We humans are fallible creatures who suffer from several cognitive biases. Using the COVID-19 pandemic as an example, Rory Kutisker-Jacobson highlights how hard it is to make a considered, unbiased assessment of what the risks are, and how dangerous it can be to allow framing and other cognitive biases to dominate our decision-making.

In a highly uncertain world, we crave certainty. We have a natural tendency to avoid situations that threaten our wellbeing, and we prefer choices that allow us to avoid pain. When a risk seems benign, we may overlook or underestimate it, but when a risk becomes front and centre, we will often prioritise minimising that risk at the expense of all other action – more so if the risk is vivid and visceral. Depending on how we have framed the problem, there is little or no consideration of the consequences of one action over another. Poor framing can result in far from optimal decision-making.

The current COVID-19 crisis provides a classic example

At first, most countries underestimated the risk of COVID-19, but once the vivid and very real images of overwhelmed hospitals in Northern Italy emerged on our TV screens, the pendulum swung in the opposite direction. Faced with the real and imminent threat from the pandemic, governments around the world responded by making minimising COVID-19 deaths the singular focus of all subsequent decisions.

When President Cyril Ramaphosa announced a national lockdown on 23 March, he spoke of this decision as “a decisive measure to save millions of South Africans from infection and save the lives of hundreds of thousands of people”. While acknowledging that sacrifices would need to be made, and that these measures would have a considerable impact on people’s livelihoods, he stated with a certainty that he could not have, that “the human cost of delaying this action would be far, far greater”.

While our knowledge of the virus was highly limited then (and still is today), we sought certainty in uncertain epidemiological forecasts that framed the pandemic solely in potential COVID-19 deaths, which created panic from governments and society at large. We sought social proof from other countries, and instinctively replicated actions undertaken elsewhere, seemingly without due consideration of whether lockdowns would be effective in our respective countries, given our existing socio-economic structures. This risk became the frame for every decision, be it minimising the spread, flattening the curve, or increasing hospital capacity. There appeared to be much less consideration of the cost of these actions, or what the repercussions would be if the forecasts were wrong.

