Gold is experiencing renewed prominence, reclaiming its status as the cornerstone of financial stability amid growing questions about the US dollar. As the precious metal moves to unseat the greenback as the preferred reserve currency, will this mark a significant moment in monetary history? Umar-Farooq Kagee discusses.

“Gold is treasure, and he who possesses it does all he wishes to in this world.” – Christopher Columbus

As South Africans, we are no strangers to gold. Following the discovery of this precious metal in the Witwatersrand Basin in 1886, the gold rush into South Africa played a pivotal role in developing the country’s economy. South Africa, at its peak in 1970, produced close to 70% of the world’s gold output.

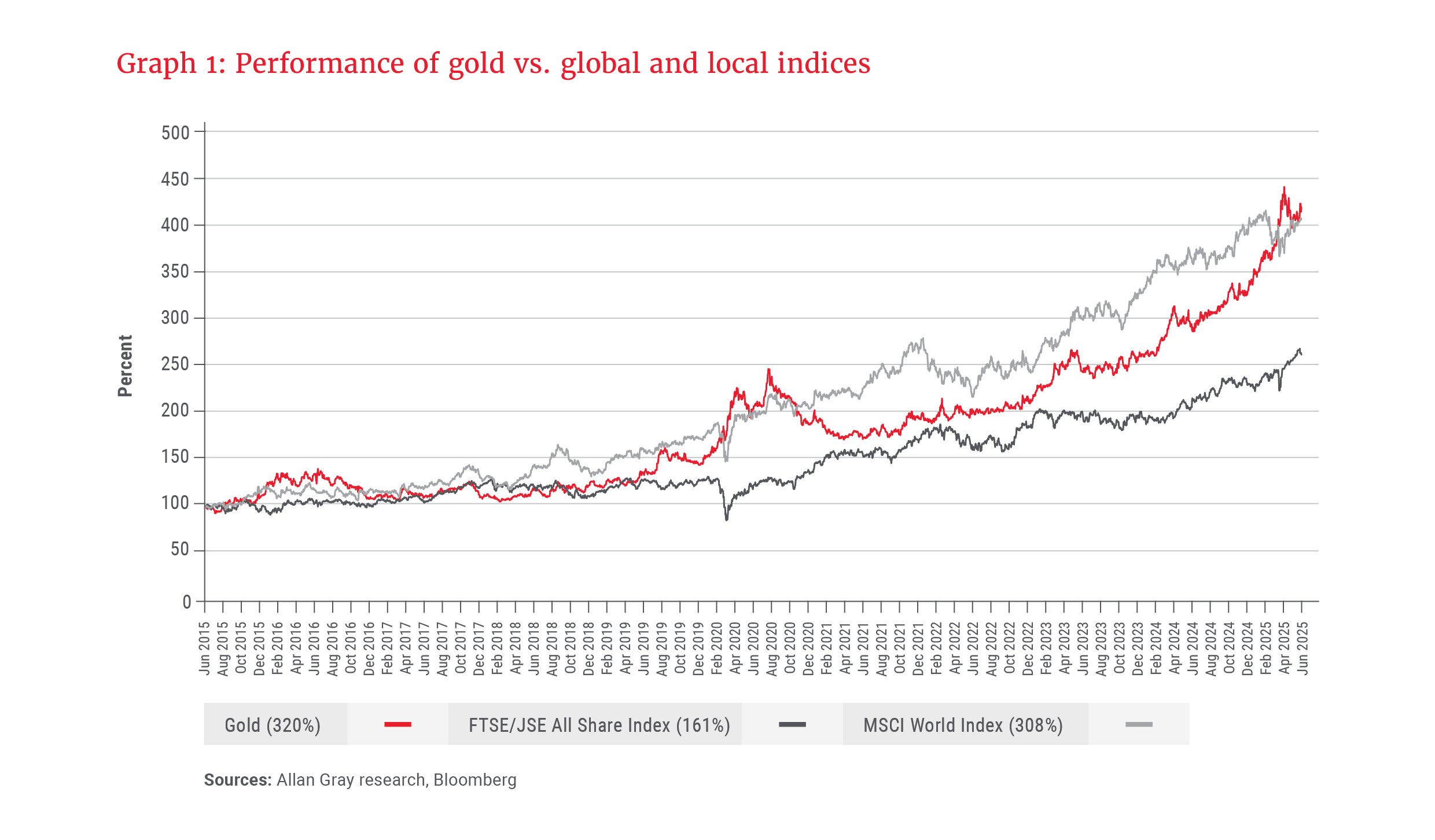

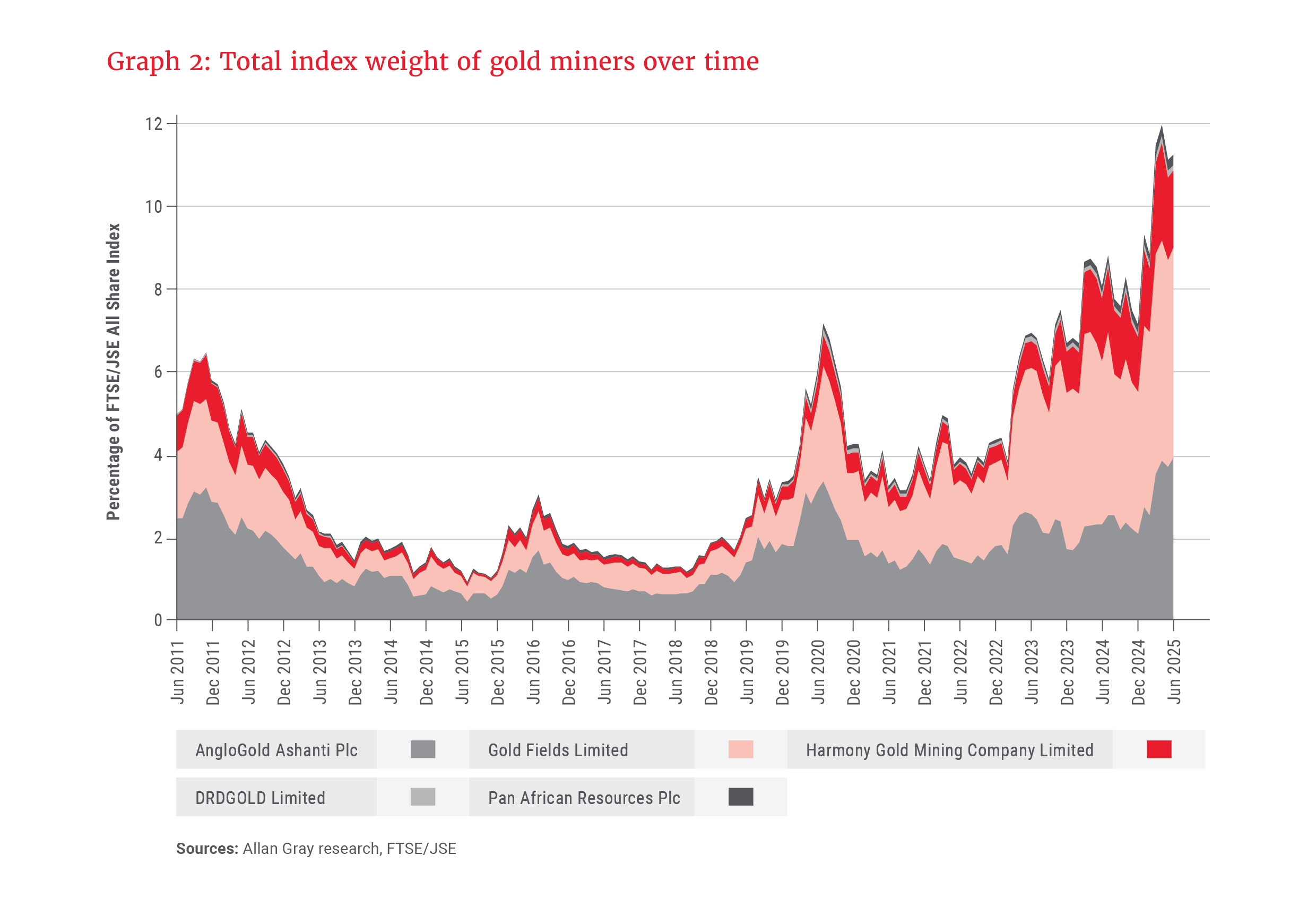

As investors, gold investments are increasingly important. Over the past 10 years to June 2025, the rand gold price has appreciated 320%, outpacing the MSCI World Index total return of 308% and the FTSE/JSE All Share Index (ALSI) total return of 161%, as shown in Graph 1. Meanwhile, as Graph 2 reflects, the ALSI has experienced a dramatic composition shift over the past 10 years, with gold equities shifting from a 1.4% weight in the index in 2015 to an 11.3% weight today.

Gold’s resurgence as a reserve currency in a fracturing world

Before 1944, gold was better seen as money or currency within the global monetary system. Under the classical gold standard, currencies were directly convertible to gold, ensuring fixed exchange rates and fiscal discipline. Gold functioned as both a medium of exchange and a store of value.

