Rob Perrone, from our offshore partner Orbis, discusses why exchange rates are a big deal, and how Orbis actively manages currency exposure in it funds.

If you buy a stock in your local market, assessing your performance is easy. If the price has gone up, you’ve made money. If you buy stocks in other markets, however, it’s not so simple. You have to consider exchange rates.

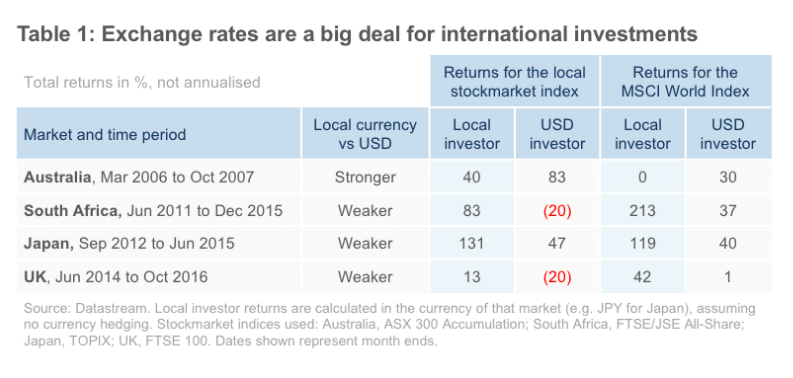

Exchange rates have a profound effect on the returns of international investments, because when you buy a stock in a foreign market, you also have to buy that market’s currency. Say you live in the UK and purchase a US stock. When you buy the stock, one pound is worth US$1.40. Over your holding period, the dollar might “strengthen” versus the pound, so that it only costs US$1.20 to get one pound back. Or the dollar could “weaken”, so that it costs a full US$1.60 for each pound. While you hold the US stock, a strengthening dollar will boost your purchasing power, and a weakening dollar will impair it. Over our history, we have seen several real-world examples of currency’s impact, as show in Table 1.

In the year or so before the global financial crisis, the MSCI World Index delivered a robust 30% return in US dollars — but strength in the Australian dollar completely erased that gain for investors based in Australia. On the other hand, a foreign investor in the Australian market would have been thrilled with their 83% US dollar return.

The reverse was true of the South African market from 2011 through 2015. In local terms, stocks were up 83%, but rand weakness more than offset this increase, leaving foreign investors with a 20% loss in US dollars. South African investors in the World Index had a much more pleasant experience. The pattern is similar for Japan in the “Abenomics” rally and for the UK in the period around Brexit. In both cases, as the local currency weakened, it diminished the returns of foreign investors in that market, while boosting the returns of locals investing elsewhere.

Exchange rates are a big deal, and currency exposures are unavoidable in international portfolios. Given this, we actively manage currency exposures in the multi-country Orbis Funds. In our view, we have to.

How we approach currency management

When we select securities, we aim to avoid a permanent loss of capital, and we believe the best way to do that is to avoid overpaying for assets. We take the same approach in currency management. But how can we judge whether a currency is cheap or expensive?

We assess currencies in two steps. The first is to look at purchasing power parity (PPP), which suggests fair “parity” levels for exchange rates by looking at consumer prices. If a basket of goods costs GBP100 in the UK and US$150 in the US, PPP would suggest a fair exchange rate of GBP1 = US$1.50. This measure provides us with a useful starting point to gauge whether a currency is cheap.

But it is only the start of our analysis—to judge whether the assessment makes sense, we also conduct qualitative research. Like other assets, a currency’s price is set by supply and demand, so we try to form a picture of all the buyers and sellers of that currency today. Then we explore how that group of buyers and sellers might change over time. Are people selling today for a reason that could prove temporary? Is the country laying the groundwork for something that could attract more buyers in the future? If we believe there will be many more sellers of a currency in the future, we might regard it as a poor store of purchasing power. In such cases, we may look to hedge the exposure.

The role of currency hedging

We hedge currency exposures by selling one currency “forward” in favour of another. Let’s return to the UK investor in a US stock. To hedge their US dollar exposure, they could agree to exchange some dollars for some pounds at a set date in the future at a pre-agreed rate. If the agreed rate is US$1.40 for one pound, and the dollar weakens, the investor’s US stock will be worth less in pounds, but this will be offset by gains on the currency contract. By hedging this way, we can usually consider the Funds’ currency exposures separately from our decisions about which stocks to buy. This lets our company analysts focus on identifying attractive securities.

In most of our Funds, our currency decisions have modestly contributed to relative returns. That is positive, but it is not the primary reason we employ hedging. We view currency hedging largely as an exercise in risk management. If we can limit exposure to expensive currencies, we can reduce the Funds’ risk of a permanent capital loss — while letting our bottom-up security selections drive attractive long-term returns.