Uncertain times may cause investors to shy away from risk. While it is important to be mindful of risk and understand the risks you are taking on when investing, avoiding risk at all costs may not be the most rewarding strategy. Nadia van der Merwe discusses why we think the current environment offers exciting opportunities for patient investors willing to do the research and take on risk where it is warranted.

Clients often view Allan Gray as a conservative investment manager and may be surprised when they find shares in the portfolios which are regarded as high-risk, especially in times of heightened uncertainty. Actually, we do not classify our approach as strictly conservative. We are willing to take substantial positions in stocks in which we have high conviction and position our portfolios very differently from the market or benchmark. Indeed, we often find attractively priced opportunities in the unpopular areas of the market, which means we may have considerable exposure to stocks that are out of favour and perceived as high-risk.

Our decisions are driven by our valuation-based contrarian approach (see Are you comfortable swimming against the tide?), where we take a different view of risk. In our view, the biggest risk investors face is the risk of permanently losing money, and this can often come about as a result of overpaying for an asset. Therefore, we aim to invest in companies that are trading at substantial discounts to our estimates of what they are worth (their intrinsic value).

A temporarily adverse environment for a good company can create a great long-term buying opportunity

While investing always involves some risk, as the future is inherently uncertain, we manage the risk of loss carefully throughout our investment process (as Andrew Lapping explains). We believe risk cannot and should not be avoided completely; rather, risks should be understood and embraced in a selective manner. Uncertainty and opportunity go hand in hand.

Risky business?

It is important to recognise that a riskier business doesn’t automatically make for a riskier investment. A company believed to have significant risk exposure may face a broad range of potential outcomes, both positive and negative. In severe cases, the negative outcomes could threaten the sustainability of the business, but more often this is not the case – the company may merely be facing temporary challenges. The presence of risks does not automatically render a company unsuitable for investment, as long as the business fundamentals are sound and the challenges can be navigated successfully.

Understanding the risks faced and their potential impact on the sustainability and intrinsic value of the company is important, yet ultimately, when evaluating the riskiness of a company as an investment, the key factor is the price you pay. The level of the purchase price in relation to intrinsic value is the most powerful indicator, not only of future returns, but also of the risk you take on, and it is the one factor over which you have the most control. A low enough price can go a long way to reducing the riskiness of the company as an investment. Similarly, a very stable business can be a high-risk investment if the price is too high. At Allan Gray, we are happy to invest in a riskier company as long as we can do so at the right price.

A company’s share price is a reflection of the market’s expectation of the future performance of the business. Generally, a low price relative to a business’s fundamentals implies that the market’s outlook for the company’s future performance is poor. If it exceeds expectations, the share price typically reacts positively, and vice versa.

Uncertainty and opportunity go hand in hand

Market participants, however, may not always place enough focus on the actual business fundamentals because they simply consider the business’s obstacles insurmountable. In addition, investors’ willingness to take on risk varies over time, which may also impact the share price. Sometimes investors are willing to pay higher prices than they would otherwise. At other times, they are very hesitant to take on any risk; lower demand may reduce prices, as may any form of negative news. We think the current environment fits the latter more than the former. Companies perceived to be high-risk have been shunned, with share prices moving sharply in response to news flow.

Sentiment towards a company is also influenced by the extent to which the risks the company is exposed to are known and appreciated. Often when the risks facing a business are particularly obvious, investors become overly pessimistic – even if the business has a long track record of successfully navigating challenges and generating decent returns for shareholders. Similarly, in the absence of obvious risks, share prices may continue to climb.

We are more excited today about the prospect of future returns than we have been for some time

Looking at global markets today, investors appear far less willing to take on obvious risks. With factors such as corporate failures, trade wars, political uncertainty and a lack of economic growth dominating the headlines, investors have shied away from shares that appear to carry above-average risk. Instead, capital has flowed into the seemingly safer areas of the market, bidding up prices to ever higher valuations. This flight to “safety” has resulted in investors ignoring many of the businesses that are perceived to be riskier, with little regard for valuation.

How to cut through the noise

When analysing companies and assessing intrinsic value, we aim to cut through the noise. This means looking through the good news, as well as through the bad, to evaluate the long-term reality. Where negative news is plentiful and the risks are obvious, opportunities abound for the patient investor. For us, the most important consideration is the quality of the business in relation to what it costs.

