South African companies are reallocating billions of rands towards the extraordinary costs associated with loadshedding, whether it be via diesel-run power expenses, ongoing generator maintenance, or lost business hours. Invariably, part of these expenses is absorbed through the narrowing of corporate profit margins, which will ultimately bleed into lower tax revenue generation, and a portion is passed along to the consumer in the form of higher prices for goods and services, which is already being seen in South Africa’s elevated inflationary prints. Government’s prospects for debt stabilisation and the growth outlook are at risk until such time as energy reform can bear fruit. Thalia Petousis discusses.

“An electrified Africa will increase production output, increase economic health, diminish debt and lead to a growing sense of self-worth. We are committed to illuminating this proverbial dark continent and to integrating it into the global economy as a participant worthy of unconditional respect.” – Eskom Annual Report 1998

To read extracts from Eskom’s annual report penned a quarter of a century ago is both significant and poignant. It highlights the optimism that was felt during the “Africa Rising” era of the early 2000s, when rapid economic growth was being experienced, and both rising incomes and the emergence of a robust new middle class were greatly anticipated. Under this hopeful narrative, the illumination of South Africa and the continent was a foregone conclusion.

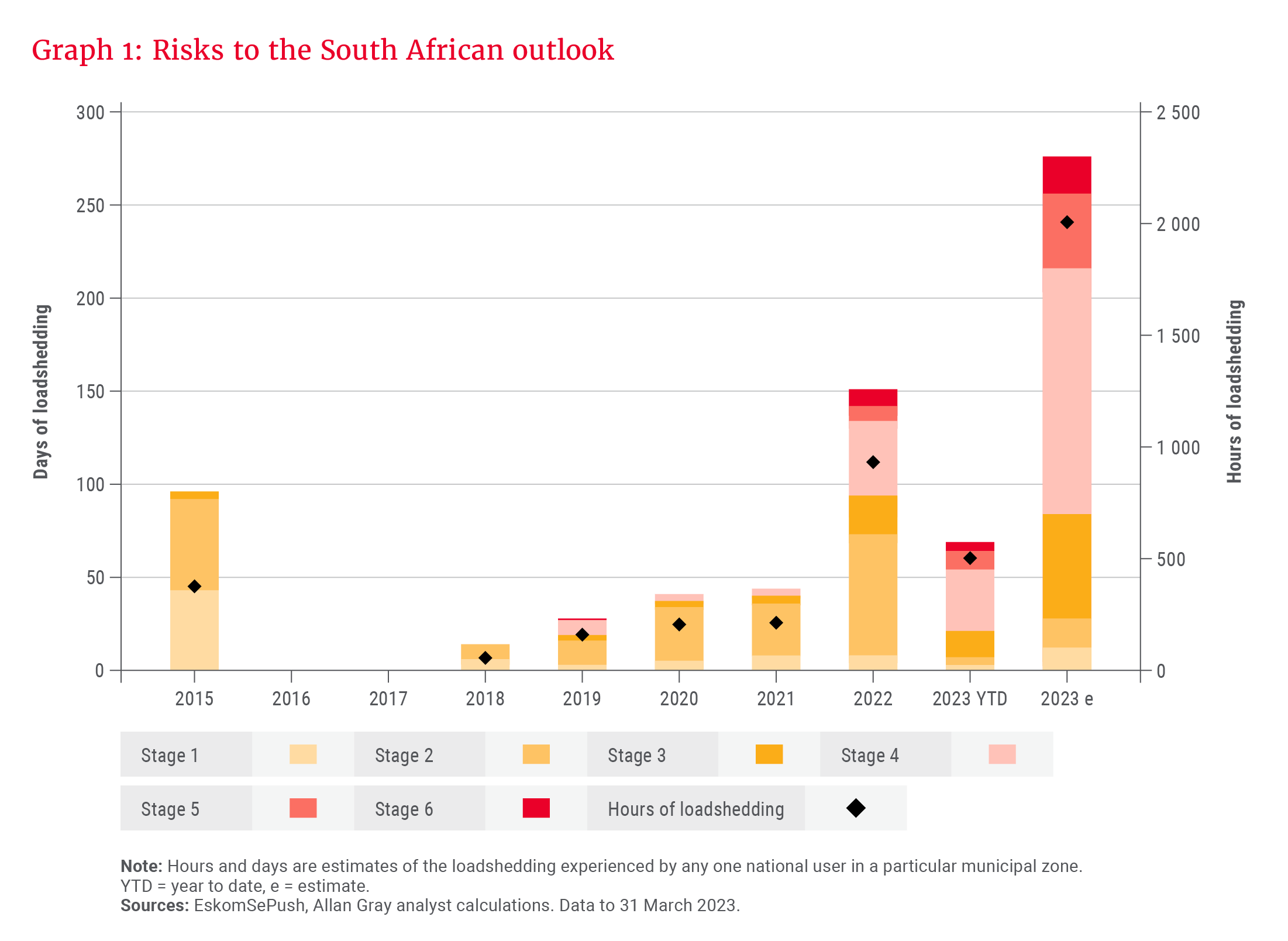

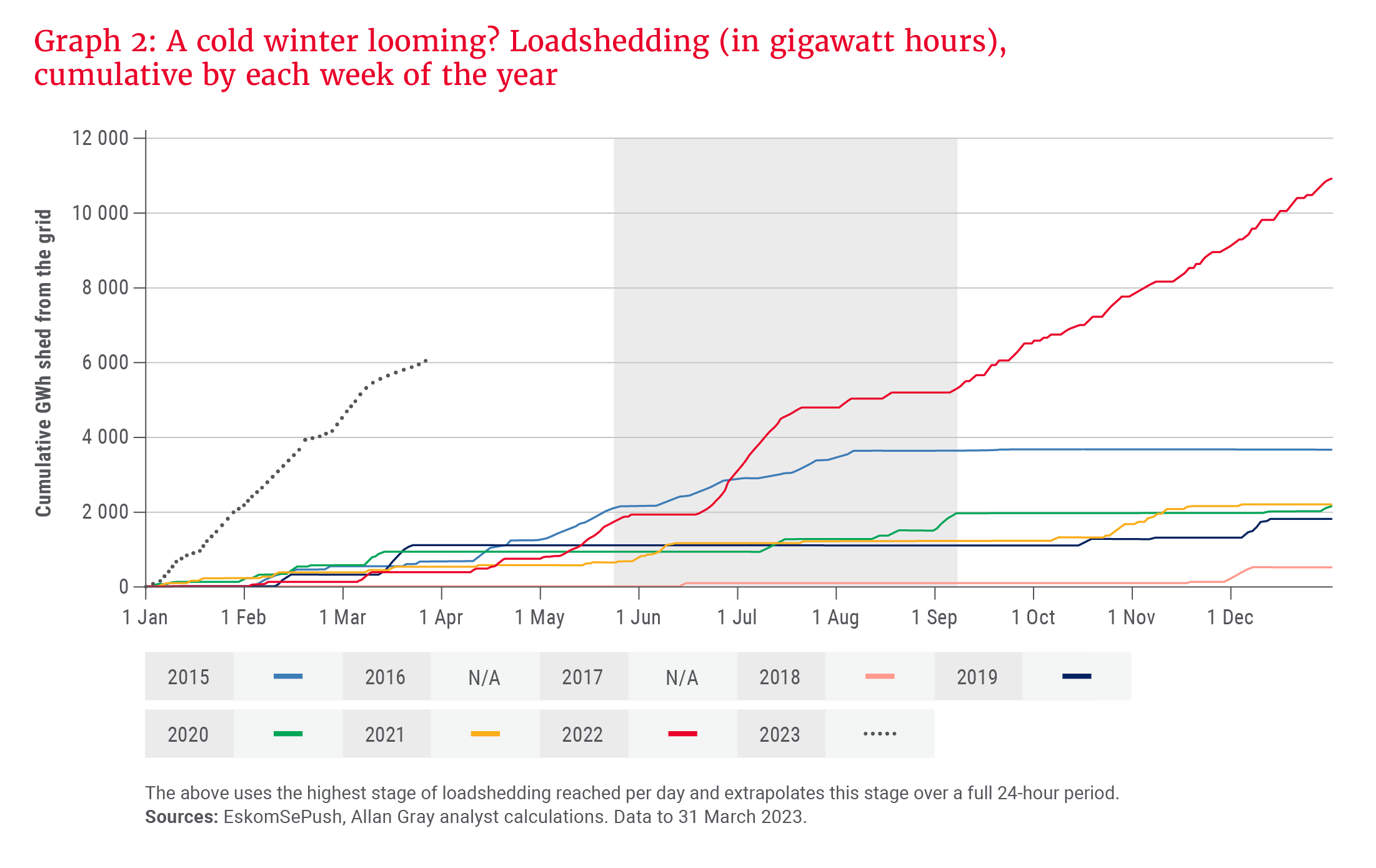

Fast-forward to the present and the outcome could not be more stark: South Africans were hit by record levels of loadshedding in 2022 in terms of days, stages, and number of hours, as shown in Graph 1. When looking at the data in terms of cumulative gigawatt hours (GWh) shed from the grid per week, 2023 is setting a new record, as seen in Graph 2 – and the outlook for the remainder of the year appears bleak. Data from prior years in Graph 2 suggests that the winter months see a spike in consumer demand for electricity and heightened stages of loadshedding, despite Eskom’s attempts to bring back into service additional generation units during this period.

What went wrong with South Africa’s energy availability since the so-called “golden renaissance” of the early 2000s?

