For many years, Naspers was the star performer of the South African stock market. The onset of COVID-19 drove the Naspers and Tencent share prices to new heights, as was the case with other technology stocks that benefited from lockdowns. In the last year, this success story has seen an abrupt reversal. Tim Acker investigates what has driven this turn of events and assesses the investment case.

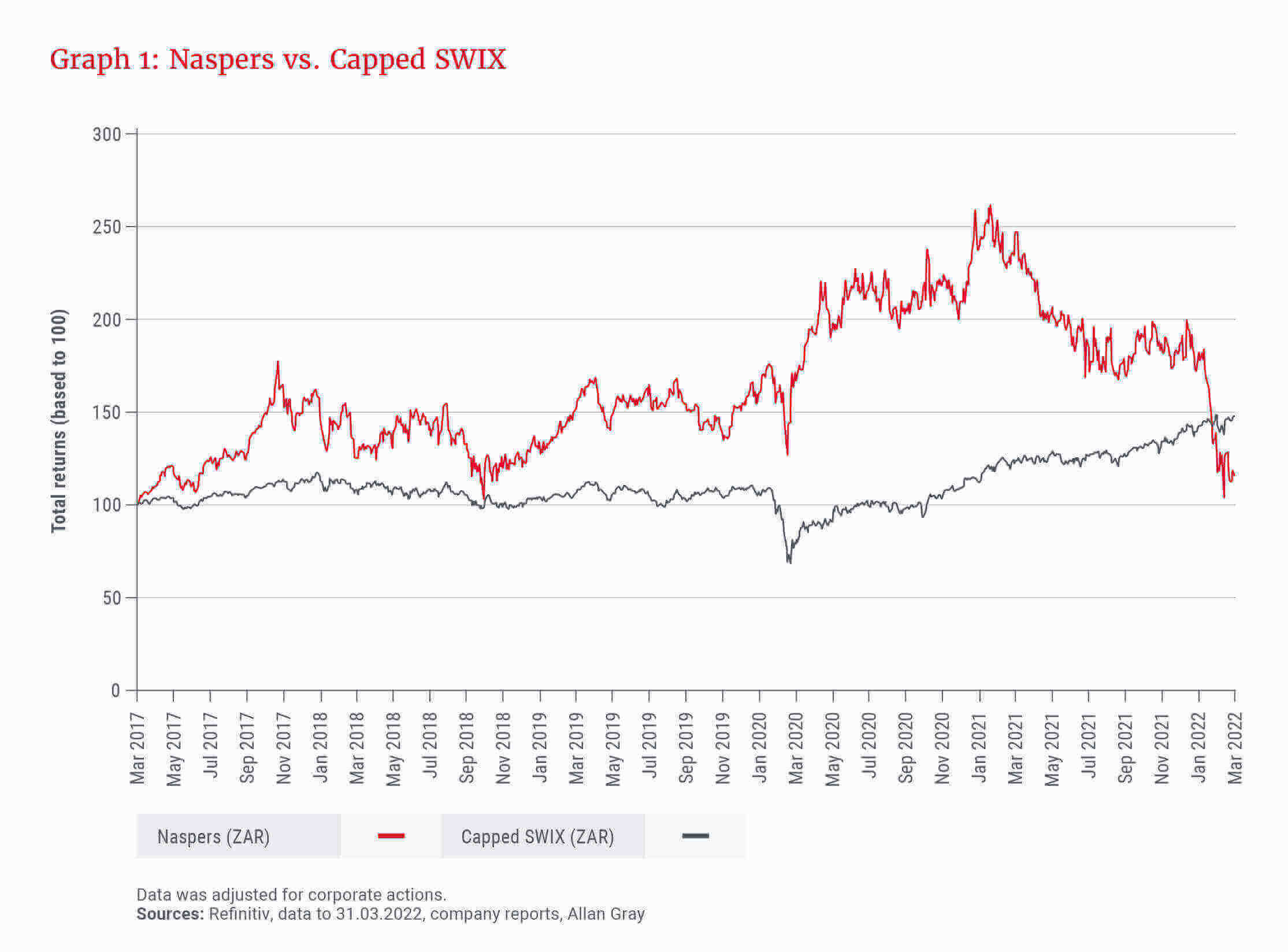

After an extended period of stellar performance, as at 31 March 2022, the Naspers share price was down 51% from its peak in early 2021. The share has now underperformed the market, as represented by the Capped SWIX, over five years, as shown in Graph 1. Has something fundamental gone wrong at Naspers, or is there value to be had at the current price?

The Naspers business has evolved many times over the company’s 107-year history, from publishing and printing, to pay-TV, to internet holding company. Naspers’s purchase of a stake in a tiny Chinese technology company called Tencent in 2001 has created immense value for South African investors, as has the decision to hold the investment for more than 20 years. The success of the Tencent investment has been so extraordinary that it has overshadowed all other parts of the business. In recent years, Naspers’s investment portfolio has been split roughly 80% Tencent and 20% everything else. Prosus is a subsidiary company listed in the Netherlands, but shares the underlying investments, so for most purposes, one can think of Naspers and Prosus as the same thing.

To understand the Naspers business today, what has gone wrong recently, and any future potential, one must look at the business in three parts:

- Tencent

- The collection of other businesses

- The combined value relative to the share price

Tencent

The Tencent share price has taken a beating recently. There are many contributing factors: declining valuations for tech businesses globally, increasing regulatory headwinds in China, a slowing Chinese economy, US rules that may disallow Chinese companies from listing in the US, and a concern that some version of sanctions may be imposed against ownership of Chinese assets (similar to what has recently happened to Russian stocks). In summary, our view is that the intrinsic value of Tencent’s business has decreased and the risks have increased.

… a price decline is not automatically a buying signal.

