With the end of the tax year fast approaching, investors who are saving for retirement through their employer’s umbrella fund have until 28 February to maximise the annual tax incentives the government has put in place to encourage South Africans to save.

The government aims to stimulate retirement savings by ensuring a person’s take-home pay does not decrease directly in line with the amount of additional contributions they invest in retirement savings.

Contributions to umbrella funds are deducted from members’ salaries before tax. If a member contributes an additional 5%, their take-home pay will not decrease by 5% because they pay less tax on the reduced pre-tax income.

As your contribution levels to an umbrella fund increase, more money is invested in your retirement savings and less goes to the tax man.

Every year members are able to make a pre-tax contribution to their umbrella fund of up to 27.5% of the higher of their taxable income or remuneration, capped at R350 000 per year.

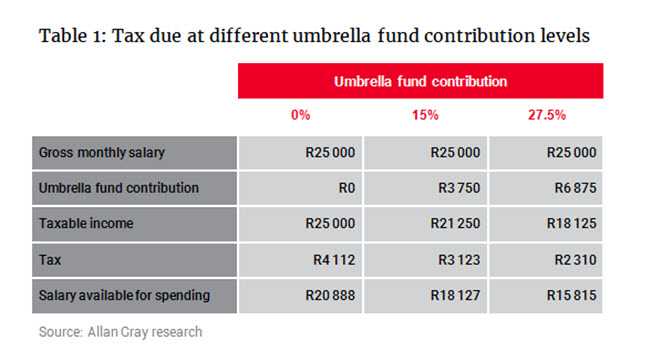

Table 1 shows a person earning R25 000 per month and contributing 15% or R3 750 to an umbrella fund. This person would take home R18 127 after an amount of R3 123 is deducted for tax. If the same person maximised umbrella fund contributions to 27.5% this would amount to an investment of R6 875 and a salary of R15 814 after tax of R2 310. By contributing more and taking a lesser salary, this person’s annual tax bill will be about R9 700 less and his retirement savings would receive a massive boost of an additional R37 500 for the year.

If your total contribution to your employer’s umbrella fund for the year is not 27.5% of your remuneration, you can maximise your tax benefit by making an additional voluntary contribution to the umbrella fund before 28 February if the fund’s rules allow for this.

Not everyone can afford a monthly salary reduction to take advantage of the maximum tax benefits. In this case, it is worth considering making top-up investments into the fund throughout the year when there’s money to spare. Speak to your payroll administrator to make this happen.

Investors who plan to make use of this tax concession invest as soon as possible to allow for the investment to process before the 28 February deadline.