When we launched the Allan Gray Stable Fund (the Fund) 15 years ago, we hoped that it would provide clients with returns that were competitive with bank deposits. The Fund has more than lived up to this, exceeding bank deposits by 5.6% per year since its inception, with a low risk of capital loss. Mahesh Cooper and Fiona Jeffery go back to the basics in this article, describing how the Stable Fund goes about achieving its objectives and what investors can expect over the long term. They also unpack the recent performance of the Fund and its positioning in the light of current market conditions.

The Allan Gray Stable Fund was one of the first of its kind in the South African unit trust space: a fund dedicated to delivering above-cash returns with low risk of capital loss. The Fund's portfolio managers start with this objective of preserving our clients' capital and then seek to deliver returns in excess of cash.

The Stable Fund is constructed from the bottom-up

We follow a valuation-based investment philosophy and construct our portfolios from the bottom-up, looking for assets, such as shares, bonds and property, where the current price is less than our estimate of their intrinsic or underlying value. The Stable Fund's positioning is a direct result of this approach: shares and other assets are selected based on their attractiveness relative to cash. For example, if we are able to find many individual SA-listed shares attractive relative to cash, taking into account its focus on capital preservation, the Stable Fund will have a higher exposure to shares, eventually up to its maximum net equity exposure of 40%. On the flipside, the Fund can have zero exposure to shares if we are not able to find any attractively priced shares to buy. Alternatively, some of the share exposure may be through our offshore partner, Orbis (if we consider other markets to be more attractively priced than South Africa). The Stable Fund's 40% share exposure limit contrasts with the Allan Gray Balanced Fund, where the net equity exposure must be between 40% and 75%. Given the Stable Fund's capital preservation objectives, the selection of individual assets is also inherently more conservative.

THE POSITIONING OF THE FUND IS SOLEY DRIVEN BY THE OBJECTIVES OF DELIVERING ABOVE-CASH RETURNS WITH A LOW RISK OF CAPITAL LOSS

The Fund is often compared with others in the low equity multi-asset class category, many of which allow for a greater short-term risk of capital loss to try and capture a higher long-term return. As with all our funds, our portfolio managers pay no attention to how the Fund's competitors are invested or the composition of any benchmark. The positioning of the Fund is driven solely by the objectives of delivering above-cash returns with a low risk of capital loss. This means that there will be times when the Fund is ahead of its competitors, but there will also be times when the Fund is behind others in the same sector. Regardless, the portfolio managers always remain focused on achieving the Fund's own objectives, irrespective of what others are doing.

What can we expect over the very long term?

Readers of our Quarterly Commentary will know that we have been concerned about the level of the South African equity market for some time. South Africa has been a great place to invest in over the last 15 years, with all asset classes delivering returns well above inflation, and this has provided a boost for low equity strategies like the Stable Fund. However, very long-term historical data suggests investors should become accustomed to lower real returns going forward.

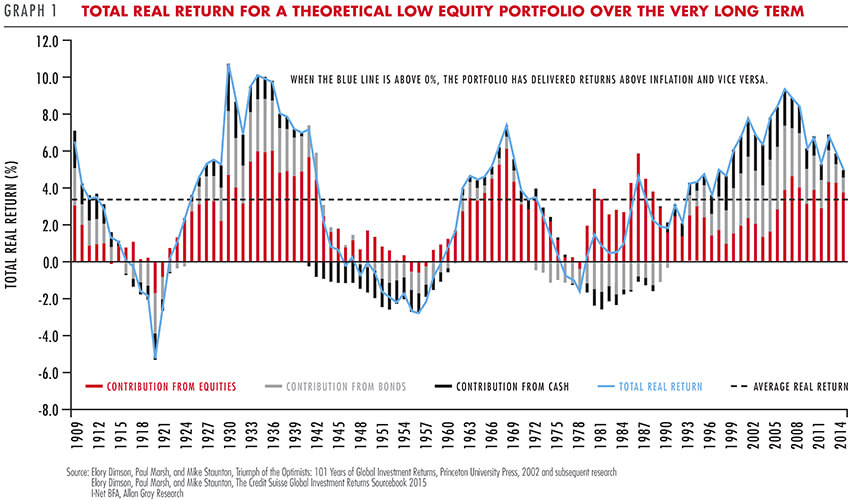

Graph 1 is based on data that tracks the after-inflation returns of different South African asset classes over the last 115 years. We have used this data to construct theoretical returns over rolling 10-year periods for a low equity portfolio invested in South African asset classes, comprising one-third equities, one-third bonds and one-third cash. The solid blue line shows the returns this portfolio has produced over 10-year rolling periods since 1900, with the bars representing the contributions from the asset classes, while the dotted black line shows the average of these 10-year real rolling returns – just over 3% per year above inflation. Looking at recent history, we can see how returns from all South African asset classes have been well above their long-term averages. However, there have also been periods in the past when this low equity portfolio has delivered returns below inflation over a 10-year period, sometimes for long periods at a time. After a long period of returns well above average (since the early 1990s), returns could be below their long-term average for a period of time, to offset the recent relative strength.