Our research of regulations imposed by China suggests that some of the negative headlines are noise and will have only a marginal impact on Tencent. Indeed, many of the regulations are catching up to similar regulatory trends in Europe and the US and are not necessarily negative in the long term. However, this is not true in all cases. Some new regulations seem to be intended to transfer value from platform internet companies like Tencent to consumers and small businesses, or seem driven by non-economic objectives of the Chinese government that seem irrational to most Western observers. Some of these variables are inherently hard to predict, such as the Chinese government’s next regulatory action, or whether China will align itself more closely to Russia’s war in Ukraine, leading to sanctions from the West. These harder-to-predict issues argue for risk mitigation actions, such as a smaller position size in the portfolio.

But it is not all bad news. In many ways, Tencent is less at risk than other Chinese tech companies. The business creates value for consumers, advertisers and small and medium-sized enterprises (SMEs), manages regulatory issues well in general and faces little direct risk from the change in US listing rules (as the primary listing is in Hong Kong). Despite outperforming other Chinese tech stocks, as shown in Graph 2, the Tencent share price is still down substantially.

Overall, Tencent’s business is still very well positioned in China, with many potential avenues for growth. The valuation is close to the lowest it has been since Tencent listed in 2004. However, it is important to emphasise that the risks have increased, and the possibility of irrational or negative government actions cannot be ruled out.

Other businesses

Naspers started investing in internet businesses in the 1990s. In the early 2000s, following the dotcom crash, it paused for a few years, later resuming investments and then stepping up the pace when the current chief executive officer took over in 2014. Since 2014, Naspers has invested in excess of US$20bn, but has also realised some value from successes such as Flipkart (Indian e-commerce company) and from trimming its stake in Tencent.

Some of the investments are starting to reach maturity e.g., OLX (online classifieds business), but many are still in very early stages, such as the various education technology businesses. Naspers has also placed big bets on online food delivery businesses such as Delivery Hero and iFood. These are growing rapidly and offer a large potential prize, but the jury is still out as to whether they can be sustainably profitable. Other investments include the payments company PayU and online retailers eMAG and Takealot. The pay-TV business was distributed to shareholders in 2019.