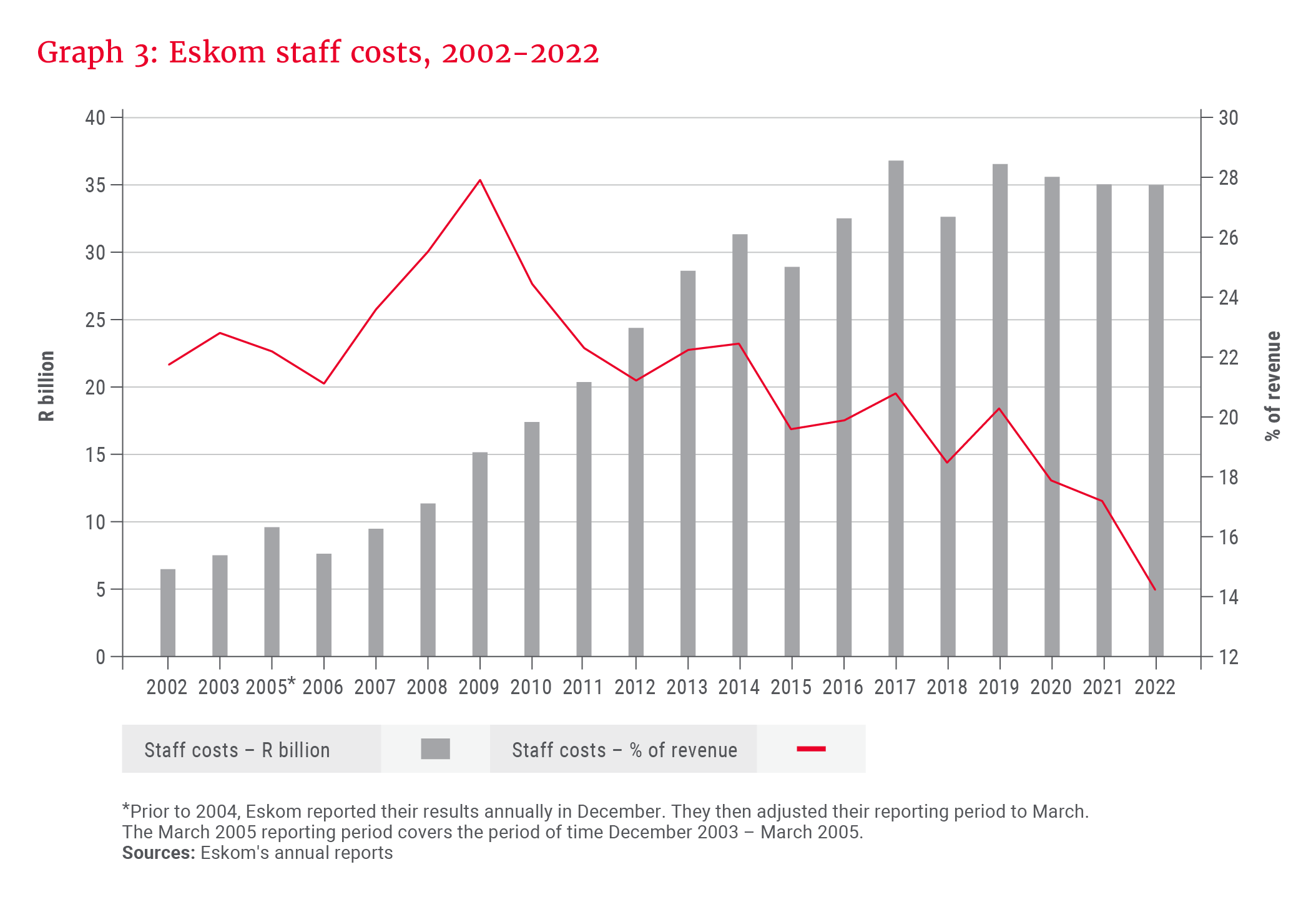

Various narratives have woven their way through popular discourse, although some are perhaps less useful than others. The argument that Eskom’s bloated employee costs have contributed to the utility’s loss of profitability is less persuasive when one considers that the R35bn spent on staff in 2022 was at a 20-year low when expressed as a percentage of revenue, as seen in Graph 3.

Important to consider, however, is that while the number of employees has only grown by 1% per year over that 20-year period, the average salary per employee has grown by an almost 9% compound growth rate per year – well in excess of average inflation of 5.6%. If Eskom were paying up for key technical and engineering skills, this may be duly warranted, but it is unclear whether Eskom has maintained the appropriate skills mix in its workforce. While the utility took on over 3 000 engineering and technical learners in 2013, it took on only 13 in 2019.