In 1944, the Bretton Woods Agreement replaced the gold standard with the gold-dollar system: Currencies were pegged to the US dollar, which was convertible to gold at US$35 per ounce. This arrangement lasted until 1971, when President Nixon ended gold convertibility, marking the transition to fiat currencies and floating exchange rates.

Gold seems to be repositioning from a passive reserve asset to an active pillar of monetary strategy …

Since then, the US dollar has served as the backbone for trade and global reserves – a symbol of trust and stability, deep liquidity and geopolitical dominance – but the greenback now appears to be on shaky ground. At the end of the second quarter of 2025, the price of gold in US dollar had rallied 42% over the previous 12 months to US$3 303 per ounce. Gold seems to be repositioning from a passive reserve asset to an active pillar of monetary strategy – a key pillar of its renaissance – due to the following factors:

- Being politically agnostic: The US dollar’s safety as a neutral asset has been broadly reassessed. The weaponisation of Russia’s foreign reserves in 2022 – its assets were frozen overnight in response to the Ukraine invasion – sent a clear message: Dollar reserves are no longer politically agnostic. The uncertain consequences of being at odds with the US government are no longer theoretical. Gold, when held in vaults that you control, escapes this overreach.

- Zero default risk: US dollar reserves are held in the form of US treasuries. The US government’s mounting debt and growing fiscal deficit put a question mark over its ability to repay the debt. Evidence of this risk is showing in the rising real yield of 10-year treasuries. Historically, gold has underperformed in such an environment owing to the non-yielding nature of the metal. The positive correlation in the current cycle reflects the market’s desire for a reserve asset that is free of default risk.

- New trade blocs: The inward focus of the European Union and growing presence of the BRICS bloc (comprising Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates), alongside the US’s wave of protectionist policies, is increasingly diverging the previously unified interests into a multipolar world. While all currencies stand to benefit from the US de-dollarisation, central banks are increasingly holding gold as a reserve that is universally recognised, borderless, and free from any interference.

Although the US dollar’s dominance remains unmatched for now, the paradigm shift is undeniable. Gold’s ancient role – as a reserve of last resort – is finding new relevance in a world where geopolitical risk is no longer a tail event, but a structural feature. Central bank purchases have surged, particularly in emerging markets, with gold bulls arguing that the International Monetary Fund’s official disclosure grossly understates the true magnitude of this trend.

Gold in our clients’ portfolios

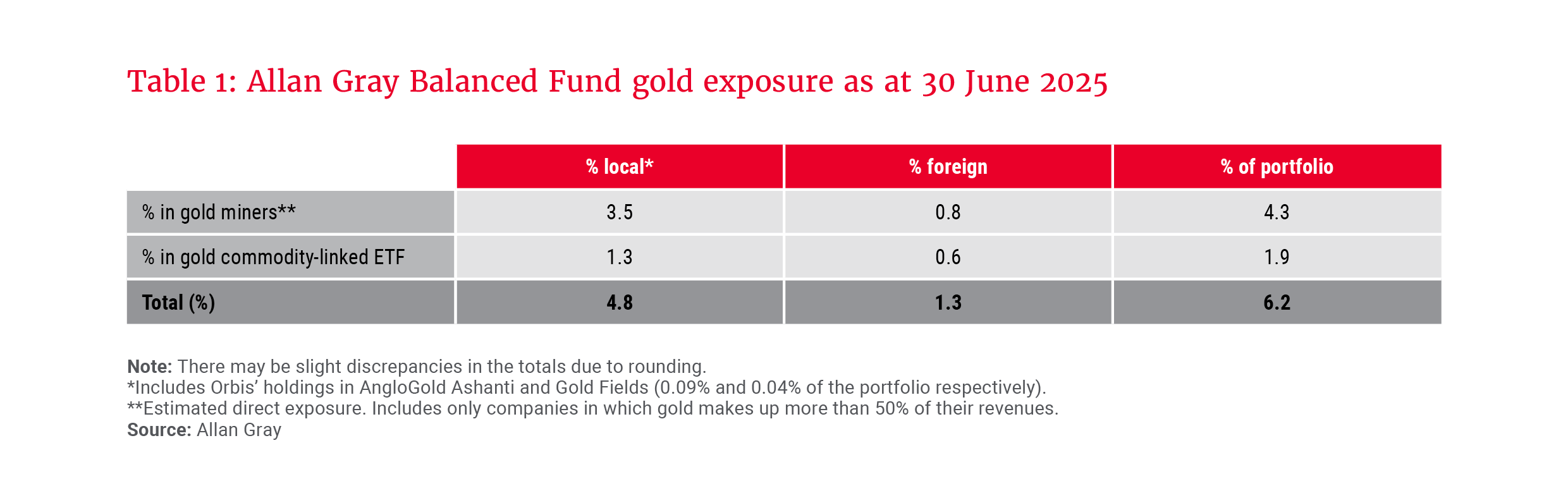

Global multi-asset funds have the flexibility to invest in gold, either in the metal itself or through locally listed and offshore listed gold miners. The Allan Gray Balanced Fund, our flagship multi-asset fund, has a 6.2% exposure to gold and gold-related equities, both directly and indirectly through our offshore partner, Orbis, as shown in Table 1.

