In a country where the vast majority will not retire financially independent, employers have an opportunity – and, arguably, a responsibility – to do more to improve retirement outcomes for employees across all levels of their organisations. Belinda Carbutt proposes a strategy for employers to contribute towards securing a more prosperous retirement for their employees.

Employers play a crucial role in retirement savings in South Africa. While it is not mandatory to offer a retirement savings benefit, many employers recognise the important role employer-arranged retirement investments, such as umbrella funds, can play in supporting employees’ long-term financial wellbeing and attracting and retaining talent.

While employers who offer a retirement fund benefit have a fiduciary responsibility to take steps to safeguard the financial interests of members, legislation gives little guidance on how to encourage and promote healthy, long-term employee contribution rates. To address this gap, employers can turn to insights from behavioural finance, which offer practical strategies for improving employee saving habits.

Learning from the behavioural finance experts

Human beings aren’t naturally wired to prioritise long-term investing. The underlying behavioural issues which give rise to low savings rates have been studied extensively by Nobel Prize-winning economist Richard Thaler and behavioural finance expert Shlomo Benartzi. Their research led to the development of the Save More TomorrowTM (SMT) strategy: a behavioural tool designed to overcome savings inertia and help people increase their retirement contributions gradually – without the immediate sting of reduced take-home pay.

How the Save More TomorrowTM strategy works

The SMT concept is built on three key behavioural insights:

- Present bias: We naturally place greater value on immediate rewards than on future ones. SMT sidesteps this by encouraging employees to commit today to saving more later, typically timed with their next salary increase.

- Loss aversion: People experience the pain of loss more intensely than the pleasure of a gain. By linking contribution increases to pay increases, SMT ensures that take-home pay doesn’t noticeably shrink, reducing the sense of loss.

- Inertia: Once in place, most people are unlikely to opt out of a system. SMT uses this to its advantage by automating the increase in contributions, turning inertia into a mechanism for positive savings growth.

The outcome is a strategy that works with our natural instincts rather than against them, guiding individuals towards stronger financial outcomes.

From theory to practice: The glide path

Employers who offer an umbrella fund can consider incorporating a glide path. The glide path, like the SMT strategy, helps members gradually increase their retirement savings contributions over time, using their future salary increases. A glide path is tailored to the requirements of each employer. Below is an example of how this can play out:

- Minimum contribution of 7.5% of pre-tax salary

- Annual escalation of 1% takes place automatically, in line with the salary increase cycle

- The glide path is capped at 15%

The power of the glide path

Let’s look at a real-world example:

- Meet Thandi: She earns R20 000 per month and currently contributes 7.5% of that (R1 500) to her retirement fund.

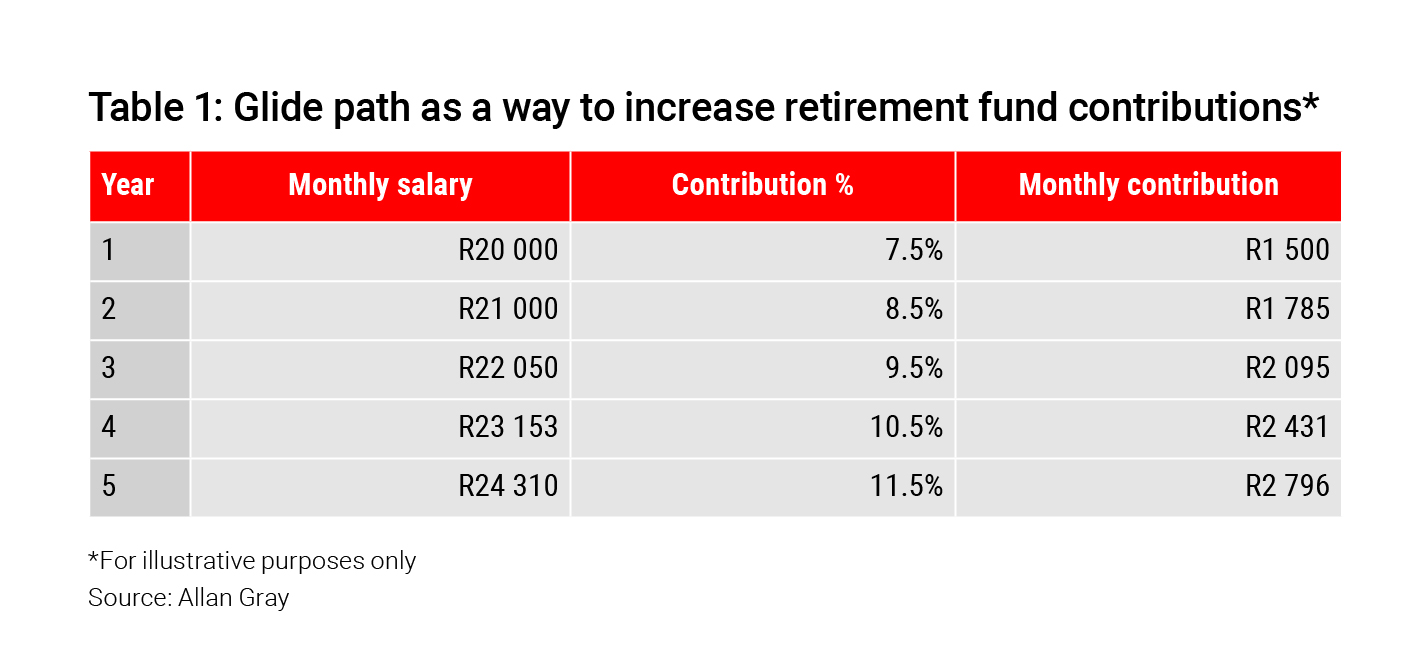

- Thandi opts in to the glide path, with her contribution rate increasing by 1% each year, aligned to a 5% annual salary increase, as shown in Table 1.

In just five years, Thandi almost doubles her monthly retirement contribution – from R1 500 to R2 796 – without ever seeing a drop in her take-home pay. Over decades of employment, this steady increase has a compounding effect, significantly boosting the final value of her retirement savings.

This simple strategy builds long-term financial security, while helping individuals overcome the mental hurdles that often make it hard to save more.

Turn inertia into momentum

When it comes to retirement savings, most people benefit from help to move from intention to action. By leveraging behavioural strategies like the glide path, employers can assist their employees to overcome inertia, avoid grappling with short-term sacrifice and steadily build wealth.

What may start as a gentle nudge can lead to a profound shift – not just in contribution rates, but in financial outcomes. For employers, it is a powerful, practical way to foster a culture of saving and help more South Africans retire financially independent.