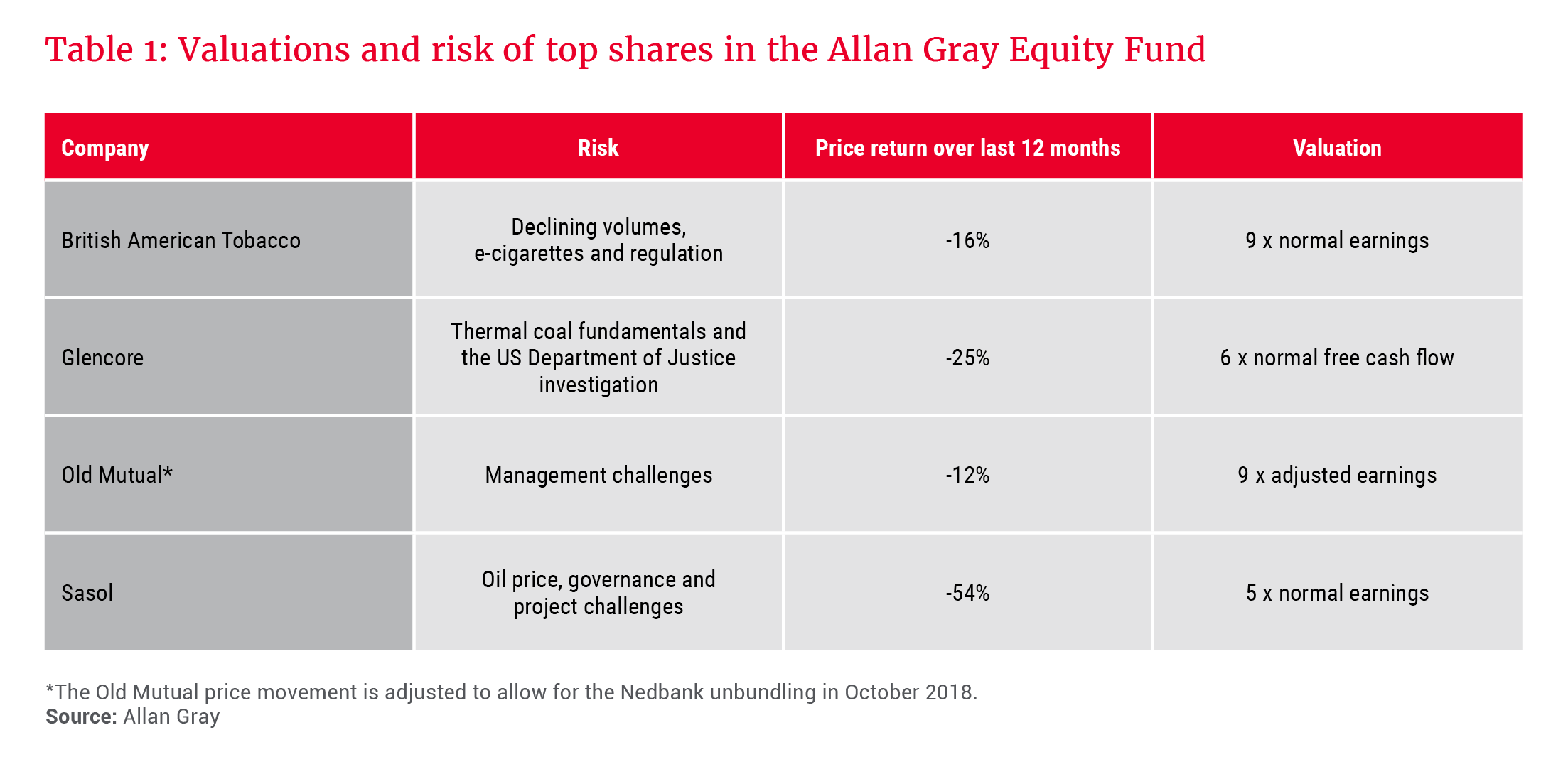

A number of the companies in our portfolios have had their fair share of bad news recently, but this potentially leaves a higher return for those willing to do the work and take on the risk where warranted. When looking at some of the biggest shares in our portfolios, the major risks are quite easy to spot, as highlighted in Table 1. We don’t pretend that these risks don’t matter; rather, we have spent a significant amount of time and effort to understand how the risks may impact the fundamental value of these businesses. These are not junk businesses – their fundamentals are solid and they should be able to navigate the current environment and overcome temporary headwinds. However, because their risks are easy to spot and recent news has remained negative, it has further impacted their share prices. This has been painful for our clients, but we think the extent of the sell-off has been unjustified.

As set out in Table 1, the current valuations of these stocks look particularly attractive, trading far below their historic levels as well as the overall market, and provide an adequate margin of safety against further adverse developments. We think the potential upside far outweighs the likely downside from this point forward – an attractive feature for us.

Priced for perfection

We typically struggle to find good investment opportunities in areas of the market where optimism abounds. Shares in these areas may appear to be low-risk, pricing in a lot of good news, yet their fundamentals are often not as strong as the prices suggest.

We tend to take a more cautious approach when valuing these businesses. When shares are priced for perfection, it does not take much to disrupt their price trajectory: lower-than-expected growth, regulatory change, etc. We have seen many such examples over the years. Conversely, we believe the risks in the companies we own are more than reflected in their valuations. We think the potential for the prices to fall further is far smaller than for many of the strong performers. These companies only need to perform “okay”, or the feared outcome only needs to be slightly less bad than anticipated for the shares to perform well.

Our portfolios are constructed to manage the risk we take on in generating returns. We are more excited today about the prospect of future returns than we have been for some time. As our founder, Allan Gray, often says: “A temporarily adverse environment for a good company can create a great long-term buying opportunity.” When the market is assuming the worst, there is the possibility of substantial upside even if things merely turn out “less bad” than feared.