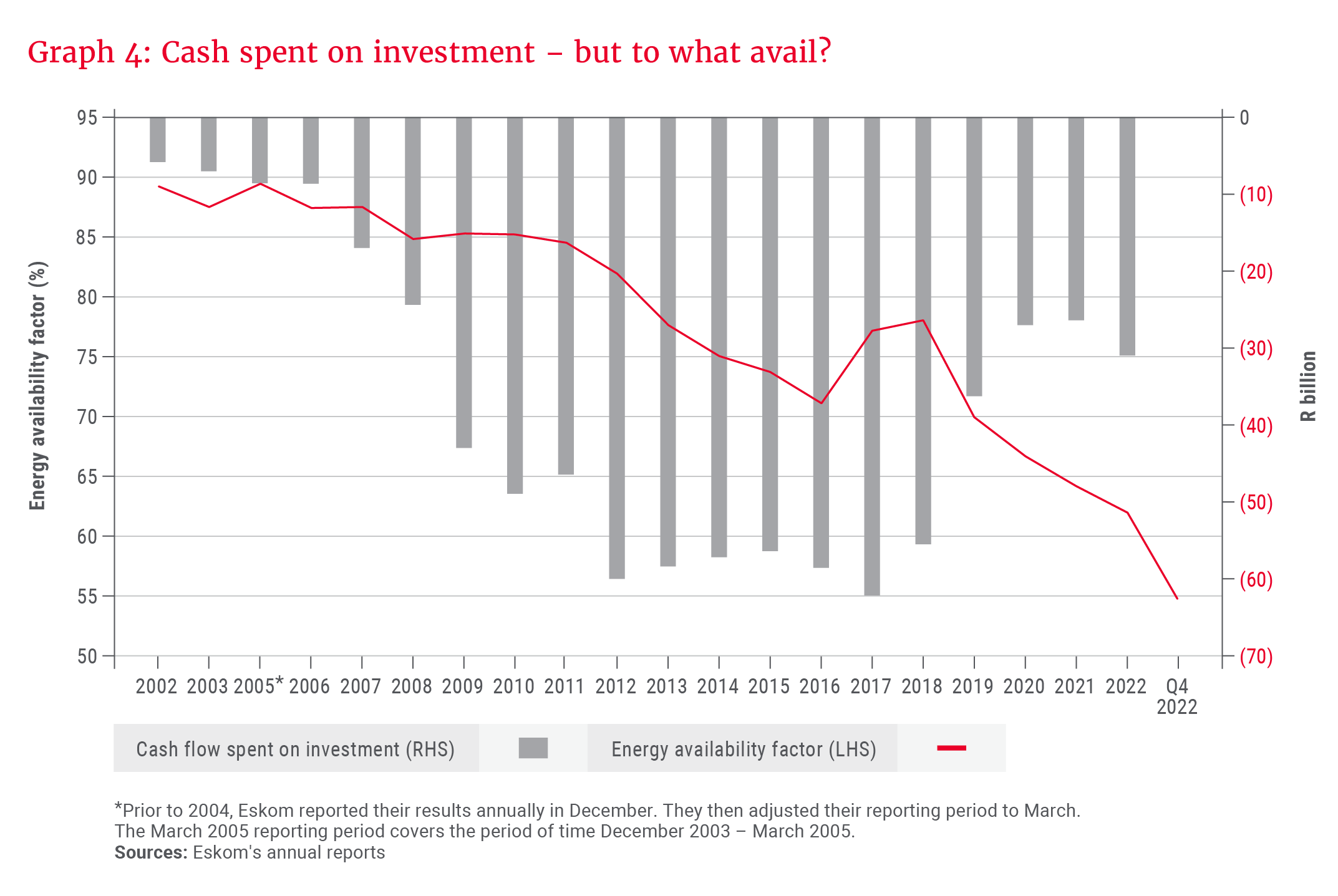

Over the 20-year period in review, Eskom has also raised more than R400bn in debt to finance roughly R700bn of investment in new assets, capital expenditure and maintenance – although maintenance accounted for only one-third of that spend. Clearly, Eskom’s retained earnings were not sufficient to fund these activities.

… Eskom’s energy availability factor has been falling over time even while cash was being ploughed into capital investment projects …

While ex-CEO André de Ruyter has argued that electricity tariffs have not been cost-reflective and were set far too low to fund the much-needed investment programme, there is some degree of circular reasoning at play to argue that a so-called cost-reflective tariff would have saved the utility, given that any wastage and excessive costs borne by Eskom would be “reflected” in the said tariff passed along to the consumer. Other arguments rest on the idea that government as shareholder should have recapitalised Eskom to enable an investment programme to get off the ground in the year that Eskom executives first requested it, namely 1998.

Perhaps a more pressing issue, and one that De Ruyter has illuminated in painstaking detail, is that Eskom’s energy availability factor has been falling over time even while cash was being ploughed into capital investment projects, as seen in Graph 4. Per De Ruyter’s testimony, new generation capacity was funnelled towards poorly designed and built power stations, the tenders for which were awarded to inexperienced or inappropriate contractors for the job at hand. Additionally, cash was siphoned out of these projects via inherent corruption during procurement and ongoing business activities.

Loadshedding is hitting financial results now, but will appear in tax revenue with a lag

In local city centres, the dull hum of a diesel-run generator has become white noise in the background of many a South African’s daily work routine. Against this, consider that diesel prices remain roughly 50% more expensive in rands than they were in pre-pandemic 2019, and that diesel-generated power is 40-60% more expensive than the average Eskom tariff per unit of electricity. Additionally, many of these diesel-run generators were simply not designed to run continuously for as many as 12 hours per day. Frequent generator breakdowns and maintenance bear their own financial costs, as well as those of lost business hours. Renewable energy and battery storage can also be very problematic in dense industrial areas due to lack of space.