The investments in these other internet businesses have been funded by dividends from Tencent, which is something investors have often criticised. As with any company, our approach is to look at the underlying businesses and investment decisions in detail, both to form a view of the intrinsic value of these businesses and to assess whether management has been allocating capital well on behalf of shareholders.

In Naspers’s case, this is complicated by many of these businesses being at an early stage, resembling a venture capital portfolio, which will have some failures and some large successes. Time will tell whether the investment track record of Naspers’s current management team has been good, but so far, the results, excluding Tencent, look unexceptional. Our assessment of the value of these businesses is updated as new data emerges, but is currently lower than management’s assessment. Even so, the value is significant at an estimated US$25bn to US$40bn.

Market valuations of unprofitable, early-stage technology businesses have declined significantly over the last year. While this was an overdue correction, in our view, it does unfortunately lower the value at which Naspers can sell investments. There are also some positive consequences to lower valuations, such as allowing Naspers to invest new money at lower prices and potentially thinning out the field of competitors for some of its businesses, as capital will be harder to raise.

Combined value relative to the share price

There are many reasons why holding companies trade at discounts to their underlying assets. Discounts of 20% to 30% are fairly common, but very large discounts are often an indication that something has gone wrong, e.g. a loss of confidence in management, poor capital allocation or high running costs.