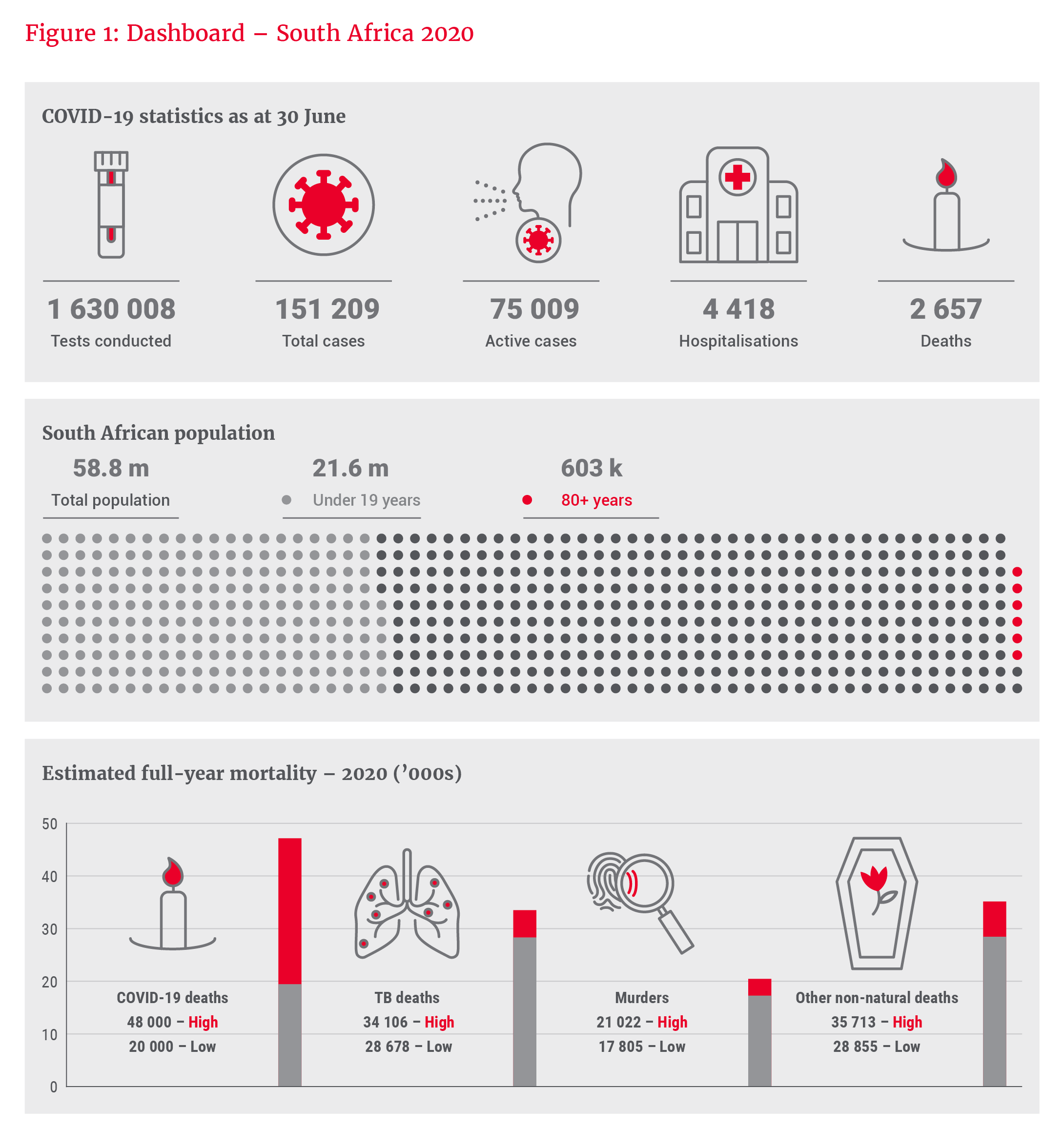

As countries around the world went into lockdown, everyone created dashboards that focused solely on statistics pertaining to COVID-19: daily tests conducted, confirmed cases, active cases, hospitalisation rates, patients in ICU, and deaths. CNN went so far as to permanently have a case and mortality counter on their news broadcasts.

There was no mention of the lives that we anticipated losing due to increases in domestic abuse, or mental health or medical treatment foregone due to lockdown restrictions. No mention of the economic cost and the subsequent lives we anticipated losing due to increases in job loss, poverty, and food insecurity. No discussion about how we would measure whether lockdown was actually being effective in reducing or eliminating the spread, or simply delaying the inevitable. No open assessment of whether the lives saved in the short term were worth the potential long-term cost of lives lost.

Reframing the risks

How different would our perspective be if these daily dashboards reported all the related impacts and the cost of lockdown on society at large? Examples of measures against which the potential benefits of lockdown could be measured in South Africa are described below, while Figure 1 is our attempt at displaying a more comprehensive dashboard to capture a range of elements; there are several more.

- Overall health and wellbeing

As at 30 June, 2 657 South Africans have lost their lives to COVID-19, and this number is likely to climb materially. Current studies estimate that the final range of deaths is likely to be anything between 20 000 and 48 000.

As a comparison, on average, over 31 000 South Africans die from tuberculosis (TB) each year. TB is one of the top 10 causes of death in children, and each year, approximately 17 500 children are treated for TB. TB deaths are highly preventable if diagnosed early and treated appropriately, yet under lockdown, overall TB testing has declined by 50% at a national level. How many additional child deaths are we potentially going to experience as a result? How might we evaluate lockdown measures differently if government reported COVID-19 cases alongside TB tests not conducted and additional lives lost to TB?

Over the last five years, an average of 19 370 South Africans have been murdered each year. In total, over 51 000 South Africans die from non-natural causes each year. All deaths are tragic, but these are arguably more so as almost all non-natural deaths are preventable.

