The Allan Gray Stable Fund celebrated its 10-year anniversary on 1 July. This is a good time to reflect on how the Fund has performed over its first 10 years and to consider what the next 10 years may hold. With equities largely responsible for the Fund's exceptional run, investors need to be aware that the significant outperformance is unlikely to be repeated over the next decade.

Over the first 10 years of its existence the Stable Fund has performed exceptionally well, beating its benchmark by 5.8% on an after-tax basis. While we are proud of these returns, we caution that they will not necessarily be repeated, especially in light of the Fund's objectives, which are:

- To provide a return that exceeds the return on cash plus 2%, on an after-tax basis, at an assumed tax rate of 25%

- To provide a high level of capital stability (rather than to provide exceptional returns)

- To minimise the risk of loss over any two-year period (Interestingly, since inception there have been no two-year periods where the Fund has delivered a negative return.)

Objectives achieved through varying asset allocation

The Stable Fund invests in a selection of bonds, cash and shares, and its asset allocation complies with the Prudential Investment Guidelines, as laid down in the Pension Funds Act. The portion of the Fund invested in the money and bond markets is actively managed, with fund managers aiming for real returns at low risk. The Fund's maximum net equity exposure is limited to 40%. However, unless the stock market offers exceptional value, the Fund's equity exposure is likely to be significantly lower.

When investors' expectations are low and stock markets offer good value, the Stable Fund is attracted to the limited downside and the potential for upside surprises. Vice versa, when stock markets offer little value, the Fund is concerned about the potential downside and it reduces its equity market exposure.

Strong returns thanks to equities

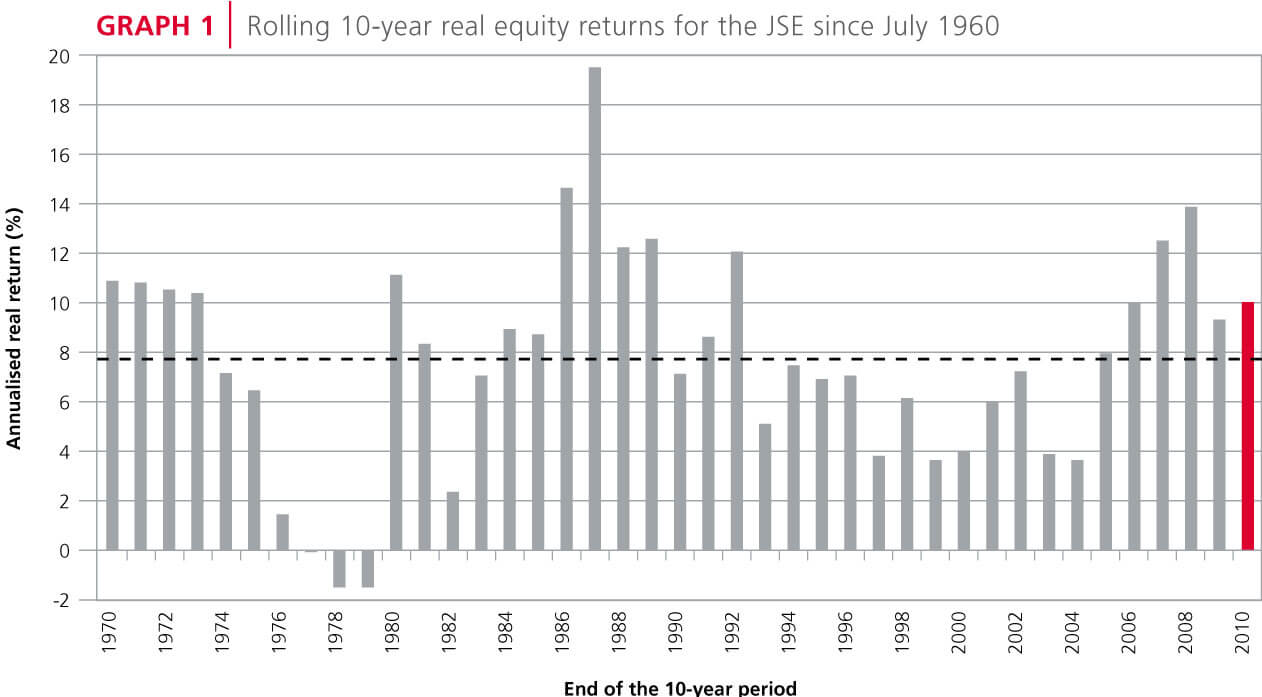

The last 10 years has been a great decade for equities and this environment has contributed to the Fund's strong performance. Graph 1 shows the rolling 10- year equity returns adjusted for inflation for every 10 years starting in July 1960 up to the present date.

While not the best on record, the most recent 10 years, highlighted in red, produced a return of 10% above inflation, significantly more than the 8.6% return for the full 50 years.

Over these 10 years the average net equity holding of the Fund has been 27%. A strategy of holding this proportion in the FTSE/JSE All Share Index (ALSI) with the balance in cash would have given a return in the region of 3% more than cash on an after-tax basis, but before fees are taken into account. This illustrates the strong tailwind the Fund has had over the period, helping it to deliver strong returns.