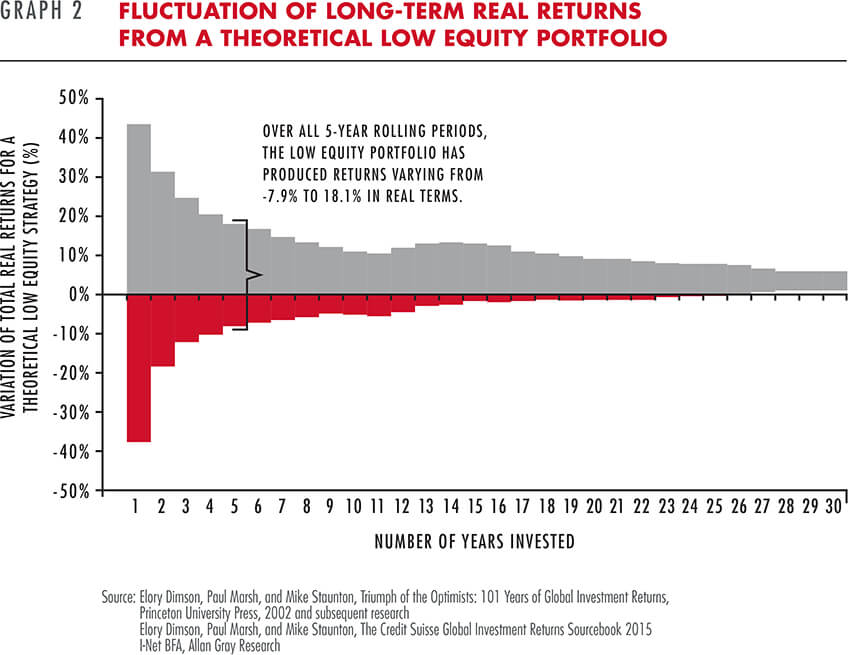

Graph 2 uses the same data as Graph 1, but instead of just looking at 10 year real returns, it looks at the real returns achieved by the portfolio over different time periods. The vertical axis shows the spread of real returns that our hypothetical low equity portfolio would deliver over one, two, three years, etc., all the way to 30 years. For example, over all the five-year rolling periods going back to 1900, this portfolio has produced five-year real returns, which have varied between -7.9% and 18.1% per year. What becomes obvious is that, over the shorter term, the outcomes of the portfolio are much more variable than the longer term. This is true for most investments. It is also worth pointing out that, over a one-year period, the portfolio failed to outperform inflation 37% of the time; this drops to 31% over a two year period. It is only after 25 years that all outcomes for the range of real returns are positive. So over the short term, investors can expect a lot more fluctuation in the real returns they experience than over the longer term. In addition, a low equity portfolio may deliver a negative nominal return over the short term. This has happened in 16 out of the last 115 calendar years for our hypothetical low equity portfolio.

With this in mind, let us consider the returns of the Fund.

Performance

The more recent returns for the Stable Fund have been disappointing relative to the longer-term returns. This is better understood in the context of the Fund's positioning, which has been cautious over the last few years, and is covered in the next section.

Since inception 15 years ago, the Fund has delivered a return of 12.9% per year (7.2% real return). While we think these returns are pleasing in light of the Fund's capital preservation objectives and low levels of risk, they have been achieved during a very favourable environment for asset management in South Africa, during which all asset classes have performed strongly. It is important that we remind ourselves that this performance is in the past, and that prices today determine returns going forward. From the current high starting point, we expect that the next 15 years are likely to be far more challenging.

