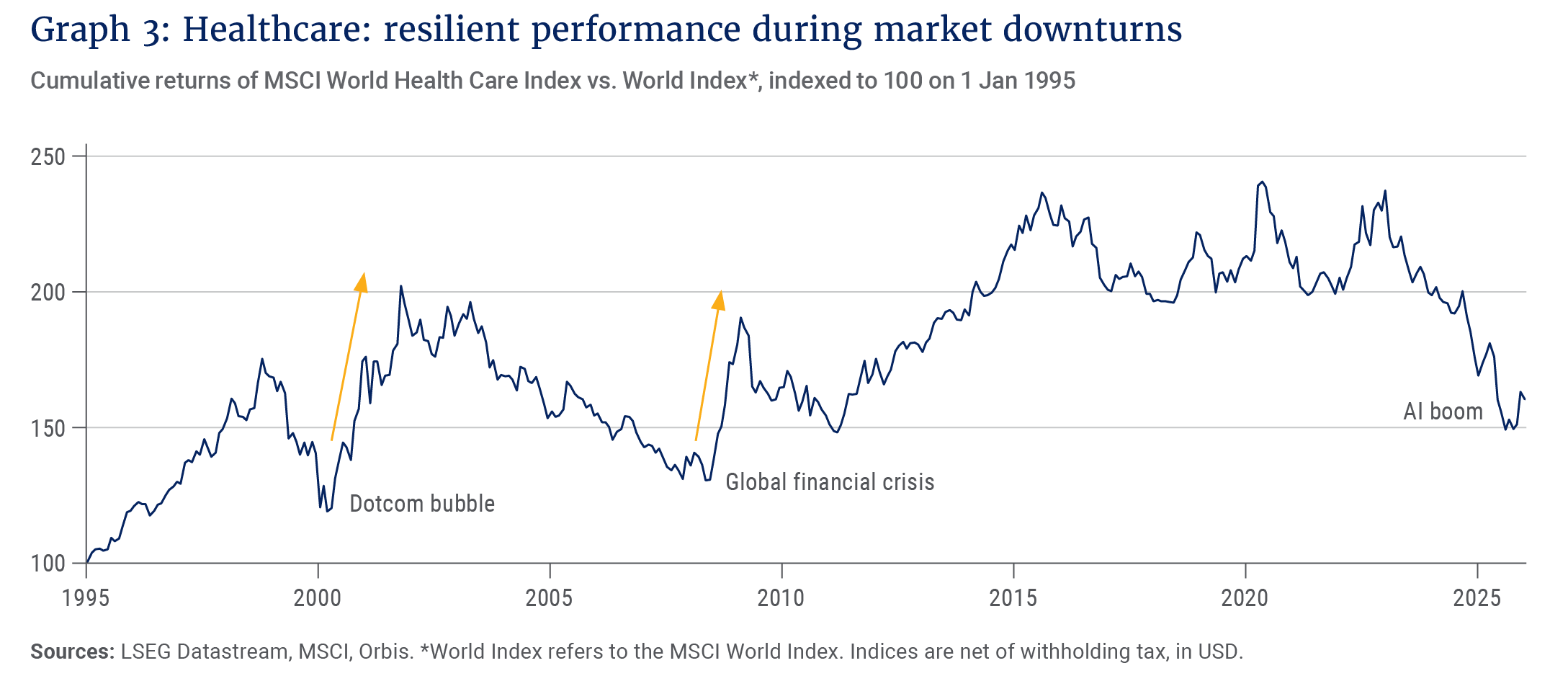

That matters because the indices do not look cheap, and when leadership becomes narrow and crowded, markets can become fragile. In that environment, defensive characteristics and company-specific drivers matter more, especially when enthusiasm wavers.

Until recently, investors had left healthcare behind – see Graph 3 below. Yet outcomes in the sector often hinge on idiosyncratic factors (research productivity, clinical data, regulatory approvals, execution and capital allocation) that reward rigorous fundamental work. That is in our wheelhouse, and we see compelling opportunities in select companies like Genmab, Bruker and ICON.

Pulling it all together

Markets rewarded investors again in 2025, but the backdrop is complicated. Valuations are stretched, and index concentration is near historic extremes.

In contrast, we offer something different: a portfolio of durable cash flows, bought at sensible prices, diversified across regions and currencies, and built to adapt. Our first job is not to chase what is working; it is to protect your capital from permanent loss. That is resilience you can own.

That is why we anchor our work on intrinsic value, interrogate risk from multiple angles and focus on management teams that have shown the ability to adapt.

Ultimately, equity returns are delivered by people – by how effectively organisations convert talent into output over time. I loved Adrian Courtenay’s The Super Organisation Secret, which reinforced something we believe: cultures that align around a clear mission, clarify roles and enable high-quality decision-making tend to compound their advantages.

That is true for Orbis, and it is true for many of the businesses we want to own. We are seeking to build a superorganism at Orbis: adaptable, resilient and long-term. We also seek to invest in companies led by individuals who convert dispersed effort into coherent, compounding value creation. I see that first-hand in leaders such as Brad Jacobs (QXO), Ron Clarke (Corpay) and Kristo Käärmann (Wise).

Time as our friend

Ants endure because they adapt over time. Compounding rewards the same behaviour.