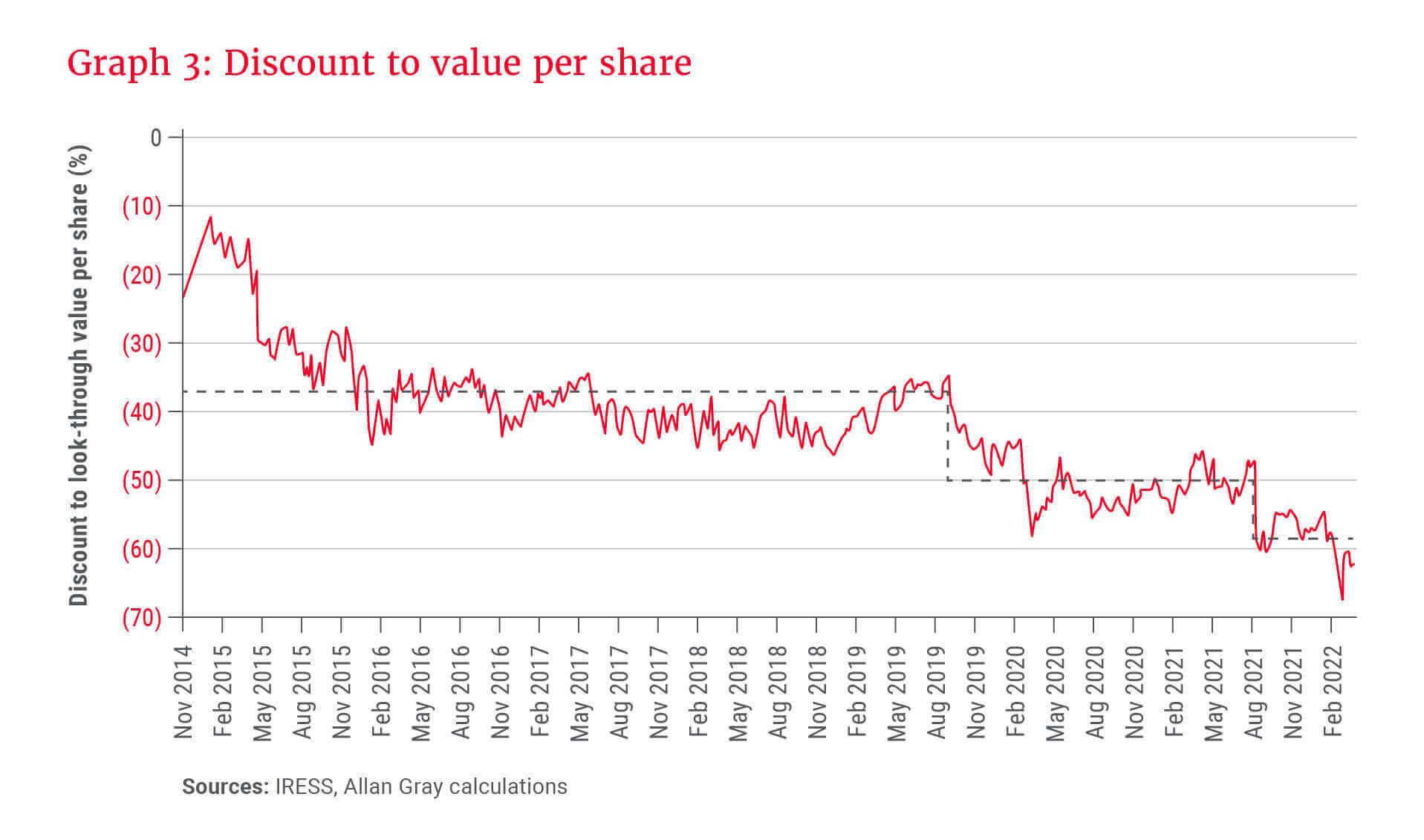

The Naspers holding company discount has been on a steadily increasing path, with big-step changes when the Prosus structure was introduced in 2019, and again in 2021, when the share exchange and cross-holding were introduced. Both of these were increases in complexity, which the market did not like. Allan Gray recommended a vote against the share exchange transaction. The current structure, while overly complex, does have some advantages, e.g. it is efficient from a tax point of view, and there is potential for simplification down the line.