The recent corporate financial reporting period has made one thing abundantly clear: South African companies are reallocating billions of rands towards the extraordinary costs associated with loadshedding.

Sectors across the South African business landscape are being hit with the raised cost of production, and not only due to the extraordinary price of diesel consumption. Consider South Africa’s mining industry: Aside from just softer platinum group metal export prices, operating margins are being decimated as intermittent power hampers production and processing output. At elevated levels of loadshedding, various mining operations are often ground to a halt and power supply is used only to evacuate underground employees and maintain safe working conditions.

More startling, perhaps, is the “failed state” narrative and the suggestion that the deindustrialisation of South Africa could be underway.

Meanwhile, extended power cuts wreak havoc for telecommunication companies and mobile operators, leading to lost revenue as a result of the depletion of their tower batteries, which causes dropped signal and reduced network availability. The additional cost of heightened security in dealing with battery theft has dealt some operators, like MTN, a double blow.

Even in the banking sector there remains a notable sense of unease about the health of their smaller business customers and the prospects for a rise in non-performing loans. Various corporates have expressed similar concerns that their smaller suppliers with low gross profit margins will fall over.

Clothing retailers, like Truworths, that do not have sufficient backup power in outlying malls are losing trading hours to loadshedding. Similarly, while the rising cost of production and irrigation is hitting the South African agriculture industry, major food retailers, like Shoprite, Pick n Pay and Woolworths, are absorbing and passing along a litany of expenses further down the supply chain as they try to maintain the uninterrupted refrigeration of produce. Upholding the integrity of stock often requires removing it from sale if the cold supply chain has been broken at any point in the supplier logistical network. Some retailers must even use their own generators at night as their landlords limit after-hours usage.