- Household income and education

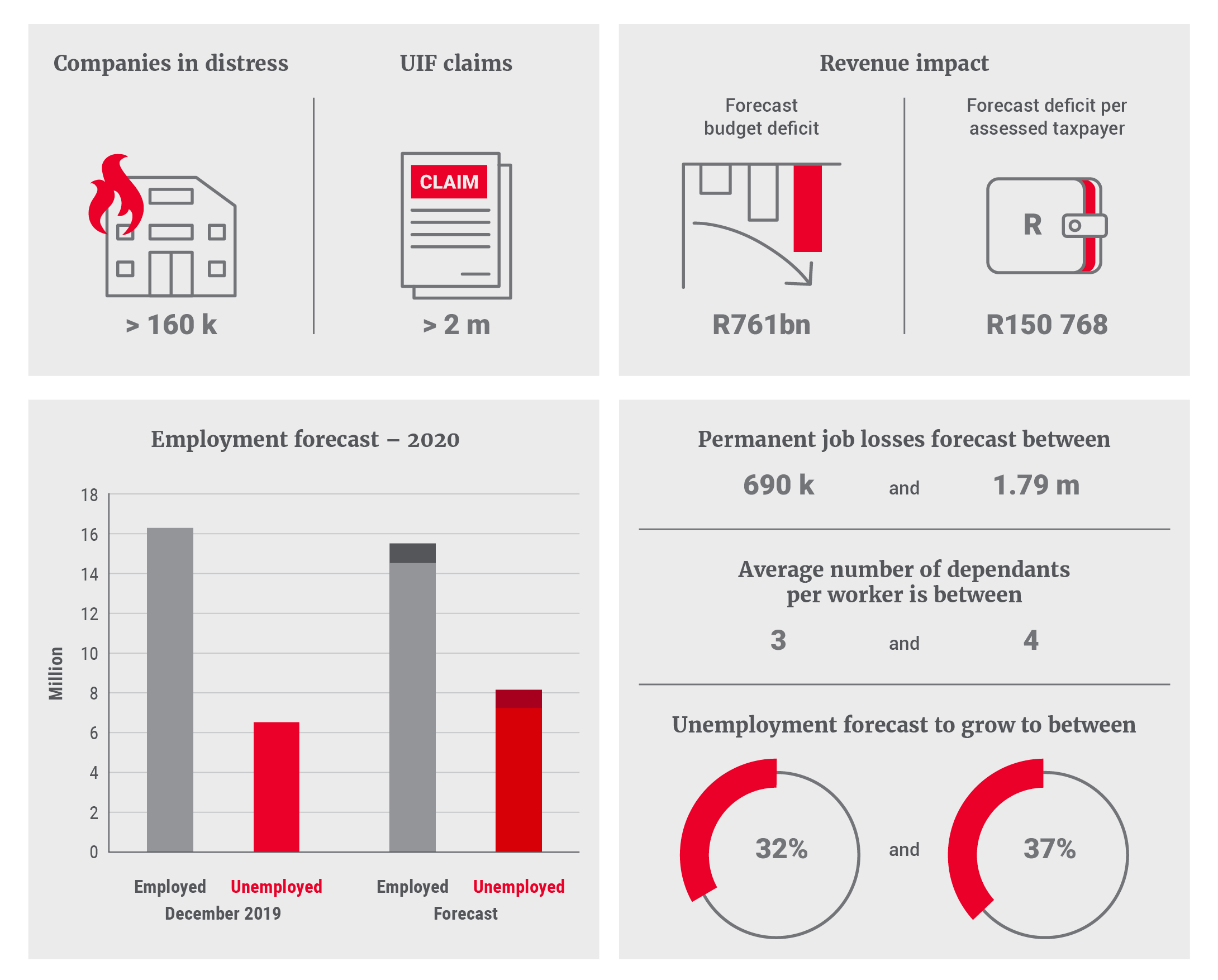

The correlation between poverty and increased mortality is well known. There are a number of studies that indicate a decline in economic wellbeing materially reduces one’s life expectancy. In turn, the primary determinants of economic wellbeing are household income and education.

