Investors frequently ask us whether or not our choice of shares reveals a particular theme or ‘story’. Investors are also curious as to how we alter our selection of shares based on the economic backdrop. While we acknowledge that themes sometimes emerge, which in hindsight may be linked to the economic climate, we make investment decisions based on our assessment of individual companies and not in response to the markets.

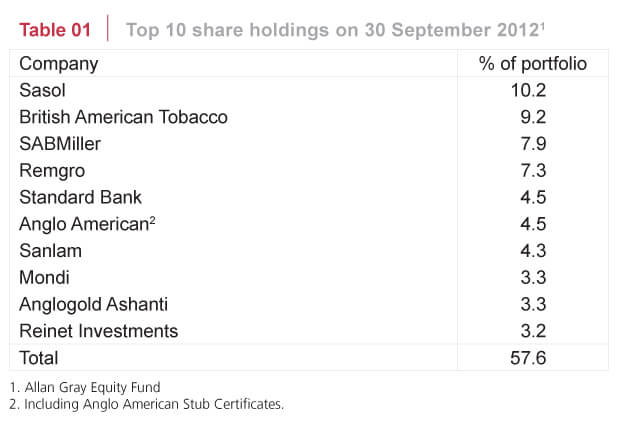

A tale of 10 shares

Every share we own is carefully selected, each for its own unique idiosyncratic reasons, but if pressed to pick a ‘message’ from our Top 10 it would be one of diversity. Our selection is kept diverse intentionally, as we believe this provides investors with a degree of stability in an environment which is hugely uncertain.

We take a ‘bottom-up’ approach to investing, seeking to understand the underlying value of shares based on long-term fundamentals. If we can buy a share for less than we believe it is worth, we will do so. This differs from a ‘top-down’ approach, where investors start with a wide view of the world and make decisions about which countries or sectors look the most attractive at any given time and buy shares accordingly.

Although we take a bottom-up approach, the companies we invest in do have some things in common. While not all these points can be universally applied to our whole selection, they hold true for most of the shares.

Things our top shares have in common:

1. Strong balance sheets

We spend a lot of time assessing the financial health of the companies we invest in on behalf of our clients. Many of the companies in our Top 10 are strong cash flow generators; often substantially more cash is being generated than is being consumed by the underlying operations. In addition to rewarding shareholders through dividends and/or share buybacks, this has enabled these companies to comfortably reduce their debt levels or grow their cash balances. Lower levels of indebtedness have reduced borrowing costs, further enhancing earnings and improving liquidity – a virtuous cycle.

With many of our companies well placed to take advantage of any opportunities that may present themselves, a well-capitalised balance sheet will remain an asset in the uncertain times that lie ahead.

2. Diversified

Most of the companies we invest in are globally diversified with well diversified asset bases. This is important as they are largely not exposed to a single grouping of consumers or region or country, giving them more chance of success in the face of tough times in a particular area.

3. Geared to a weaker rand

With a weakening rand a key risk to several companies’ profitability, it is important to bear currency risk in mind when researching and assessing potential shares. Well over two-thirds of the aggregate revenues of our Top 10 shares are generated either directly overseas, or are exposed to a foreign currency (e.g. Sasol’s exposure to the rand/dollar oil price).

Most, but not all, of the companies in our Top 10 also have strong leadership who are capable of navigating their companies through what could become even more difficult times. Leadership can be a key differentiator between similar companies in a sector, but it is often also built into the share price.

Our current holdings

Table 1 reflects a disparate selection of shares from a variety of sectors; from financials, to industrials to resources. Some are defensive plays, like British American Tobacco, SAB Miller and Sanlam. Some are cyclical, like Sasol, Mondi and Anglogold. A closer look will show that their cycles are all very different, which provides added diversity.

In summary: We believe investors are best served over the long term through a well-diversified selection of shares that trade at discounts to their intrinsic values. We rely on our investment philosophy and research process to uncover the best opportunities and invest in these opportunities with conviction.

For a more detailed discussion of our Top 10 holdings we encourage you to watch Simon’s presentation on our Equity Fund holdings, delivered at an Adviser event in October.

Allan Gray Proprietary Limited is an authorised financial services provider.