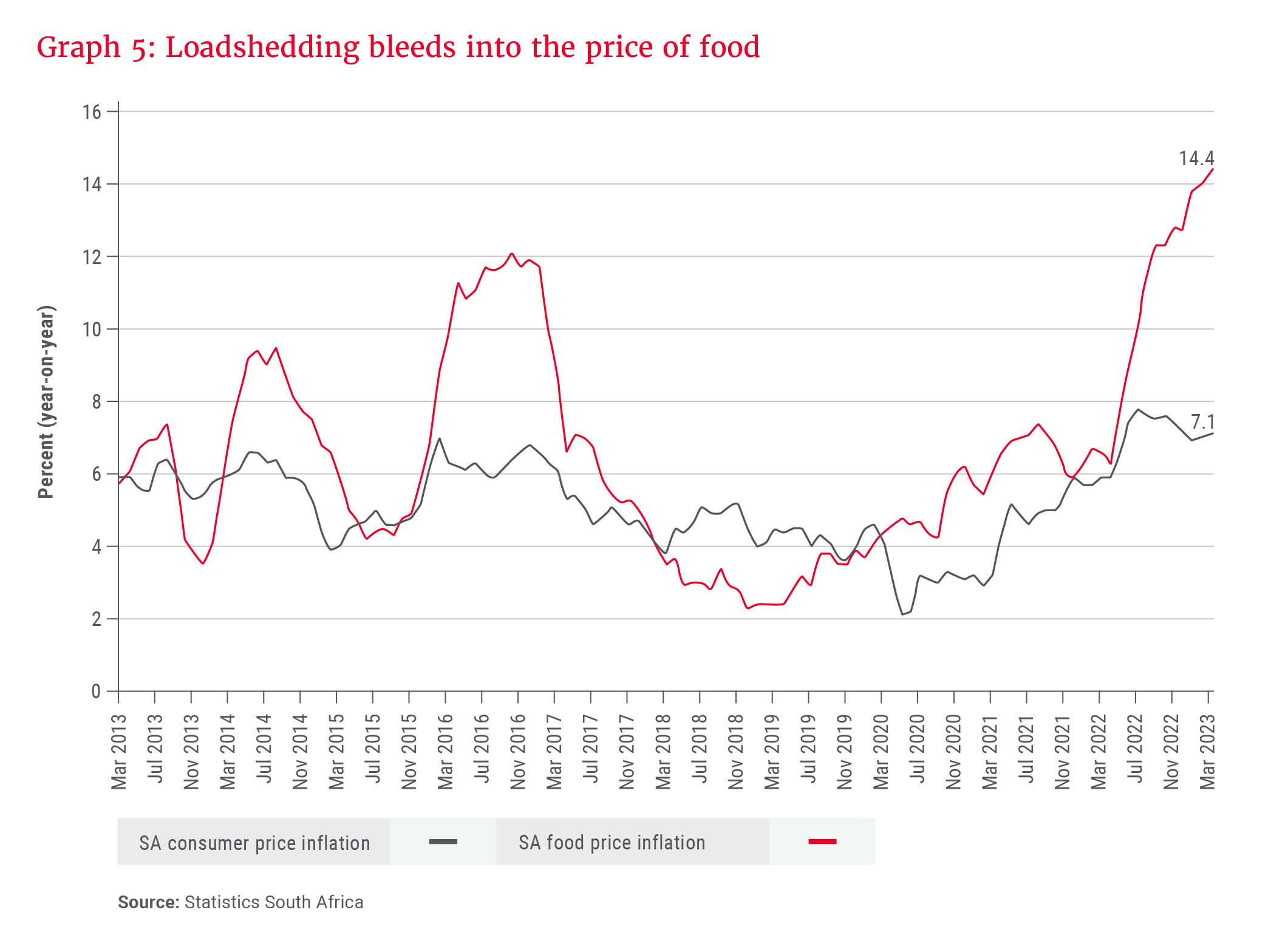

It is perhaps unsurprising, then, that South African consumer food price inflation continues to rise at multi-year highs, increasing by 14% year-on-year in March 2023, as shown in Graph 5. To add salt to the wound, once produce is on the grocery store shelf, the retailers’ difficulties do not end: Customer demand for fresh food items is often dampened by concern that food may spoil due to at-home power interruptions.

Various businesses are suggesting that both water supply and quality are becoming a major issue in their operations as local water-pumping stations suffer from low or no pressure during prolonged stages of high loadshedding. In boardroom conversations, it is not uncommon to hear management speak about risk mitigation strategies in the event of a nationwide blackout. More startling, perhaps, is the “failed state” narrative and the suggestion that the deindustrialisation of South Africa could be underway.

The other shoe is waiting to drop: the read-through to growth figures

Given such a bleak near-term outlook, it was surprising to see the National Treasury forecast an increase in tax revenue of 6% per year on average over the next three years, as discussed in our recent research piece, The 2023 Budget: A crisis of credibility in the outer years of the forecast. Loadshedding is hitting financial results now, but will bleed into tax revenue and growth with a lag.