Over two million South Africans have already claimed from the Unemployment Insurance Fund (UIF) since South Africa went into lockdown, and over 160 000 companies have reported being in financial distress. Many of these companies and jobs will never return: National Treasury now estimates that permanent job losses will be anything between 690 000 and 1.79 million. For a country that employed 16.4 million people and had a 29% unemployment rate prior to lockdown, this is material. Taking into consideration the dependants of those with an income, millions of South Africans will permanently move further into poverty, with the pain likely to be felt more acutely in the already marginalised parts of our society.

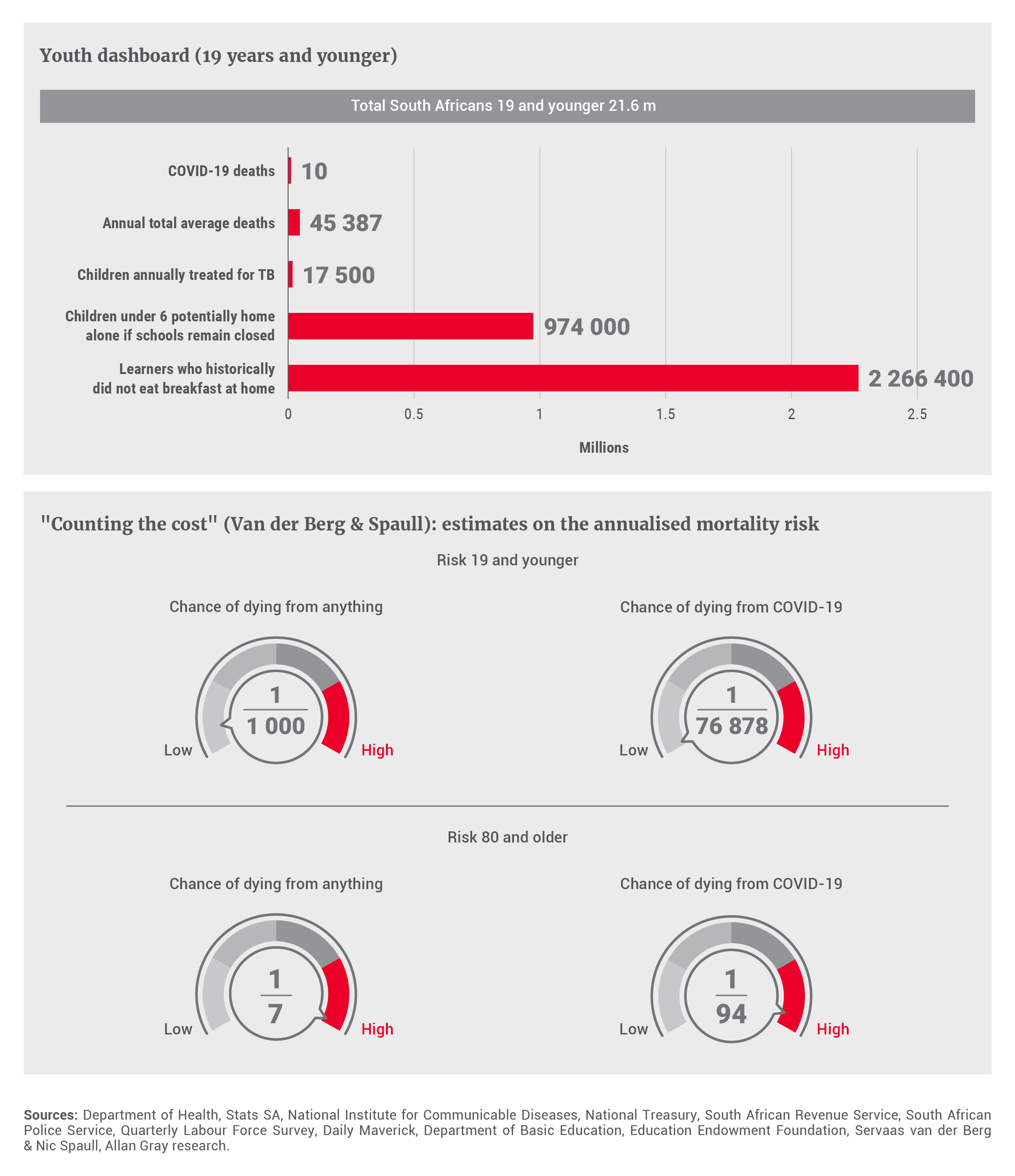

As schools begin to open, many parents are concerned about sending their children back into the classroom, but the morbidity risk from COVID-19 for children under the age of 19 is very low. In any one year, a South African child has a one in 1 000 chance of dying. Based on what we now know about COVID-19 and how it disproportionately affects older people, one study estimates that the risk of those under 19 dying from COVID-19 is one in 76 878. A child is more likely to die en route to school than from a communicable disease picked up at school.

