Some clients have asked for an update on how well their investments are doing in the current very volatile market. It’s risky to respond until things have settled down, and our unit trust prices, published every day on our website, give the latest factual indication of how we are doing (no matter what I write here). Nevertheless, and at the risk that short-term market movements or political developments make me look foolish in retrospect, here is a brief explanation of how your investments are positioned.

Portfolios positioned to preserve capital

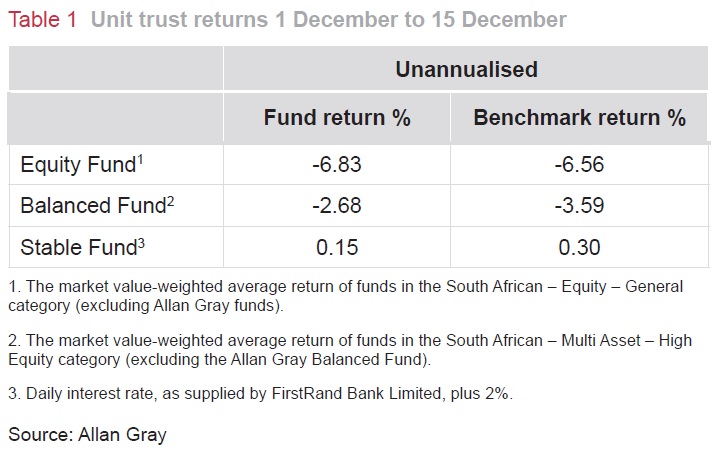

For a while now we have been concerned about South Africa’s poor fundamentals, and our unit trusts have been managed to protect capital. At the time of writing, the Allan Gray Balanced, Stable and Equity Funds have all outperformed their respective benchmarks for the year-to-date, as well as over the past three- and five-year periods. This has been partly due to the strong performance of the JSE-listed equities, which earn profits outside of South Africa. We have been careful to invest substantial portions of our domestic assets into defensive, globally diversified stocks, including British American Tobacco, SABMiller, Old Mutual and Reinet. A weaker exchange rate has been beneficial to these companies, considering a significant portion of their earnings are derived outside of South Africa.

In addition, we have maintained maximum foreign offshore exposure (outside of Africa) in the Balanced and Stable Funds, and obtained your permission early this year to allow the Equity Fund to invest offshore too.

A weaker rand will be good for South African exporters, including our mining companies. On the other hand, South African miners face very difficult social and political challenges and weak dollar prices for commodities. Unfortunately, we have held some exposure to South African mining companies over the last year, and they have detracted from returns. Fortunately, we carefully limited our portfolios’ overall exposure to these companies, and this limited their negative impact on total portfolio returns. We continue to selectively add to our positions in the mining companies, with a bias towards companies with stronger balance sheets, a good position on the cost curve, and proactive and tough executive managers.

Conservative approach to fixed interest exposure

We have positioned the bond exposure in multi-asset unit trusts to do better in a rising interest rate environment. A further downgrade from the ratings agencies would see South African government debt rated below investment grade – ‘junk’ status. Such a downgrade (or the market’s anticipation of it) would cause an increase in government borrowing costs and probably a further sell-off on the local bond market. Foreigners own approximately 30% of our government debt; many would be forced to sell these bonds as they are prohibited from investing in debt instruments which are below investment grade. This would put significant downward pressure on South African bond prices and cause yields to rise, which would invariably have knock-on effects for the rand, which may depreciate further.

Within the Balanced and Stable Funds, we prefer cash and short-term instruments to longer-term bonds. These unit trusts currently have approximately 11% invested in local bonds but, very importantly, both portfolios have a low duration. Duration is an indicator of how sensitive a bond’s price is to a change in interest rates, with a low duration indicating lower exposure to losses arising from an increase in interest rates. If South African bonds were to decline in value as a result of interest rates rising significantly and/or being assigned junk status, we would expect the fixed interest portion of both of these unit trusts to outperform the bond market significantly and protect clients’ capital to a much larger degree.