The investment case for AngloGold Ashanti

The core investment case for investing in gold equities is that the operating leverage of the miners significantly amplifies the performance of the underlying gold price. To illustrate: AngloGold Ashanti (ANG) reported that its average gold price for the first quarter of 2025 was US$2 874 per ounce – a 39% increase year-on-year. The miner further reported that its free cash flow increased from US$57m to US$403m – a seven-fold increase year-on-year. At the time of writing, the spot gold price was roughly US$3 420 per ounce, providing an additional 19% upside to the first quarter’s gold price and free cash flow performance.

As always, we construct our clients’ portfolios to withstand a range of scenarios …

ANG has been our highest-conviction gold equity call. We feel that under the leadership of its CEO, Alberto Calderon, ANG has done well relative to its peer group. The team’s focus on maximising value is one that resonates with the Allan Gray mindset. Calderon made it clear from the onset of his tenure in 2021: Fix the underperforming assets or get rid of them.

The examples below showcase this approach:

- Full asset potential: The management team’s hyperfocus on simplicity and unlocking the full potential of assets is welcomed. The Brazilian operations are a good example: The business originally consisted of two operating assets, the Cuiabá and Córrego do Sítio (CdS) mining complexes. CdS experienced ongoing losses, but within two years of taking over as CEO, Calderon put the mine on care and maintenance and focused on turning Cuiabá into a Tier 1 asset.

- Countercyclical capital allocation: In the past, gold companies typically used gold price rallies as opportunities to invest in large projects and engage in mergers and acquisitions. These often turned out to be poor investments, especially as the gold price retreated. ANG’s countercyclical capital allocation resonates with the Allan Gray investment philosophy, which is focused on holding assets priced below our estimate of intrinsic value. Evidence of this is seen in ANG’s recently announced disposal of one of its low-quality South American assets, the completed sale of a speculative project in Africa at a high point in the gold cycle, and the revised dividend policy to pay up to 50% of free cash flow.

There are still opportunities on the table:

- Iduapriem, ANG’s open-pit operation in Ghana, has underperformed following a temporary plant shutdown and repairs to the tailings storage facility in the first quarter of 2025, which resulted in production falling 35% and unit costs increasing 59%.

- Since 2019, ANG made large investments in Ghana to restart the Obuasi mine, aiming to develop towards the higher-grade underground block. With the large capital expenditure now behind the company, and the shift in focus to ramping up production towards the 400 koz (thousand troy ounce) target (from the current 221 koz trailing annual run rate), Obuasi stands to generate significant free cash flow in the current gold price environment. This is a good example of investing ahead during the challenging periods in the cycle and enjoying the rewards when sentiment improves.

- Over the longer term, investments in the higher-quality Nevada assets in the US, through the North Bullfrog and Arthur Gold projects, may coincide with further divestments in lower-quality assets, such as Cerro Vanguardia in Argentina and Sunrise Dam in Australia. The portfolio shift to lower-risk regions opens the possibility of ANG attracting a higher rating.

Despite the 112% share price rally year to date, we estimate that ANG still trades on an attractive 13% spot free cash flow yield and 6.5% spot dividend yield. As always, we construct our clients’ portfolios to withstand a range of scenarios: An allocation across both physical gold and the gold miners allows clients to benefit from gold’s growing role as a reserve asset, while preserving a return profile with diverse correlations to other traditional asset classes.

Explore more insights from our Q2 2025 Quarterly Commentary:

- 2025 Q2 Comments from the Chief Operating Officer by Mahesh Cooper

- Allan Gray Stable Fund: Celebrating a quarter of a century by Radhesen Naidoo and Danielle Nissen

- Crouching tiger, hidden value by Andrew McGregor

- Orbis Global Equity: Discipline in the face of volatility by Adam R. Karr

- How to think about beneficiary nominations for your retirement funds by Ian Barow

- Three questions to evaluate your investment manager by Nomi Bodlani

To view our latest Quarterly Commentary or browse previous editions, click here.