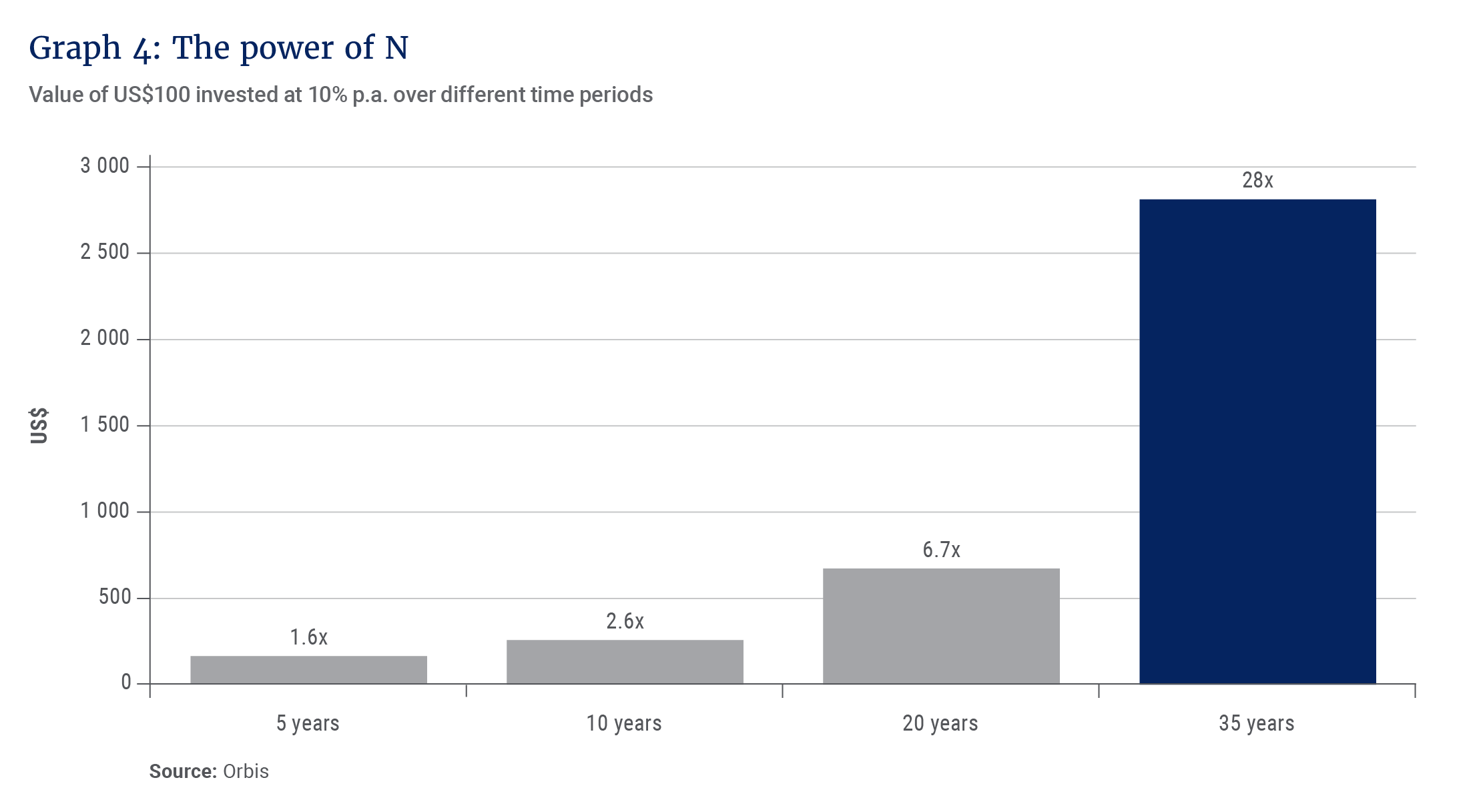

I often talk about the “power of N”: the number of years you give a good decision to work.

Client Wealth = Invested Capital x (1 + R)N

We work relentlessly to maximise R – the return you earn – while managing risk. But N is different. N is time, and it is powerful. It is also in your hands: the choice to remain invested and allow compounding to work through the inevitable noise along the way.

When N is long, small edges can be massive over time. That is why we care about durability and continuity: in our process, in our team, and in the businesses we own. Our goal is simple: to give your capital the best chance to compound over many years, as shown in Graph 4.

We ask you to judge us over full cycles, including the difficult years. The only performance that matters is the kind you can stay invested through, and that requires not just returns, but resilience.

Gratitude and commitment

2025 was a special year. It was also the product of thousands of unglamorous efforts: bottom-up research, debate, risk review, operational excellence, technology investment and client partnership, all done well.

Thank you for your trust. Darren Johnston (our chief operating officer) and I, along with the entire Orbis team, don’t take responsibility lightly. Trust compounds the same way returns do: through small, consistent actions over time. We will show up with humility, adaptability, and a long-term mindset; working every day to keep earning it.

As I close, I want to reaffirm my commitment to you:

Our firm’s success begins and ends with delivering best-in-class investment performance. As it was on day one, I am certain that what we aspire to achieve will not be easy. But how we show up is in our control and we are determined to deliver. Here is my commitment to you:

- relentless focus;

- transparent and direct engagement;

- entrusting others;

- a culture of inclusion;

- the courage to be different;

- an appetite for feedback;

- and a willingness to change what isn’t working.

Thank you for entrusting us. With your support, we will keep N (time) working in your favour.

Explore more insights from our Q4 2025 Quarterly Commentary

- 2025 Q4 Comments from the Chief Operating Officer by Mahesh Cooper

- Tipping point or false dawn? South Africa’s defining question by Raine Adams

- AB InBev: Catching up over a beer by Jithen Pillay

- The long-term benefits of maximising your retirement fund contributions by Carla Rossouw

- The compounding power of micro wins by Thandi Skade

To view our latest Quarterly Commentary or browse previous editions, click here.