LOOKING AT VERY LONG-TERM HISTORICAL DATA SUGGESTS INVESTORS SHOULD BECOME ACCUSTOMED TO LOWER REAL RETURNS GOING FORWARD

Positioning

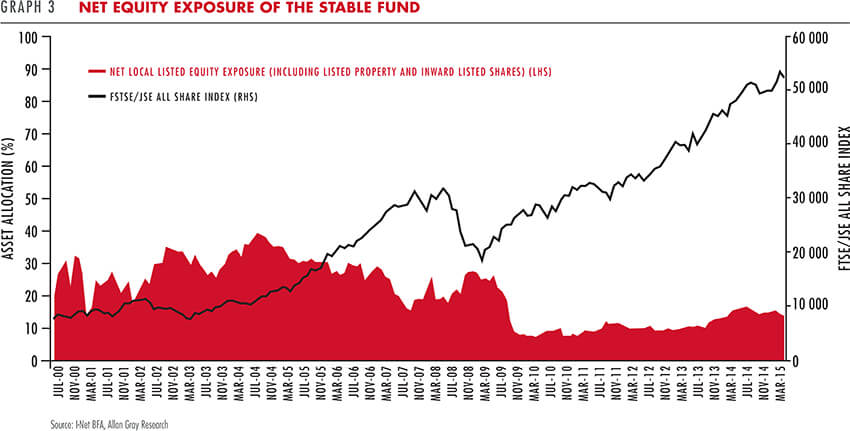

The solid black line (right axis) in Graph 3 shows how strong the South African equity market has been over the last 15 years, rising more than five times over the period. Bearing this in mind, together with our concerns regarding high asset valuations, our portfolio managers have taken several steps to protect your investments. The outcome of this is that the net equity position in the Fund is low and a large portion of the Fund is invested in fixed interest investments and cash equivalents. The Fund also currently favours investments in shares where we believe the downside risk is below average – higher quality companies with diversified and stable earnings streams which are highly cash generative.

Graph 3 also shows the net South African equity exposure of the Fund over time (on the left axis). The current net SA equity exposure is 13.8% (including property), lower than the long-term average of 23.2% and well below the overall maximum 40% permitted. As is evident in Graph 3, we have been cautiously positioned for some time.

This low exposure to South African equities has hurt the Fund's performance both in absolute terms and relative to its competition as the stock market has continued to rise. With the benefit of hindsight, we lowered the Fund's equity exposure too quickly in 2009/10 post the global financial crisis. We can't undo the past, but we do continuously and rigorously assess our positioning and, in light of current market conditions, we believe that the net South African equity exposure is appropriate.

A large portion of the Fund is invested in ‘hedged equities', both locally and offshore. We use hedging when we are concerned about asset valuations as it provides downside protection for your investments. Hedged equities can be thought of as cash-equivalents where we effectively exchange market returns for more stable cash-like returns. At the same time, we retain exposure to the potential outperformance from our selection of shares relative to the market, which should further enhance returns over the long term.

Unfortunately hedging has recently detracted from returns as equity markets have continued to outperform cash returns, and Orbis' offshore stock selection has been disappointing. Hedged equities, however, offer a source of returns which are uncorrelated to equities, adding diversification benefits on behalf of our clients. This portion of the Fund is also very liquid and, together with the cash in the portfolio, provides us with the flexibility of being able to materially increase net equity exposure (by decreasing the hedged equities and deploying the cash reserves) at some point in the future when shares present more attractive opportunities.

We also continue to hold the maximum permitted allocation of offshore assets in the Fund. We have written before about the benefits of investing offshore (please see Seema Dala's piece in Quarterly Commentary 1, 2013 and Mahesh Cooper and Ian Liddle's piece in Quarterly Commentary 4, 2010) and we continue to believe that the offshore exposure in the Fund will assist in preserving the purchasing power of our clients' capital over the long term. However, more recently this positioning has hurt performance. While the Orbis funds performed very well in 2013, last year was disappointing, with Orbis' funds underperforming their benchmarks. This was primarily driven by Orbis' selection of shares performing poorly relative to global equity markets (see Graeme Forster's piece). Global equity markets are also looking more stretched and, in light of its conservative objectives, the Fund has favoured a more cautious net equity exposure offshore, which has detracted from returns given the strong performance of global markets.

HOPEFULLY THE MORE CONSERVATIVE APPROACH WE TAKE IN THE STABLE FUND WILL PROVIDE OUR CLIENTS WITH MORE DOWNSIDE PROTECTION

Capital preservation is key

Although the Fund's conservative positioning has hurt its recent performance, we believe that, in the current environment, it is the appropriate way to fulfil our objective of protecting our clients' capital over the long term. We expect it to be more difficult to achieve cash-beating returns going forward. If equity markets locally and globally continue to perform strongly, our clients can expect the Stable Fund's returns to be lower than its peers' returns. However, if valuations revert to what we believe are more normal levels, hopefully the more conservative approach we take in the Stable Fund will provide our clients with more downside protection. In the meantime, you can rest assured that we remain as focused as always on preserving and growing our clients' investments over the long term.