We are ‘bottom-up’ investors who pay more attention to valuations than to macroeconomic forecasts. We do extensive research to calculate what we believe is intrinsic value (the underlying worth or price you would pay for the business), and buy assets when the discount between this intrinsic value and the market price is sufficiently large to limit downside risk.

Earlier this year we were able to find commodity-related shares that meet this criterion. As an example, African Rainbow Minerals has little debt, owns low-cost assets and we were able to invest when it was trading at a particularly low multiple of our assessment of normalised free cashflow. Similarly, Glencore generates reliable cashflow and is run by management who focus on shareholder value. We invested in Glencore when negativity around its debt was overwhelming these positives.

The benefits (or not) of hindsight

Despite such opportunities, we remain cautious on commodity prices. One reason for this is what can be called ‘obvious in hindsight’ warning signs.

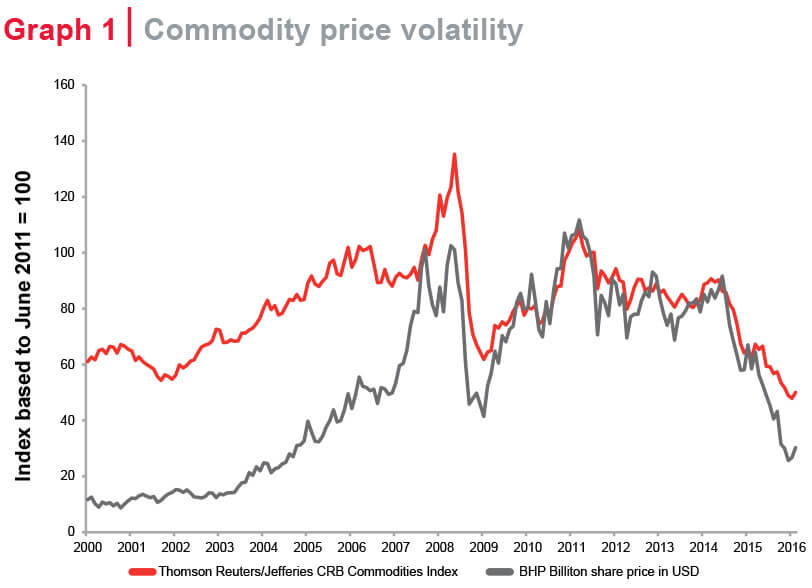

Commodity profit margins provide an example of a warning sign that has influenced our investment views in the past. Five years ago, at the peak of the commodity boom, it was so profitable to mine commodities that a record amount of capital was invested. This investment led to higher supply, which in turn led to lower commodity prices. Graph 1 illustrates the extent to which the prices of underlying commodities and the share prices of commodity companies such as BHP Billiton have fallen from the peak. With hindsight, this is obvious and often referred to: ‘the best cure for high prices is high prices’.

There are similar warning signs today. One may be that last year China consumed approximately 50% of a global commodity basket but only generated 15% of global GDP. The large gap between the two cannot continue indefinitely; either China should generate a higher share of global GDP, or it should consume a lower share of commodities. We believe most of the adjustment will come via China using relatively less commodities. If this plays out, sometime in the future it will be obvious that China’s commodity demand was unsustainably high.

More concerning is that a credit correction in China may also be obvious in hindsight. China has experienced a rapid credit boom since the global financial crisis, with private sector non-financial debt increasing from 120% of GDP in 2008 to more than 200% today. Similar increases in debt have proven unsustainable in other countries, and led to some form of correction. Put more bluntly, most credit booms end in busts, a recent example being American mortgages in 2008. Chinese statistics are notoriously unreliable but if the country’s credit figures are somewhat accurate, it is merely a matter of time before it experiences its own version of a credit correction.

However, it is not clear how China’s credit correction will happen. An important variable is the party funding the credit. By most accounts, the lenders in China are state-owned banks and enterprises, in other words, the Chinese government. Therefore, the government would need to trigger a correction. This seems unlikely since doing so would harm the Chinese economy, at least in the short term. The government’s alternate solution seems to be to ‘kick the can down the road’ by refinancing debt into longer maturities or converting debt to equity. Such actions may avoid short-term pain but seldom solve the problem, often resulting in sustained low economic growth as seen in Japan since the mid-1990s.

Investment implications

Whether quickly or slowly via government actions, we believe that China needs to de-leverage. In a few years’ time, looking back it may be obvious that China today was using too much debt to consume too many commodities. We are thus cautious when investing in commodity-related shares but continue to look for opportunities where bottom-up valuation is sufficiently attractive to offset the risks.