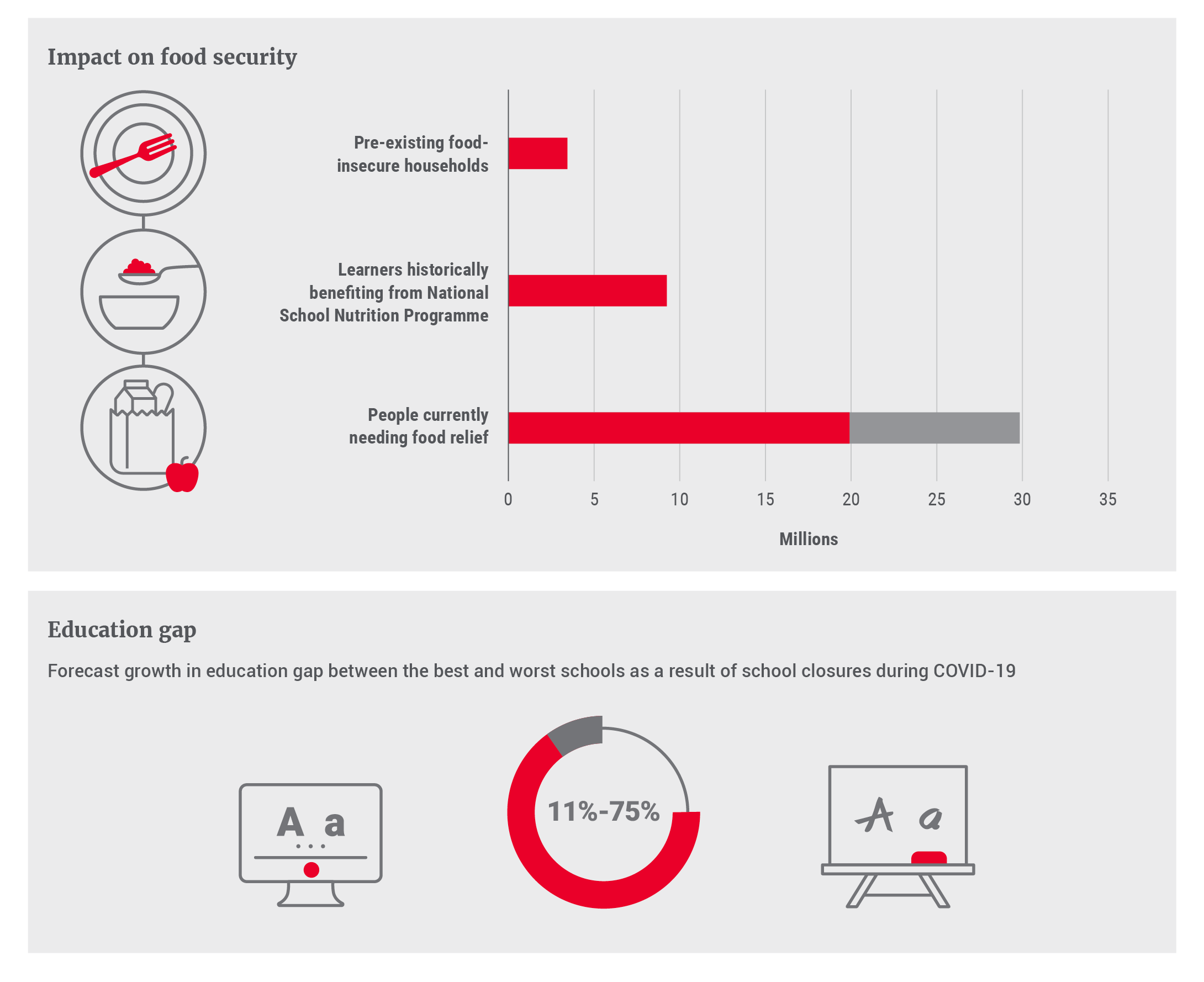

At the same time, keeping our schools closed is having a permanent impact on many of our children in South Africa, and it is disproportionately impacting the poor. The National School Nutrition Programme supports over 19 000 schools, feeding over nine million children each day. An estimated one in five South African learners do not eat breakfast at home. Under lockdown, many of these meals are not finding their way to the children most in need.

Similarly, depending on how consistently schools can go back to teaching for the rest of this year, children will have lost between 14% and 33% of the regular academic year. Children from wealthy households have been able to substitute school learning with online classes in the convenience of their own homes, but these facilities are not available to many of the poorest in our country. As a result, one study indicates that the education gap between the wealthiest and poorest is likely to widen by between 11% and 75% this year. This gap is unlikely to ever be closed, further exacerbating inequality for these learners.

How different would our perspective be if these daily dashboards reported all the related impacts and the cost of lockdown on society at large?

Framing in investment decision-making

Understanding and avoiding these cognitive biases has several parallels in investment decision-making. It is important to consider risk from multiple perspectives.

The most obvious risk is likely to be the most recently experienced, but it is unlikely to be the only risk. The single largest determinant of future investment returns is the price you pay today. Irrespective of the underlying quality of a company, pay too high a price at inception and the subsequent investment returns will be disappointing.

Similarly, when a company is undergoing difficulties, investors tend to only see risks and price the company as if the current turmoil is permanent. At times they will be willing to sell at almost any price. This creates opportunities for long-term investors like us, who are happy to buy such shares if we are adequately compensated for the risks. All too often, the future only has to turn out marginally better than what is currently expected for the subsequent returns to be excellent. As an example of this, consider our view on South African banks in Tim Acker’s piece.