THE STABLE FUND REMAINS A COMPELLING OPTION FOR INVESTORS WHO ARE SEEKING TO PRESERVE CAPITAL OVER A TWO-YEAR TIME HORIZON

Offshore exposure may bolster future returns

One does not know what the future will hold but it is unlikely that the next 10 years will be as good for equities as the last 10 have been. We have been steadily lowering the Fund's net equity exposure, which currently sits at just over 14%. Given this low current net equity exposure, investors could be forgiven for thinking that we have given up and are happy to accept safe returns close to cash. In fact, much of the share exposure has been removed by selling stock index futures and not selling the underlying shares. Before this hedging, the Fund had 38% gross equity exposure, which means that the Fund is still exposed to the potential for us and our offshore partner Orbis to add value through stock picking, to the extent that the shares we pick do better than the overall index.

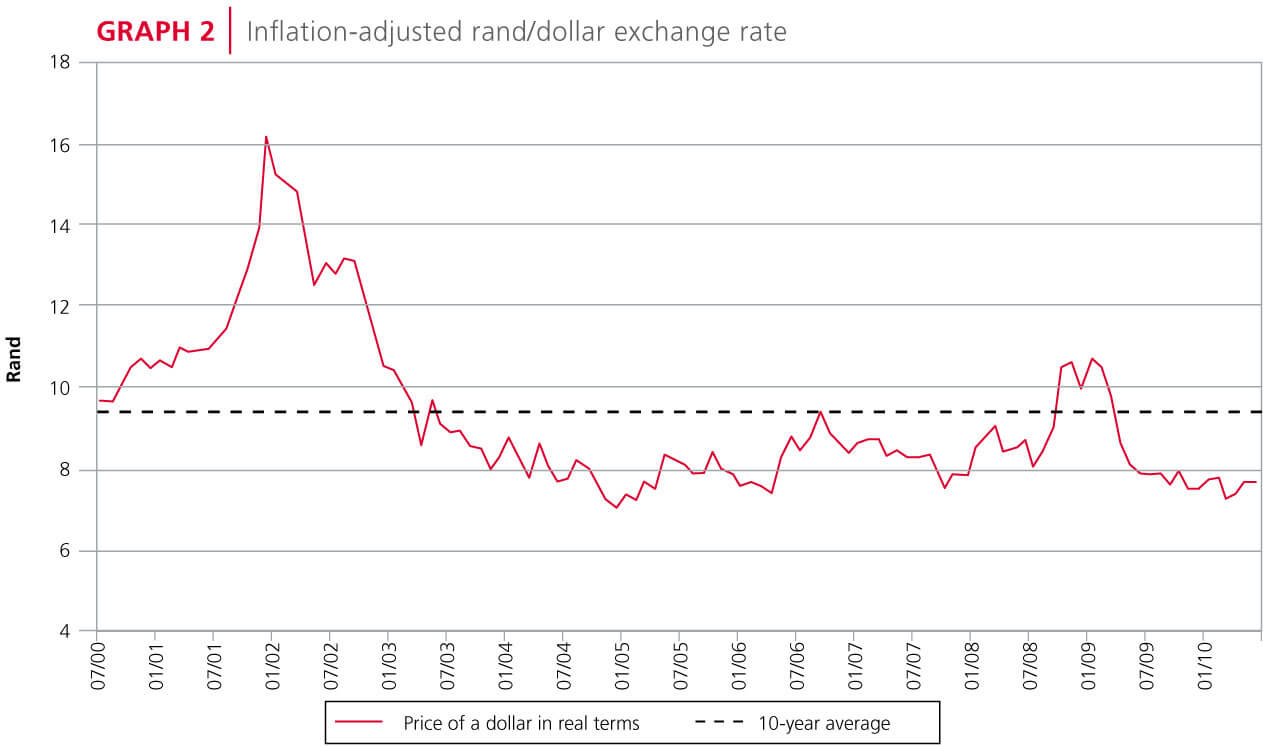

However, it remains unlikely that these equities will deliver the same results as before. Fortunately, there are other opportunities to bolster the Fund's returns, one of which is the Fund's high offshore exposure. Although the Fund's offshore exposure has been a significant drag on performance over the last year as the rand has strengthened, we expect it to contribute positively over the long term if the rand weakens (which we regard as more likely than long-term strength from this point).

Graph 2 shows the appreciation of the rand versus the dollar in real terms. The rand has appreciated remarkably over the last 10 years, particularly after allowing for inflation. We think that it is more likely that the rand will lose ground against the dollar from here, rather than the other way around. Over the long term, we expect the Fund's exposure to foreign assets, via its holding in Orbis funds, to bolster returns.

Overall, the Stable Fund remains a compelling option for investors who are seeking to preserve capital over a twoyear time horizon. However, investors should not necessarily expect the Fund to deliver the same phenomenal returns of the last decade in the next.