A key problem in the LISP industry is that fees are complex, and different platforms use different fee structures. Many investors do not understand how much they are paying, who they are paying and what they are paying for. This makes it very challenging to identify the ‘price tag’ and to compare charges. A good starting point is for investors to understand who is earning a fee, why they are earning a fee and what impact the fee has on the performance of the investment.

We believe that transparent disclosure of all the costs associated with investments, in clear understandable language is non-negotiable. The industry has come a long way towards achieving this goal and we whole-heartedly support the collective effort to empower investors to make better investment decisions by providing them with the information they need to do so.

There is a current move in the industry towards ‘clean priced’ funds. This is to be welcomed to the extent that it improves transparency. However, rather than introducing new fund classes when there is no clear cost benefit, it would surely be simpler to improve disclosure to make it clear for investors to understand the various components of their fees? The proponents of clean pricing will argue that clean pricing brings clarity and doesn’t allow any opportunity for abuse.

Rather than try to argue for or against these structures, we will continue to assess what is in the best interests of our clients in different scenarios. This currently involves maintaining the rebate structure of our platform, but being open to clean priced funds on our platform (where there is a cost benefit) and developing new clean priced fund classes for other platforms when it benefits clients.

How does the rebate structure work?

A part of the management fee which fund managers charge is to pay for administration. Many fund managers pass on all or part of this administration portion to the LISP. This is done to remunerate the LISP for administering the investment as well as for marketing the fund manager’s funds.

When administration, advice and fund management fees are segregated and clearly disclosed, rebates are a good way for LISPs to lower the total cost to clients since they effectively make the fund manager’s ‘slice’ of the total fees more negotiable for bulk buyers. At Allan Gray we have always tried to educate our clients and to disclose administration fees and rebates in a way that is easy to understand.

This is not always the case with rebates. The payment of rebates can be opaque and blur the lines between the different fee types, making it harder for clients to get the best deal. There are even instances where the rebate structure has been abused, to the detriment of clients, by inflating the administration cost or to fund the solicitation of business. This has led to some debate in the industry as to whether or not rebates should be allowed at all.

What about clean pricing?

A clean pricing structure clearly segregates the different fees applicable. With clean pricing, fund management fees are paid to the fund manager, administration fees to the administrator and advice fees to the adviser. Proponents of clean pricing argue that this is in the best interest of clients as it is transparent and easy to understand. Clients can see and compare how much they are paying to each party.

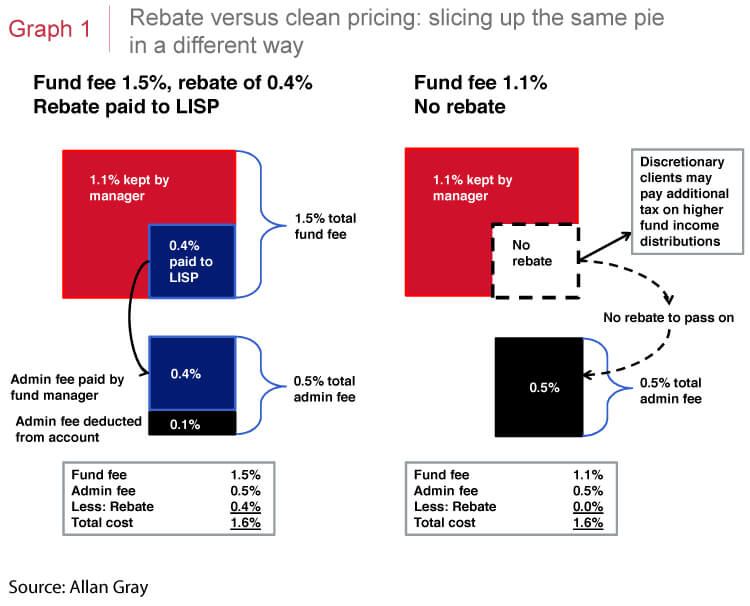

Clean pricing does not directly translate into lower costs to the client, and while the disclosure of fees will be different, it may not necessarily be more effective. For companies where the different fee types have been adequately segregated and disclosed in the past, clean pricing may simply be a case of slicing the same sized pie in a different way as shown in Graph 1. The tax implications could, in certain scenarios, result in a higher tax drag on the investment than in the past. And if fund providers are less free to respond to buying pressure from LISPs the competition for investors may be less fierce and the total fees charged can end up being higher.

Which kind of platform should you choose?

What matters most is not the structure of the platform or the fund but the total cost that the investor is paying for administration and the value they get in return. Part of the value may be in the form of lower fund manager fees through the LISP’s bulk buying power. At the end of the day, the lower the total charge, the better. The other thing that really matters is transparency – if you can’t see and easily work out what is being paid for administration, for fund management and for advice, it is probably higher than you think. A transparent platform, with clear disclosure, should be preferable to an opaque one every time.

A ‘linked investment services provider’, or investment platform, enables you to access a broad range of unit trusts and investment products from different fund managers through one service provider.

Allan Gray Proprietary Limited is an authorised financial services provider.