Both of these unit trusts also maintain significant allocations to cash and hedged equities, which provide further protection against market losses and the option to deploy into more attractive assets as opportunities arise. These positions have been a drag on returns until recently; the value and optionality of liquidity was clear to see in weeks like last week.

Lastly, we have relatively low exposure (less than 2% of the Balanced and Stable Funds) to South African listed property companies. Property companies and their share prices are sensitive to interest rate movements: with the sharp rise in bond yields last week and prospects for more of the same, we remain sceptical of this sector.

Emotional markets present opportunities for the long-term, valuation-oriented investor

Plenty has been written in the last week about the impact of President Jacob Zuma’s decisions to appoint David van Rooyen and then Pravin Gordhan as finance minister. The first decision was unnerving, to say the least. Even so, the very emotional reaction in the markets presented opportunities to buy some shares at prices below their intrinsic worth. On Thursday and Friday last week we traded over R6 billion worth of shares on the JSE (excluding trades in index futures contracts). This is about six times more than we would usually trade over a two-day period.

News headlines and the political and macroeconomic backdrop are uncertain and unsettling; however we remain focused on finding the best opportunities for our clients. While the markets are VERY unpredictable in the short term, we are becoming somewhat more optimistic about the prospects for long-term absolute returns from the stocks in our client portfolios. This is not because we are more optimistic about the economic outlook (if anything we are more pessimistic), but because the prices of many JSE-listed shares have fallen significantly. Over the last five years the FTSE/JSE All Share Index has been beaten by dollar cash despite the outstanding performance of Naspers, SABMiller and Richemont (which now comprise over a third of the index). With some shares now much more appropriately priced for risk than they were five years ago, we are becoming somewhat more optimistic on value to be found in selected shares on the JSE.

Allan Gray Unit Trust Management (RF) Proprietary Limited (the ‘Management Company’) is registered as a management company under the Collective Investment Schemes Control Act 45 of 2002. Allan Gray Proprietary Limited (the ‘Investment Manager’), an authorised financial services provider, is the appointed investment manager of the Management Company and is a member of the Association for Savings & Investment South Africa (ASISA). Collective Investment Schemes in Securities (unit trusts or funds) are generally medium- to long-term investments. Except for the Allan Gray Money Market Fund, where the Investment Manager aims to maintain a constant unit price, the value of units may go down as well as up. Past performance is not necessarily a guide to future performance. The Management Company does not provide any guarantee regarding the capital or the performance of its unit trusts. Funds may be closed to new investments at any time in order for them to be managed according to their mandates. Unit trusts are traded at ruling prices and can engage in borrowing and scrip lending. Performance figures are for lump sum investments with income distributions reinvested. Actual investor performance may differ as a result of the investment date, the date of reinvestment and dividend withholding tax. Movements in exchange rates may also be the cause of the value of underlying international investments going up or down. Different classes of units apply to the Equity, Balanced, Stable and Optimal funds only and are subject to different fees and charges. Unit trust prices are calculated on a net asset value basis, which is the total market value of all assets in the Fund including any income accruals and less any permissible deductions from the Fund, divided by the number of units in issue. Forward pricing is used and fund valuations take place at approximately 16:00 each business day. Purchase and redemption requests must be received by 14:00 each business day to receive that day’s price. Unit trust prices are available daily on www.allangray.co.za. Permissible deductions may include management fees, brokerage, Securities Transfer Tax (STT), auditor’s fees, bank charges and trustee fees. A schedule of fees, charges and maximum commissions is available on request from the Management Company. The FTSE/JSE All Share Index is calculated by FTSE International Limited (‘FTSE’) in conjunction with the JSE Limited (‘JSE’) in accordance with standard criteria. The FTSE/JSE All Share Index is the proprietary information of FTSE and the JSE. All copyright subsisting in the FTSE/JSE All Share Index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved. FTSE is a trademark of the London Stock Exchange Group of Companies. The FTSE World Index is calculated by FTSE International Limited (‘FTSE’) in accordance with standard criteria and is the proprietary information of FTSE. All copyright subsisting in the FTSE World Index values and constituent lists vests in FTSE. All its rights are reserved.