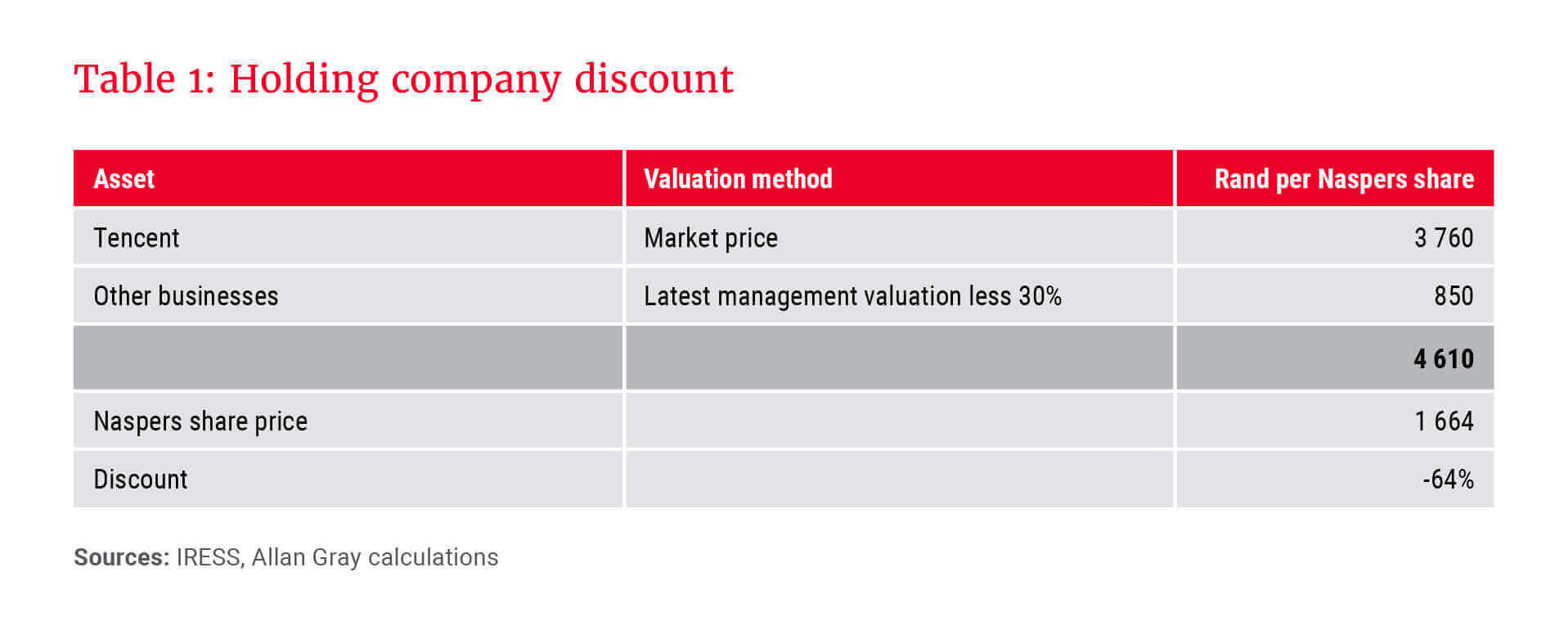

Much of the public criticism against management for not pursuing a simple structure is valid, but one should also acknowledge that there are obstacles such as regulatory approvals, tax considerations and operational requirements. As shown in Table 1, the current discount is very large at 64%; Naspers trades at less than half the value of its underlying investments (see Graph 3).

Unfortunately, with Naspers, the trend has been an increasing holding company discount, which has caused the Naspers share price to underperform Tencent. Frustratingly for investors, it is uncertain when and how the Naspers discount will narrow. But the massive size of the discount creates some margin of safety and the potential to unlock significant value in various ways. For example, any asset that Naspers can distribute (or sell and distribute the proceeds) creates an approximately 3x uplift in value (going from 64% discount to no discount on distribution to shareholders). Similarly, buying back shares is highly accretive. At a 64% discount, R1 of asset value can be bought for 36 c – an almost 3x immediate return on any capital deployed. Both these examples are before assuming any narrowing of the discount itself, which would be additional upside.

… the massive size of the discount creates some margin of safety and the potential to unlock significant value in various ways.

Naspers management is coming under increasing pressure to unlock value from the structure, rather than pursue new investments. There are different ways in which the structure can be simplified, each with its own trade-offs, for example selling or partially unbundling Tencent, separately listing all the other businesses, or selling off assets individually. Allan Gray recommended a vote against the remuneration policy at the most recent AGM, but there have at least been some improvements to management incentives in recent years, which will hopefully improve alignment with shareholders.

So what has gone wrong?

To come back to answering the title of this article: The share price decline has been caused by several factors. Some have been external factors outside management’s control (e.g. a general reduction in valuations of tech companies, a loss of value of Naspers’s Russian assets and a sharp turn in sentiment to Chinese assets), and some have been self-inflicted actions (e.g. not unlocking more value from asset sales or unbundlings and overcomplicating the structure). It is too early to make a final judgement about some aspects, e.g. management’s investment track record. Regardless of the reasons, some of these factors are likely to be permanent changes that reduce our estimate of the value of Naspers and Prosus shares, while some may be temporary in nature, creating opportunities for long-term investors.

...our view of intrinsic value has declined, but is still above the price at which the share is trading.

Even though we are value-orientated investors, who buy shares when we believe they are below our estimate of their intrinsic value, a price decline is not automatically a buying signal. We first review our estimate of intrinsic value, considering new information and the various scenarios that could play out. In this case, our view of intrinsic value has declined, but is still above the price at which the share is trading.

Currently, we think Naspers/Prosus presents an attractive opportunity, and it makes sense to own a fairly large position. As always, this may change if our view of the facts changes, or if there are more attractive alternatives. Very importantly, we carefully consider the risk of loss, which plays into factors like the size of the position. Risk is also considered at a portfolio level, e.g. a portfolio’s total exposure to China. This last point is important given that many of the large JSE-listed businesses have significant direct or indirect exposure to China.