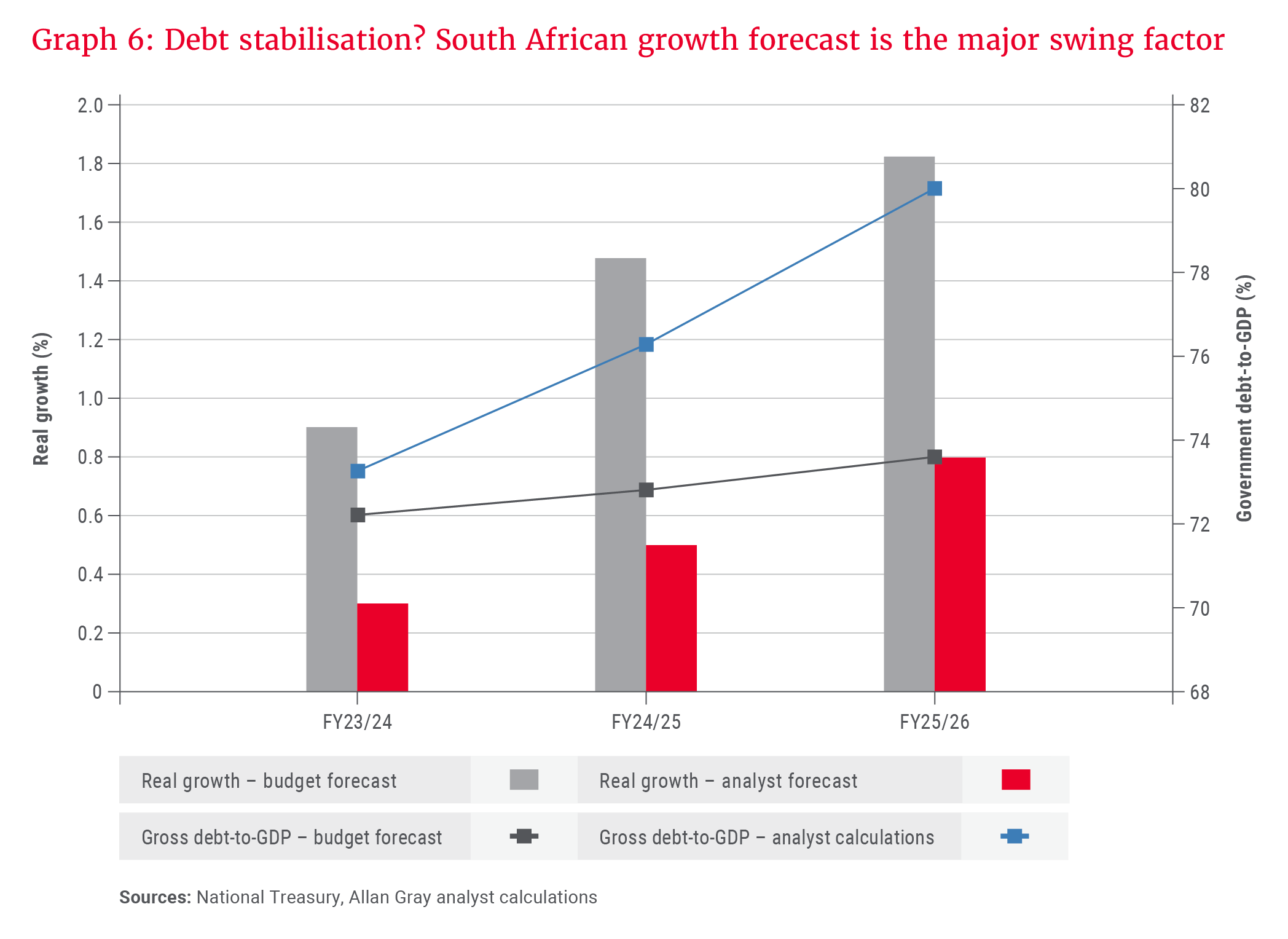

Treasury has forecast average South African real growth rates (i.e. growth in excess of inflation) of 1.4% over the next three years. This should be considered while keeping in mind that South Africa was only growing at a 0.3% annual real growth rate prior to the pandemic. Such estimates have a material impact on tax revenue estimates and underpin Treasury’s forecasted stabilisation of government debt at a peak figure of 73.6% of GDP.

Using an average real growth rate of 0.5% per year over 2023-2025, and factoring in slippage in the public sector wage bill such that the government grants 7% per year increases over each of the next three years, in fact wipes out government’s primary surplus and implies that debt rises to 80% of GDP, as seen in Graph 6, without stabilisation. Against population growth rates of 1.2% per year, such a meagre growth outlook suggests that living standards will continue to fall, as presumably will municipal electricity and water collection rates alongside them.

What, then, are we to make of those hopeful sentiments penned by Eskom’s management decades ago, and can South Africa still be integrated into the global economy as a high-performing participant?

While our growth projections make for gloomy reading in the near term, I would caution against viewing South Africa’s long-term outlook as simply resigned to the shadows. Not only have our corporates proven remarkably resilient through various crises, but there are a multitude of private sector renewable energy projects that are being accelerated alongside more friendly government policy. This should add additional capacity to the grid over the next two to three years as solar, wind and gas initiatives, as well as Eskom’s own battery storage project, bear fruit.

The optimist in me tends to think that it is always darkest before the dawn.