There is a lot going on in the regulatory space. Between retirement reform, on the one hand, and the so-called ‘Twin peaks’ model of financial regulation on the other, it is challenging to keep on top of the changes that are imminent and those that are still some way off. With the first of the changes coming into force from March 2015, let’s review where we are at:

Increased tax deductions for contributions to retirement funds: delayed

Retirement annuity fund members will have to wait to enjoy increased tax deductions from their contributions to retirement funds. The tax deduction of up to 27.5% of the greater of taxable income or employment income, and the introduction of an annual contribution ceiling of R350 000, have been delayed until at least 1 March 2016.

Aligning retirement funds: delayed

Proposals to harmonise retirement funds have also been delayed until at least 1 March 2016. Treasury has stressed that vested rights will be protected, and that provident fund members will not be forced to annuitise their historic savings. This hasn’t prevented knee-jerk reactions from some investors concerned about the future of their retirement savings.

The proposal to include employer contributions to occupational pension and provident funds in the gross income of employees as a fringe benefit has also been delayed. This means that employees cannot treat these contributions as their own when calculating their tax deductions. As per current legislation, employer contributions to a retirement annuity fund will still be a fringe benefit and employees may treat these contributions as their own when calculating their tax deductions.

Changes to commutation amounts: delayed

It was also proposed that if the value of a retirement benefit at retirement is less than R150 000, the member should be able to withdraw the entire amount without the need to purchase an annuity. This has also been delayed. The total value of a retirement benefit at retirement must still be less than R75 000 for the member to make a full withdrawal.

Tax-free savings set for 1 March 2015

While retirement reform has been delayed, the plan to introduce taxincentivised savings is going ahead. As envisaged, investors will be allowed to contribute R30 000, up to a lifetime maximum of R500 000, into a taxfree savings or investment account. Over-contributions will be taxed at 40%. Certain product design restrictions are envisaged, and we are still waiting for these to be finalised. Once the regulations are finalised we will study their impact and decide whether or not to offer a product.

Twin Peaks set for 2015/2016

Our regulators pay close attention to what is happening internationally, and with the Twin Peaks approach being successfully adopted elsewhere, we are following suit. Twin Peaks aims to:

- Improve financial stability

- Protect consumers

- Improve accessibility to financial services

- Combat fraud

The framework is called ‘Twin peaks’ as it involves two regulatory bodies: one to regulate market conduct and one for prudential regulation and supervision.

In our local context, the Financial Services Board (FSB), which currently regulates insurers, retirement funds, unit trusts and independent financial advisers, will regulate market conduct overall, with a specific focus on how firms in the financial sector conduct their business and treat their customers. The South African Reserve Bank (SARB), which currently regulates the banks and worries about financial system stability, will be responsible for prudential regulation and supervision (such as the solvency and liquidity of financial institutions), and will continue to promote financial system stability. Both will be responsible for combatting fraud. Many financial service companies which are currently regulated by either the FSB or the SARB will now be answerable to both.

Twin peaks will be implemented in two phases:

- Establishing the two regulators and appropriate powers assigned to them through the Financial Sector Regulation Bill. Expected 2015.

- Replacing or amending legislation such as the Banks Act and the Long-Term Insurance Act to align with the framework. Expected 2016.

The main emphasis of the new framework is to do the right thing and to change things for the better for the end client. Some of the thinking has already been phased in through the currently regulatory structures, but Twin Peaks will give things an explicit, over-arching legislative framework. One example is the Treating Customers Fairly (TCF) initiative, which the FSB is increasingly embedding into its approach to supervision. The FSB has also started testing TCF commitment through routine monitoring.

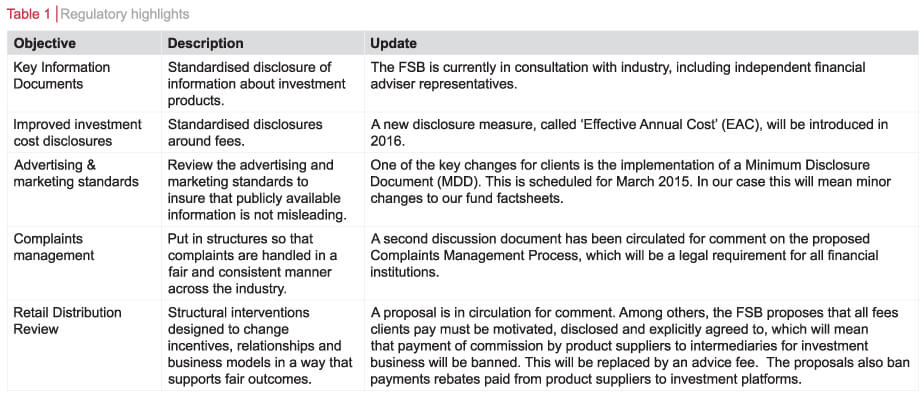

Specific regulatory projects are aimed at driving TCF objectives. Some of these are summarised in Table 1.

The transition to the Twin Peaks model and reform of the retirement saving space are expected to be phased in over the coming years. On the whole, these changes are for the better and will ultimately level the playing fields and should ensure that the financial services industry has a more client-centric focus.