Be careful about making decisions based on expert models

In highly uncertain environments like today, we gravitate towards people who speak with confidence and provide us with assurance based on models or other compelling forecasts. But forecasting is an inexact science and it is important not to place excess confidence in the predictive ability of models. The future is inherently uncertain, and risk means that more things can happen than will happen. As US economist John Kenneth Galbraith once said: “We have two classes of forecaster: Those who don’t know – and those who don’t know they don’t know.”

So how do we get around this?

We invest with a multidisciplinary view and a margin of safety. Not knowing what the future holds requires us to consider a number of potential outcomes and opposing risks. This requires us to be rational, seek out dissenting opinions, and consider incomplete and often conflicting information. We acknowledge that we don’t know what the future holds, and so we seek to buy companies trading at a significant discount to our estimate of fair value to account for a variety of outcomes.

It is important to consider risk from multiple perspectives

Frame and reframe

All too often, our choices involve trade-offs. The world is complex, and our instinctive reactions fail to adequately account for the interplay between various elements. You cannot eliminate all risks. Overestimating the risk in one area may result in us materially underestimating the risk and costs in others.

As investors, we constantly need to balance the risk of loss against the risk of losing out. We need to be as conscious of the limits of our knowledge as we are of what we know. We need to approach problems from multiple angles, and be comfortable making sometimes counter-intuitive and uncomfortable decisions.